Construction Demolition Market Size 2025-2029

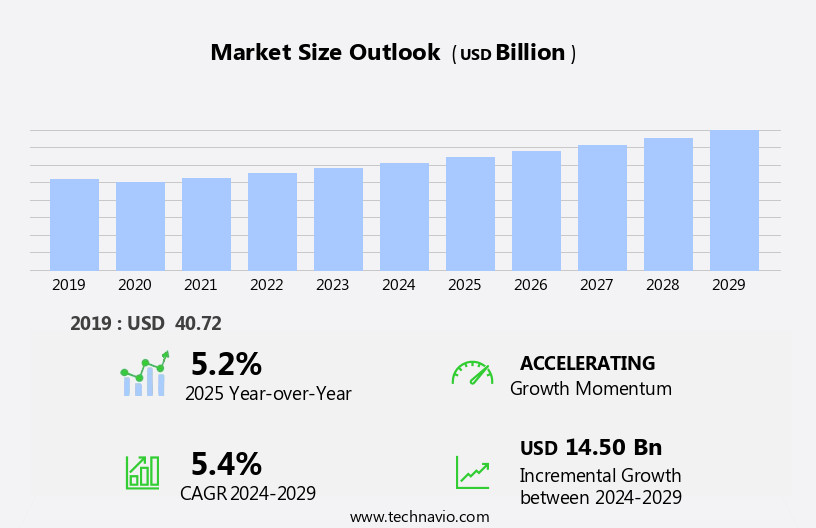

The construction demolition market size is forecast to increase by USD 14.50 billion, at a CAGR of 5.4% between 2024 and 2029.

- The market is experiencing significant growth due to key drivers such as rapid urbanization and population expansion. These factors have led to an increase in construction activities, resulting in a higher demand for demolition services. Additionally, the expansion of construction demolition waste recycling is another major trend In the market. This sustainable practice not only reduces the environmental impact of demolition but also offers cost savings for construction projects. Strict environmental regulations are also pushing the industry towards more eco-friendly practices, further boosting the market's growth. Overall, the market is poised for continued expansion as the need for sustainable and efficient demolition solutions becomes increasingly important.

What will be the Size of the Construction Demolition Market During the Forecast Period?

- The market encompasses the dismantling of buildings and structures, with a focus on maximizing resource recovery and minimizing environmental impact. This market is driven by the increasing demand for renewed infrastructure and urban development, as well as the growing importance of green building practices and regulations. Recycling and reusing services are critical components of the demolition process, with advancements in technology enabling higher recycling rates and the conversion of waste into energy-efficient materials. Drones and AI robots are increasingly utilized for project efficiency and safety while building information modelling and green materials are prioritized for energy-efficient design and ecologically friendly solutions.

- Critical systems, such as transport networks and safety tunnels, require specialized demolition techniques. Industrial adoption of construction technology continues to drive innovation, addressing supply chain issues and economic downturns. Environmental regulations and building rules are shaping the market, with a focus on reducing landfill use and increasing waste sorting and material recovery. Commercial projects, including affordable housing and renovation services, are significant contributors to the market's growth. Overall, the market is experiencing steady expansion, with a focus on sustainability, process innovations, and meeting the needs of infrastructure and property development.

How is this Construction Demolition Industry segmented and which is the largest segment?

The construction demolition industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Concrete

- Gravel

- Sand

- Soil

- Others

- Type

- Non-hazardous

- Hazardous

- Service

- Demolition

- Asbestos abatement

- Others

- Source

- Outsourced

- In-house

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- APAC

By Material Insights

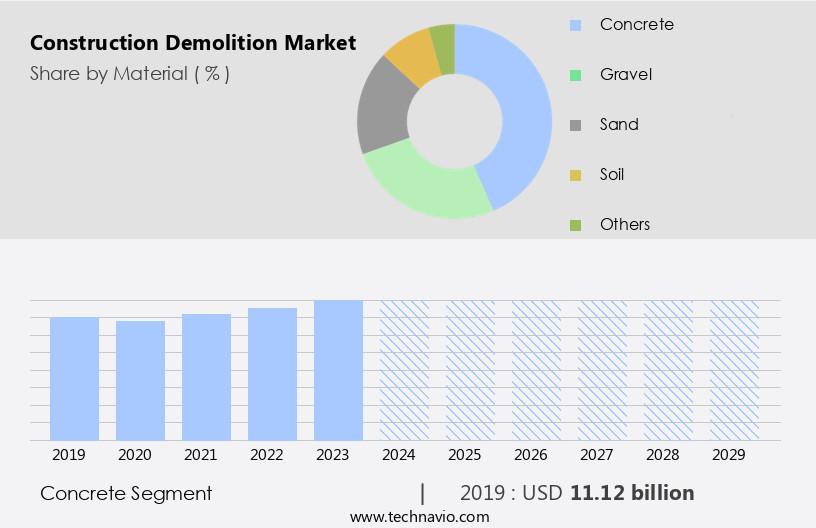

- The concrete segment is estimated to witness significant growth during the forecast period. The market is driven by the increasing use of recycled construction materials, particularly recycled concrete aggregates (RCA), In the industry. With concrete being the most commonly used construction material, the recycling of demolition waste into RCA has become a significant focus. Mechanical crushing and reprocessing techniques facilitate this process, making it an economically viable and sustainable solution. The European Union's mandate for the recycling of 70% of construction demolition waste has led to the establishment of numerous concrete recycling facilities. Countries such as Australia and China are also adopting similar practices to meet their sustainability goals.

- RCA is extensively used in various applications within the construction industry, including road construction, asphalt production, and concrete manufacturing. Construction project management companies are increasingly incorporating waste reduction strategies and sustainable practices to meet environmental standards and reduce construction costs. Infrastructure development challenges, such as urban renewal projects and infrastructure investment, also present opportunities for the growth of the market.

Get a glance at the market report of share of various segments Request Free Sample

The concrete segment was valued at USD 11.12 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

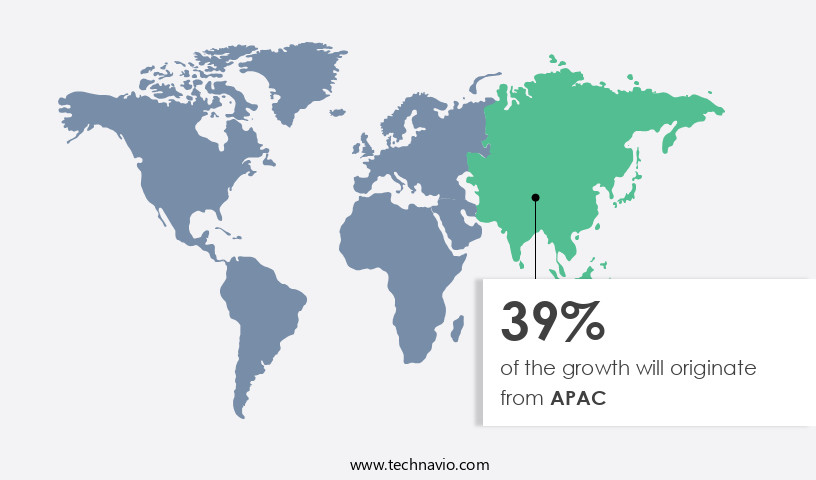

- APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market In the Asia-Pacific (APAC) region is experiencing significant growth due to urbanization, infrastructure development, and regulatory requirements. In China, the market is thriving due to massive urbanization and infrastructure expansion, driven by initiatives like the Belt and Road Initiative (BRI). Old infrastructure replacement and urban renewal projects in major cities, such as Beijing, Shanghai, and Shenzhen, are further fueling demolition activities. Construction technology adoption, including building automation and offsite construction, is addressing the construction labor shortage and increasing efficiency. Construction financing, building materials innovation, and sustainable construction practices are key trends shaping the market. Urban renewal projects, waste reduction strategies, and circular economy initiatives are prioritized In the development of smart cities and sustainable infrastructure.

In addition, construction project management, digital construction, and construction safety regulations ensure efficient and safe demolition processes. Economic growth and infrastructure investment are creating opportunities for construction project bidding, project financing options, and waste management consulting services. Environmental impact assessments, waste audit services, and recycling facility services are essential for waste management and disposal in a sustainable manner. Construction costs, project scheduling, and contract negotiation are critical factors influencing market dynamics.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of the Construction Demolition Industry?

- Rapid urbanization and population growth are the key driver of the market. The market is experiencing significant growth due to urbanization and population expansion. According to the United Nations, over half of the world's population currently resides in urban areas, and this figure is projected to increase to 68% by 2050. This shift towards urban living necessitates the construction of new infrastructure, housing, and commercial spaces, resulting in an increased demand for demolition activities. Construction waste management is a crucial aspect of demolition projects, with a focus on building automation, digital construction, and recycling initiatives. Construction technology adoption, including waste reduction strategies and green infrastructure development, is essential for sustainable urban planning and the creation of smart cities.

- Building materials innovation and sustainable construction practices are also critical for economic growth and infrastructure investment. Construction financing, project scheduling, and contract negotiation are essential components of demolition projects. Construction safety regulations, insurance, and project management are also vital to ensure the safe and efficient execution of demolition activities. Environmental impact assessments, site cleanup, and waste audit services are essential for minimizing the environmental footprint of demolition projects. Circular economy initiatives, such as waste recycling programs and the development of recycling facilities, are becoming increasingly important for reducing construction costs and promoting sustainable infrastructure development. Modular construction and demolition restoration are also gaining popularity due to their cost-effectiveness and environmental benefits.

What are the market trends shaping the Construction Demolition Industry?

- Expansion of construction demolition waste recycling is the upcoming market trend. The market is experiencing a notable shift towards waste recycling, fueled by technological advancements and a heightened focus on sustainability. This trend is evidenced by recent developments, including the completion of Kiverco's second recycling facility for Britaniacrest and the opening of Renewi's hard plastics sorting facility In the Netherlands. These projects underscore the growing importance of construction waste management In the industry. Building automation, green infrastructure, and smart cities are also driving demand for innovative building materials and sustainable construction practices. Construction financing, project management, and safety regulations are key challenges that require project financing options, construction project bidding, and waste reduction strategies.

- Digital construction, demolition restoration, modular construction, and construction insurance are essential components of this evolving landscape. Circular economy initiatives and sustainable urban planning are further shaping the market, with a focus on zero-waste construction and waste management consulting. Urban renewal projects and residential construction are major sectors benefiting from these trends, with green building certification and construction debris removal playing crucial roles. Environmental impact assessments and waste audit services are also essential for ensuring compliance with environmental standards. Waste recycling programs and sustainable infrastructure development are key priorities for the future of the construction industry.

What challenges does the Construction Demolition Industry face during its growth?

- Stringent environmental regulations are a key challenge affecting industry growth. The market is experiencing significant change as environmental regulations prioritize sustainable development and waste reduction. Regulations, such as the European Union Waste Framework Directive and the US Environmental Protection Agency's Resource Conservation and Recovery Act, mandate strict waste management and recycling targets. These regulations aim to minimize the environmental impact of construction activities by controlling waste disposal, air pollution, energy consumption, and resource efficiency. Construction technology adoption, including building automation, digital construction, and modular construction, is a key response to these regulations. Offsite construction and recycling facility services help reduce waste and improve efficiency. Urban renewal projects, smart cities, and sustainable infrastructure development are also driving the market, with a focus on green infrastructure, sustainable building, and zero-waste construction.

- Construction financing, project scheduling, and contract negotiation are also impacted by these regulations. Waste management consulting and waste audit services help ensure compliance with circular economy initiatives and environmental standards. Construction safety regulations and insurance requirements are also evolving to address the unique challenges of demolition projects. Infrastructure development and economic growth present ongoing challenges for the market. Innovations in building materials and construction project management help mitigate these challenges, while waste reduction strategies and demolition restoration services contribute to the circular economy. Construction debris removal and recycling are essential components of sustainable urban planning and green building certification.

Exclusive Customer Landscape

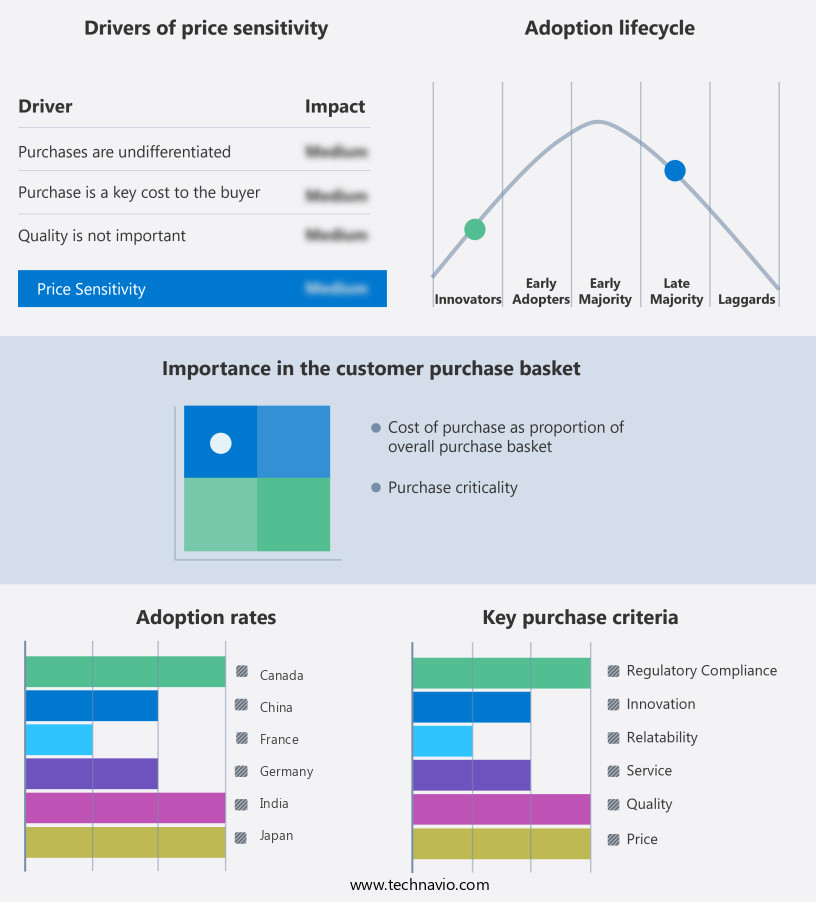

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, construction demolition market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Adamo Group Inc. - The company offers construction demolition services which includes decontamination, decommissioning, and asset recovery.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AF Gruppen Norge AS

- Brandenburg Industrial Service Co.

- Clean Harbors Inc.

- Demolition Plus

- East Coast Abatement and Demolition

- Independence Demolition

- ISI Demolition Inc.

- Kiverco Ltd.

- Lindamood

- Penhall Co.

- Priestly Demolition Inc.

- Renewi Plc

- Total Wrecking and Environmental LLC

- Veolia Environnement SA

- Waste Management Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing a period of significant transformation, driven by various market dynamics and technological advancements. One of the key areas of focus is construction demolition, which plays a crucial role in paving the way for new projects and urban renewal. Construction demolition involves the systematic dismantling of structures, often to make way for new developments. This process can be complex and time-consuming, requiring careful planning and execution to minimize disruptions and ensure safety. One of the major drivers of the market is urban renewal. As cities continue to grow and evolve, there is a constant demand for new infrastructure and developments.

Further, demolition is an essential part of this process, allowing for the redevelopment of outdated or obsolete structures. Another significant trend In the construction industry is the adoption of technology. Building automation, digital construction, and smart cities are just a few examples of how technology is transforming the way we design, build, and manage construction projects. Demolition is no exception, with the use of advanced technology helping to streamline the process and improve safety. Offsite construction is another area of growth In the construction industry. This approach involves constructing building components in a controlled factory environment and transporting them to the construction site for assembly.

In addition, demolition plays a crucial role In the offsite construction process, as it allows for the efficient removal of existing structures to make way for new ones. The construction labor shortage is a challenge facing the industry, and demolition is no exception. With a shortage of skilled labor, there is a growing demand for innovative solutions to make the demolition process more efficient and less labor-intensive. Construction financing is another critical factor In the demolition market. Securing financing for demolition projects can be a complex process, requiring careful planning and negotiation. Construction financing options, such as project financing and construction loans, can help to make the demolition process more feasible for developers.

Moreover, building materials innovation is another trend impacting the demolition market. The development of new and sustainable building materials is driving demand for demolition services, as existing structures are often made of materials that are no longer in use or are not environmentally friendly. The construction industry is also facing challenges related to infrastructure development and economic growth. Infrastructure development projects often require extensive demolition work, and the economic growth of cities can lead to a higher demand for new developments. Sustainable construction practices are becoming increasingly important In the construction industry, and demolition is no exception. Circular economy initiatives, waste reduction strategies, and sustainable urban planning are all driving demand for demolition services that prioritize the recycling and disposal of construction waste in an environmentally responsible manner.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

242 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market Growth 2025-2029 |

USD 14.50 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.2 |

|

Key countries |

US, China, India, Canada, Japan, South Korea, Germany, UK, Poland, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Construction Demolition Market Research and Growth Report?

- CAGR of the Construction Demolition industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the construction demolition market growth of industry companies

We can help! Our analysts can customize this construction demolition market research report to meet your requirements.