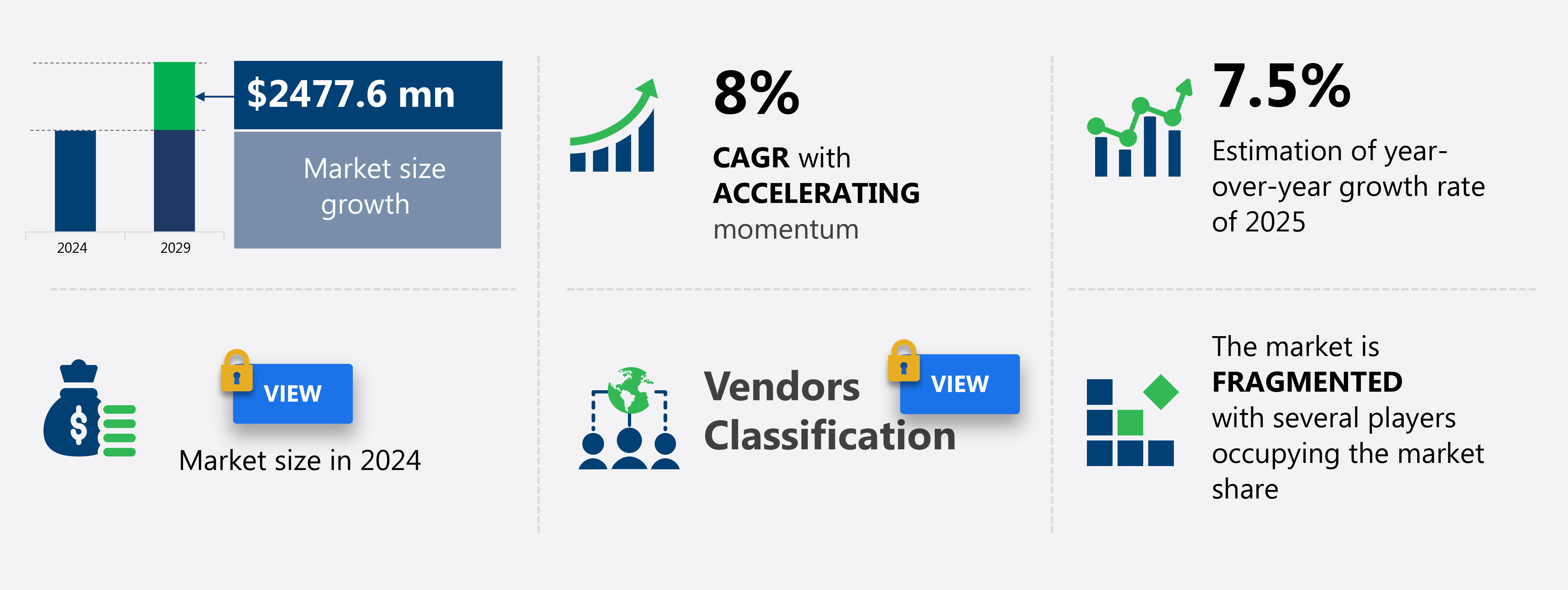

Africa Medical Devices Market Size 2025-2029

The africa medical devices market size is forecast to increase by USD 2.48 billion at a CAGR of 8% between 2024 and 2029.

- The African medical devices market is experiencing significant growth, driven by the rising prevalence of chronic diseases and the increasing adoption of wearable medical devices. Chronic conditions, such as diabetes and cardiovascular diseases, are on the rise across Africa, necessitating the need for continuous monitoring and management. This trend is fueling the demand for medical devices that can help diagnose, treat, and manage these conditions more effectively. Moreover, the adoption of wearable medical devices is gaining momentum in Africa. These devices offer several advantages, including remote monitoring, real-time data analysis, and improved patient engagement. They are particularly useful in remote and underserved areas where access to healthcare facilities is limited.

- However, the high cost of medical devices remains a significant challenge. Affordability is a critical factor for many African consumers, and pricing remains a significant barrier to entry for many medical device manufacturers. Companies seeking to capitalize on the opportunities in this market must focus on developing innovative and cost-effective solutions to address this challenge. Additionally, navigating regulatory frameworks and logistical complexities will be essential for success in the African medical devices market.

What will be the size of the Africa Medical Devices Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The African medical devices market encompasses various sectors, including home healthcare, digital health, medical education, hospice care, and medical tourism. Medical device innovation is a key driver, with emerging technologies such as gene therapy, nanotechnology in medicine, robotics in surgery, and precision medicine gaining traction. Private healthcare providers and public health initiatives are integrating digital health solutions for chronic disease management and disease prevention. Healthcare financing and healthcare workforce development are critical challenges, necessitating creative distribution models and partnerships. Mobile health applications, mental health services, and palliative care are also priority areas for growth.

- Government healthcare policies and public-private collaborations are shaping the landscape, with a focus on healthcare financing, disease prevention, and health data analytics. Wearable health devices and community health programs are further expanding access to healthcare services in remote areas.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Hospitals and clinics

- Diagnostic centers

- Others

- Type

- In-vitro diagnostics

- Cardiovascular devices

- Diagnostic equipment

- Dental equipment

- Others

- Geography

- Middle East and Africa

- Egypt

- Kenya

- South Africa

- Middle East and Africa

By End-user Insights

The hospitals and clinics segment is estimated to witness significant growth during the forecast period.

The African medical devices market encompasses a range of essential healthcare technologies and services, including medical imaging techniques, electronic health records, medical consumables, radiology equipment, oxygen concentrators, hearing aids, blood glucose monitors, medical device certification, insulin pumps, surgical instruments, x-ray machines, medical software, medical equipment leasing, ultrasound scanners, healthcare infrastructure, sterilization techniques, medical device safety, medical waste management, diabetes management devices, CT scanners, medical devices regulation, endoscopy devices, medical device manufacturing, cardiovascular devices, hospital beds, clinical trials, diagnostic imaging equipment, assistive devices, orthopedic implants, respiratory devices, biomedical engineering, MRI scanners, biocompatibility testing, hospital equipment supply, laparoscopic instruments, patient monitoring systems, remote patient monitoring, and telemedicine solutions.

These technologies and services cater to various healthcare needs, from diagnostic imaging and patient monitoring to sterilization and medical waste management. Telemedicine, in particular, has emerged as a vital healthcare service in Africa, connecting doctors and patients remotely, enabling access to medical consultations and healthcare services from the comfort of their homes. This technology is especially crucial in remote areas where access to healthcare facilities is limited. The African healthcare system's complexity necessitates the integration of advanced medical devices and technologies to improve patient care and outcomes. The market for these devices is expected to grow significantly, driven by the increasing demand for accessible and quality healthcare services.

Additionally, the adoption of electronic health records, medical software, and medical device certification will further enhance the efficiency and effectiveness of healthcare services in Africa. In conclusion, the market is a dynamic and evolving landscape, with a diverse range of technologies and services catering to various healthcare needs. Telemedicine, medical software, and electronic health records are just a few examples of the innovative solutions transforming healthcare delivery in Africa. The market's growth is driven by the increasing demand for accessible and quality healthcare services, coupled with the adoption of advanced medical technologies and regulations to ensure medical device safety and effectiveness.

The Hospitals and clinics segment was valued at USD billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Africa Medical Devices Market market drivers leading to the rise in adoption of the Industry?

- The prevalence of chronic diseases is significantly increasing in Africa, serving as the primary driver for the growth of the healthcare market in the region.

- In Africa, chronic diseases are a significant health concern, with non-communicable diseases (NCDs) such as cardiovascular diseases, cancers, respiratory diseases, and diabetes accounting for approximately 29% of African deaths. This number is projected to increase to 46% by 2030. Over one-third of annual deaths in Africa are due to NCDs, and premature deaths from NCDs in people under 70 years old are on the rise. Urban lifestyle changes are a major contributor to the increasing prevalence of chronic diseases in Africa. These lifestyle modifications put individuals at risk of developing conditions like obesity, hypertension, and diabetes.

- To address this growing health challenge, the African healthcare sector is witnessing significant investment in advanced medical technologies. Biomedical engineering innovations, such as MRI scanners, are becoming more accessible, enabling early and accurate diagnosis. Biocompatibility testing ensures the safety and effectiveness of hospital equipment supply, including laparoscopic instruments and patient monitoring systems. Remote patient monitoring and telemedicine solutions are gaining popularity, allowing healthcare providers to monitor patients in real-time and offer timely interventions. Healthcare IT solutions are also being adopted to improve efficiency and enhance the overall quality of care. In conclusion, the African medical devices market is experiencing substantial growth, driven by the increasing burden of chronic diseases and the adoption of advanced technologies to improve healthcare delivery.

What are the Africa Medical Devices Market market trends shaping the Industry?

- Wearable medical devices are gaining increasing popularity in the market, representing a notable trend in healthcare technology. This adoption is driven by advances in technology and growing consumer demand for convenient, continuous health monitoring solutions.

- In Africa, the adoption of medical devices has witnessed notable progress, particularly in the areas of wearable technology and chronic disease management. This trend is driven by the increasing prevalence of conditions such as diabetes, hypertension, and cardiovascular diseases. Wearable medical devices, including insulin pumps, blood glucose monitors, hearing aids, and oxygen concentrators, have gained popularity due to their ability to monitor health conditions, enhance quality of life, and reduce healthcare costs. For instance, smart insulin pens have become increasingly common among diabetic patients, enabling them to manage their insulin intake effectively. Medical imaging techniques, electronic health records, radiology equipment, medical consumables, and surgical instruments are also in demand.

- Medical device certification is crucial to ensure safety and efficacy, and various international standards are being adopted to meet this requirement. Overall, the African medical device market presents significant opportunities for growth, driven by the rising burden of chronic diseases and the increasing adoption of technology to improve healthcare access and outcomes.

How does Africa Medical Devices Market market faces challenges face during its growth?

- The escalating costs of medical devices pose a significant challenge to the industry's growth trajectory.

- In Africa, the high cost of medical devices remains a significant challenge to delivering quality healthcare. Factors contributing to this include limited local production, high import duties, and inadequate regulatory frameworks. Consequently, most medical devices used in African hospitals and clinics are imported from Europe, Asia, and North America, leading to increased expenses due to import taxes, shipping costs, and currency fluctuations. To address this issue, African countries are encouraged to invest in local medical device production to reduce costs and expand access. Medical devices essential for healthcare infrastructure include x-ray machines, ultrasound scanners, CT scanners, and medical software.

- Additionally, medical equipment leasing and sterilization techniques are crucial for maintaining medical device safety and medical waste management. Diabetes management devices are also increasingly important as Africa experiences a rise in diabetes prevalence. The African medical device market is expected to grow due to population growth, increasing healthcare spending, and the adoption of advanced technologies. However, challenges such as regulatory frameworks, infrastructure, and affordability must be addressed to ensure the sustainable growth of the market. Enhancing local production and implementing cost-effective solutions for medical waste management and sterilization techniques can help mitigate some of these challenges. In conclusion, the African medical device market presents opportunities for growth but requires addressing the challenges of high costs, limited local production, and regulatory frameworks.

- Investments in local production, advanced technologies, and cost-effective solutions for medical waste management and sterilization techniques can help expand access to medical devices and improve healthcare outcomes in Africa.

Exclusive Africa Medical Devices Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Becton Dickinson and Co.

- Boston Scientific Corp.

- Canon Inc.

- CapeRay Medical Pty Ltd.

- Danaher Corp.

- DISA Life Sciences

- F. Hoffmann La Roche Ltd.

- Fresenius SE and Co. KGaA

- Gabler Medical UK Ltd.

- General Electric Co.

- Johnson and Johnson Services Inc.

- Koninklijke Philips NV

- Lodox Systems Pty Ltd.

- Medtronic Plc

- Olympus Corp.

- Shenzhen Mindray BioMedical Electronics Co. Ltd

- Siemens AG

- Sinapi Biomedical

- Stryker Corp.

- TiTaMED

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Medical Devices Market In Africa

- In February 2023, Medtronic, a leading global healthcare solutions company, announced the launch of its new insulin pump system, MiniMed⢠780G, in South Africa. This advanced system features built-in continuous glucose monitoring and automated insulin delivery, aiming to improve diabetes management for patients (Medtronic Press Release, 2023).

- In March 2024, Philips and the African Union Commission signed a Memorandum of Understanding (MoU) to strengthen their collaboration in healthcare technology. The partnership focuses on improving access to diagnostics and medical equipment across Africa, with an initial investment of â¬100 million (Philips Press Release, 2024).

- In May 2024, Ethiopia's Ministry of Health and the World Health Organization (WHO) launched the National Medical Devices Regulatory Agency. This new agency aims to ensure the quality, safety, and efficacy of medical devices in Ethiopia, thereby improving the overall healthcare infrastructure (WHO Press Release, 2024).

- In October 2024, Siemens Healthineers, a leading medical technology company, opened its first African Production Site in Rwanda. This new facility will manufacture and distribute diagnostic imaging equipment, contributing to local production and job creation (Siemens Healthineers Press Release, 2024).

Research Analyst Overview

The market is characterized by continuous evolution and dynamic growth. Medical imaging techniques, such as X-ray machines, ultrasound scanners, and MRI scanners, play a crucial role in diagnosing and treating various health conditions. Electronic health records facilitate efficient and accurate patient care, while medical consumables ensure the proper functioning of medical equipment. Radiology equipment, including oxygen concentrators, hearing aids, and blood glucose monitors, cater to diverse health needs. Medical device certification ensures the safety and efficacy of these devices, while medical device manufacturing adheres to stringent regulations. Medical software, medical equipment leasing, healthcare infrastructure, sterilization techniques, and medical waste management are essential components of the medical devices ecosystem.

Diabetes management devices, cardiovascular devices, hospital beds, clinical trials, and diagnostic imaging equipment are just a few applications of medical devices in Africa. Assistive devices, orthopedic implants, respiratory devices, and endoscopy devices are transforming healthcare delivery, enabling early detection and intervention. Biomedical engineering and biocompatibility testing are driving innovation in medical device design and development. Patient monitoring systems, remote patient monitoring, telemedicine solutions, and healthcare IT solutions are revolutionizing healthcare delivery, making medical care more accessible and affordable. The market for medical devices in Africa is ever-evolving, with new applications and technologies emerging constantly.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Medical Devices Market in Africa insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8% |

|

Market growth 2025-2029 |

USD 2.48 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch