Commercial Bain-Marie Heaters Market Forecast 2024-2028

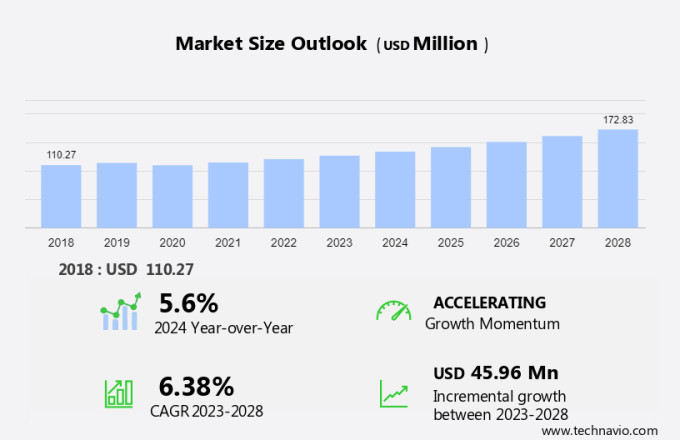

The commercial bain-marie heaters market size is forecast to increase by USD 45.96 million, at a CAGR of 6.38% between 2023 and 2028. The market's growth trajectory is shaped by several key factors. This includes the heightened emphasis on cooking uniformity within food service venues, a rising inclination towards commercial bain-marie heaters equipped with safety certifications, and the expanding reach of distribution channels overall. These trends underscore a growing demand for reliability and safety in commercial kitchen equipment. Ensuring consistent cooking standards and adhering to stringent safety measures are becoming increasingly vital considerations driving the market forward.

Moreover, the rise in North American market growth is driven by the swift integration of cutting-edge food service equipment, exemplified by the adoption of commercial bain-marie heaters. Buffalo presents a range of options including those with taps and without pans, like the Buffalo Bain Marie L371 and Buffalo Bain Marie with Pans S007. Meanwhile, HUPFER Metallwerke GmbH and Co. KG offer mobile bain-marie solutions with foil heating, facilitating the transportation and serving of prepared food in GN containers.

Market Forecasting

Market Forecast 2024-2028

To learn more about this report, Request Free Sample

Market Dynamics

The market is driven by factors such as the increasing demand for pre-cooked foodstuff and the expanding distribution channels. Trends indicate a rising preference for gas or electric maries and the adoption of IP marking for product authentication. However, challenges include ensuring cooking consistency and maintaining water resistance capacity. Company analysis is crucial for understanding market dynamics while navigating the global market scenario and staying abreast of the latest trends aids in strategic decision-making amid the evolving market environment. Our researchers studied the data for years, with 2023 as the base year and 2024 as the estimated year, and presented the key drivers, trends, and challenges for the market.

Driver - Focus on cooking consistency in food service establishments

Food service establishments are focused on providing various types of feed with consistent quality. In addition, they are also focusing on using commercial kitchen equipment that is designed to offer versatile applications to utilize commercial kitchen spaces efficiently. Furthermore, such heaters offer various benefits in edible service establishments.

For instance, they can hold food items at high temperatures, which helps end-users to serve food items at the required temperatures, they optimize the use of energy as well as they can handle the work of several pieces of equipment while taking minimum space in commercial kitchens. In addition, they are available with an automatic internal energy control mechanism to keep the temperature within the set limit and they are ideal for heat-sensitive products like sauces and fillings. Hence, such factors are driving the market during the forecast period.

Trends - Availability of commercial bain-marie heaters with IP marking

Commercial bain-marie heaters comprise water chambers with heating elements wrapped on the outside. In addition, the hot water inside the water chamber helps in maintaining the required heat for edibles safely. Furthermore, IP marking in such heaters indicates the water resistance capacity of the equipment.

Moreover, IP ratings refer to the degree of protection provided for the equipment against external factors, which can be dust, accidental contact, and water. In addition, companies are focusing on offering heaters with IP markings. Therefore, the availability along with IP markings will drive the market during the forecast period.

Challenge - High threat from substitute food service equipment

Several food service establishments increasingly prefer equipment that can provide faster heat-up time and are available with energy-efficient features. In addition, some commercial meal service equipment provides versatile applications. For example, commercial braising pans can be used to braise, grill, poach, steam, bain-marie, cook, and hold a variety of food with consistent food quality.

Moreover, this flexibility ensures substantial labor and energy savings to the end-users. In addition, eat-service establishments that need to hold a large number of food products prefer to invest in equipment like commercial braising pans. Furthermore, some of the other food service equipment that offers features similar to such heaters are hot food serving counters, mobile cooking carts, heated cabinets, and edible wells. Hence, such factors are hindering the market during the forecast period.

Market Segmentation by Product

In the market segmentation, various factors drive the market dynamics. The market size is influenced by the increasing demand for Bain maries and cabinets across diverse sectors such as food service establishments and commercial kitchen equipment. Growth drivers include the expansion of distribution channels and the rising preference for pre-cooked foodstuff. However, challenges like ensuring cooking consistency and water resistance capacity in Bain-Marie heaters persist. Company analysis plays a crucial role in understanding the key companies and their contributions to the market. Additionally, insights into the global market scenario and the latest trends help navigate the evolving market environment

Product Segment Analysis:

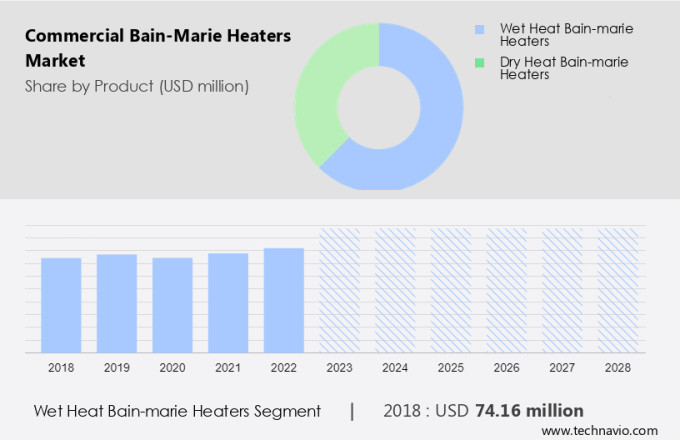

The wet heat bain-marie heaters segment is estimated to witness significant growth during the forecast period. A commercial wet heat bain-marie heater segment comprises an inner container and an outer container. The inner container is immersed about halfway into the water. In addition, the insulating action of water prevents the edible products from boiling and scorching; the maximum temperature of the edible products in the inner container will not exceed 212 degrees Fahrenheit. Furthermore, the maximum temperature can be altered by using different liquids such as oil or salt solutions.

Customised Report as per your requirements!

The wet heat bain-marie heaters segment was the largest segment and was valued at USD 74.16 million in 2018. Moreover, this can produce steam and provide a damp environment for grub to retain moisture and prevent drying out. In addition, these heaters can only be used for maintaining the temperature and heating food. Furthermore, some of the additional uses of commercial wet heat bain-marie heaters compared with commercial dry heat bain-marie heaters include baking cheesecake to prevent cracking, making custard, preparing warm sauces such as Hollandaise and baking terrines and pates. Hence, such factors are fuelling the growth of this segment which in turn drives the market growth during the forecast period.

Type Segment Analysis:

Based on type, the segment is classified into commercial countertop bain-marie heaters and commercial floor-standing bain-marie heaters. The commercial countertop bain-marie heaters segment will account for the largest share of this segment. The segment is significant in the global market. Moreover, the demand has been steadily increasing due to the growing food service industry worldwide. The countertop models are particularly popular as they offer convenience, efficiency, and flexibility in food preparation and service. However, these heaters are commonly used in hotels, restaurants, cafeterias, catering services, and other edible establishments. One of the key factors driving the growth of the segment is the rising demand. Such factors will increase the segment growth during the forecast period.

Regional Analysis

For more insights on the market share of various regions Download Sample PDF now!

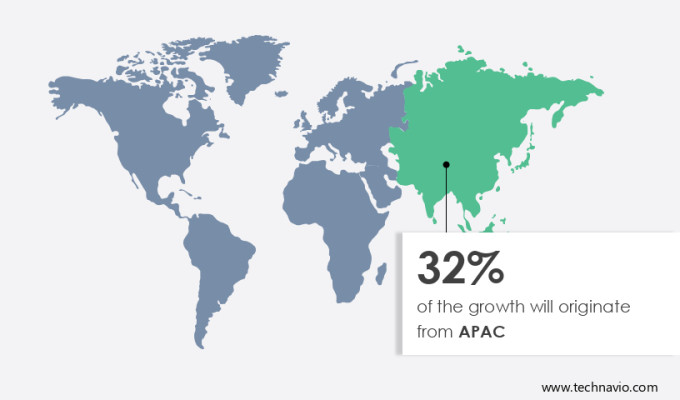

APAC is estimated to contribute 32% to the growth by 2028. Technavio’s analysts have elaborately explained the regional trends, drivers, and challenges that are expected to shape the market growth analysis during the forecast period. Another region offering significant growth opportunities to companies is North America. There are several food service establishments in North America that are some of the early adopters of technologically advanced food service equipment. In addition, the energy-saving benefits and enhanced production of food products offered are the major factors contributing to market development in the region. Furthermore, the multifunctional features offered enable potential end-users in the region to expand their food service offerings.

Moreover, food service establishments also use the commercial bain-marie heaters offered by Henny Penny Corp. Therefore, as per the market forecast, it is positively impacting the market growth in the region. Hence, such factors are driving the market development in North America during the forecast period.

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

JLA Ltd: The company offers commercial bain marie heaters such as JLA commercial Bain Marie, that ensure pre-cooked food and sauces are maintained at consistent, optimum, and reliable temperatures so food is ready to be plated during busy service periods.

We also have detailed analyses of the market’s competitive landscape and offer information on 20 market companies, including Aarvik Industries, Electrolux Professional AB, King Edward Ltd., Lanxess AG, Moffat E and R Ltd, Omcan Inc., Parry Catering Group Ltd., Roband Australia Pty. Ltd., ROLLER GRILL INTERNATIONAL SAS, S.A.G. Engineering Products, Sammic SL, SOFRACA, The Middleby Corp., The Vollrath Co. LLC, and Victor Manufacturing Ltd.

Technavio's market research and growth report provides an in-depth analysis of the market and its players through combined qualitative and quantitative data. The market analysis and report classify companies into categories based on their business approaches, including pure-play, category-focused, industry-focused, and diversified. Companies are especially focusing on Market forecasting in order to categorize into dominant, leading, strong, tentative, and weak, based on their quantitative data analysis.

Segment Overview

The market research report analysis and market report forecasts market growth by revenue at global, regional & country levels and provides an analysis of the latest trends and growth opportunities from 2018 to 2028.

- Product Outlook

- Wet heat bain-marie heaters

- Dry heat bain-marie heaters

- Type Outlook

- Commercial countertop bain-marie heaters

- Commercial floor-standing bain-marie heaters

- Geography Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

The market is experiencing growth driven by various factors such as the expansion of food entrepreneurs, ongoing innovation in commercial kitchens, and the preference for secondhand bain maries and cabinets. Qualitative and quantitative research indicate steady, moderate heat is essential for pre-cooked foodstuff, meals, and food delivery. Data synthesis reveals key parameters like the market landscape, key companies, and industry influencers. Upcoming trends include the adoption of IP-marked bain maries and cabinets and the expansion of self-service areas. Market growth opportunities lie in catering to quick-service restaurants, cafes, and groceries.

Additionally, the global market covers various segments, including water baths, double boilers, and gastronorm pans. The choice between gas or electric Bain Maries caters to diverse eateries, quick-service restaurants, and businesses specializing in prepared foods. The market segmentation extends to canteens, caterers, cafes, and commercial kitchen areas where these appliances efficiently melt ingredients, cook specialty meals, and cater to a variety of cuisine options. Energy consumption, suitability for heat-sensitive items, and the prevalence of secondhand models impact the market regionally, with a significant share in the catering industry, fast-food outlets, and local suppliers.

Moreover, the market is a dynamic sector driven by various factors such as profit, pricing, and competition. Qualitative research plays a crucial role in understanding consumer preferences, while primary information and secondary information help in making informed decisions. Promotions and market research reports aid in company selection methodology and assessing the market. The sector caters to a wide range of establishments, including the quick-service restaurant sector, cafés, and commercial kitchen setups. Industry progress is evident in the global bain and marine market, highlighting the diverse needs of feasts, independent food service businesses, and the catering industry. Secondhand commercial bain-marie heaters offer cost-effective solutions, particularly for previously used models, reducing upfront costs. The market regional insight provides valuable information on market share and new product launches, shaping the future of this market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.38% |

|

Market Growth 2024-2028 |

USD 45.96 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.6 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 32% |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aarvik Industries, Buffalo, Electrolux Professional AB, HUPFER Metallwerke GmbH and Co. KG, JLA Ltd., King Edward Ltd., Lanxess AG, Moffat E and R Ltd, Omcan Inc., Parry Catering Group Ltd., Roband Australia Pty. Ltd., ROLLER GRILL INTERNATIONAL SAS, S.A.G. Engineering Products, Sammic SL, SOFRACA, The Middleby Corp., The Vollrath Co. LLC, and Victor Manufacturing Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market growth and trends and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Market growth and forecasting across North America, Europe, APAC, Middle East and Africa, and South America

- A thorough market analysis and report of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch