UK Ceramic Tiles Market Size 2024-2028

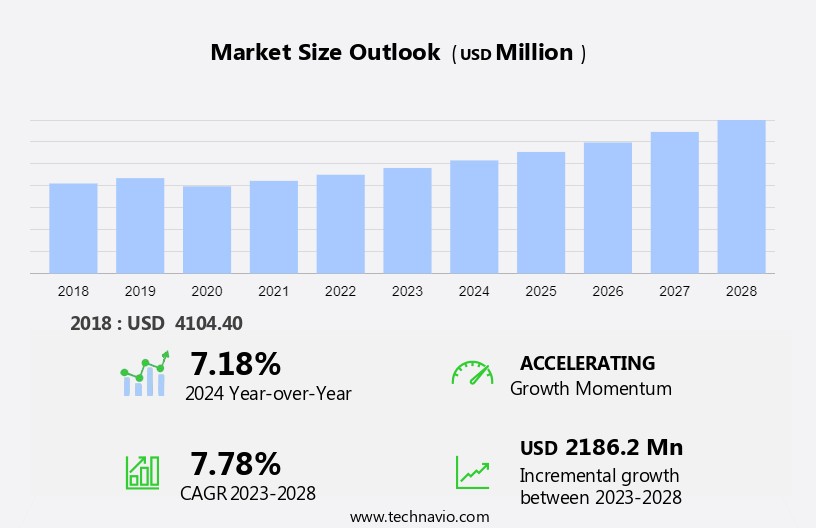

The UK ceramic tiles market size is forecast to increase by USD 2.19 billion at a CAGR of 7.78% between 2023 and 2028.

- The market In the UK is witnessing significant growth due to the expansion of the construction and real estate industry. This sector's growth is driving the demand for ceramic tiles as they are a popular choice for flooring and wall covering in both residential and commercial projects. Additionally, ceramic tiles offer anti-slip properties, making them suitable for various applications, such as bathroom walls, kitchen floor surfaces, and commercial projects. Another trend influencing the market is the increasing preference for 3D ceramic tiles, which offer unique designs and textures, adding aesthetic value to spaces. However, the market faces challenges such as fluctuating raw material costs, which impact the pricing and profitability of ceramic tile manufacturers. Despite these challenges, the market is expected to continue its growth trajectory due to the increasing demand in various applications.

What will be the size of the UK Ceramic Tiles Market during the forecast period?

- The market in the UK exhibits growth, driven by the industry's versatility and wide-ranging applications. These tiles, crafted from clay and other natural materials like sand and quartz, offer desirable properties such as chemical and stain resistance, dimension stability, and water absorption levels below 0.5%. Ceramic tiles come in various forms, including glazed and porcelain, catering to diverse needs. They are renowned for their durability, with excellent surface abrasion and cracking resistance. They boast anti-slip properties, making them suitable for various interior decoration projects in houses, restaurants, offices, shops, and public spaces.

- Marble-styled tiles, achieved through digital printing processes, add an elegant touch to modern interiors. They are also valued for their heat resistance, enabling their use in high-temperature environments. The market's growth is further fueled by the increasing popularity of colorful and patterned tiles, enhancing the aesthetic appeal of bathroom walls and kitchen floor surfaces. Additionally, the market benefits from the tiles' ability to withstand acidic materials and high temperatures, making them a preferred choice for various industries.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Ceramic floor tiles

- Ceramic wall tiles

- Others

- End-user

- Residential

- Non-residential

- Application

- New construction

- Renovation and replacement

- Geography

- UK

By Product Insights

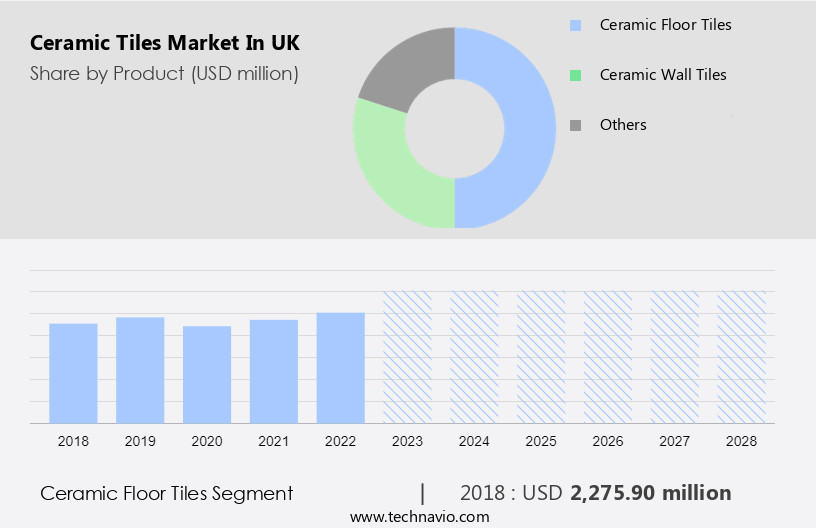

- The ceramic floor tiles segment is estimated to witness significant growth during the forecast period. Ceramic floor tiles have gained significant popularity in both residential and commercial sectors due to the increasing trend of renovation and remodeling projects. The durability and low maintenance requirements make them an ideal choice for various applications, including offices, retail stores, and restaurants. Ceramic tiles offer several advantages such as frost resistance, water absorption resistance, stain resistance, chemical resistance, strength, dirt resistance, heat resistance, fire resistance, and slip resistance. These tiles are also available in a wide range of designs, sizes, and finishes due to advancements in manufacturing technology.

- In the commercial sector, ceramic tiles are frequently used for flooring in buildings like hospitals, government offices, sports institutes, and new residential construction projects. Additionally, the porcelain tiles market, a type of ceramic tile, is experiencing growth due to its increased usage in high-traffic areas and its ability to mimic the look of marble and other natural stones through digital printing processes and glazing techniques. They contribute to sustainable building development by offering recycled material content and heat absorption properties, making them suitable for roofing and ceiling tiles as well.

Get a glance at the market share of various segments Request Free Sample

- The ceramic floor tiles segment was valued at USD 2.28 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of UK Ceramic Tiles Market?

- Growth of construction and real estate industry is the key driver of the market. The European market experiences significant growth due to the expansion of the construction and real estate sectors. Infrastructure projects, such as roads, bridges, and public buildings, utilize ceramic tiles for their durability and versatility in flooring, cladding, and other applications. Residential housing projects, including renovations and new construction, are substantial consumers. European homeowners and developers prefer these tiles for their aesthetic appeal and long-lasting properties.

- The market in Europe benefits from the increasing demand for flooring and wall solutions that can withstand heavy foot traffic, water absorption, surface abrasion, and cracking. The market for porcelain tiles, specifically, gains popularity due to its chemical resistance, stain resistance, and ability to mimic the appearance of marble-styled tiles through digital printing processes. The demand for sustainable building development and the use of recycled material content further boosts the market in Europe.

What are the market trends shaping the UK Ceramic Tiles Market?

- Growing popularity of 3D tiles is the upcoming trend In the market. The market in the UK is witnessing growth due to the increasing demand for 3D ceramic tiles. These tiles offer unique and visually appealing designs, making them a popular choice for both residential and commercial spaces. The preference for contemporary and artistic designs among UK consumers is driving the demand for 3D ceramic tiles. However, the demand for these tiles can fluctuate based on the trends favored by architects and interior designers. Their specification for construction and renovation projects significantly influences the market. They provide several benefits such as chemical and stain resistance, dimension stability, water absorption resistance, surface abrasion resistance, and cracking resistance. These properties make them suitable for various applications, including interior decoration, the real estate market, floor-covering products, and the porcelain tiles market. Porcelain tiles, in particular, are gaining popularity due to their high heat and strength, making them suitable for use in hospitals, government offices, sports institutes, new residential construction, and commercial projects. The demand for 3D ceramic tiles is influenced by factors such as disposable income levels, infrastructure spending, and the popularity of marble-styled tiles. Digital printing processes have made it possible to produce a wide range of colors and patterns, further increasing their appeal. The market also includes glazed tiles, which offer additional benefits such as water absorption and resistance to acidic materials.

- The market comprises clay, sand, quartz, water, and other raw materials, and the production process involves kiln firing at high temperatures. The ceramic tiles market caters to various industries, including houses, restaurants, offices, shops, bathroom walls, kitchen floor surfaces, and sanitary ware. The market also includes applications in industrial sectors, such as kiln linings, knife blades, disc brakes, vehicles, watch cases, biomedical implants, gas, fire radiant, hydrophilic kaolin, flooring, and ceiling tiles. The commercial sub-segment includes buildings, air pollution, water consumption, and sustainable building development. The market also includes recycled material content and heat absorption, making it an environmentally friendly choice for roofing tiles. The ceramic tiles market faces challenges from factors such as dirt, dust, pollen, and allergens, which can affect living spaces, particularly in warm climates. However, the market is expected to grow due to increasing infrastructure spending and the popularity of sustainable building development. The market also offers opportunities for innovation, such as the development of new digital printing processes and the use of recycled materials. Overall, the ceramic tiles market is expected to continue growing due to its versatility, durability, and aesthetic appeal.

What challenges does UK Ceramic Tiles Market face during the growth?

- Fluctuating raw material costs of ceramic tiles is a key challenge affecting the market growth. The ceramic tiles market In the UK is driven by various factors, including infrastructure spending and the real estate market. The demand for ceramic tiles, which includes porcelain and glazed varieties, is influenced by their chemical and stain resistance, dimension stability, water absorption, surface abrasion, and cracking resistance. These tiles are used extensively in interior decoration for both residential and commercial projects, such as houses, restaurants, offices, shops, and bathroom walls. Infrastructure spending on transportation infrastructures, hospitals, and government offices also contributes to market growth. New residential construction and housing renovation, as well as remodeling activities, are significant market drivers. Disposable income levels and sustainable building development, which include the use of recycled material content and heat absorption, are also key factors. The porcelain tiles market, specifically, is gaining popularity due to its high strength, heat resistance, and ability to withstand high temperatures and acidic materials. Digital printing processes enable the production of marble-styled tiles, further expanding the market. However, the industry faces challenges from raw material price volatility and energy-intensive manufacturing processes, which impact production costs and profit margins. Ceramic tiles are used in various applications, including flooring, pipes, bricks, cookware, tableware, sanitary ware, pottery products, kiln linings, knife blades, disc brakes, vehicles, watch cases, biomedical implants, gas, fire radiant, hydrophilic kaolin, and more.

- The market is segmented into residential and commercial construction, with the latter experiencing significant growth due to increased demand for durable, aesthetically pleasing, and functional flooring solutions. The ceramic tiles market is subject to various external factors, such as dirt, dust, pollen, and allergens, which impact living spaces, particularly in warm climates. The market also faces challenges from air pollution and water consumption concerns, necessitating the development of eco-friendly and water-efficient manufacturing processes. In low-density residential areas, the focus on sustainable building development is driving the demand for ceramic tiles with high recycled material content. Thus, the ceramic tiles market in the UK is influenced by various factors, including raw material prices, energy costs, and external environmental factors. The market is driven by the real estate market, infrastructure spending, and the demand for durable, functional, and aesthetically pleasing flooring solutions. The porcelain tiles market is gaining popularity due to its high strength, heat resistance, and ability to withstand high temperatures and acidic materials. However, the industry faces challenges from raw material price volatility and energy-intensive manufacturing processes. The market is segmented into residential and commercial construction, with the latter experiencing significant growth. Sustainability and eco-friendliness are key trends In the market, driven by concerns over air pollution, water consumption, and the need for durable, functional, and aesthetically pleasing flooring solutions.

Exclusive UK Ceramic Tiles Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Al Murad D.I.Y Ltd.

- Ceramica Impex Ltd.

- Compagnie de Saint Gobain

- Craven Dunnill and Co Ltd.

- Dune Ceramica SL

- H and E Smith Ltd.

- Mohawk Industries Inc.

- Norcros Plc

- Original Style Ltd.

- PORCELANOSA Grupo AIE

- Unique Tiles Ltd.

- Victoria Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The ceramic tiles market In the UK exhibits growth, driven by the increasing demand for floor-covering products that offer superior durability, chemical resistance, and stain resistance. These tiles, available in various dimensions and water absorption rates, cater to diverse applications in both residential and commercial sectors. Ceramic tiles, a popular choice for interior decoration, have gained significant traction In the real estate market due to their versatility and aesthetic appeal. Housing renovation and remodeling activities, fueled by disposable income levels, have further fuelled the market's expansion. Porcelain tiles, a refined variant of ceramic tiles, have garnered considerable attention due to their high strength, heat resistance, and ability to withstand high temperatures. Their resistance to acidic materials makes them suitable for various applications, including healthcare centers, government offices, and sports institutes. New residential construction and commercial projects are significant contributors to the ceramic tiles market's growth. Marble-styled tiles, produced using digital printing processes, have gained popularity due to their affordability and realistic appearance. Glazed tiles, another variant, offer a wide range of colors and finishes, making them suitable for various applications, such as bathroom walls and kitchen floor surfaces. The ceramic tiles market is segmented into floor tiles and wall tiles based on their application. Floor tiles are further classified into porcelain and glazed tiles.

Porcelain tiles, due to their strength and durability, are widely used in commercial projects, such as restaurants, offices, shops, and public buildings. Glazed ceramic tiles, on the other hand, are preferred for their aesthetic appeal and are commonly used in residential applications. The demand for ceramic tiles is influenced by several factors, including surface abrasion resistance, cracking resistance, and anti-slip properties. In addition, the tiles' ability to withstand dirt, dust, pollen, and allergens makes them an attractive choice for living spaces, particularly in warm climates. The ceramic tiles market's growth is also driven by the increasing focus on sustainable building development. The use of recycled material content in ceramic tiles is gaining popularity due to its environmental benefits. Furthermore, the market's expansion is influenced by the growing demand for heat absorption properties in roofing and ceiling tiles. Thus, the ceramic tiles market In the UK is experiencing steady growth, driven by the increasing demand for durable, chemical-resistant, and stain-resistant floor-covering products. The market's expansion is influenced by various factors, including the real estate market, housing renovation activities, and the growing focus on sustainable building development. Porcelain and glazed tiles, with their unique properties, cater to diverse applications in both residential and commercial sectors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

129 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.78% |

|

Market growth 2024-2028 |

USD 2.19 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

7.18 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across UK

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch