Cannabis-Infused Edible Products Market Size 2024-2028

The cannabis-infused edible products market size is forecast to increase by USD 7.01 billion at a CAGR of 20.04% between 2023 and 2028.

- The Cannabis-Infused Edibles Market is experiencing significant growth, driven by the increasing social acceptance of cannabis and the advent of advanced cultivation methods. Legalization and regularization of cannabis in various regions, including North America and Europe, are key factors fueling market expansion. The edibles segment is gaining popularity due to its discreet consumption method and long-lasting effects. However, the market is not without challenges, including regulatory complexities, product consistency issues, and safety concerns. To capitalize on this market opportunity, companies must prioritize product innovation, adhere to stringent regulatory requirements, and invest in research and development to ensure product safety and consistency.

- Additionally, strategic partnerships and collaborations can help companies navigate the complex regulatory landscape and expand their reach in the global market. Overall, the Cannabis-Infused Edibles Market presents significant growth opportunities for companies willing to invest in research, innovation, and regulatory compliance.

What will be the Size of the Cannabis-Infused Edible Products Market during the forecast period?

- The cannabis-infused edibles market in the healthcare sector is experiencing significant growth, driven by the increasing acceptance of cannabidiol (CBD) and tetrahydrocannabinol (THC) derivatives for medicinal purposes. Chocolate cookies and brownies, lollipops, pizza, and beverages are among the popular edible product categories. Regulatory issues surrounding marijuana legalization and legislative discrepancies pose challenges for companies. Despite these hurdles, the market continues to evolve, with CBD gaining traction due to its health advantages in managing conditions such as cancer, muscular spasms, glaucoma, epilepsy, and post-traumatic stress disorder. Hemp-derived CBD products offer a legal alternative to marijuana-derived THC, addressing concerns within the healthcare system.

- Smoking remains a common method of cannabis consumption, but edibles provide a more discreet and long-lasting alternative. Recreational cannabis legalization is further fueling market expansion, with THC-infused products catering to both medical and recreational users. Cannabis edibles are not limited to chocolate and baked goods; they also include gummy consistent items and beverages. As research continues to uncover new health benefits, the market is expected to grow, offering opportunities for businesses in the sector. However, shop closures and regulatory changes may impact market dynamics, necessitating adaptability and agility from companies. Overall, the cannabis-infused edibles market presents a promising landscape for businesses, with potential applications in various industries and ongoing research into the health benefits of cannabinoids.

How is this Cannabis-Infused Edible Products Industry segmented?

The cannabis-infused edible products industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Food

- Beverage

- Geography

- North America

- US

- Canada

- Europe

- Croatia

- Italy

- Middle East and Africa

- APAC

- South America

- Rest of World (ROW)

- North America

By Distribution Channel Insights

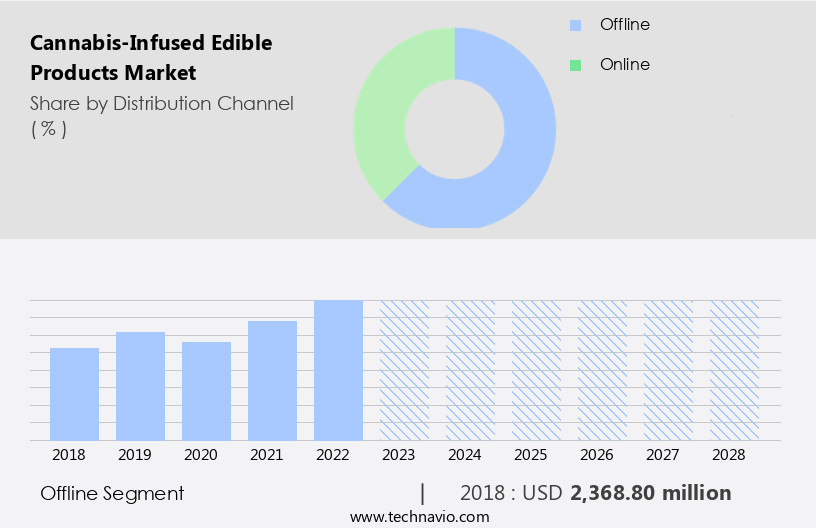

The offline segment is estimated to witness significant growth during the forecast period.

The offline distribution of cannabis-infused edible products is subject to varying regulations across countries and regions. In regions where cannabis is legal for recreational or medicinal use, such as some European countries and Canada, these products can be sold through dispensaries and pharmacies. However, in countries like the US and Australia, where cannabis remains illegal, distribution is restricted to medical dispensaries or pharmacies. Factors fueling the expansion of this market segment include the increasing social acceptance of cannabis, growing awareness of its health benefits, and the ongoing legalization of cannabis in numerous jurisdictions. Cannabis-infused beverages, gummies, chocolates, and other edibles cater to diverse consumer preferences, with offerings ranging from THC-dominant to CBD-rich products.

Additionally, product innovation continues to drive the market, with companies introducing new formats like Lollipops, gummies, and even cannabis-infused pizza and cereal. Despite these opportunities, challenges persist, including regulatory issues, legislative discrepancies, and consumer education. Companies like Infused Drinks, Gfarmalabs, and Province Brands are addressing these challenges by focusing on product innovation, adhering to strict quality standards, and engaging in dialogue with regulatory bodies. As the healthcare system increasingly recognizes the therapeutic potential of cannabis for conditions like Alzheimer's disease, muscular spasms, and PTSD, the demand for cannabis-infused edibles is expected to continue growing.

Get a glance at the market report of share of various segments Request Free Sample

The Offline segment was valued at USD 2.37 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

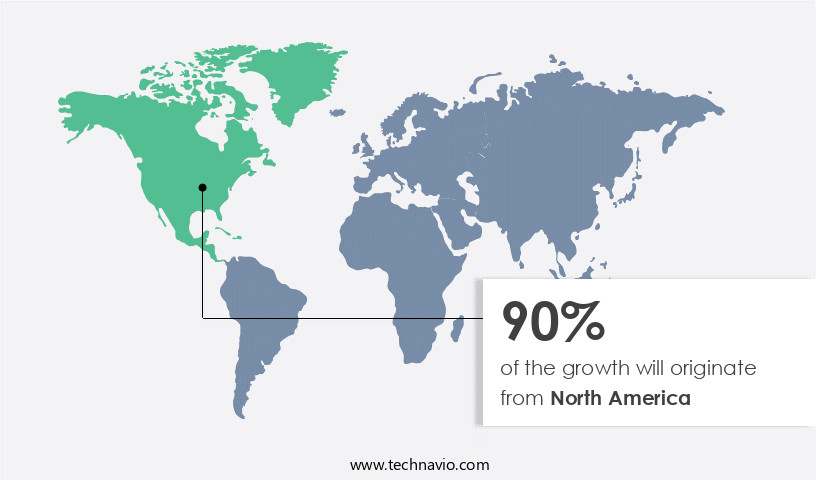

North America is estimated to contribute 90% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market for cannabis-infused edibles has experienced notable expansion, driven by the legalization of cannabis in the United States and Canada and shifting consumer preferences. Chocolates, gummies, baked goods, beverages, and other forms of infused products have gained popularity, with an emphasis on health-conscious options such as low-sugar, gluten-free, and vegan alternatives. Alzheimer's disease, muscular spasms, and post-traumatic stress disorder are among the health conditions for which cannabis-infused edibles are being used. Infused beverages, including white grape juice and vitamin C beverages, are also gaining traction. The cannabis industry's regulatory landscape is complex, with legislative discrepancies between states and provinces.

Companies like Gfarmalabs and Province Brands are innovating to address these challenges, offering private-label brands and gummy consistent items for retailers. Meanwhile, the healthcare system is increasingly recognizing the potential benefits of cannabis-infused products for conditions such as epilepsy and cancer-related symptoms. Consumer demand for cannabis-infused products continues to grow, with etrahydrocannabinol (THC) and cannabidiol (CBD) being the most sought-after compounds. THC is used for recreational purposes and to manage pain and nausea, while CBD is popular for its therapeutic effects, including reducing inflammation and anxiety. Companies like Sprig and Shop closures are meeting this demand by offering a wide range of product choices, including chocolate cookies/brownies, lollipops, and gummies.

However, the market faces challenges, including the stigma surrounding cannabis use and the potential for negative side effects such as vomiting. As the market evolves, it is essential to navigate these issues while maintaining regulatory compliance and addressing consumer concerns. For instance, micro-dosing and the use of gamma-aminobutyric acid (GABA) can help mitigate the negative effects of THC. In summary, the North American cannabis-infused edibles market is experiencing significant growth, driven by legalization, changing consumer attitudes, and health benefits. Companies are innovating to meet consumer demand for a wide range of products, including health-conscious options and THC and CBD-infused edibles.

However, the market faces challenges related to regulatory issues, negative side effects, and stigma, which must be addressed to ensure long-term success.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Cannabis-Infused Edible Products Industry?

- Growing social acceptance of cannabis is the key driver of the market.

- The market is experiencing significant growth due to the evolving perception of cannabis as a business opportunity rather than just an intoxicant. This shift in perspective is driving interest from new companies and large investors, particularly in the food and beverage industry. The global market for these products has consistently shown strong growth, providing substantial potential for long-term gains. Moreover, the expansion of the cannabis industry has generated substantial revenue for governments and corporations alike.

- This trend is expected to continue as the acceptance of cannabis spreads across the globe.

What are the market trends shaping the Cannabis-Infused Edible Products Industry?

- Advent of advanced cultivation methods for cannabis is the upcoming market trend.

- The global legal cannabis market has experienced notable growth due to advancements in cultivation techniques. In state-of-the-art laboratories, cannabis is now grown using sophisticated facilities, including sanitized chambers and a controlled environment. Innovative methods like Screen of Green (SCROF) and Sea of Green (SOG) have significantly enhanced production levels. These techniques employ a nutrient-enriched solution to cultivate cannabis high in tetrahydrocannabinol (THC) and cannabidiol (CBD).

- The implementation of these advanced procedures has resulted in improved product quality and increased production rates for marijuana-derived edibles. These developments have contributed to the market's expansion, providing opportunities for companies in the cannabis industry.

What challenges does the Cannabis-Infused Edible Products Industry face during its growth?

- Legalization and regularization of cannabis is a key challenge affecting the industry growth.

- The cannabis-infused edibles market faces intricate legal complexities due to varying regulations across countries and even within legal jurisdictions. For instance, while some countries like China, Russia, and Brazil maintain strict prohibition, others, such as the US, India, and Australia, allow its use only in specific states. These legal nuances create challenges for companies seeking to manufacture and sell cannabis edibles. In countries where it is legal, stringent regulations govern production, sale, and distribution.

- Compliance with these regulations can be costly and complex, posing a barrier to entry for smaller market players. Overall, navigating the legal landscape of the cannabis industry requires a deep understanding of the specific regulations in each jurisdiction.

Exclusive Customer Landscape

The cannabis-infused edible products market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cannabis-infused edible products market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cannabis-infused edible products market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bhang Nation - The company produces cannabis-infused chocolates, formulated to promote biological harmony and potentially enhance cognitive performance. These confections are meticulously crafted to deliver a balanced experience, aimed at elevating mood and cognitive function. The use of cannabis in these chocolates is thoughtfully integrated, ensuring a refined and enjoyable experience for consumers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bhang Nation

- Blemish Inc.

- Cannabinoid Creations

- Cannabis Energy Drink

- CBDfx UK

- Charlottes Web Holdings Inc.

- Cornbread Hemp

- Diamond CBD

- Dixie Brands

- Green Roads.

- Gron

- Happy Flower Co.

- Harmony

- Hugs Wellness Inc.

- Kats Botanicals

- Kiva Brands Inc.

- Lulus Chocolate

- Medix CBD

- Medterra CBD

- Sunday Scaries

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The cannabis-infused edibles market has experienced significant growth in recent years, with consumers increasingly seeking alternative methods to consume cannabis beyond traditional smoking and vaping methods. One segment of this market that has gained considerable traction is infused drinks. These beverages offer consumers a discreet and convenient way to consume cannabis, allowing them to enjoy the health advantages of the plant without the negative effects associated with smoking. Infused drinks come in various forms, from white grape juice to vitamin C beverages, providing consumers with a wide range of options to suit their preferences. The market for these products is driven by customer demand for convenient and discreet consumption methods, as well as the growing recognition of the health benefits of cannabis for various conditions.

One such condition is Alzheimer's disease. Research suggests that cannabinoids, the active compounds in cannabis, may help improve memory and cognitive function in individuals with Alzheimer's. This has led to increased interest in the development of infused drinks specifically formulated for this purpose. Another condition that has gained attention in the cannabis industry is glaucoma. Marijuana and its active compounds, such as tetrahydrocannabinol (THC) and cannabidiol (CBD), have been shown to help reduce intraocular pressure, making them a potential treatment option for this condition. Infused drinks offer a convenient and discreet way for patients to consume these compounds, making them an attractive alternative to traditional cannabis products.

However, the cannabis-infused edibles market is not without its challenges. Regulatory issues and legislative discrepancies continue to pose significant barriers to growth. For instance, some provinces have banned the sale of infused drinks altogether, while others have imposed strict regulations on their production and sale. These challenges have led some companies, such as GFarmLabs, to focus on private-label brands, allowing them to bypass some of the regulatory hurdles and reach a wider customer base. Despite these challenges, innovation continues to drive the cannabis-infused edibles market. Companies are exploring new product lines, such as gummy consistent items, lollipops, and even chocolate cookies and brownies, to cater to the evolving preferences of consumers.

Product choices are expanding, with some companies even experimenting with micro-dosing, allowing consumers to enjoy the health benefits of cannabis without the psychoactive effects. The healthcare system also plays a role in the growth of the cannabis-infused edibles market. Conditions such as muscular spasms, epilepsy, post-traumatic stress disorder, and cancer-related symptoms have all been identified as potential areas of application for cannabis-infused products. As more research is conducted and regulatory frameworks evolve, it is expected that the market for these products will continue to grow. However, it is important to note that not all infused products are created equal.

Quality and consistency are key considerations for consumers, and companies must ensure that their products meet the highest standards of safety and efficacy. This is particularly important for infused drinks, which can be more susceptible to contamination and inconsistencies in dosing. In conclusion, the cannabis-infused edibles market, particularly infused drinks, is poised for significant growth as consumers seek alternative methods to consume cannabis and take advantage of its health benefits. However, regulatory challenges and quality concerns must be addressed to ensure the long-term success of this market. Companies that can navigate these challenges and deliver high-quality, consistent products are well-positioned to capitalize on the growing demand for cannabis-infused beverages.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.04% |

|

Market growth 2024-2028 |

USD 7011.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

18.7 |

|

Key countries |

US, Canada, Czech Republic, Italy, and Croatia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cannabis-Infused Edible Products Market Research and Growth Report?

- CAGR of the Cannabis-Infused Edible Products industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cannabis-infused edible products market growth of industry companies

We can help! Our analysts can customize this cannabis-infused edible products market research report to meet your requirements.