Anti-Caking Agents Market Size 2024-2028

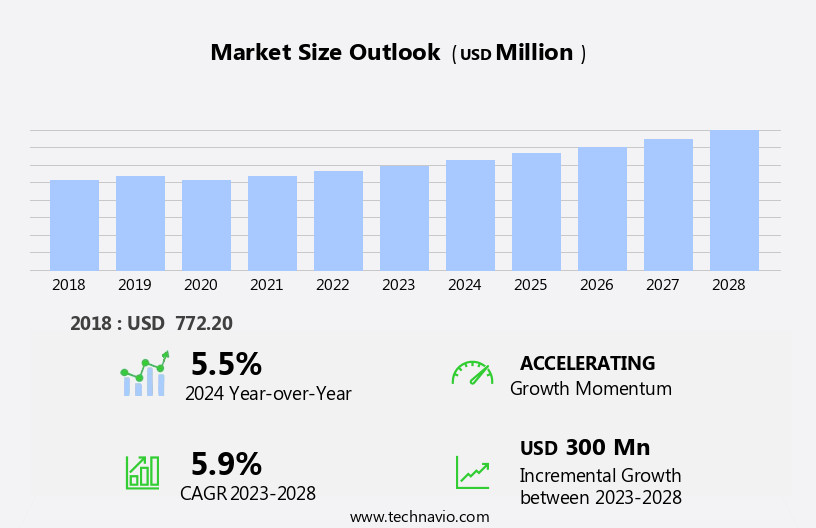

The anti-caking agents market size is forecast to increase by USD 300 million, at a CAGR of 5.9% between 2023 and 2028.

- The market is driven by the increasing consumption of food ingredients in various industries, including food and beverages, pharmaceuticals, and agriculture. These agents prevent the formation of lumps and improve the flowability of powders, ensuring consistent product quality and reducing wastage. Additionally, the growing awareness about food safety in developed regions, particularly in Europe and North America, is fueling the demand for anti-caking agents in food applications. However, the market faces challenges from stringent government regulations, particularly in the European Union and the United States, which impose strict safety standards and limit the use of certain chemicals as anti-caking agents.

- Companies must navigate these regulations to ensure compliance and maintain their market position. To capitalize on opportunities and overcome challenges, market participants should focus on innovation, developing natural and organic alternatives to synthetic anti-caking agents, and expanding their presence in emerging markets.

What will be the Size of the Anti-Caking Agents Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic interplay of various factors. These include particle morphology, powder dispersion, and moisture content control, among others. In the realm of packaging optimization, the focus is on enhancing product flowability and reducing cohesion, thereby improving production efficiency. Coating process optimization is another key area of interest, with a view to ensuring uniformity and reducing dust generation. Bulk density measurement and sieving analysis play crucial roles in ensuring product consistency, while surface area analysis and additive selection are essential for optimizing the efficacy of anti-caking agents. Regulatory compliance is a constant concern, necessitating ongoing research and development in binder selection and compressibility index.

Moreover, the application method and ingredient interaction are critical factors in preventing caking and agglomeration. Granulation techniques, product shelf life, and pour flow rate are also key considerations in the production of free-flowing powders. Abrasion resistance and material handling efficiency are important in maintaining product quality during storage and transportation. The ongoing unfolding of market activities reveals a complex and interconnected web of factors shaping the market. From particle size distribution to coating uniformity, the focus is on continuous optimization and improvement. The evolving patterns in this market underscore the importance of staying abreast of the latest developments and trends.

How is this Anti-Caking Agents Industry segmented?

The anti-caking agents industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Source

