Chocolate Market Size 2025-2029

The chocolate market size is forecast to increase by USD 52.7 billion, at a CAGR of 5.1% between 2024 and 2029. Increasing premiumization of chocolates will drive the chocolate market.

Major Market Trends & Insights

- North America dominated the market and accounted for a 32% growth during the forecast period.

- By Product - Milk chocolate segment was valued at USD 70.70 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 44.26 billion

- Market Future Opportunities: USD 52.70 billion

- CAGR : 5.1%

- North America: Largest market in 2023

Market Summary

- The market is a dynamic and evolving industry, marked by continuous innovation and shifting consumer preferences. Premiumization of chocolates, driven by the increasing demand for high-quality, artisanal, and ethically sourced products, is a significant trend shaping the market. Simultaneously, advancements in chocolate packaging technology, such as biodegradable and reusable materials, are gaining traction, addressing consumer concerns around sustainability. However, the market faces challenges, including unstable cocoa prices and declining per capita consumption in key markets. According to recent studies, The market accounted for over 30% of the total confectionery market share in 2020.

- Looking ahead, the market is expected to remain robust, with opportunities in emerging regions and the continued expansion of e-commerce platforms. For related markets, explore the dynamic world of the Nut Butter Market and the evolving trends in the Confectionery Coatings Market.

What will be the Size of the Chocolate Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Chocolate Market Segmented and what are the key trends of market segmentation?

The chocolate industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Milk chocolate

- Dark chocolate

- White chocolate

- Distribution Channel

- Offline

- Online

- Type

- Traditional

- Artificial

- Cocao Content

- Low (<30%)

- Medium (30-60%)

- High (>60%)

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The milk chocolate segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, mass production techniques have significantly evolved, enabling the industry to cater to increasing demand. Traceability systems ensure product authenticity and consumer trust, while sensory evaluation methods maintain consistent taste and quality. Shelf life extension is a crucial focus, with quality assurance procedures and rheological properties ensuring optimal texture and preventing fat bloom. Tempering methods, process monitoring systems, and ingredient sourcing are essential components of the chocolate manufacturing process. Waste reduction strategies and sustainable sourcing practices are gaining importance, as is colorimetric analysis for maintaining uniform color. Conching techniques refine the chocolate's flavor, and microbial contamination control is vital for food safety.

Aroma compound profiling and melting point determination contribute to the unique taste experiences consumers expect. Supply chain management and energy efficiency improvements are essential for maintaining profitability and competitiveness. The market's continuous evolution includes product diversification, flavonoid quantification, sugar crystallization, and viscosity measurement. Quality control parameters, packaging optimization, and process optimization strategies ensure product excellence. Cocoa bean fermentation and shear thinning behavior influence the final product's flavor and texture. Flavor compound analysis and polyphenol content are essential for product differentiation and health benefits. According to recent studies, milk chocolate accounts for approximately 60% of the market.

Its popularity is attributed to its smoother and creamier taste. However, the health concerns surrounding milk chocolates have resulted in a decrease in demand, with sales projected to account for 57% of the market by 2027. Meanwhile, dark chocolate, with its higher cocoa solids content, is expected to capture a larger market share, growing from 32% to 39% during the same period. Another trend is the increasing focus on antioxidant capacity and product formulation, with chocolate liquor processing gaining popularity for its health benefits. Additionally, companies are investing in polyphenol content analysis and sugar crystallization to cater to the health-conscious consumer base.

The market's future growth is expected to be driven by these trends, with a projected increase of 22% in sales by 2027.

The Milk chocolate segment was valued at USD 70.70 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

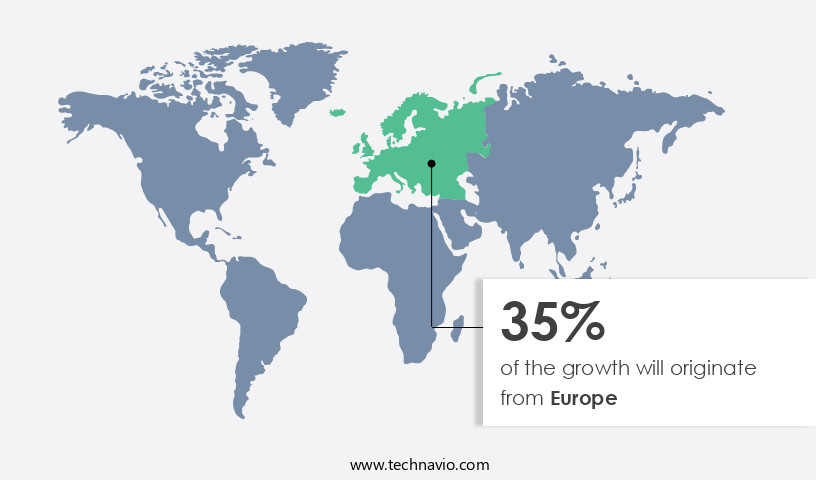

North America is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Chocolate Market Demand is Rising in North America Request Free Sample

Europe, a significant player in The market, experiences high consumer preference for premium chocolates. The demand for dark chocolates and organic varieties is on the rise in European countries. Europe's chocolate industry relies heavily on cocoa beans for production, leading to a surge in fine flavor cocoa demand. This growth is attributed to increasing health consciousness and a high obesity rate in the region.

Companies are focusing on innovating low-sugar chocolate products, contributing to the competitive and fragmented European the market. The market's expansion is expected to continue due to the consistent launch of new and improved chocolate offerings.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and intricate industry, encompassing various aspects of cocoa bean processing that significantly impact the final product's flavor, texture, and quality. One crucial process is cocoa bean fermentation, which influences the development of complex flavors through the metabolism of polyphenols. The length and temperature of fermentation can alter the chocolate's taste profile. Another essential process is conching, which refines the chocolate by reducing bitterness and improving its texture. The duration and intensity of conching impact the particle size and mouthfeel, ultimately affecting the sensory evaluation of different chocolate types. Tempering, a critical step in chocolate production, ensures the chocolate develops a glossy appearance and a desirable snap.

The polyphenol content and antioxidant activity in chocolate are influenced by the cocoa solids' crystallization during tempering. Understanding the rheological properties and chocolate flow is essential for optimizing manufacturing processes. The correlation between particle size and mouthfeel, sugar crystallization, and fat bloom prevention strategies are all crucial factors in maintaining chocolate's desirable texture. Sustainable sourcing practices in cocoa production are increasingly important in the market. Quality control parameters, such as roasting temperature and grinding fineness, are essential for enhancing chocolate flavor. Analyzing volatile aroma compounds and the chemical composition of chocolate can provide valuable insights into the sensory perception of various chocolate types.

In terms of process optimization, determining the impact of milk powder on viscosity and measuring the effect of conching on particle size are critical considerations. Comparing the conching time of two leading chocolate manufacturers, Nestlé and Mars, reveals a difference of 2 hours, with Nestlé conching for 72 hours and Mars for 70 hours (Source: Chocolate Almanac, 2021). This difference can significantly impact the chocolate's texture and flavor. Flavor compound analysis in dark chocolate varieties and assessing the effect of roasting temperature on flavor further highlight the complexity of the market. By addressing these factors and implementing research-backed insights, chocolate manufacturers can create high-quality products that cater to consumers' evolving preferences.

What are the key market drivers leading to the rise in the adoption of Chocolate Industry?

- The premiumization trend significantly drives the market's growth, with consumers increasingly opting for higher-end, artisanal, and gourmet chocolate products.

- The global premium the market is experiencing significant growth, with a notable increase in demand, especially in emerging economies like China, India, and Brazil. Companies such as Mars, Barry Callebaut, and Mondelez International are responding to this trend by introducing new premium offerings to differentiate, personalize, and improve the taste and quality of their chocolate segments. For instance, in February 2024, Chocoladefabriken Lindt and Sprungli introduced premium Lindor dark truffles. This strategy allows companies to secure higher profit margins and cater to consumers who value price, packaging, ingredients, exclusivity, and provenance.

- The use of premium chocolates as gifts, given their superior taste and quality, is also prevalent. The chocolate industry's continuous evolution and the ongoing launch of new premium products underscore the market's dynamic nature.

What are the market trends shaping the Chocolate Industry?

- The rising innovation in chocolate packaging is a notable trend in the upcoming market. Innovative approaches to chocolate packaging are gaining momentum in the marketplace.

- In the dynamic world of business, product packaging plays a pivotal role in capturing consumer attention and differentiating brands. With the escalating trend of chocolates as popular gifts, companies invest significantly in innovative packaging to extend product shelf life and rejuvenate consumer interest. Creative designs and branding strategies are crucial elements, as they are the initial points of engagement for consumers.

- Packaging serves as an extension of a brand's value, sparking curiosity and interest. Consequently, companies are continually innovating to stay competitive in this integral aspect of their product portfolio. Packaging's significance in brand marketing is evident, driving key players to consistently push boundaries and set new industry standards.

What challenges does the Chocolate Industry face during its growth?

- The cocoa industry faces significant challenges due to unstable prices and decreasing per capita consumption, which poses a threat to its growth.

- The cocoa market, a significant component of the global confectionery industry, has experienced price volatility over the last decade. The price fluctuations of cocoa pose a challenge for chocolate manufacturers, as the cost of production becomes less predictable. Cocoa prices can shift by up to 15% over short periods, making it difficult for businesses to estimate their production expenses. This volatility is attributed to various factors, including weather conditions and global supply and demand dynamics. Despite the challenges, chocolate remains a popular treat in the confectionery sector, with sales continuing to grow.

- The unpredictability of cocoa prices adds complexity to the business landscape, requiring manufacturers to adapt and respond to market conditions. The cocoa market's continuous evolution underscores the importance of staying informed about its trends and fluctuations.

Exclusive Customer Landscape

The chocolate market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the chocolate market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Chocolate Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, chocolate market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arcor Group - This company specializes in a diverse range of chocolate products, including bonbons, bite-sized chocolates, tablets, sugar-coated varieties, baking chocolate, and pastry chocolates, catering to various consumer preferences and applications. Their offerings extend to chocolate products designed for children as well.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arcor Group

- AUGUST STORCK KG

- Barry Callebaut AG

- Chocoladefabriken Lindt and Sprungli AG

- Crown Confectionery Co. Ltd

- Delfi Ltd.

- Ezaki Glico Co. Ltd.

- Ferrero International S.A.

- Ghirardelli Chocolate Co.

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Lotte Corp.

- Mars Inc.

- Meiji Holdings Co. Ltd.

- Mondelez International Inc.

- Moonstruck Chocolate Co.

- Nestle SA

- Orion Corp.

- The Australian Carob Co.

- The Hershey Co.

- Unreal Brands Inc.

- Yildiz Holding AS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Chocolate Market

- In January 2024, Nestlé, the world's largest food company, announced the launch of a new line of vegan chocolate products under its iconic brand, KitKat. This expansion aimed to cater to the growing demand for plant-based food alternatives (Nestlé Press Release, 2024).

- In March 2024, Ferrero Group, the Italian confectionery company, signed a strategic partnership with Cargill, a leading agricultural supplier, to source sustainably grown cocoa beans. This collaboration aimed to improve transparency and sustainability in the chocolate industry (Ferrero Press Release, 2024).

- In May 2024, Hershey's, the American chocolate giant, completed the acquisition of SkinnyPop, a popcorn brand, from H.J. Heinz Company for USD1.6 billion. This acquisition was part of Hershey's growth strategy to expand its snack offerings beyond chocolate (Hershey's Press Release, 2024).

- In April 2025, the European Union passed the new Cocoa Sustainability Regulation, which requires companies to ensure that 100% of their cocoa beans are sustainably sourced by 2030. This regulation aims to address issues such as child labor and deforestation in the cocoa industry (European Parliament Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Chocolate Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 52.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving the market, various trends and innovations continue to shape the industry's landscape. One significant area of focus is the implementation of advanced mass production techniques to enhance efficiency and productivity. These methods ensure consistent product quality and help meet the growing demand for chocolate products. Another critical aspect is the adoption of traceability systems to maintain transparency throughout the supply chain. These systems enable tracking of ingredients from sourcing to manufacturing, ensuring ethical and sustainable sourcing practices. Sensory evaluation methods play a vital role in maintaining chocolate's desirable sensory properties, with texture profile analysis and sensory testing essential for quality assurance.

- Shelf life extension is another key trend, with various strategies employed to prevent fat bloom and maintain chocolate's texture and taste. Rheological properties, such as viscosity measurement and melting point determination, are crucial in optimizing chocolate processing techniques, including tempering methods and conching. Process monitoring systems are integral to maintaining product quality, with real-time analysis of quality control parameters essential for identifying and addressing potential issues. Ingredient sourcing strategies, such as waste reduction and sustainable practices, are becoming increasingly important, with a focus on antioxidant capacity and polyphenol content. Chocolate liquor processing, colorimetric analysis, and sugar crystallization are other areas of ongoing research and development, with innovations in packaging optimization, process optimization strategies, and energy efficiency improvements driving market growth.

- Additionally, product diversification and flavor compound analysis are key trends, with companies exploring new product offerings and innovative flavor profiles to cater to diverse consumer preferences.

What are the Key Data Covered in this Chocolate Market Research and Growth Report?

-

What is the expected growth of the Chocolate Market between 2025 and 2029?

-

USD 52.7 billion, at a CAGR of 5.1%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Milk chocolate, Dark chocolate, and White chocolate), Distribution Channel (Offline and Online), Type (Traditional and Artificial), Geography (Europe, North America, APAC, South America, and Middle East and Africa), and Cocao Content (Low (<30%), Medium (30-60%), and High (>60%))

-

-

Which regions are analyzed in the report?

-

Europe, North America, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing premiumization of chocolates, Unstable cocoa prices and declining per capita consumption

-

-

Who are the major players in the Chocolate Market?

-

Key Companies Arcor Group, AUGUST STORCK KG, Barry Callebaut AG, Chocoladefabriken Lindt and Sprungli AG, Crown Confectionery Co. Ltd, Delfi Ltd., Ezaki Glico Co. Ltd., Ferrero International S.A., Ghirardelli Chocolate Co., Gujarat Cooperative Milk Marketing Federation Ltd., Lotte Corp., Mars Inc., Meiji Holdings Co. Ltd., Mondelez International Inc., Moonstruck Chocolate Co., Nestle SA, Orion Corp., The Australian Carob Co., The Hershey Co., Unreal Brands Inc., and Yildiz Holding AS

-

Market Research Insights

- The market is a dynamic and intricately structured industry, characterized by ongoing advancements in bean sorting techniques, refining processes, and product innovation. With a global production volume of over 4 million metric tons annually, the market showcases significant diversity in product offerings, from dark to milk chocolate. Product stability is a critical concern, with ingredient interactions and bitter taste reduction being key areas of focus. Cocoa butter extraction and packaging materials are essential components, influencing physical properties and sensory attributes.

- Consumer preferences for specific roasting profiles and sweetness enhancement drive continuous process control strategies and product differentiation. Flavor development and mouthfeel improvement are also crucial aspects, achieved through various grinding methods and chemical composition adjustments. Yield optimization and cost reduction methods are continually pursued, alongside quality grading and storage condition management. Defect detection and new product development are ongoing priorities, with a focus on crystal structure and consumer perception.

We can help! Our analysts can customize this chocolate market research report to meet your requirements.