Automotive Green Tires Market Size 2024-2028

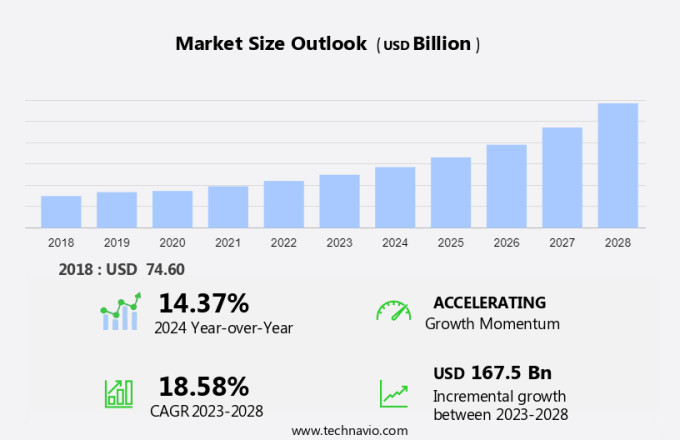

The automotive green tires market size is forecast to increase by USD 167.5 billion at a CAGR of 18.58% between 2023 and 2028. The market is witnessing significant growth due to the increasing adoption of electric vehicles (EVs) and hybrid vehicles, which require tires with low rolling resistance to minimize energy consumption and reduce CO2 emissions. Additionally, the logistics industry is shifting towards compressed natural gas (CNG) and liquefied natural gas (LNG) vehicles, leading to an increased demand for fuel-efficient tires. Original Equipment (OE) manufacturers are focusing on developing green tires to meet the evolving needs of the automotive industry. Companies such as Goodyear, and Pirelli are investing in research and development to produce tires with improved fuel efficiency and reduced environmental impact. Moreover, rim size is also a crucial factor in tire selection, as larger rims can increase rolling resistance and decrease fuel economy. The high affordability and low maintenance cost of green tires, coupled with the need to comply with stringent emissions regulations, are driving market growth. However, tire companies face high-cost pressures to maintain competitive pricing, which may hinder market growth.

The market is experiencing significant growth due to the increasing popularity of electric vehicles (EVs) and shifting consumer preferences towards reducing carbon emissions. EVs and hybrid vehicles require low rolling resistance tires to improve total vehicle efficiency, enhance range, and minimize fuel consumption. The logistics industry is also embracing EVs and CNG-powered vehicles, further driving demand for green tires. Manufacturers like Goodyear, and Pirelli are investing in research and development of green tires using silica, silane, and other advanced materials from companies like Evonik. These materials help reduce rolling resistance, minimize CO2 emissions, and improve tire durability. Heavy trucks are also transitioning towards green tires to reduce their carbon footprint.

Moreover, the tire assembly process is being optimized to ensure minimal waste and energy consumption. The European Union's Tire Energy Label is driving the adoption of green tires by providing consumers with clear information on tire energy efficiency and CO2 emissions. The passenger car segment is expected to dominate the market due to the increasing sales of electric cars. However, the market for airless tires is also gaining traction due to their environmental benefits and improved durability. The shift towards green tires is a crucial step towards reducing the carbon emissions from the transportation sector and moving away from fossil fuels.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger vehicles

