Electric and Hybrid Aircraft Propulsion System Market Size 2024-2028

The electric and hybrid aircraft propulsion system market size is forecast to increase by USD 12.31 billion at a CAGR of 4.53% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for light and ultralight electric aircraft and the increased use of electrical systems in modern aircraft. This trend is driven by the environmental benefits of electric aircraft, which produce fewer emissions compared to traditional aircraft.

- However, the market faces challenges, including the limitations of existing battery technology. These batteries must be lightweight, high-capacity, and able to withstand extreme temperatures and conditions. As the industry continues to innovate and overcome these challenges, the market for electric and hybrid aircraft propulsion systems is expected to grow steadily. The future of aviation lies in sustainable and efficient propulsion systems, making this an exciting and dynamic market to watch.

What will be the Size of the Electric and Hybrid Aircraft Propulsion System Market During the Forecast Period?

- The market encompasses the development and implementation of advanced propulsion technologies, including electrically powered aircraft and hybrid electric propulsion systems, in the aviation industry. This market is experiencing significant growth due to the increasing demand for sustainable and eco-friendly transportation solutions.

- The commercial aviation industry is at the forefront of this trend, with next-gen aircraft incorporating electric propulsion systems to reduce fuel consumption and emissions. Unmanned aerial vehicles (UAVs) and model aircraft are also adopting electric propulsion for extended flight times and improved performance. General aviation, air taxis, short haul flights, and regional airlines are exploring the use of lightweight composites and technological convergence to create more efficient and cost-effective solutions for short distances and nearby cities.

- The civil aircraft segment is expected to dominate the market, driven by the growing demand for convenient and affordable air travel. Overall, the market is poised for substantial expansion as the aviation industry embraces innovation to meet evolving consumer needs and regulatory requirements.

How is this Electric and Hybrid Aircraft Propulsion System Industry segmented and which is the largest segment?

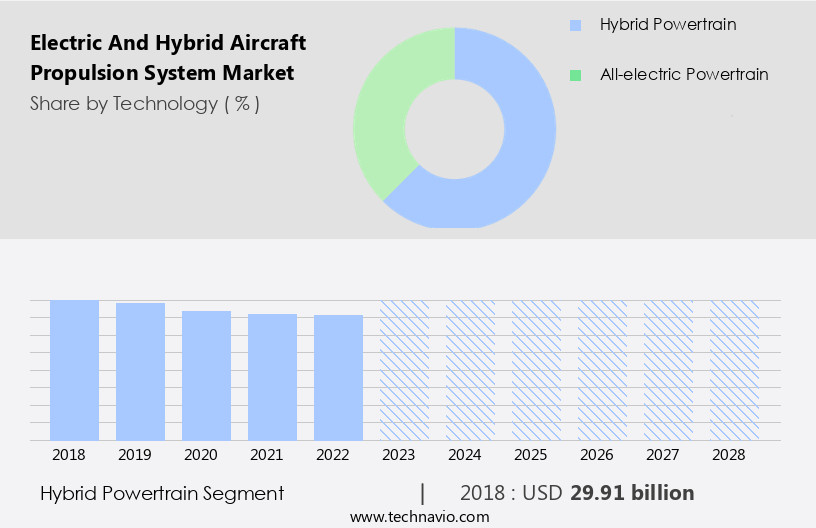

The electric and hybrid aircraft propulsion system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Hybrid powertrain

- All-electric powertrain

- End-user

- Military

- Commercial

- civil

- Geography

- Europe

- Germany

- France

- North America

- US

- APAC

- China

- Middle East and Africa

- South America

- Europe

By Technology Insights

The hybrid powertrain segment is estimated to witness significant growth during the forecast period. Hybrid aircraft represent the future of air travel, combining conventional fuel-powered systems with electric propulsion for optimized performance and reduced environmental impact. While lithium-ion batteries currently cannot power an aircraft for extended periods, they can be utilized during taxiing and takeoff phases. In these stages, electric motors can supplement the energy provided by combustion engines, reducing noise levels and fuel consumption. At cruise altitude, the aircraft relies solely on the generator to power electric fans, with excess energy stored in batteries for later use. This hybrid approach enables short-haul flights, urban air taxis, and regional connectivity, addressing the needs of commercial aviation, next-gen aircraft, and general aviation industries.

Technological convergence in aircraft construction, including lightweight composites, 3D printing, and advanced power management systems, enhances the capabilities of hybrid aircraft. By reducing carbon emissions, pollutants, and noise pollution, hybrid aircraft contribute to mitigating climate change, improving air quality, and promoting social equity and accessibility. Key considerations include battery technology, electric motors, fuel cells, and hydrogen hybrid power sources, which offer extended range capabilities and quick refueling times.

Get a glance at the market report of various segments Request Free Sample

The Hybrid powertrain segment was valued at USD 29.91 bn in 2018 and showed a gradual increase during the forecast period.

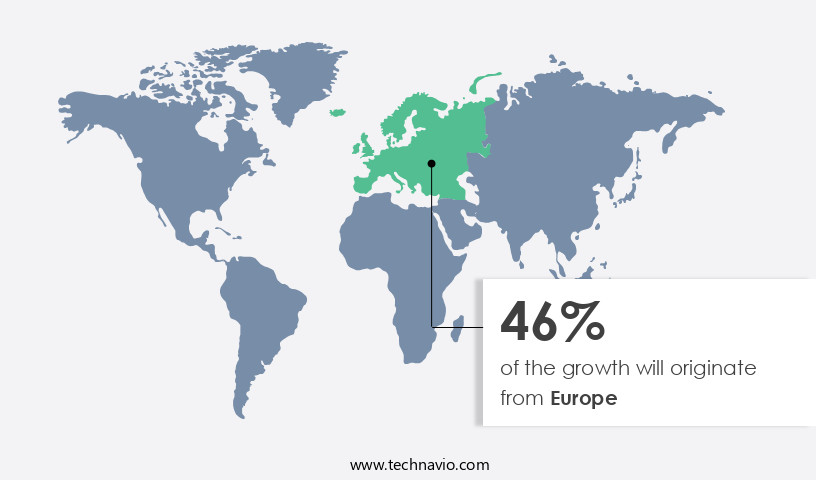

Regional Analysis

Europe is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing significant growth, particularly in Europe, which holds the largest market share in 2023. Europe's dominance is attributed to the region's extensive research and development in electric aviation, with numerous leading manufacturers based there. Notable collaborations between manufacturers and operators are driving innovation in the field. The partnership aims to evaluate the performance, reliability, and safety of electric engines under various conditions, including temperature, altitude, and electromagnetic forces. Additionally, the project seeks to establish regulations for future electric and hybrid aircraft propulsion systems and to educate the next generation of designers and engineers.

Key components of these systems include electric propulsion systems, fuel cells, batteries, generators/engines, aerostructures, commercial aircraft avionics, software, and power management systems. The market is poised to reduce carbon emissions, pollutants, and noise levels, making it an environmentally friendly and socially responsible solution for air travel in short distances and nearby cities, serving regional airlines, low cost carriers, and urban air taxi services. The hybrid aircraft industry's technological convergence with advancements in lightweight composites, 3D printing, and alternative fuels is expected to further improve air quality, energy efficiency, and social equity, while addressing economic, environmental, and safety considerations.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Electric and Hybrid Aircraft Propulsion System Industry?

- Growing demand for light and ultralight electric aircraft is the key driver of the market.The market is experiencing significant growth, particularly in the General Aviation (GA) segment. Manufacturers prefer electrically powered aircraft for testing purposes due to their lighter weight. In the GA sector, innovations such as Urban Air Taxi are focusing on short-haul flights within a 31-mile range, utilizing Vertical Takeoff and Landing (VTOL) capabilities to minimize noise pollution and offer zero emissions. Technological convergence in the commercial aviation industry is driving the development of next-gen aircraft, including electric propelled Unmanned Aerial Vehicles (UAVs) and Model aircraft. Hybrid electric propulsion systems, which combine batteries, fuel cells, and combustion engines, are gaining popularity for their extended range capabilities and quick refueling times.

The civil aircraft segment is also exploring the use of lightweight composites, 3D printing, and advanced avionics for aircraft construction. Environmental considerations, including reducing carbon emissions, mitigating climate change, and improving air quality, are key factors driving the adoption of electric propulsion systems. Battery technology, electric motors, power management systems, and hydrogen fuel cells are essential components of these systems. Flight characteristics, airframe, wings, landing gear, and environmental considerations are all under consideration for the development of hybrid aircraft. The hybrid aircraft industry is expected to grow as it addresses economic, social, and regulatory considerations, including reducing emissions, noise pollution, and improving transportation and logistics.

What are the market trends shaping the Electric and Hybrid Aircraft Propulsion System market?

- Increased use of electrical systems in modern aircraft is the upcoming market trend.The market encompasses the development and implementation of advanced propulsion systems for aircraft, including electrically powered aircraft and hybrid electric propulsion systems. Unmanned aerial vehicles (UAVs) have already embraced electric propulsion, and this technology is now gaining traction in the Commercial Aviation Industry for next-gen aircraft. Traditional aircraft are being reimagined with lightweight composites, 3D printing, and advanced avionics, leading to the creation of electric propelled UAVs, Urban Air Taxis, and Short Haul Flights. Hybrid aircraft, which combine the benefits of fuel cells, batteries, and combustion engines, are gaining popularity in the Civil Aviation Segment. These technological advancements offer numerous advantages, such as improved fuel efficiency, reduced emissions, and lower noise levels, making them an environmentally friendly and socially responsible choice.

The hybrid aircraft market is driven by the need for reducing greenhouse gases, improving air quality, and addressing environmental and social considerations. Battery technology, electric motors, power management systems, and hydrogen fuel cells are key components of these advanced propulsion systems. The hybrid aircraft industry's growth is influenced by factors like extended range capabilities, quick refueling times, and the ability to charge batteries during flight. The integration of generators/engines, aerostructures, avionics, software, runway requirements, and vectored thrusts, among other elements, is essential for the successful development and implementation of these innovative propulsion systems. The hybrid wing, power source, and flight characteristics are crucial aspects of these aircraft, with the airframe, wings, landing gear, and environmental considerations playing significant roles in their design and production.

The market's economic considerations include the cost of batteries, fuel cells, and the overall aircraft, as well as the maintenance requirements and safety considerations.

What challenges does the Electric and Hybrid Aircraft Propulsion System Industry face during its growth?

- Limitations of existing battery technology is a key challenge affecting the industry growth.The market holds promise for next-gen aircraft, including electrically powered unmanned aerial vehicles (UAVs) and hybrid electric propulsion systems for commercial aviation. However, the application of these technologies in commercial aircraft faces challenges due to the energy requirements and limitations of current battery technology. While electric propulsion systems offer fuel efficiency, reduced emissions, and lower noise levels, they require a significant amount of energy to power an aircraft. In contrast, traditional aircraft rely on combustion engines and fuel consumption, contributing to high carbon emissions, pollutants, and noise pollution. To address these concerns, the aviation industry is exploring hybrid aircraft solutions, combining electric propulsion systems with fuel cells or hydrogen fuel cells.

These technologies offer extended range capabilities and quick refueling times, making them attractive for short haul flights and regional air travel. Lightweight composites, 3D printing, and advanced materials are being used in aircraft construction to reduce weight and improve energy efficiency. Power management systems, electric motors, and battery technology are also advancing, enabling better payload capacity and flight characteristics. Environmental considerations, social considerations, and economic considerations are driving the demand for electric and hybrid aircraft. As the market evolves, it will require addressing charging times, flight scheduling, and runway requirements, as well as integrating vectored thrusts and hybrid wing designs.

The hybrid aircraft industry is experiencing technological convergence, with generators/engines, aerostructures, avionics, software, and other components working together to create more efficient, environmentally friendly, and convenient transportation solutions.

Exclusive Customer Landscape

The electric and hybrid aircraft propulsion system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electric and hybrid aircraft propulsion system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electric and hybrid aircraft propulsion system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airbus SE - The company specializes in the development and implementation of advanced electric and hybrid aircraft propulsion systems. Notable offerings include the EcoPulse, Vahana, and CityAirbus NextGen technologies.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- Bye Aerospace

- Cranfield Aerospace Solutions Ltd.

- Elektra Solar GmbH

- General Electric Co.

- GKN Aerospace Services Ltd.

- Honeywell International Inc.

- Israel Aerospace Industries Ltd.

- Lange Aviation GmbH

- Leonardo Spa

- Lockheed Martin Corp.

- magniX

- MAN Energy Solutions SE

- Raytheon Technologies Corp.

- Rolls Royce Holdings Plc

- Safran SA

- Siemens AG

- Textron Inc.

- The Boeing Co.

- Joby Aviation Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The electric and hybrid propulsion system market encompasses the development and implementation of advanced propulsion technologies for aircraft, including electrically powered aircraft and hybrid electric propulsion systems. These systems offer significant potential benefits for various sectors of the aviation industry, including unmanned aerial vehicles (UAVs), commercial aviation, and general aviation. Hybrid electric propulsion systems represent a convergence of traditional combustion engines and electric propulsion systems. These systems utilize batteries to store energy and electric motors to power the aircraft during takeoff and landing, while the combustion engine takes over during cruising altitudes for extended range capabilities. This technological convergence aims to improve fuel efficiency, reduce emissions, and mitigate noise pollution in the aviation sector.

Lightweight composites and 3D printing are key technologies driving innovation in aircraft construction, enabling the development of more efficient and cost-effective airframes, wings, and landing gear. These advancements contribute to the growing popularity of electric and hybrid aircraft, particularly in short haul flights and urban air taxi applications. The commercial aviation industry is under increasing pressure to reduce carbon emissions and improve air quality, making electric and hybrid propulsion systems an attractive solution. Traditional aircraft consume vast amounts of fuel and emit significant amounts of greenhouse gases and pollutants. In contrast, electric and hybrid aircraft offer the potential for significant reductions in fuel consumption and emissions, making them an environmentally friendly alternative.

Moreover, electric and hybrid propulsion systems offer several advantages over traditional propulsion systems in terms of noise levels. Electric motors produce less noise than combustion engines, making them ideal for operation in noise-sensitive regions. This is particularly important for urban air travel, where noise pollution is a significant concern. Charging times and flight scheduling are critical factors in the adoption of electric and hybrid aircraft. While battery technology has made significant strides in recent years, it still lags behind the energy density and refueling times of traditional jet fuel. However, advancements in battery technology and charging infrastructure are expected to address these challenges in the coming years.

The hybrid aircraft market is expected to grow significantly in the coming years, driven by the increasing demand for more efficient, environmentally friendly, and cost-effective aircraft. The civil aircraft segment, in particular, is expected to see significant growth as regional airlines and low-cost carriers seek to expand their networks and serve smaller cities. However, the adoption of electric and hybrid aircraft is not without challenges. Economic considerations, such as the cost of batteries and the infrastructure required for charging and maintenance, are significant barriers to widespread adoption. Additionally, safety, reliability, and quality control are critical considerations, as the aviation industry has a high standard for safety and performance.

The electric and hybrid propulsion system market represents a significant opportunity for innovation and growth in the aviation industry. These technologies offer the potential for significant reductions in fuel consumption, emissions, and noise pollution, making them an attractive solution for various sectors of the aviation industry. However, challenges remain, particularly in terms of battery technology, charging infrastructure, and economic considerations. Despite these challenges, the future of electric and hybrid aircraft looks promising, with continued innovation and investment expected to address these challenges and drive growth in the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.53% |

|

Market growth 2024-2028 |

USD 12.31 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.82 |

|

Key countries |

US, China, France, Germany, and Slovenia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electric and Hybrid Aircraft Propulsion System Market Research and Growth Report?

- CAGR of the Electric and Hybrid Aircraft Propulsion System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electric and hybrid aircraft propulsion system market growth of industry companies

We can help! Our analysts can customize this electric and hybrid aircraft propulsion system market research report to meet your requirements.