Automotive Emissions Ceramics Market Size 2024-2028

The automotive emissions ceramics market size is forecast to increase by USD 20.6 million at a CAGR of 3.28% between 2023 and 2028. The market is experiencing significant changes, with fragmentation dominating the landscape due to the presence of numerous small players. However, amalgamation traits are also emerging as some companies seek to expand their offerings and gain a competitive edge. Key trends in the market include the high demand for emissions ceramics from the automotive industry, the reduction in cold-start emissions, and the declining demand for diesel vehicles. The Light Commercial Vehicle and Heavy Commercial Vehicle segments are expected to drive market growth. As cognitive technologies continue to advance, the use of emissions ceramics in catalytic converters and diesel particulate filters is becoming increasingly important for meeting stringent emissions regulations. This market analysis report provides a comprehensive outlook on the Automotive Emissions Ceramics industry, including market size, trends, and challenges.

What will be the Size of the Market During the Forecast Period?

The market represents a significant niche in the larger context of the transportation industry's ongoing commitment to sustainability and environmental regulations. This market, characterized by its focus on engine parts, exhaust systems, automotive electronics, braking systems, and battery technology, plays a vital role in reducing harmful emissions from traditional internal combustion engines and electric and hybrid vehicles. The competitive nature of this market is driven by the accumulation of various amalgamation traits, including the use of advanced materials like titanate oxide, zirconia oxide, and alumina oxide.

Additionally, these ceramic materials contribute to the enhanced performance and durability of emissions control systems, ensuring product satisfaction for both automakers and consumers. The market's fragmentation dominance can be attributed to the diverse applications of these materials in various automotive components. These applications include catalytic converters, diesel particulate filters, and fuel injector nozzles. As environmental regulations continue to evolve, the demand for advanced emissions control technologies will persist, providing growth opportunities for market participants. Electric vehicles (EVs) and hybrid vehicles (HEVs) are increasingly gaining popularity due to their reduced environmental impact. However, these vehicles still require emissions ceramics for their batteries and electronic components.

Also, as the battery technology in EVs and HEVs advances, the demand for emissions ceramics is expected to grow. The competitive landscape of the market is shaped by the ever-evolving regulatory environment. Governments worldwide are implementing stringent emissions standards to reduce the carbon footprint of the transportation sector. This regulatory pressure is driving innovation in emissions control technologies, creating opportunities for market participants to differentiate themselves through advanced ceramic materials and solutions. In conclusion, the market is a vital niche in the larger transportation industry, offering significant growth opportunities for market participants. The competitive landscape is shaped by the fragmentation dominance of various applications, the evolving regulatory environment, and the increasing demand for sustainability in transportation. By focusing on innovation and product development, market players can capitalize on these trends and maintain their competitive edge in this niche market.

Market Segmentation

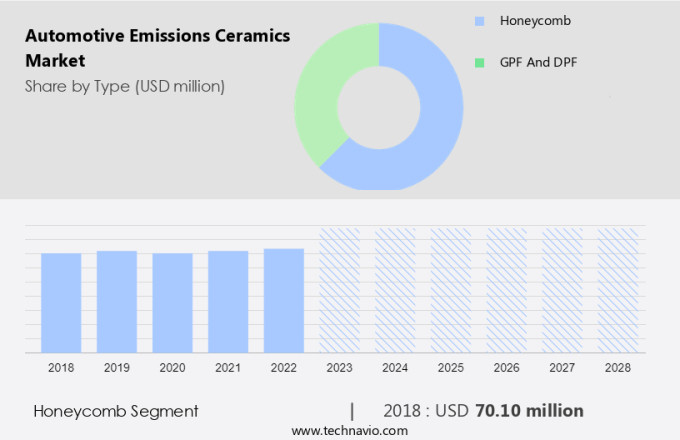

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Honeycomb

- GPF and DPF

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

The honeycomb segment is estimated to witness significant growth during the forecast period.In the realm of automotive emissions mitigation, ceramics play a pivotal role as carriers of catalysts in honeycomb substrates. These substrates are instrumental in eliminating harmful substances and particulate matter from exhaust emissions. The market is characterized by fragmentation dominance and amalgamation traits, with various manufacturers offering different types of catalysts based on fuel and engine specifications. Ceramic honeycomb substrates are extensively employed in automobile exhaust purifying systems and industrial exhaust gas treatment systems.

Once coated with catalysts, ceramic is utilized in diesel or gasoline vehicles' catalytic converters to catalyze, convert, and purify exhaust gases. This process enables vehicles to adhere to stringent emission standards, such as Euro IV and Euro V. Three-way catalytic (TWC) converters, diesel oxidation catalysts (DOCs), and selective catalytic reduction (SCR) catalysts are the most common types of catalysts used in this context. These catalysts work in conjunction with other emission control technologies to ensure the cleanest possible exhaust emissions. The demand for automotive emissions ceramics is driven by the increasing focus on reducing greenhouse gas emissions and improving air quality, particularly in light and heavy commercial vehicles.

Get a glance at the market share of various segments Request Free Sample

The honeycomb segment was valued at USD 70.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 57% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is primarily driven by environmental regulations and sustainability concerns in the global automotive industry. APAC is the largest market for automotive emissions ceramics, accounting for approximately 45% of the worldwide demand in 2023. This region is home to major automotive markets such as Japan, South Korea, China, and India, which are also significant vehicle manufacturing countries. The increasing number of on-road vehicles in these countries necessitates stricter emission standards to control automotive emissions. Automotive Electronics, Engine Parts, Exhaust Systems, Braking Systems, and other electronic components in vehicles incorporate emissions ceramics to meet these regulations. These components are essential for reducing harmful emissions, improving engine performance, and ensuring fuel efficiency. Titanate Oxide, a key material used in emissions ceramics, plays a crucial role in catalytic converters and diesel particulate filters.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

High demand from automotive industry is the key driver of the market. The automotive industry relies heavily on the use of advanced ceramics in the design and manufacturing of both passenger and commercial vehicles. Ceramics, such as Zirconia Oxide and Alumina Oxide, are valued for their ability to withstand extreme temperatures and offer superior physical, thermal, and electrical properties. These materials have become increasingly popular due to their cost-effectiveness and reliability, providing alternatives to metals and other non-ceramic materials.

Also, automotive ceramics are utilized in various functional components, including spark plugs, oxygen sensors, and fuel injection systems, as well as structural components like brake discs, catalyst supports, and pump components. Moreover, the adoption of ceramics is not limited to traditional internal combustion engine vehicles; they are also used in electric vehicles for thermal management and energy storage applications. In the automotive sector, ceramics play a crucial role in enhancing the performance, durability, and safety of vehicles. Their use in various applications contributes to the overall efficiency and reduced emissions, making them an essential component in the ongoing advancements in automotive technology.

Market Trends

Reduction in cold-start emissions is the upcoming trend in the market. The market is experiencing significant advancements and financial commitments from key industry players. Companies are dedicating substantial resources to research and development, focusing on the creation of novel compounds that reach operational temperatures more swiftly than traditional materials. One of the market's leading figures, Corning Inc., provides FLORA substrates to minimize cold-start emissions. The reduction of cold-start emissions represents an essential trend in the market. Typically, substrates necessitate specific temperatures to activate catalysts. Once this temperature is achieved, the substrates initiate the conversion of harmful gases.

However, the exhaust must reach a high temperature to activate the substrate, which can result in substantial emission volumes within the initial few minutes of starting the vehicle. Market players are dedicated to addressing this issue and delivering product innovations that cater to the evolving needs of consumers and regulatory bodies.

Market Challenge

Declining demand for diesel vehicles is a key challenge affecting the market growth. Automotive emission ceramics play a crucial role in minimizing emissions from diesel engines, particularly in reducing the output of gases and particulate matter. Diesel engines offer superior fuel efficiency and high torque, making them a popular choice for many consumers.

However, the demand for diesel-powered passenger vehicles has been declining due to concerns over their environmental impact. The Volkswagen emissions scandal in 2015 highlighted the issue of excessive emissions from diesel cars, leading to a significant decrease in sales. In addition, the demand for diesel vehicles is waning in emerging economies such as India. The shift towards autonomous vehicles and the integration of advanced sensors and electronics are expected to impact the market. These technologies will require materials with specific mechanical properties to optimize vehicle performance. As the automotive industry continues to evolve, the demand for emission reduction technologies will remain a priority.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Cangzhou Sefu Ceramic New Materials Co. Ltd. - The company offers automotive emissions ceramics for diesel soot and particulate matters to improve the exhaust quality of a vehicle.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- CDTi Advanced Materials Inc.

- Compagnie de Saint Gobain

- Corning Inc.

- Faurecia SE

- Ibiden Co. Ltd.

- Imerys S.A.

- Jiangsu Yixing Nonmetallic Chemical Machinery Factory Co. Ltd.

- Johnson Matthey Plc

- KYOCERA Corp.

- LiqTech International Inc.

- Logical Clean Air Solutions

- NGK Insulators Ltd

- SCHOTT AG

- Shandong Sinocera Functional Material Co. Ltd.

- Tenneco Inc.

- Umicore SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a niche yet vital segment in the transport and logistics domain, focusing on the production and application of ceramic materials in reducing emissions from light commercial and heavy commercial vehicles. These ceramics, primarily made of titanate oxide, zirconia oxide, and alumina oxide, play a pivotal role in improving vehicle performance and fuel efficiency. The market is witnessing fragmentation dominance due to the amalgamation of cognitive technologies, electronic components, and sensors in engine parts, exhaust systems, and automotive electronics. The increasing adoption of electric and hybrid vehicles, driven by environmental regulations and sustainability concerns, is further fueling the growth of the market.

Manufacturing processes, such as 3D printing, are revolutionizing the production of these ceramics, making them more cost-effective and efficient. The rising demand for autonomous vehicles and the need for specific data in vehicle weight, battery technology, and emissions are also creating new opportunities in this market. The market is a pathfinder in the forefront of innovation, constantly pushing the boundaries of technology to meet the evolving needs of the automotive industry. Product satisfaction and business strategy are key drivers for market players, as they strive to stay ahead of the curve in this dynamic and ever-changing market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.28% |

|

Market growth 2024-2028 |

USD 20.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.14 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 57% |

|

Key countries |

China, Japan, Germany, US, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Cangzhou Sefu Ceramic New Materials Co. Ltd., CDTi Advanced Materials Inc., Compagnie de Saint Gobain, Corning Inc., Faurecia SE, Ibiden Co. Ltd., Imerys S.A., Jiangsu Yixing Nonmetallic Chemical Machinery Factory Co. Ltd., Johnson Matthey Plc, KYOCERA Corp., LiqTech International Inc., Logical Clean Air Solutions, NGK Insulators Ltd, SCHOTT AG, Shandong Sinocera Functional Material Co. Ltd., Tenneco Inc., and Umicore SA |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch