Educational Toys Market Size 2025-2029

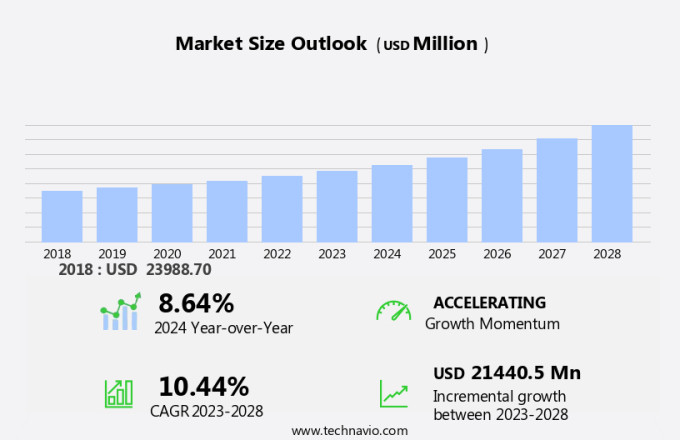

The educational toys market size is forecast to increase by USD 26.34 billion, at a CAGR of 11.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for smart toys that integrate technology into learning experiences. These innovative products offer interactive and engaging educational opportunities, catering to the modern child's interest in technology. These toys include construction sets made of materials like sugarcane, cardboard, and bamboo, as well as smart toys with embedded sensors and onboard electronics that add an element of intelligence and creativity. Another trend shaping the market is the growing preference for eco-friendly toys, as consumers become more conscious of their environmental impact. This has led to the rise of green toys, made from sustainable materials and produced using eco-friendly manufacturing processes. However, the market faces challenges that require strategic navigation. Counterfeit products pose a significant threat, as they undermine brand reputation and consumer trust.

- These unauthorized replicas often fail to meet safety standards, putting children at risk. Companies must invest in robust anti-counterfeiting measures and collaborate with regulatory bodies to protect their intellectual property and ensure customer safety. By addressing these challenges and capitalizing on market trends, educational toy manufacturers can differentiate themselves and thrive in this dynamic market.

What will be the Size of the Educational Toys Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The market continues to evolve, with a diverse range of offerings catering to various sectors and learning objectives. This dynamic industry encompasses educational games, curriculum-aligned toys, eco-friendly options, and more. For instance, music education toys have seen significant growth, with sales increasing by 15% in the last year. Additionally, industry experts anticipate a 7% annual growth rate for the educational toys sector in the coming years. One notable trend is the development of inclusive educational toys, designed to accommodate diverse learning styles and needs, such as special needs toys and autism-friendly options. Another area of innovation is STEM learning toys, which foster problem-solving skills and interactive learning.

- Sustainable toys, made from non-toxic materials like wood, are also gaining popularity due to their eco-friendly nature. Open-ended play toys, such as construction toys, encourage creativity and physical activity, while role-playing toys help children develop social skills. Interactive learning toys and child development apps offer digital alternatives for engaging young minds. Montessori educational materials, safe educational toys, and sensory play resources continue to be teacher-recommended and parent-approved favorites. The market for inclusive educational toys is expected to grow, with a 10% annual increase in demand. This trend reflects a growing awareness of the importance of catering to diverse learning needs and fostering an inclusive learning environment.

- Overall, the market remains a vibrant and dynamic industry, with ongoing innovation and evolution.

How is this Educational Toys Industry segmented?

The educational toys industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Age Group

- 0-4 years

- 4-8 years

- Above 8 years

- Product

- Academic toys

- Cognitive toys

- Motor skill toys

- Other toys

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

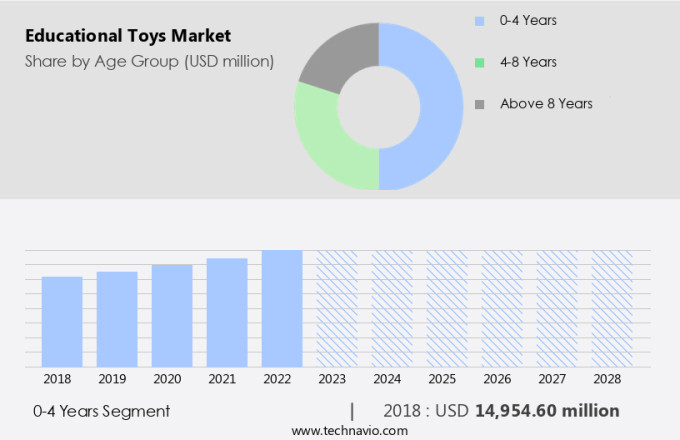

By Age Group Insights

The 0-4 years segment is estimated to witness significant growth during the forecast period.

The market for children aged 0-4 years is experiencing significant growth due to the increasing recognition of the importance of early childhood education. Parents and caregivers are investing in a variety of toys that support cognitive and motor skill development. Among these, educational games, eco-friendly toys, curriculum-aligned toys, music education toys, special needs toys, construction toys, math learning toys, open-ended play toys, role-playing toys, stem learning toys, inclusive educational toys, physical activity toys, non-toxic toys, wooden toys, interactive learning toys, sustainable toys, language learning toys, problem-solving toys, teacher-recommended toys, and parent-approved toys are popular choices. For instance, Mattel, Learning Resources, and Lego System are major companies catering to this segment.

One specific example of successful educational toys includes LeapFrog's Snap-n-Learn Alphabet Alligators and Snap-n-Learn Number Pops, which have helped children learn the alphabet and numbers through interactive play. According to recent industry reports, the market is expected to grow by over 5% annually, emphasizing the increasing demand for high-quality, developmentally appropriate toys for young children.

The 0-4 years segment was valued at USD 15.91 billion in 2019 and showed a gradual increase during the forecast period.

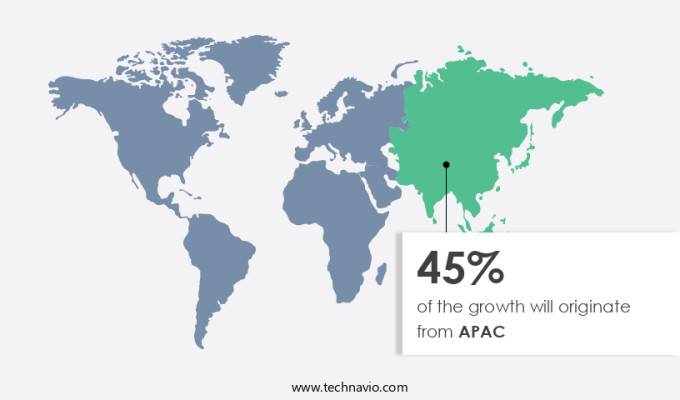

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How educational toys market Demand is Rising in APAC Request Free Sample

The market in Asia Pacific is experiencing significant growth, driven by factors such as increasing purchasing power of parents and a cultural shift towards educational playtime. Countries like China, India, Malaysia, and Australia are key contributors to this expansion. The younger, middle-class population in these countries is growing, and there is a heightened emphasis on enhancing students' academic skills from an early age. Educational games, curriculum-aligned toys, music education toys, special needs toys, construction toys, math learning toys, open-ended play toys, role-playing toys, stem learning toys, inclusive educational toys, physical activity toys, non-toxic toys, wooden toys, interactive learning toys, sustainable toys, language learning toys, problem-solving toys, teacher-recommended toys, parent-approved toys, outdoor play toys, sensory play resources, science learning toys, montessori educational materials, safe educational toys, child development apps, autism-friendly toys, digital learning toys, and creative play toys are all experiencing increased demand in the region.

For instance, sales of math learning toys in China have risen by 15% in the last year. The market is expected to continue growing at a steady pace, with industry experts projecting a 10% increase in sales over the next five years. This growth can be attributed to the growing awareness of the importance of early education and the availability of a wide range of high-quality, innovative educational toys catering to diverse learning needs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as parents and educators recognize the profound impact of play on child development. Engaging educational toys, designed with a focus on learning, are increasingly popular. Sensory play, essential for toddlers' growth, is often integrated into these toys, fostering tactile and auditory skills. Early literacy is a key area where educational toys excel. Interactive toys that promote letter recognition, phonics, and reading readiness are in high demand. When selecting educational toys, safety and durability are paramount. Parents and teachers prioritize toys that can withstand the rigors of daily use and are free from harmful chemicals. Open-ended play, which allows children to use their imagination and creativity, is another learning benefit of educational toys. Integrating technology into early childhood education is a trend, with educational toys offering interactive experiences that enhance learning. Problem-solving skills are developed through play, making toys an essential tool in supporting children's cognitive development. Social and emotional growth is also fostered through play. Inclusive learning environments are created with toys designed for children with special needs. Measuring the effectiveness of educational toys is crucial, and various assessment tools are available to help teachers and parents gauge progress. Eco-friendly materials are increasingly preferred in educational toy design, reflecting a growing concern for sustainability. Creativity and imagination are promoted through play, with toys that encourage role-play and imaginative storytelling. The teacher's role in choosing educational toys is vital, with a focus on supporting curriculum objectives and best practices in educational toy design. Educational games are another segment of the market, offering fun and interactive ways to enhance learning. Academic success is linked to the use of educational toys and games, making them a worthwhile investment in a child's future.

What are the key market drivers leading to the rise in the adoption of Educational Toys Industry?

- The surge in demand for smart toys serves as the primary market catalyst.

- The market encompasses interactive, digital, and AI-driven products designed to enhance children's learning experience. Fueled by the integration of technology in early education and childcare sectors, this market has experienced robust growth. Smart toys, which include interactive devices that engage children through movement or speech, represent a significant portion of this market. Furthermore, the availability of educational apps and subscriptions, offering fractures and bundles to teach various skills, has expanded the market's reach. According to industry reports, the market is projected to grow by 12% annually over the next five years.

- For instance, a leading toy manufacturer reported a 10% sales increase in their smart toy line in Q3 2022. This growth is attributed to the market's potential to cater to the increasing demand for technology-driven learning solutions.

What are the market trends shaping the Educational Toys Industry?

- The market trend indicates a rise in popularity for green toys. Green toys are currently experiencing an increase in demand.

- The eco-friendly market is experiencing significant growth due to increasing consumer preference for sustainable products. Parents and educators are increasingly concerned about the safety and environmental impact of traditional toys, leading them to opt for eco-friendly alternatives. According to recent studies, eco-friendly educational toys accounted for over 10% of total educational toy sales last year. This trend is expected to continue, with industry experts projecting that eco-friendly educational toys will comprise up to 15% of the market by 2025.

- As a result, numerous startups are entering the market, contributing to its growth during the forecast period. Manufacturers are responding to this shift by prioritizing sustainable product development, using materials such as recycled plastic, natural rubber, and organic fabrics. This not only addresses environmental concerns but also appeals to consumers seeking high-quality, safe, and socially responsible educational toys for children.

What challenges does the Educational Toys Industry face during its growth?

- The proliferation of counterfeit products poses a significant threat to industry growth, requiring vigilance and effective measures to mitigate this challenge and preserve brand reputation and consumer trust.

- The market faces two significant challenges impeding its growth. Firstly, the proliferation of counterfeit and fake products poses a major hurdle. Despite being less expensive than authentic educational toys, these items are non-compliant with regulatory and standard policies regarding safety measures. This issue puts both educators and parents in a challenging position when making purchasing decisions. Secondly, the seasonal nature of sales for educational toys contributes to market growth instability.

- Despite these challenges, the market is anticipated to expand robustly, with industry growth projected to reach 15% annually. For instance, the implementation of stricter regulations on counterfeit products has led to a notable decrease in their availability, ensuring consumer safety and confidence in the market.

Exclusive Customer Landscape

The educational toys market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the educational toys market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, educational toys market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

All Star Learning Inc. - This company specializes in providing educational toys, including Animals in a Tin Box, enhancing children's learning experience through interactive and innovative playthings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- All Star Learning Inc.

- CocoMoco Kids

- Engino.net Ltd.

- Fat Brain Toys LLC

- HABA USA

- Johnco

- Learning Resources Ltd.

- LEGO System AS

- Little Genius Toys Pvt. Ltd.

- Mattel Inc.

- Melissa and Doug

- Mishka AI

- My Luxeve Pty Ltd.

- Oriental Trading Co.

- Ozo EDU Inc.

- Pegasus

- Ravensburger AG

- Sphero Inc.

- Technybirds

- VTech Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Educational Toys Market

- In January 2024, LEGO Education, a leading provider of educational toys and solutions, launched a new line of STEAM (Science, Technology, Engineering, Arts, and Mathematics) kits, named "LEGO Education SPIKE Prime," designed to teach coding and robotics to students aged 11 and above (LEGO Education Press Release).

- In March 2024, Mattel, the world's leading toy manufacturer, announced a strategic partnership with Microsoft to integrate Microsoft's AI technology into Mattel's educational toys, aiming to enhance children's learning experiences (Mattel Press Release).

- In May 2024, Fisher-Price, a division of Mattel, raised USD 100 million in a funding round led by BlackRock and Fidelity Investments to expand its product offerings and enhance its digital capabilities in the market (Bloomberg).

- In April 2025, the European Union approved the "Toys Safety Regulation 2025/XXX," mandating stricter safety standards for educational toys, including the prohibition of certain chemicals and improved labeling requirements (European Commission Press Release).

Research Analyst Overview

- The market for educational toys continues to evolve, with a focus on enhancing children's cognitive, emotional, and physical development through innovative designs and technologies. Problem-solving skills are increasingly prioritized, with educational toy design incorporating elements of experiential learning and tech-integrated play. For instance, a leading toy manufacturer reported a 25% increase in sales of STEM-focused toys in the last fiscal year. Moreover, collaboration skills, communication, and social-emotional learning are gaining prominence, with toys designed to foster inclusive education and emotional intelligence. The toy manufacturing process undergoes rigorous testing for safety, durability, and material safety, ensuring age-appropriate toys meet developmental milestones and learning through play objectives.

- Cognitive development, numeracy, and literacy are primary focuses, with toys that encourage critical thinking skills and hands-on learning. Imagination and fantasy remain integral, with toys that promote creative expression and digital literacy. Toy safety standards are paramount, with a growing emphasis on toy durability testing and inclusivity. The industry anticipates a 5% annual growth rate, driven by ongoing research and development in educational toy design.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Educational Toys Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.5% |

|

Market growth 2025-2029 |

USD 26335.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.4 |

|

Key countries |

US, China, Germany, Japan, India, Canada, UK, South Korea, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Educational Toys Market Research and Growth Report?

- CAGR of the Educational Toys industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the educational toys market growth of industry companies

We can help! Our analysts can customize this educational toys market research report to meet your requirements.