- Synthetic

- Natural

- Type

- Silicon Dioxide

- Calcium Compounds

- Sodium Compounds

- Others

- Application

- Bakery Products

- Dairy Products

- Seasonings & Condiments

- Table Salt

- Distribution Channel

- Business-to-Business

- Supermarkets & Hypermarkets

- Online Retail

- Specialty Stores

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

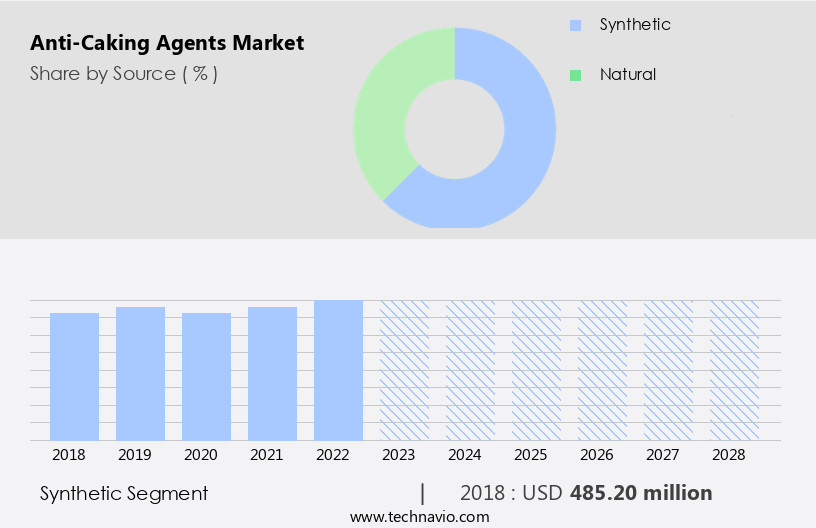

By Source Insights

The synthetic segment is estimated to witness significant growth during the forecast period.

Synthetic anti-caking agents, derived from chemicals and other artificial substances like silicates and acids, dominate the global market due to their cost-effectiveness in bulk production. companies provide a range of synthetic options, such as calcium silicate, magnesium carbonate, and sodium aluminosilicate. These agents are essential in various food applications, including dairy products, bakery items, seasoning and condiments, soups and sauces, and more. Moisture content control is crucial in preventing caking and improving flowability. Synthetic anti-caking agents address this issue by reducing cohesion and enhancing dispersion. Regulatory compliance is another significant factor, with companies ensuring their products meet food safety standards.

Binder selection and compressibility index play a role in optimizing coating processes, while angle of repose and dust suppression address powder handling challenges. Angle of repose affects the ease of pouring, and dust suppression prevents particle dispersion during handling. Process optimization and material handling efficiency are essential for maintaining production efficiency. Abrasion resistance is another factor, ensuring the agents maintain their efficacy during transportation and storage. Surface area analysis and particle size distribution are crucial for ensuring consistent product quality. Anti-caking agents also impact product shelf life, with the right agent selection preventing caking and maintaining the desired consistency.

Application methods and agglomeration prevention techniques are essential for optimizing the use of these agents in various food manufacturing processes. Ingredient interaction and product consistency are crucial factors, with the right anti-caking agent ensuring the desired texture and taste in food products. Coating uniformity is another essential factor, with the right agent ensuring even coating during the manufacturing process. Quality control testing and coating uniformity are essential for maintaining product consistency and ensuring customer satisfaction. Pour flow rate and production efficiency are crucial for maintaining a competitive edge in the market. In summary, synthetic anti-caking agents play a vital role in the food industry, addressing various challenges in powder dispersion, moisture content control, regulatory compliance, and production efficiency.

Their ability to improve flowability, prevent caking, and maintain product consistency makes them an indispensable component in food manufacturing processes.

The Synthetic segment was valued at USD 485.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market experiences significant activity and evolving trends, driven by various factors. In developed regions, such as North America, the market holds a substantial share, with the US and Canada being key contributors. The food and beverage industry's growth in these countries, particularly in bakery products, fuels market expansion. For instance, US bread production exports increased by 7.2% in 2020 compared to the previous year, with Canada importing 80% of these products. Effective moisture content control is crucial in the production process to prevent caking and improve flowability. Regulatory compliance is essential to ensure safety and quality, driving the demand for anti-caking agents.

Binder selection and particle morphology play a significant role in powder dispersion and product consistency. Coating process optimization and packaging optimization enhance product shelf life. Granulation techniques and ingredient interaction are essential considerations in the application method. Coating uniformity and particle size distribution are crucial factors in ensuring product consistency. Angle of repose, compressibility index, and surface area analysis help assess powder rheology and material handling efficiency. Dust suppression and abrasion resistance improve production efficiency and storage stability. Anti-caking agents' efficacy is determined by their ability to reduce cohesion and improve flowability. Pour flow rate, production efficiency, and quality control testing are essential factors in assessing their performance.

Abrasion resistance and material handling efficiency are crucial in the manufacturing process. In the global market, regulatory compliance, binder selection, and production efficiency are significant trends. Anti-caking agents' role in improving powder handling, process optimization, and product shelf life continues to gain importance. The market's future growth is expected to be driven by the increasing demand for free-flowing powders and the need for caking prevention in various industries.

Market Dynamics

The Global Anti-Caking Agents Market is experiencing robust anti-caking agents market growth, primarily driven by the surging demand for convenience foods and the need to maintain product quality. Food-grade anti-caking agents like silicon dioxide, calcium compounds, and magnesium compounds are essential for preventing clumping and ensuring powder flowability across various applications. Key segments such as seasonings and condiments, along with dairy products and bakery products, are major consumers. Current anti-caking agents market trends highlight a strong shift towards natural anti-caking agents and clean label anti-caking agents, reflecting evolving consumer preferences and stricter food safety regulations. Furthermore, significant new product development anti-caking agents is underway, with the Asia Pacific anti-caking agents market demonstrating substantial potential. The overall Global anti-caking agents market size continues to expand, impacting industries from food to fertilizers, necessitating efficient anti-caking agent production.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Anti-Caking Agents Industry?

- The significant increase in the consumption of food ingredients serves as the primary driver for the market's growth.

- The global food and beverage industry has witnessed significant growth in recent years, with an increasing number of applications and product innovations. The US Food and Drug Administration (FDA) maintains a database of over 3,000 food ingredients, catering to the diverse and evolving consumer preferences. The market for food ingredients is driven by several factors, including changing consumer tastes and the demand for high-quality food products. Some of the popular food ingredients include bakery premixes, milk and cream powder, instant soup powder, baking powder, yeast, and seasoning and spices. These ingredients not only enhance the taste and texture of food products but also ensure storage stability, which is crucial for maintaining product quality and safety.

- The food and beverage industry's focus on innovation and product development has led to the introduction of various food coating ingredients, food premixes, and other additives. These ingredients not only improve the sensory attributes of food products but also extend their shelf life and ensure consistent quality. As a professional assistant, it is essential to maintain a formal and knowledgeable tone when discussing the food ingredients market. The market's growth is attributed to the increasing demand for convenience foods, the rising preference for natural and organic ingredients, and the growing trend of health and wellness.

- The market is expected to continue its growth trajectory, driven by these trends and the increasing demand for high-quality food products.

What are the market trends shaping the Anti-Caking Agents Industry?

- In developed regions, the growing concern for food safety is shaping the market trend. This increasing awareness signifies a significant opportunity for businesses focused on ensuring food safety and hygiene.

- In the packaged food industry, anti-caking agents play a crucial role in ensuring the proper flowability and dispersion of powdered food products. These agents prevent the formation of lumps and caking, which can affect the overall quality and consumer experience. The particle morphology and moisture content of food powders are significant factors influencing the effectiveness of anti-caking agents. Regulatory compliance is another critical consideration, as these agents must meet specific safety and performance standards. Binder selection, compressibility index, angle of repose, and dust suppression are essential aspects of powder rheology that impact the functionality of anti-caking agents. Proper control of these factors can lead to improved powder dispersion and better product consistency.

- Dust suppression is particularly important in preventing the generation of airborne particles, which can impact product quality and pose health risks. Anti-caking agents also contribute to the overall texture and mouthfeel of food products, making them an essential component of the formulation. As the demand for packaged food continues to grow, the importance of effective anti-caking agents in maintaining product quality and ensuring consumer satisfaction is increasingly recognized.

What challenges does the Anti-Caking Agents Industry face during its growth?

- Government regulations pose a significant challenge to the growth of the industry. With increasing regulatory requirements, businesses must navigate complex compliance frameworks to ensure they remain in accordance with the law. This can result in additional costs, time, and resources being allocated to regulatory compliance efforts, potentially hindering growth opportunities.

- Anti-caking agents are essential additives used in various industries, including food, pharmaceuticals, and chemicals, to improve flowability and prevent clumping. In the global market, companies must adhere to regulatory bodies' guidelines to ensure product safety and quality. For instance, in India, the Food Safety and Standards Authority of India (FSSAI) regulates the usage of anti-caking agents in food products. The FSSAI's Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011, set the permissible levels for anti-caking agents in table salt, onion powder, garlic powder, fruit powder, and soup powder, not exceeding 2%. Manufacturers aim to optimize packaging and coating processes to enhance the effectiveness of anti-caking agents.

- Bulk density measurement, sieving analysis, cohesion reduction, production efficiency, surface area analysis, and additive selection are crucial factors in the production process. By focusing on these aspects, companies can ensure the desired outcome while maintaining regulatory compliance and improving overall product quality.

Exclusive Customer Landscape

The anti-caking agents market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the anti-caking agents market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, anti-caking agents market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agropur Dairy Cooperative - AgroPur specializes in providing anti-caking agents to address the diverse challenges in cheese production, such as particle barrier, dust, shelf life, and clumping issues. These agents cater to various packaging types, cheese formats, and customer groups, enhancing product quality and consistency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agropur Dairy Cooperative

- BASF SE

- Bogdany Petrol Ltd.

- BRENNTAG SE

- Cabot Corp.

- Chemipol SA

- Evonik Industries AG

- Fuji Chemical Industries Co. Ltd.

- J.M. Huber Corp.

- JELU WERK J. Ehrler GmbH and Co. KG

- Jinsha Precipitated Silica Manufacturing Co. Ltd.

- Kao Corp.

- Merck KGaA

- Norkem Ltd.

- Polwax S.A.

- PPG Industries Inc.

- PQ Group Holdings Inc.

- Roquette Freres SA

- Solvay SA

- Sweetener Supply Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Anti-Caking Agents Market

- In January 2024, DuPont Nutrition & Biosciences announced the expansion of its Capstone facility in Iowa, USA, to increase production capacity of its anti-caking agents, including Aqualon and Carboxymethyl Cellulose (CMC) products. This expansion aimed to meet the growing demand for these products in various industries, including food, beverages, and pharmaceuticals (DuPont Press Release, 2024).

- In March 2024, Ashland Global Holdings Inc. And Ingredion Incorporated entered into a definitive agreement for Ashland to acquire Ingredion's specialty ingredients business. This acquisition included Ashland's acquisition of Ingredion's food and beverage applications of its anticaking agent, Maltodextrin, expanding Ashland's product portfolio and market reach (Ashland Press Release, 2024).

- In May 2024, Clariant International AG, a leading specialty chemical company, completed the acquisition of Huntsman Corporation's functional ingredients business. This acquisition included the addition of Huntsman's anticaking agent, Calcium Stearate, to Clariant's product portfolio, enhancing their position in the market and providing a broader range of offerings to their customers (Clariant Press Release, 2024).

- In April 2025, the European Food Safety Authority (EFSA) reaffirmed the safety of using Silicon Dioxide as an anti-caking agent in food and food supplements. This approval came after a comprehensive review of the available scientific data and supported the continued use of this ingredient in various food applications (EFSA Press Release, 2025).

Research Analyst Overview

- The market exhibits long-term stability due to the increasing demand for bulk solid handling in various industries, including food and pharmaceuticals. Performance testing plays a crucial role in ensuring the effectiveness of these additives, with food grade anti-caking agents undergoing rigorous safety standards and regulatory requirements. Material selection is a key consideration in the manufacturing process, with particle engineering and improved product quality essential for enhancing rheological properties and additive compatibility. Cost-effective solutions and application techniques are also vital for process control and quality assurance measures.

- Stability study, powder characterization, and powder processing are essential for ensuring efficient processing and formulation development, while chemical properties and material flow are crucial factors in performance improvement. Safety standards and regulatory requirements continue to evolve, necessitating ongoing research and development in this field.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Anti-Caking Agents Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2024-2028 |

USD 300 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.5 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Anti-Caking Agents Market Research and Growth Report?

- CAGR of the Anti-Caking Agents industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the anti-caking agents market growth of industry companies

We can help! Our analysts can customize this anti-caking agents market research report to meet your requirements.