Germany Automotive Engine Oil Market Size 2024-2028

The Germany automotive engine oil market size is forecast to increase by USD 1.07 billion at a CAGR of 5.44% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. The increasing adoption of specialty lubricants, which offer enhanced engine performance and fuel efficiency, is driving market expansion. Moreover, advances in engine oil technology continue to shape the market, with innovations in low-viscosity oils and synthetic blends gaining popularity. These innovations include the use of advanced antioxidants, surfactants, high-pressure agents, and corrosion inhibitors. Another significant market trend is the impact of fluctuating crude oil prices on the demand for engine oils. Despite these challenges, the market is expected to grow steadily due to the increasing demand for fuel-efficient vehicles and stringent emission norms. Overall, the German automotive engine oil market is poised for growth In the coming years, driven by these key trends and challenges.

What will be the size of the Germany Automotive Engine Oil Market during the forecast period?

- The German automotive engine oil market is a significant segment of the global lubricants industry, characterized by growth and innovation. With the rise of electric vehicles, the market is shifting towards sustainable lubricants, including those derived from renewable sources. The focus on fuel efficiency optimization and engine protection remains paramount, driving demand for high-performance lubricants. Synthetic lubricants continue to dominate the market due to their superior performance and ability to prevent engine damage. Market consolidation and brand awareness are key trends, as larger players seek to expand their customer base and enhance their offerings through marketing and innovation. Regulations, such as those related to engine oil viscosity and emissions, play a crucial role in shaping market dynamics. Lubricant additives, technology advancements, and oil analysis services are also critical areas of research and development to meet evolving customer needs and expectations.

- The future of lubricants in the automotive industry is shaped by electric vehicle lubricants, with a growing focus on lubricant performance, technology advancements, and environmental impact. Lubricant distribution is evolving alongside global market trends, with research emphasizing innovation and lubricant recycling. Challenges include maintaining customer loyalty, managing pricing, and navigating regulations. Effective lubricant selection guides, engine maintenance tips, and oil viscosity guides help optimize engine performance, extend engine life, and reduce wear. Marketing strategies and brand awareness are key to expanding business in this competitive market.

How is this market segmented and which is the largest segment?

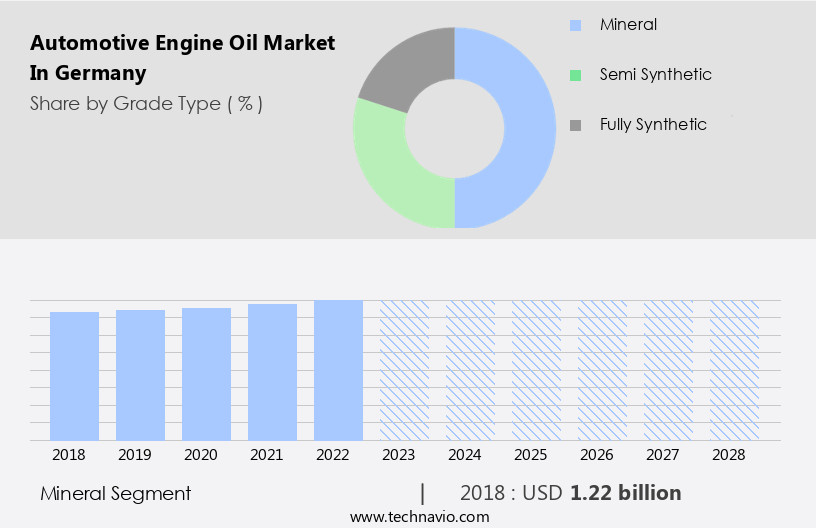

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Grade Type

- Mineral

- Semi synthetic

- Fully synthetic

- Type

- Diesel

- Petrol

- Alternative fuels

- Application

- Passenger vehicles

- Commercial vehicles

- Geography

- Germany

By Grade Type Insights

- The mineral segment is estimated to witness significant growth during the forecast period.

Mineral-grade engine oils are generally more affordable than synthetic oils. This makes them an attractive option for vehicle owners who prioritize cost savings without compromising on basic protection and performance. Additionally, mineral grade provides effective lubrication to engine components, helping to reduce friction and wear. This helps extend the life of engine parts such as pistons, cylinders, and bearings, leading to improved engine longevity and reliability. Furthermore, mineral grades typically have good cold-flow properties, enabling them to flow more easily at low temperatures. This improves cold-start performance, reduces engine wear during startup, and enhances overall engine reliability, especially in colder climates in Germany. Mineral oils often contain additives that help condition and rejuvenate engine seals, preventing leaks and maintaining seal integrity. This can help reduce oil consumption and extend the service life of engine seals, saving vehicle owners money on repairs and maintenance. Thus, such factors will boost the expansion of the mineral segment of the automotive engine oil market in Germany during the forecast period.

Get a glance at the market share of various segments Request Free Sample

The mineral segment was valued at USD 1.22 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Germany Automotive Engine Oil Market?

Growing development of specialty lubricants is the key driver of the market.

- The German automotive engine oil market is witnessing significant growth due to the increasing demand for high-performance lubricants in passenger vehicles. Specialty lubricants, including gear oils, transmission oils, brake oil, and motorcycle lubricants, cater to the specific needs of modern engines, providing enhanced protection, improved fuel efficiency, and extended service intervals. Advancements in engine technology, such as turbocharged engines, direct injection systems, and hybrid powertrains, necessitate the use of specialized lubricants to ensure optimal lubrication and component protection. These lubricants are formulated to meet stringent performance requirements, enabling vehicles to comply with emission level regulations. Beyond traditional engine oils, specialty lubricants are also used in various automotive applications, such as automatic transmissions and moving parts in vehicles like mopeds and motorcycles. The market for automotive lubricants is expected to expand as businesses invest in low carbon solutions and alternative fuels, such as electric vehicle charging stations.

- Moreover, major players In the lubricants market offer product solutions through technical collaboration and engineering expertise, providing innovative business lines and partnerships to meet the evolving needs of the automotive industry. The market for engine oil consumption is driven by factors such as fuel economy, engine life, R&D, and manufacturing processes. The automotive engine oil market is dynamic, with diverse midstream companies offering a range of products, from synthetic motor oil to mineral oil, catering to various engine types and viscosity requirements. Despite the challenges of engine wear, oxidation, and friction, these companies continue to invest in research and development to deliver high-performance, low-viscosity grade motor oils that meet the demands of modern engines.

What are the market trends shaping the Germany Automotive Engine Oil Market?

Advances in engine oil technology is the upcoming trend In the market.

- The German automotive engine oil market is experiencing growth due to the adoption of advanced technologies In the industry. companies are investing in research and development to produce superior engine oils for passenger vehicles, mopeds, and motorcycles. Advanced fuel and lubricant technologies are driving the development of engine oils with improved efficiency and engine protection.

- Additionally, the market is witnessing the implementation of advanced bonding technology, which utilizes high-pressure lubricants formed through the chemical treatment of hydrocarbons. The focus on reducing greenhouse gas emissions and improving fuel economy is also leading to the development of low viscosity engine oils and alternative lubricant solutions. The market is a significant business line for various players In the lubricants industry, including upstream companies and original equipment manufacturers (OEMs). The market's growth is expected to continue as the demand for advanced engine oils and lubricants increases, driven by the need for improved engine performance, extended engine life, and reduced maintenance costs.

What challenges does Germany Automotive Engine Oil Market face during the growth?

Fluctuating crude oil prices is a key challenge affecting the market growth.

- The German automotive engine oil market is influenced by the price fluctuations of crude oil, which serves as a primary raw material in engine oil production. Crude oil price volatility directly impacts the cost of base oils and additives used in engine oil formulation, subsequently affecting the pricing of automotive engine oil. In 2022, the global crude oil market experienced significant price fluctuations, according to The World Bank Group. These price changes impacted the production costs of automotive engine oil manufacturers in Germany, with higher crude oil prices leading to increased production costs. Automotive engine oil is essential for various types of vehicles, including passenger vehicles, mopeds, and motorcycles. The market consists of upstream companies involved In the production of base oils and additives, as well as downstream players engaged In the manufacturing, distribution, and retailing of automotive lubricants. Competitors in this industry offer a range of product solutions, including engine oils, gear oils, transmission oils, brake oil, and motorcycle lubricants. Emission level regulations play a crucial role In the development of engine oil formulations, with manufacturers focusing on low carbon solutions and meeting the requirements of emission models.

- In addition, innovation and technical collaboration are essential business lines for companies In the automotive lubricants market, as they strive to improve engine oil consumption, engine protection, and engine life through advanced formulations and engineering expertise. The market for automotive engine oil is diverse, catering to various engine types, including diesel and petrol engines. Low viscosity grades, such as synthetic motor oil and mineral oil, are popular choices for modern engines due to their improved fuel economy, reduced engine wear, and extended oil change intervals. The market also offers a range of product lines designed for specific vehicle applications, such as automatic transmission and engineering expertise for various industries. Investment in research and development is crucial for companies in the automotive engine oil market to address the challenges of energy alternatives, reduce greenhouse gas emissions, and meet the evolving needs of the automotive industry. The market is expected to grow as the demand for lubricants increases due to the expanding use of charging stations and the increasing popularity of electric and hybrid vehicles.

Exclusive Germany Automotive Engine Oil Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADDINOL

- AS Automotive GmbH and Co. KG

- AVISTA OIL Deutschland GmbH

- Boost Oil

- BP Plc

- Chevron Corp.

- Drivol

- EUROLUB GmbH

- Exxon Mobil Corp.

- FUCHS PETROLUB SE

- GERMAN GOLD

- LIQUI MOLY GmbH

- MITAN Mineralol GmbH

- MOTUL SA

- MVG Mathe Gleitstofftechnik GmbH

- Ravensberger Schmierstoffvertrieb GmbH

- ROWE MINERALOLWERK GMBH

- Shell plc

- TotalEnergies SE

- UAB SCT Lubricants

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant segment of the broader lubricants industry, catering to the requirements of various types of engines powering passenger vehicles, mopeds, and motorcycles. This market is driven by the need for efficient and effective lubrication solutions that ensure optimal engine performance, extended engine life, and reduced emissions. The industry overview of the market is characterized by a diverse range of business lines, each focusing on specific engine types and applications. Upstream companies play a crucial role In the production of base oils, which are then refined and formulated into finished engine oils by downstream players. These finished products are further distributed through various channels, including OEMs, retail service stations, and direct sales to end-users. The sales of automotive engine oils in Germany are influenced by several factors, including vehicle servicing schedules, emission level regulations, and consumer preferences for fuel economy and low carbon solutions. Transmission oils, gear oils, and motorcycle lubricants are essential product solutions catering to the specific requirements of these vehicle types. The market is highly competitive, with numerous players vying for market share. Technical collaboration and innovation are key strategies adopted by these players to differentiate themselves and meet the evolving needs of the market.

Additionally, low viscosity grades of motor oil, synthetic motor oil, and mineral oil are popular choices among consumers, as they offer improved engine protection, reduced friction, and extended oil change intervals. Emission models and alternative fuels are gaining traction In the German automotive market, leading to a shift in lubricant consumption patterns. Diesel engines, in particular, are undergoing significant changes to meet stringent emission regulations, necessitating the use of specialized engine oils that can effectively address issues such as oxidation, varnish formation, and engine wear. The market is also influenced by regulatory requirements, such as service fill requirements and engine type approvals. Manufacturing and R&D investments are crucial for players to stay competitive and meet the evolving needs of the market. The market for automotive engine oils in Germany is expected to continue expanding, driven by the growing demand for efficient and effective lubrication solutions that cater to the diverse needs of the automotive industry.

Thus, the market is poised for growth, as the German automotive industry continues to innovate and adopt new technologies to improve fuel efficiency, reduce emissions, and enhance engine performance. The market is a dynamic and evolving industry, driven by the need for efficient and effective lubrication solutions that cater to the diverse needs of the automotive industry. Players in this market must stay abreast of the latest trends and regulations to remain competitive and meet the evolving needs of consumers and OEMs. The market is expected to continue growing, as the German automotive industry continues to innovate and adopt new technologies to improve fuel efficiency, reduce emissions, and enhance engine performance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.44% |

|

Market growth 2024-2028 |

USD 1.07 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.53 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Germany

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch