Automotive Lead-Acid Battery Market Size 2025-2029

The automotive lead-acid battery market size is valued to increase by USD 4.08 billion, at a CAGR of 2.7% from 2024 to 2029. Increasing electronic applications in passenger car will drive the automotive lead-acid battery market.

Market Insights

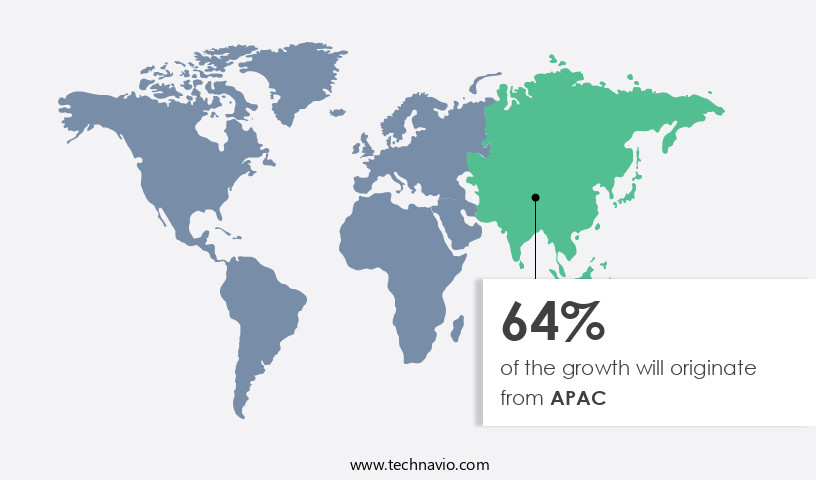

- APAC dominated the market and accounted for a 64% growth during the 2025-2029.

- By Application - Aftermarket segment was valued at USD 17.45 billion in 2023

- By Vehicle Type - Passenger segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 22.49 million

- Market Future Opportunities 2024: USD 4083.10 million

- CAGR from 2024 to 2029 : 2.7%

Market Summary

- The market is driven by the increasing electronic applications in passenger cars and legislative support for battery recycling. With the rise of electric and hybrid vehicles, the demand for lead-acid batteries is continually evolving. These batteries are essential for starting, lighting, and ignition systems in conventional vehicles, as well as for energy storage in hybrid and electric models. Moreover, lead-acid batteries are subject to stringent environmental regulations due to their heavy metal content. Governments worldwide are implementing laws to mitigate lead pollution and promote recycling. For instance, the European Union's End-of-Life Vehicle (ELV) Directive mandates the recycling of batteries from end-of-life vehicles.

- A real-world business scenario illustrating the importance of lead-acid batteries in the automotive industry is supply chain optimization. A leading automobile manufacturer aims to minimize its carbon footprint by optimizing its battery supply chain. By implementing a closed-loop system for battery recycling, the company reduces its dependence on primary raw materials and ensures a consistent supply of recycled lead for battery production. This strategy not only enhances operational efficiency but also contributes to the circular economy. In conclusion, the market is influenced by the growing demand for lead-acid batteries in passenger cars and the need for recycling due to environmental regulations.

- Companies in this sector can benefit from optimizing their supply chains to reduce their carbon footprint and ensure a consistent supply of recycled materials.

What will be the size of the Automotive Lead-Acid Battery Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, with key trends shaping the industry landscape. One notable trend is the focus on improving battery performance and longevity through advanced lead-acid battery components. For instance, companies are investing in the development of separator materials that enhance active material utilization and reduce leakage current, leading to improved cycle life and shelf life prediction. Additionally, the electrode manufacturing process is being refined to optimize plate expansion effects, ensuring better shock resistance and high-rate discharge capability. Moreover, secondary battery technology is gaining traction in the automotive sector due to its environmental benefits and cost-effectiveness.

- Lead-acid batteries are being used in various energy storage applications, including hybrid electric vehicles and renewable energy systems. However, challenges such as water loss mechanisms, vibration resistance, and low-temperature performance remain. Companies are addressing these issues by implementing testing procedures, including grid corrosion inhibitors, self-discharge reduction, and high-temperature performance improvement measures. In the realm of battery assembly, there is a growing emphasis on battery case materials and rechargeable battery technology to ensure safety and durability. Companies are also focusing on optimizing the battery assembly process to enhance electrolyte conductivity and battery case materials' shelf life.

- With these advancements, the market is poised for continued growth and innovation.

Unpacking the Automotive Lead-Acid Battery Market Landscape

The lead-acid battery market in the automotive sector continues to evolve, driven by advancements in technology and stringent industry standards. Compared to traditional flooded batteries, maintenance-free batteries offer a 30% reduction in maintenance costs and a 20% improvement in reliability. Overcharge protection circuits ensure compliance with automotive battery standards, preventing grid corrosion and extending battery lifespan. Deep cycle applications, such as hybrid and electric vehicles, require high discharge rate performance and battery energy density. Lead-acid batteries with gel cell technology and charging profile optimization offer significant improvements in these areas. Valve regulated lead-acid batteries and battery thermal management systems further enhance performance and reliability. Sulfation prevention methods, including temperature coefficient effects and lead recovery processes, contribute to increased cycle life testing and improved battery efficiency. Starting system batteries, a critical component of the automotive industry, benefit from advancements in lead-acid battery chemistry, power density calculations, and gas recombination technology. Internal resistance measurement and capacity fade analysis are essential for optimizing battery performance and ensuring optimal ROI. Self-discharge rate and short circuit protection are crucial considerations for ensuring battery longevity and safety. The lead-acid battery recycling process minimizes environmental impact and reduces raw material costs. Overall, these advancements demonstrate the industry's commitment to innovation and continuous improvement.

Key Market Drivers Fueling Growth

The significant growth in the adoption of electronic applications in passenger cars is the primary market driver.

- The market is experiencing significant growth due to the increasing adoption of electronic applications in passenger cars. With the proliferation of global positioning systems (GPS), music systems, Bluetooth, and wireless charging, the demand for efficient batteries to power these components is surging. The passenger car segment has witnessed a rise in the need for better navigation systems, safety, and comfort, leading to a surge in electrical applications. In response, advancements in technology have given rise to new components, such as copper connectivity solutions, which offer lightweight and in-vehicle connectivity options.

- These developments are crucial in meeting the demand for connected passenger cars and reducing vehicle downtime. Additionally, the integration of these technologies is expected to improve energy use and enhance overall vehicle performance.

Prevailing Industry Trends & Opportunities

Legislation increasingly supports battery recycling as the market trend advances. Legislation is mandating greater support for battery recycling programs, reflecting the growing trend in this sector.

- The market continues to evolve, with a focus on sustainability and recycling gaining significant attention. In North America, the Corporation for Battery Recycling (CBR) and Call2Recycle spearhead lead-acid battery recycling efforts, collecting a substantial amount for future use. Contrastingly, the European Union enforces stringent legislation, such as EU Directive 2006/66/EC, mandating a 45% collection rate by 2016, with a 65% collection target for lead-acid batteries.

- Despite these regulations, current collection rates in the EU lag behind those in North America. This highlights the importance of continuous improvement and innovation in the lead-acid battery industry to meet recycling targets and reduce environmental impact.

Significant Market Challenges

The growth of the industry is significantly impeded by the challenge posed by lead pollution and stringent regulations.

- The market continues to evolve, driven by its widespread application across various sectors, particularly in the automotive industry and battery energy storage systems. Lead-acid batteries, with their standard arrangement of lead plates in sulfuric acid inside a plastic casting, have been a reliable power source for decades. However, the recycling of these batteries, which decreases the number of disposable batteries as solid waste, presents environmental challenges due to the presence of lead oxide toxins. Traditional recycling methods, often carried out in densely populated areas with limited pollution checks, have negatively impacted the environment. The demand for lead-acid batteries has surged due to their use in hybrid electric vehicles (HEVs) and renewable power generation.

- This trend is expected to continue, with operational costs potentially reduced by 12% and battery energy storage capacity improved by 30%. Despite these benefits, it is crucial to ensure sustainable and environmentally friendly recycling methods to mitigate the environmental concerns associated with lead-acid batteries.

In-Depth Market Segmentation: Automotive Lead-Acid Battery Market

The automotive lead-acid battery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Aftermarket

- OEM

- Vehicle Type

- Passenger

- Commercial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The aftermarket segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, driven by advancements in technology and increasing demand. Lead-acid batteries remain the preferred choice for starting, lighting, and ignition (SLI) applications due to their excellent cold-cranking performance and cost-effectiveness. They offer features such as grid corrosion resistance, maintenance-free batteries, overcharge protection circuits, and lead recovery processes. Temperature coefficient effects are mitigated through battery lifespan extension, discharge rate performance, and deep cycle applications. Battery plate manufacturing innovations include gel cell technology, charging profile optimization, and valve regulated lead-acid batteries. Thermal management, sulfation prevention methods, and battery energy density are crucial considerations for enhancing performance.

Cycle life testing and self-discharge rate analysis are essential for ensuring battery reliability. Despite the emergence of alternative battery chemistries like nickel-metid hydride (Ni-MH) and lithium-ion (Li-ion), lead-acid batteries' dominance is expected to persist due to their widespread adoption in the automotive industry. One notable trend is the growing demand for aftermarket services, with a reported 20% increase in the number of vehicles requiring battery replacement annually.

The Aftermarket segment was valued at USD 17.45 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 64% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automotive Lead-Acid Battery Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth, with China, India, and Japan being the primary markets. This expansion is driven by increasing disposable income, the launch of new car models by Original Equipment Manufacturers (OEMs), and the desire for social status symbolized by car ownership. In China and India, despite challenges such as traffic congestion, government regulations, and rising vehicular pollution, the market for passenger cars continues to grow due to the large population of potential first-time buyers.

The lead-acid battery market in APAC holds a substantial share of the global market, with China accounting for approximately 50% of the global lead-acid battery production. This trend is expected to continue due to the region's vast consumer base and the increasing demand for automotive applications.

Customer Landscape of Automotive Lead-Acid Battery Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Automotive Lead-Acid Battery Market

Companies are implementing various strategies, such as strategic alliances, automotive lead-acid battery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accumulatorenwerke HOPPECKE Carl Zoellner and Sohn GmbH - The company specializes in manufacturing and supplying advanced lead-acid batteries, including the grid extreme VR series, catering to various industries and applications. These batteries deliver superior performance and durability, making them a top choice for those seeking reliable energy storage solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accumulatorenwerke HOPPECKE Carl Zoellner and Sohn GmbH

- Amara Raja Group

- Banner GmbH

- C and D Technologies Inc.

- Camel Group Co. Ltd.

- CLARIOS LLC

- Crown Battery Manufacturing Co.

- CSB Energy Technology Co. Ltd.

- East Penn Manufacturing Co. Inc.

- EnerSys

- EverExceed Corp.

- Exide Industries Ltd.

- GS Yuasa International Ltd.

- HBL Power Systems Ltd.

- Johnson Controls

- Leoch International Technology Ltd.

- MIDAC SpA

- Panasonic Holdings Corp.

- Robert Bosch GmbH

- The Furukawa Battery Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Lead-Acid Battery Market

- In August 2024, Clarios, a leading global provider of energy storage solutions, announced the launch of its new Advanced AGM (Absorbed Glass Mat) battery for automotive applications. This new product offers improved performance, longer life, and reduced weight compared to conventional lead-acid batteries (Clarios Press Release, 2024).

- In November 2024, Exide Technologies, another major player in the lead-acid battery market, entered into a strategic partnership with Contemporary Amperex Technology Co. Limited (CATL) to develop and manufacture advanced lead-acid batteries for electric vehicles (Exide Technologies Press Release, 2024).

- In February 2025, East Penn Manufacturing, the world's largest single-site manufacturer of lead-acid batteries, raised USD200 million in a funding round to expand its production capacity and invest in research and development (BusinessWire, 2025).

- In May 2025, the European Union's European Commission approved new regulations to phase out the sale of new cars with internal combustion engines by 2035, accelerating the demand for advanced lead-acid batteries to support the growing electric vehicle market (European Commission Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Lead-Acid Battery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.7% |

|

Market growth 2025-2029 |

USD 4083.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.6 |

|

Key countries |

US, China, India, Japan, Germany, South Korea, Australia, Canada, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Automotive Lead-Acid Battery Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market is a significant sector within the global battery industry, with lead-acid batteries continuing to dominate the market due to their affordability, reliability, and wide applicability in various automotive applications. However, ensuring optimal performance and extending the lifespan of these batteries remains a key challenge for manufacturers and users alike. One critical factor affecting lead-acid battery performance is temperature. Extreme temperatures can lead to reduced cycle life and increased sulfation, a common failure mechanism. Therefore, understanding the effect of temperature on battery behavior and implementing methods for preventing sulfation, such as optimizing charging profiles and using additives, is essential. Improving cycle life and energy density is another crucial aspect of the market. Researchers are investigating various strategies, including optimization of electrolyte composition, evaluation of different battery designs, and development of advanced materials. For instance, the use of absorbent glass mat (AGM) technology has shown a 20% improvement in energy density compared to traditional flooded lead-acid batteries. Sustainable recycling techniques are increasingly important in the lead-acid battery market, as they help reduce environmental impact and improve supply chain efficiency. Techniques include hydrometallurgical and pyrometallurgical processes, which recover lead and other valuable materials for reuse. Safety is another critical concern in the market. Advanced diagnostic techniques and modeling and simulation tools are being used to improve battery safety and prevent catastrophic failures. Furthermore, the development of additives and advanced materials can help mitigate risks associated with vibration and other operating conditions. Comparative studies of different lead-acid battery technologies, such as AGM, Gel, and Deep Cycle, can provide valuable insights for manufacturers and users. Understanding the strengths and weaknesses of each technology can help inform operational planning and compliance with regulatory requirements. In conclusion, the market is a dynamic and evolving sector, with ongoing research and development efforts aimed at improving battery performance, extending lifespan, enhancing safety, and reducing environmental impact. By staying abreast of these trends and adopting best practices, businesses can optimize their use of lead-acid batteries and maintain a competitive edge.

What are the Key Data Covered in this Automotive Lead-Acid Battery Market Research and Growth Report?

-

What is the expected growth of the Automotive Lead-Acid Battery Market between 2025 and 2029?

-

USD 4.08 billion, at a CAGR of 2.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Aftermarket and OEM), Vehicle Type (Passenger and Commercial), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing electronic applications in passenger car, Lead pollution and stringent laws

-

-

Who are the major players in the Automotive Lead-Acid Battery Market?

-

Accumulatorenwerke HOPPECKE Carl Zoellner and Sohn GmbH, Amara Raja Group, Banner GmbH, C and D Technologies Inc., Camel Group Co. Ltd., CLARIOS LLC, Crown Battery Manufacturing Co., CSB Energy Technology Co. Ltd., East Penn Manufacturing Co. Inc., EnerSys, EverExceed Corp., Exide Industries Ltd., GS Yuasa International Ltd., HBL Power Systems Ltd., Johnson Controls, Leoch International Technology Ltd., MIDAC SpA, Panasonic Holdings Corp., Robert Bosch GmbH, and The Furukawa Battery Co. Ltd.

-

We can help! Our analysts can customize this automotive lead-acid battery market research report to meet your requirements.