Cottonseed Oil Market Size 2023-2027

The cottonseed oil market size is forecast to increase by 965.24 th t at a CAGR of 3.6% between 2022 and 2027. The market is experiencing significant growth due to the health benefits it offers, particularly for those following high-calorie diets or seeking alternatives to saturated fats. Consumers increasingly prefer health-conscious options, leading to increased demand for cottonseed oil. Advanced packaging technologies, such as airtight containers and extended shelf life, are also driving market growth. However, the availability of substitutes, including canola oil and brominated oils, poses a challenge. Moreover, the rising popularity of organic variants, such as hemp seed oil and omega-3 and omega-6 rich oils, caters to the needs of cancer and heart disease patients.

Furthermore, the market is witnessing expansion due to the health advantages it provides, particularly for individuals following energy-dense diets or opting for alternatives to saturated fats. The shift towards healthier choices among consumers is fueling market growth. Advanced packaging solutions, including airtight containers and extended shelf life, are also contributing to market expansion. However, the presence of substitutes, such as canola oil and brominated oils, poses a challenge. Additionally, the increasing preference for organic alternatives, including hemp seed oil and omega-3 and omega-6 rich oils, caters to the needs of cancer and heart disease patients.

Cottonseed oil, derived from the seeds of cotton plants, has been a staple ingredient in various industries for decades. Its unique properties, such as high smoke point, neutral flavor, and rich content of unsaturated fatty acids, make it an ideal choice for numerous applications. In the food processing sector, cottonseed oil is widely used due to its high smoke point, which allows for deep frying without the risk of burning or developing off-flavors. This attribute is particularly essential in modern trade stores where the shopping experience is crucial, as consumers demand consistent product quality.

Furthermore, cottonseed oil is also a popular choice in the culinary world, especially for cooking applications. Its neutral flavor profile makes it an excellent base oil for various dishes, allowing other ingredients to shine. Furthermore, its high content of unsaturated fatty acids, including monounsaturated and polyunsaturated fatty acids, makes it a healthier alternative to other cooking oils with high saturated fat content. Besides food processing and cooking, cottonseed oil finds extensive applications in the cosmetics industry. Its anti-aging properties and anti-inflammatory benefits make it an essential ingredient in various skincare and personal care products. The health-conscious consumers' growing preference for heart-healthy options has led to an increased demand for cottonseed oil.

Additionally, the use of advanced packaging techniques ensures that cottonseed oil maintains its quality and freshness, extending its shelf life. Brominated oils and high-calorie diets are not ideal choices for health-conscious consumers. In contrast, cottonseed oil, with its heart-healthy benefits and neutral flavor, is an attractive alternative. Moreover, the increasing popularity of omega-3 and omega-6 rich oils like hemp seed oil has not significantly impacted the market. While these oils offer unique health benefits, cottonseed oil's versatility and affordability make it a preferred choice for many consumers. In conclusion, the market is witnessing significant growth due to its unique properties and wide range of applications in food processing, cooking, and cosmetics. The increasing preference for heart-healthy options and the growing demand from health-conscious consumers further bolster the market's growth.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD th t" for the period 2023-2027, as well as historical data from 2017-2021 for the following segments.

- Product

- GM cottonseed oil

- Non-GM cottonseed oil

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- Middle East and Africa

- North America

- US

- South America

- Brazil

- Europe

- APAC

By Product Insights

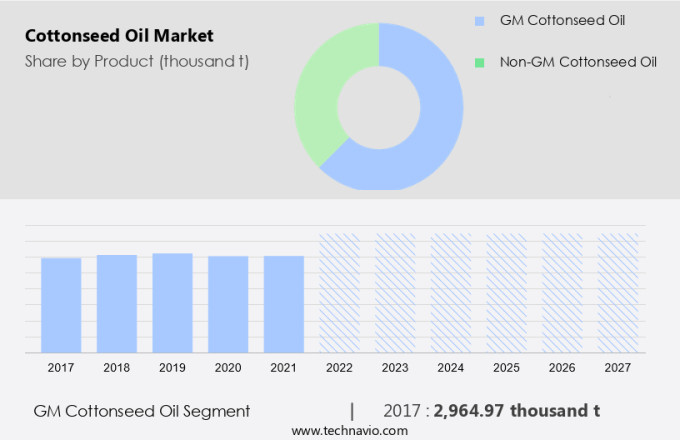

The GM cottonseed oil segment is estimated to witness significant growth during the forecast period. Cottonseed oil, derived from the seeds of cotton plants, holds a significant market share due to its high oil content and desirable characteristics for cooking and food processing. In 2022, the conventional cottonseed oil segment dominated the global market. However, the increasing consumer awareness and concerns regarding genetically modified cottonseed oil may lead to a decrease in its market share during the forecast period. Unlike naturally occurring cottonseed oil, genetically modified (GM) cottonseed oil is produced using advanced techniques that introduce new traits to the plant. Despite the benefits of GM crops, such as increased yield and resistance to pests, the sales of GM cottonseed oil for human consumption are restricted in certain countries, including India, due to regulatory issues.

Furthermore, cottonseed oil is valued for its neutral flavor and high smoke point, making it suitable for deep frying and various food applications. Additionally, it is rich in unsaturated fatty acids, contributing to its popularity in the food industry and the cosmetics sector. In modern trade stores, consumers seek a superior shopping experience, and cottonseed oil caters to this demand by offering a versatile and nutritious product. The market is expected to grow steadily, driven by its diverse applications and the increasing preference for healthier cooking oils.

Get a glance at the market share of various segments Request Free Sample

The GM cottonseed oil segment was valued at 2964.97 th t in 2017 and showed a gradual increase during the forecast period.

Regional Insights

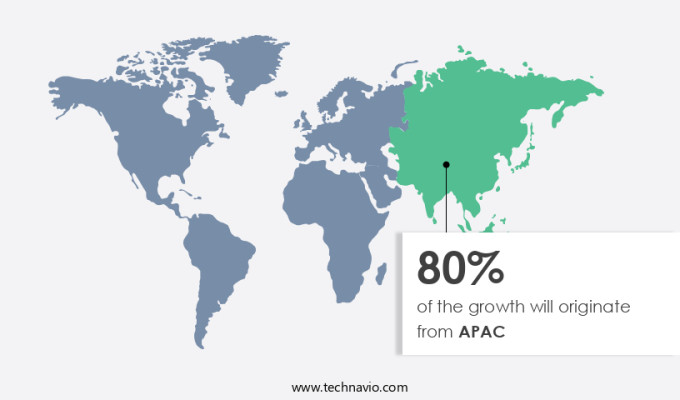

APAC is estimated to contribute 80% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market for cottonseed oil, particularly organic cottonseed oil, is experiencing significant growth in Asia Pacific (APAC) countries, particularly China and India. India is the world's largest producer of cotton, and production is projected to rise due to government initiatives like intensive cotton production programs. This upward trend in cotton production will positively impact the market in the region. Cottonseed oil's versatility extends beyond the food industry. In APAC, it's used to produce biodiesel, and the demand for biodiesel is increasing due to the global depletion of fossil fuels. Other industries, such as cosmetics and pharmaceuticals, also use cottonseed oil for its antioxidant properties.

However, despite these opportunities, challenges persist. Genetically modified cottonseed oil contamination is a concern, as is the pesticide load and potential health issues. Climatic conditions also impact cotton plant production and, consequently, cottonseed oil supply. Raw material prices for cottonseed oil can fluctuate based on various factors, including weather conditions and global supply and demand dynamics. Producers must navigate these challenges to maintain the quality and consistency of their products. In the US market, cottonseed oil competes with other edible oils like olive oil, almond oil, and sunflower oil. Consumers' preferences and health concerns influence the demand for these oils. As the market evolves, stakeholders must stay informed about the latest trends and developments.

Our researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The health benefits of cottonseed oil is the key driver of the market. The market in the United States is witnessing growth due to the rising consumer preference for this oil owing to its health benefits. Cottonseed oil is known for its low cholesterol content, making it an ideal choice for health-conscious consumers. Moreover, it is rich in antioxidants and vitamin E, which are vital for maintaining good health. The presence of a high number of tocopherols in food products made with cottonseed oil contributes to their extended shelf life. Additionally, cottonseed oil has a high smoke point, making it suitable for deep frying and high-temperature cooking in the food service industry, including fast food chains, restaurants, and franchise outlets.

Furthermore, in the retail sector, specialty stores are increasingly stocking cottonseed oil due to its health benefits and versatility in cooking. The advanced breeding and biotechnology techniques used in cottonseed production have led to an improvement in its fatty acid composition, enhancing its value in the market. The anti-aging and anti-inflammatory properties of cottonseed oil are also gaining attention in the health and wellness sector, further fueling its demand.

Market Trends

The availability of cold-pressed cottonseed oil is the upcoming trend in the market. The market is experiencing growth due to the rising demand for nutritional supplements and their application in various industries, including baked foods, salad oils, sauces, and the bakery, confectionery, and whipped toppings sectors. Unsaturated vegetable oils, such as cottonseed oil, rich in monounsaturated fatty acids, are increasingly being preferred for their health benefits, particularly in reducing the risk of cardiovascular diseases. Cold-pressed cottonseed oil is gaining popularity among consumers due to its natural antioxidants, odor, and flavor. This trend is driving market growth, with manufacturers introducing new cold-pressed cottonseed oil products. The cold-pressing process extracts the oil by pressing the seeds or fruits with modern steel presses, preserving the oil's natural properties.

Furthermore, with consumer preference for natural and healthy food options continuing to rise, The market is poised for significant expansion during the forecast period.

Market Challenge

The easy availability of substitutes is a key challenge affecting market growth. Cottonseed oil is a popular choice for cooking due to its content of healthy unsaturated fatty acids. However, other vegetable oils such as palm oil, olive oil, soybean oil, and canola oil can also be used as alternatives in both commercial and domestic cooking. Among these, soybean oil is particularly noteworthy for its essential fatty acids, including linoleic acid, alpha-linolenic acid, and monounsaturated oleic acid. This balanced composition of fatty acids ensures that the body receives the necessary fatty acids and maintains healthy cholesterol levels. Canola oil is another preferred option for health-conscious consumers due to its rich vitamin K and vitamin E content.

Additionally, there is a growing demand for organic variants of these oils, including cottonseed oil, hemp seed oil, and others. These oils offer the same health benefits but are produced using sustainable farming practices and do not contain added chemicals or preservatives. Furthermore, brominated oils are sometimes used in food and beverage applications due to their ability to enhance the stability of beverages. However, their long-term health effects are still under investigation. For individuals on high-calorie diets or those with health conditions such as cancer or heart disease, it is essential to consult with healthcare professionals to determine the best oil choices for their specific needs.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Archer Daniels Midland Co. - The company offers cottonseed oil for frying, spray oil, baking, and industrial margarine.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- Aryan International

- Asha Cotton Industries

- Authentic Oil Co.

- Bunge Ltd.

- Cargill Inc.

- Henry Lamotte Services GmbH

- ITOCHU Corp.

- Matangi Cotton Industries

- Oilseeds Australia Pty Ltd.

- PYCO Industries

- S.R. Cotton

- SULU ORGANICS Corp.

- Vimal Oil and Foods Ltd.

- Wilmar International Ltd.

- Gemini Edibles and Fats India Pvt. Ltd.

- Gokul Refoils and Solvent Ltd.

- Louis Dreyfus Holding BV

- Maharashtra solvent extraction P Ltd.

- Oilseeds International Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Cottonseed oil, derived from the seeds of cotton plants, is a popular edible oil with a neutral flavor and high smoke point, making it suitable for deep frying and cooking at high temperatures. Its unsaturated fatty acid content, rich in monounsaturated and polyunsaturated fats, contributes to heart health by reducing bad cholesterol levels and triglycerides. This oil is widely used in food processing for various applications, including cooking oils, margarine, salad dressings, and cosmetics. Cottonseed oil is also used in the production of soaps, personal care items, and industrial applications such as enamels, lacquers, varnishes, and paints. Its antioxidant properties, including Vitamin E, make it beneficial for preventing arrhythmias and improving blood pressure.

Moreover, health-conscious consumers increasingly prefer organic cottonseed oil due to concerns over genetically modified contamination and pesticide load. The oil's fatty acid composition, with a balance of monounsaturated and polyunsaturated fats, makes it a popular alternative to saturated fats. Cottonseed oil competes with other cooking oils like olive oil, almond oil, sunflower oil, canola oil, and others, in modern trade stores and e-commerce platforms. Its versatility in various industries, from food service to cosmetics, makes it a valuable raw material. The price of cottonseed oil is influenced by raw material prices, health issues, and climatic conditions, among other factors.

Furthermore, cottonseed oil is used in various industries, including bakery, confectionery, and fast food chains, due to its neutral flavor and high smoke point. It is also used in the production of nutritional supplements, baked foods, and sauces. Cottonseed oil is rich in vitamins, proteins, and minerals, making it beneficial for cardiovascular diseases, cancer, asthma, depression, and other health issues. Its advanced packaging and biotechnology applications offer opportunities for innovation in the industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.6% |

|

Market growth 2023-2027 |

965.24 th t |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023(%) |

2.44 |

|

Regional analysis |

APAC, Middle East and Africa, North America, South America, and Europe |

|

Performing market contribution |

APAC at 80% |

|

Key countries |

US, India, China, Pakistan, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Archer Daniels Midland Co., Aryan International, Asha Cotton Industries, Authentic Oil Co., Bunge Ltd., Cargill Inc., Henry Lamotte Services GmbH, ITOCHU Corp., Matangi Cotton Industries, Oilseeds Australia Pty Ltd., PYCO Industries, S.R. Cotton, SULU ORGANICS Corp., Vimal Oil and Foods Ltd., Wilmar International Ltd., Gemini Edibles and Fats India Pvt. Ltd., Gokul Refoils and Solvent Ltd., Louis Dreyfus Holding BV, Maharashtra solvent extraction P Ltd., and Oilseeds International Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2023 and 2027

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Middle East and Africa, North America, South America, and Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch