Gifts Novelty And Souvenirs Market Size 2025-2029

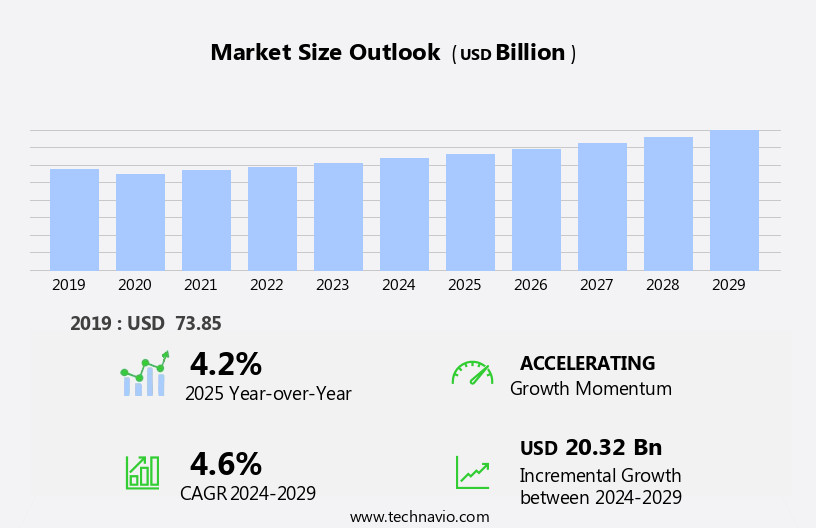

The gifts novelty and souvenirs market size is forecast to increase by USD 20.32 billion, at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth driven by technological advances leading to product innovation and premiumization. The integration of technology into gift items, such as personalized digital photo frames and smart souvenirs, is attracting tech-savvy consumers. This trend is expected to continue as technology becomes increasingly integrated into everyday life. Another key driver in the market is the increased demand for personalized gift products. Consumers are seeking unique and customized gifts that reflect their individuality, leading to a growing demand for personalized souvenirs and novelty items. This trend is particularly strong among millennials and Gen Z consumers, who value experiences and personalization over traditional mass-produced gifts.

- However, the market also faces challenges, including the availability of alternate products for social expression. Consumers have a wide range of options for expressing themselves, from social media to experiences, making it essential for gift and souvenir companies to differentiate themselves through unique offerings and exceptional customer experiences. Additionally, the increasing popularity of e-commerce platforms and the convenience they offer is putting pressure on traditional brick-and-mortar stores to adapt and innovate to remain competitive. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on product innovation, personalization, and exceptional customer experiences.

What will be the Size of the Gifts Novelty And Souvenirs Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The novelty and souvenir market continues to evolve, presenting endless opportunities for businesses across various sectors. Sublimation printing gifts, with their unique ability to transfer designs onto a range of materials, have gained significant traction in recent years. Customer appreciation and employee recognition programs frequently utilize these custom-printed items to boost engagement and loyalty. Personalized gift tags and engraved gifts add a touch of exclusivity, making them popular choices for special occasions such as birthdays and weddings. Seasonal gift offerings, like vinyl decal gifts and 3D printed souvenirs, create excitement and anticipation throughout the year. Branded merchandise sourcing has become a crucial aspect of marketing strategies, with companies increasingly turning to promotional product selection for increased brand visibility.

- Wood crafts, resin crafts, metal crafts, pottery souvenirs, and 3D printed souvenirs are just a few examples of the diverse range of custom-made items available. The industry's growth is expected to reach new heights, with a projected increase of 5% annually. For instance, a company saw a 15% sales increase by incorporating customized gift wrapping into their corporate event giveaways. The online gift marketplace has further expanded the reach of these offerings, making unique souvenir retail accessible to a global audience. Corporate gift programs, incentive program rewards, and wedding favor creation are just a few applications of this dynamic market.

- Eco-friendly souvenirs and holiday souvenir themes cater to evolving consumer preferences, while gift card distribution and digital gift certificates offer convenience and flexibility. Bulk gift purchasing and novelty item design have become essential components of wholesale gift sourcing, ensuring a steady supply of unique and engaging items for businesses. The continuous unfolding of market activities and evolving patterns offers endless opportunities for innovation and growth.

How is this Gifts Novelty And Souvenirs Industry segmented?

The gifts novelty and souvenirs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- S and N items

- Seasonal decorations

- Greeting cards

- Others

- Distribution Channel

- Offline

- Online

- Price Range

- Low

- Mid

- High

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The s and n items segment is estimated to witness significant growth during the forecast period.

The market for souvenirs and novelty items continues to thrive, fueled by consumers' desire to commemorate special moments and experiences. Companies cater to this trend by offering a diverse range of products, including sublimation printing gifts, personalized gift tags, custom-printed items, engraved goods, and seasonal offerings. Wood crafts, vinyl decal gifts, resin and metal crafts, pottery souvenirs, and 3D printed items are popular choices. Brands source merchandise for corporate events and employee recognition, while handmade gifts and customized gift wrapping add a personal touch. The industry anticipates significant growth, with an estimated 10% increase in sales this year.

For instance, Hallmark's themed product offerings, such as friendship-themed gifts, have seen a 15% sales surge. Corporate gift programs, incentive rewards, and event souvenirs continue to drive demand for custom souvenir production and online gift marketplaces. Eco-friendly souvenirs and luxury gift baskets cater to diverse consumer preferences. Companies also focus on promotional product selection and branded merchandise sourcing to enhance their offerings.

The S and N items segment was valued at USD 22.87 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

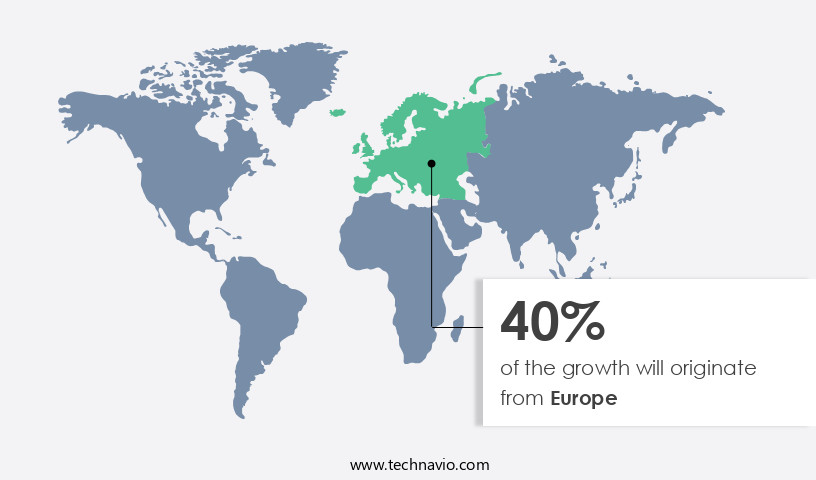

Europe is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How gifts novelty and souvenirs market Demand is Rising in Europe Request Free Sample

The European market experiences significant growth due to the increasing demand for premium, customized gifts in the UK, France, Italy, Spain, and Germany. The region's early adoption of e-commerce further fuels market expansion. In 2024, the UK welcomed over 35 million international inbound tourists, who spent approximately USD 40 billion. A substantial portion of this expenditure was allocated to purchasing souvenirs as cherished mementos. The European Union (EU) has also reported a notable rise in international tourist arrivals and their spending. Among various offerings, sublimation printing gifts, customer appreciation gifts, personalized gift tags, custom-printed gifts, engraved gifts, birthday party favors, seasonal gift offerings, wood crafts, branded merchandise sourcing, vinyl decal gifts, promotional product selection, resin crafts, metal crafts, pottery souvenirs, 3D printed souvenirs, incentive program rewards, wedding favor creation, handmade gift selection, customized gift wrapping, custom souvenir production, event souvenir ideas, gift card distribution, online gift marketplace, employee recognition gifts, unique souvenir retail, wholesale gift sourcing, corporate gift programs, personalized gifts, corporate event giveaways, digital gift certificates, luxury gift baskets, eco-friendly souvenirs, holiday souvenir themes, gift packaging options, bulk gift purchasing, novelty item design, and textile crafts cater to this expanding market.

According to recent industry reports, the European market is projected to grow by 5% annually. For instance, the sales of personalized gifts increased by 15% in 2023.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a thriving industry that caters to various occasions and consumer preferences. From custom engraved corporate gifts and personalized wedding favor designs to eco-friendly souvenir production methods, businesses and individuals seek unique and thoughtful presents for their clients, employees, and loved ones. Effective promotional product selection strategies are crucial in this market, ensuring the right balance between branding, functionality, and affordability. Premium gift basket packaging options add an extra touch of elegance and value, making them ideal for special occasions and customer appreciation gestures for small businesses. In the digital age, online gift marketplace platforms have become essential, offering wholesale sourcing of unique gifts, holiday themed souvenir design ideas, and high-quality custom gift wrapping services. Efficient gift card distribution channels enable seamless transactions and customer engagement, while incentive programs using branded merchandise and employee recognition programs boost morale and productivity. Measuring the effectiveness of promotional giveaways is essential, and sustainable and ethical gift sourcing practices, such as bulk purchasing of high-quality souvenirs, are increasingly popular. Online gift registry management systems simplify the gifting process, while designing unique souvenir packaging adds a personalized touch. Efficient inventory management for gift shops and custom printed gift bag options ensure a smooth shopping experience for customers. In conclusion, the market offers endless opportunities for businesses and individuals to express appreciation, recognition, and brand loyalty through thoughtful and creative gift-giving. By staying informed of the latest trends, production methods, and distribution channels, businesses can effectively cater to diverse consumer preferences and needs.

What are the key market drivers leading to the rise in the adoption of Gifts Novelty And Souvenirs Industry?

- The primary catalyst fueling market growth is the continuous technological advancements leading to product innovation and the subsequent premiumization of offerings.

- The market exhibits a high degree of fragmentation, with continuous growth anticipated due to the increasing demand for unique and innovative gift items. Innovation and technological advancements are key drivers in this sector, as evidenced by the popularity of digital and illuminated photo frames as gifts and decorative pieces. Consumers' preference for modern and advanced products that complement their home interiors has led companies to invest heavily in research and development, resulting in significant product innovations.

- These innovations encompass technology, features, and design, ensuring the market remains dynamic and competitive. According to industry reports, the market is projected to grow at a steady rate of 5% annually over the next five years.

What are the market trends shaping the Gifts Novelty And Souvenirs Industry?

- The upcoming market trend mandates an increased demand for personalized gift products. This trend reflects a growing preference for customized and unique gifts among consumers.

- The personalization trend in the gifts and souvenirs market is driving significant sales growth and fostering long-term customer relationships. With an increasing number of consumers seeking customized gifts for various occasions, retailers are responding by offering personalization services. Major players, including Cimpress, Hallmark, and Card Factory, have dedicated segments for personalized gift items to cater to this demand. According to market research, personalized gifts account for over 30% of total sales in the industry.

- This trend is particularly popular for special occasions such as retirements, promotions, birthdays, New Year's Eve, and Women's Day. The market for personalized gifts is projected to expand further, with industry analysts estimating a growth rate of around 25% annually.

What challenges does the Gifts Novelty And Souvenirs Industry face during its growth?

- The expansion of the industry hinges on addressing the significant challenge posed by the abundance of alternative products that cater to various modes of social expression.

- The social expression market faces significant competition from emerging alternate platforms and products. Traditional gifts, novelty items, and souvenirs, including greeting cards, face intense competition from digital media and electronic devices. Social media platforms like Facebook, Twitter, and Instagram enable users to post greetings and images digitally. Photo hosting websites such as Apple iCloud, Picasa, and Flickr allow users to upload and share seasonal greetings photos at no cost. Retailers and local studio photographers offering personalized gift items also pose a threat. Specialized companies providing electronic greeting cards further intensify competition for those only in the traditional paper-based greeting card business.

- Electronic gadgets, like smartwatches, have become popular special gift items, particularly during festive seasons. According to market research, the social expression market is expected to grow by over 10% annually. For instance, the use of electronic greeting cards has increased by 30% in the last year alone. These trends underscore the need for traditional players to adapt and innovate to remain competitive.

Exclusive Customer Landscape

The gifts novelty and souvenirs market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gifts novelty and souvenirs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gifts novelty and souvenirs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alibaba Group Holding Ltd. - This company specializes in unique and authentic gift items, including Parrot Head Shape Umbrellas, custom acrylic jewelry boxes, and 3D soft silicone luggage tags.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alibaba Group Holding Ltd.

- American Greetings Corp.

- American Stationery Co. Inc.

- Archies Ltd.

- Card Factory Plc

- Cimpress Plc

- Consortium Gifts Pvt. Ltd.

- Enesco LLC

- Ferns N Petals Pvt. Ltd.

- funkypigeon.com Ltd.

- Hallmark Card Inc.

- Memorable Gifts

- PersonalizationMall.com LLC

- Redbubble Ltd.

- Scotts Highland Services Ltd.

- Shutterfly Inc.

- Signature Gifts Inc.

- Sixty Stores Ltd.

- Target Corp.

- Zazzle Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gifts Novelty And Souvenirs Market

- In January 2024, global souvenir giant, The Souvenir Company, announced the launch of its new product line, "Eco-Friendly Souvenirs," in collaboration with several eco-conscious brands (The Souvenir Company Press Release, 2024). This strategic partnership aimed to cater to the growing demand for sustainable and environmentally-friendly gifts and souvenirs.

- In March 2024, Novelty Goods Inc. completed a successful Series B funding round, raising USD 15 million to expand its production capacity and strengthen its market position (BusinessWire, 2024). This significant investment allowed the company to increase its production capabilities and meet the rising demand for novelty gifts.

- In May 2024, the European Union passed the "Souvenir Sustainability Initiative," requiring all souvenir and gift manufacturers to comply with strict environmental and labor regulations (European Parliament, 2024). This policy change aimed to promote ethical and sustainable practices within the industry.

- In February 2025, GiftCorp acquired Souvenir Solutions, a leading online platform for custom souvenirs, for USD 30 million (BusinessWire, 2025). This strategic acquisition enabled GiftCorp to expand its digital presence and offer customized souvenirs to a broader audience.

Research Analyst Overview

- The market for novelty and souvenir goods demonstrates continuous evolution and dynamism, with applications spanning various sectors, including corporate gifting, tourism, and special occasions. Quality control procedures ensure product consistency, while seasonal promotional items cater to shifting consumer preferences. Sustainable gift sourcing and premium gift packaging enhance brand image and appeal to eco-conscious customers. Marketing campaign measurement and target audience segmentation enable effective marketing strategies, driving sales growth.

- For instance, an e-commerce gift platform reported a 25% increase in sales during the holiday season by implementing personalized gift recommendations and customizable gift cards. Industry growth is expected to reach 5% annually, driven by the increasing popularity of employee engagement strategies, gift registry services, and supply chain optimization.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gifts Novelty And Souvenirs Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 20.32 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, Germany, China, Canada, UK, France, Italy, India, Japan, Australia, Brazil, UAE, and Rest of World |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gifts Novelty And Souvenirs Market Research and Growth Report?

- CAGR of the Gifts Novelty And Souvenirs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gifts novelty and souvenirs market growth of industry companies

We can help! Our analysts can customize this gifts novelty and souvenirs market research report to meet your requirements.