- Commercial vehicles

- Type

- Radial tire

- Bias tire

- Geography

- Europe

- Germany

- France

- North America

- US

- APAC

- China

- Japan

- South America

- Middle East and Africa

- Europe

By Application Insights

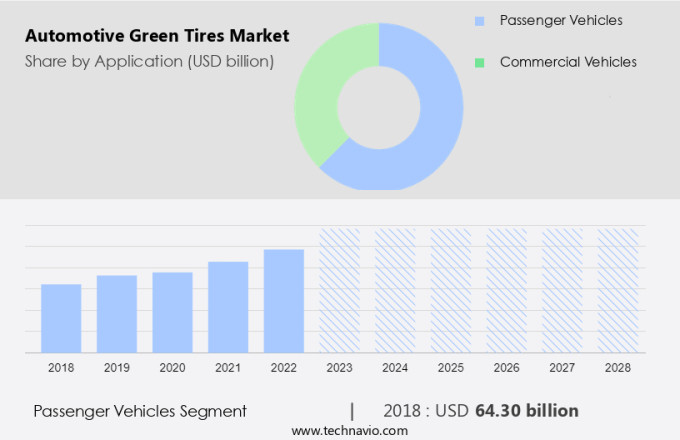

The passenger vehicles segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to the increasing preference for fuel-efficient and low-rolling resistance tires among owners of passenger cars and light commercial vehicles (LCVs). This trend is being driven by the rising sales volume of these vehicles, particularly in emerging and developing economies like China, Japan, South Korea, India, and Southeast Asian countries.

Furthermore, the availability of affordable vehicle financing options worldwide has led to an increase in purchases of more expensive passenger vehicles, which often come equipped with high-performance green tires. Passenger vehicles are projected to dominate The market, with key Original Equipment Manufacturers (OEMs) such as Rivian R1T, Ford F-150 Lightning, Cooper, Cheng Shin Rubber, and ZC Rubber leading the way in adoption. Consumer awareness regarding the environmental benefits of green tires is also contributing to their increasing popularity in the passenger vehicles segment.

Get a glance at the market share of various segments Request Free Sample

The passenger vehicles segment accounted for USD 64.30 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

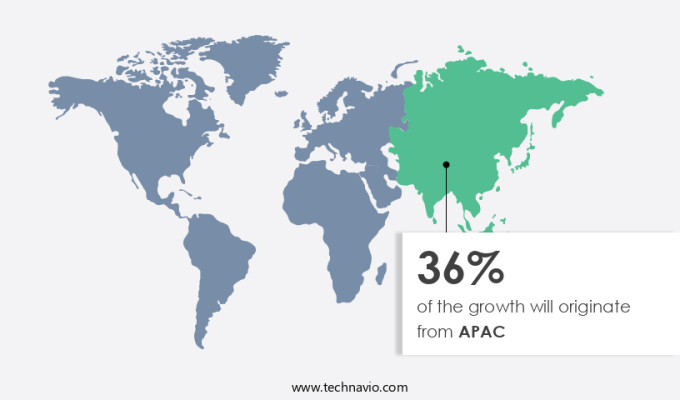

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Europe is primarily driven by the significant contributions of key OEMs, including Daimler, BMW, AUDI, Volkswagen group, and Renault, based in Germany, the UK, France, Italy, and Spain. These countries lead the market in terms of both fitment rate and volume. Eastern European economies also play a substantial role in the region's market. Notably, the penetration rate is more pronounced in Western European economies. Major global automakers headquartered in Europe provide green tires as an option with their vehicles, although availability may vary among automakers and models. Germany, France, and Spain are the leading European countries in the market.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

High affordability and low maintenance cost is the key driver of the market. The market is witnessing significant growth due to the increasing preference for environmentally friendly solutions in the automotive industry. Factors such as the low cost of purchase and maintenance and the rising adoption of electric vehicles, hybrid vehicles, and Compressed Natural Gas (CNG) vehicles are driving the market. Major tire manufacturers, including Goodyear, and Pirelli, are offering green tires for various vehicle segments to cater to this growing demand. For instance, Bridgestone's Ecopia range and Michelin's Energy Saver range are priced between USD 40 and USD 70 per tire, depending on the vehicle model. The logistics industry is also adopting green tires to reduce CO2 emissions, further boosting market growth.

Market Trends

Developments in the field of automotive green tires is the upcoming trend in the market. The automotive industry is witnessing a shift towards eco-friendly solutions, with a particular focus on tires for electric vehicles, hybrid vehicles, and Compressed Natural Gas (CNG) vehicles. The increasing emphasis on reducing CO2 emissions and improving rolling resistance has led to the development of innovative tire designs using advanced, energy-efficient materials. Notable automotive manufacturers, including Goodyear, and Pirelli, are investing heavily in research and development to create environmentally sustainable tire solutions. For instance, Goodyear recently unveiled a new concept tire to support cleaner and more efficient urban mobility. The logistics industry is also adopting these green tires to reduce its carbon footprint. As the demand for sustainable transportation grows, the market for automotive green tires is poised for significant expansion.

Market Challenge

High-cost pressures on tire companies for competitive pricing is a key challenge affecting the market growth. The global automotive industry is experiencing significant advancements, with electric vehicles, hybrid vehicles, and Compressed Natural Gas (CNG) vehicles gaining popularity. These technological innovations have led to reduced rolling resistance and CO2 emissions, making vehicles more energy efficient. The logistics industry is also embracing these trends, leading to increased demand for green tires in the Original Equipment (OE) market. Major tire manufacturers, including Goodyear, and Pirelli, are investing heavily in research and development to produce tires that meet these evolving needs. However, the increasing competition in the automotive market, with the emergence of new Original Equipment Manufacturers (OEMs) and the growing number of product launches, is putting cost pressures on stakeholders in the automotive value chain. This trend is also impacting The market, acting as a significant market inhibitor.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Bridgestone Corp: The company is involved in manufacturing and selling different types of passenger vehicles and motorcycle tires.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apollo Tyres Ltd.

- Balkrishna Industries Ltd.

- DOUBLE STAR TIRE

- Emerald Resilient Tyre Manufacturers Pvt. Ltd.

- Giti Tire Pte. Ltd.

- GRI Tires

- Hankook Tire and Technology Co. Ltd.

- Maxxis International

- Michelin Group

- NEXEN TIRE Corp.

- Nokian Tyres Plc.

- Pirelli and C S.p.A

- RPG Enterprises

- Sailun Group Co. Ltd.

- Schaeffler AG

- The Goodyear Tire and Rubber Co.

- Triangle Tyres

- Yokohama Tire Corp.

- Zhongce Rubber Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing adoption of electric vehicles (EVs) and hybrid vehicles. These vehicles prioritize low rolling resistance and high fuel efficiency, making eco-friendly tires a crucial component. Tire manufacturers like Goodyear, Pirelli, and others are focusing on producing tires with silica, styrene-butadiene rubber, and silane to reduce rolling resistance and CO2 emissions. The logistics industry and OEMs in the passenger cars, light commercial vehicles (LCVs), and trucks segments are increasingly opting for green tires to enhance total vehicle efficiency, improve range, and reduce fuel consumption. The shift in consumer preferences towards environment-friendly raw materials and sustainable tire materials is also driving market growth.

Moreover, tire manufacturers are introducing innovative technologies like lightweight enliten technology, sound comfort technology, and the Star Labeling Program to cater to the needs of the electric car segment. The global sales of electric cars are expected to flood, with Rivian R1T and Ford F-150 Lightning leading the charge. The tire market is also witnessing the emergence of airless tires, which offer reduced carbon emissions and improved sustainability. The heavy vehicle segment, including buses and heavy trucks, is also adopting green tires to reduce carbon emissions and improve fuel efficiency. The availability of charging infrastructure and the growing popularity of EVs and hybrid vehicles are expected to further boost the demand for green tires in the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.58% |

|

Market growth 2024-2028 |

USD 167.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

14.37 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 36% |

|

Key countries |

US, Germany, China, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Apollo Tyres Ltd., Balkrishna Industries Ltd., Bridgestone Corp., DOUBLE STAR TIRE, Emerald Resilient Tyre Manufacturers Pvt. Ltd., Giti Tire Pte. Ltd., GRI Tires, Hankook Tire and Technology Co. Ltd., Maxxis International, Michelin Group, NEXEN TIRE Corp., Nokian Tyres Plc., Pirelli and C S.p.A, RPG Enterprises, Sailun Group Co. Ltd., Schaeffler AG, The Goodyear Tire and Rubber Co., Triangle Tyres, Yokohama Tire Corp., and Zhongce Rubber Group Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch