Climbing Gym Market Size and Forecast 2025-2029

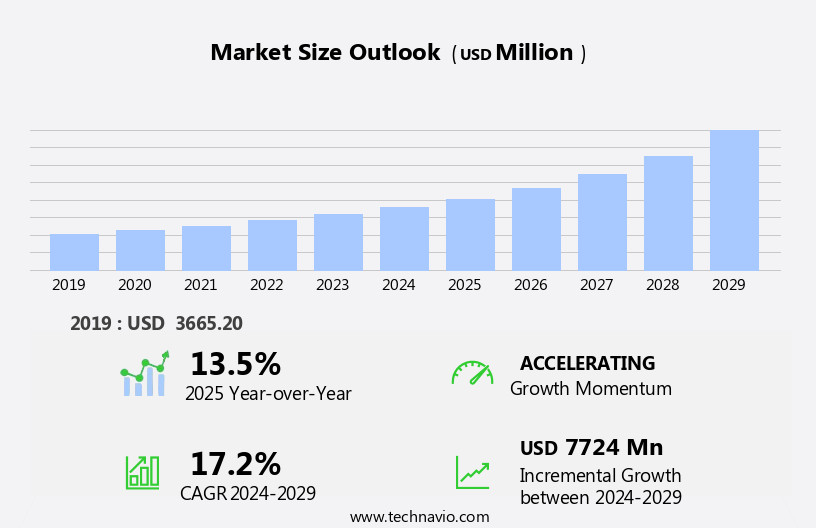

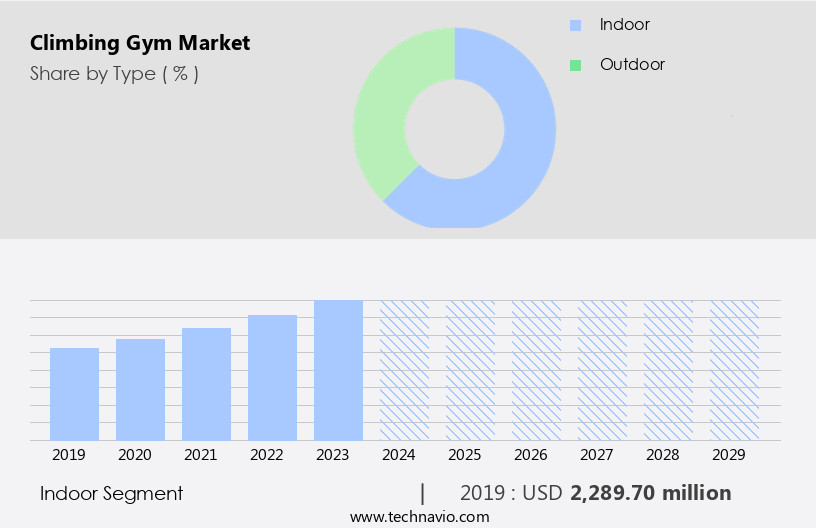

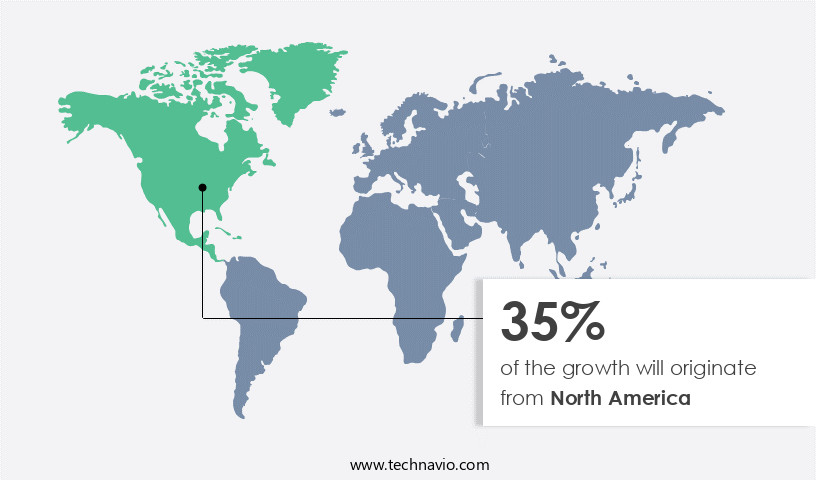

The climbing gym market size estimates the market to reach USD 7.72 billion, at a CAGR of 17.2% between 2024 and 2029. North America is expected to account for 35% of the growth contribution to the global market during this period. In 2019, the indoor segment was valued at USD 2.29 billion and has demonstrated steady growth since then.

Market Size & Forecast

- Market Opportunities: USD 7.724 Billion

- Future Opportunities: USD 0.284 Billion

- CAGR : 17.2%

- Base yer largest region tag: Largest market in 2023

The market is experiencing significant growth, driven by the increasing popularity of climbing as an outdoor sport and the inclusion of climbing events in the Olympics. This trend is expected to continue as climbing gains broader recognition and appeal, particularly among younger generations. However, challenges persist in expanding market penetration, particularly in developing countries where awareness of climbing and access to climbing facilities remain limited.

As the market evolves, companies must navigate these challenges by increasing outreach efforts and investing in infrastructure to cater to both established and emerging markets. By addressing challenges and capitalizing on the growing interest in fittness app, companies can effectively capitalize on market opportunities and solidify their position in the strategic landscape. Capitalizing on the growing interest in climbing and addressing market gaps presents a promising opportunity for businesses to differentiate themselves and capture market share.

What will be the Size of the Climbing Gym Market during the forecast period?

The market continues to evolve, with innovations in various sectors driving growth and change. For instance, advancements in lead climbing systems have led to increased safety and efficiency, enabling climbers to focus on mastering complex routes. In the realm of bouldering wall design, designers are exploring new ways to create dynamic and challenging walls that cater to diverse climbing styles. Moreover, the integration of injury rehabilitation programs and advanced climbing techniques into climbing gyms is gaining traction, as these offerings attract a wider demographic and foster a more inclusive community. Chalk bag design and climbing hold durability have also seen significant improvements, ensuring a better climbing experience for users.

Lighting design standards and climbing gym ventilation are essential aspects of gym design, as they impact both the functionality and the ambiance of the space. Climbing shoe technology continues to advance, offering climbers enhanced grip and comfort. Customer management systems, auto belay systems, and gym safety regulations are crucial components of successful climbing gym operations. Wall angle optimization, gym insurance policies, and Fall Protection systems ensure a safe and secure climbing environment. Staff training programs and wall cleaning procedures contribute to a high-quality climbing experience. Risk assessment protocols, personal training programs, and climbing wall materials are essential for gym owners to maintain a competitive edge.

Harness inspection methods, gym membership software, and climbing gym flooring are other critical aspects of gym infrastructure. The climbing gym industry is expected to grow by 5% annually, as more people discover the physical and mental benefits of climbing. For example, a gym in Denver, Colorado, reported a 25% increase in memberships after implementing a comprehensive injury prevention strategy. This growth is fueled by the continuous unfolding of market activities and evolving patterns.

How is this Climbing Gym Industry segmented?

The climbing gym industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Indoor

- Outdoor

- Application

- Top-rope climbing

- Lead climbing

- Bouldering

- End-User

- Adults

- Teenagers

- Children Application Residential

- Commercial

- Target Audience

- Beginners

- Advanced Climbers

- Families

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The indoor segment is estimated to witness significant growth during the forecast period.

Indoor climbing gyms have gained significant traction in the US market, merging the excitement of climbing with a comprehensive fitness center experience. This unique proposition caters to the increasing demand from the Millennial population, who value immersive and harmonious wellness experiences. These facilities offer various climbing techniques, including bouldering, top-rope climbing, and lead climbing, each presenting distinct challenges. Bouldering, which involves climbing shorter heights without ropes or harnesses, is particularly popular. Climbing gym design encompasses advanced systems, such as lead climbing and auto belay, ensuring safety and efficiency. Injury rehabilitation programs and personal training sessions cater to climbers' needs, promoting injury prevention strategies.

Climbing hold durability, chalk bag design, and lighting design standards enhance the user experience. Ventilation and gym membership software facilitate smooth operations, while gym safety regulations and emergency response plans prioritize safety. Staff training programs and risk assessment protocols ensure a competent team, while harness inspection methods and climbing wall materials maintain equipment integrity. Climbing shoe technology and grip strength training cater to climbers' performance needs. Wall cleaning procedures and rope management systems maintain climbing wall conditions, while gym insurance policies and fall protection systems offer peace of mind. Weight training equipment and route setting techniques cater to diverse fitness equipment goals. Accessibility features and advanced climbing techniques further broaden the appeal, making indoor climbing gyms a thriving and inclusive community.

As of 2019, the Indoor segment estimated at USD 2.29 billion, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, North America is projected to contribute 35% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America, with the US leading the charge, is experiencing significant growth due to the well-established sports industry and increasing health consciousness among consumers. Indoor and outdoor climbing participation rates have been on the rise, fueled by the availability of numerous climbing gyms and outdoor destinations, the emergence of interactive climbing walls, and the influx of tourists. Advanced climbing techniques, such as lead climbing and top-roping, are gaining popularity, driving the demand for specialized equipment and training programs. Injury rehabilitation programs and injury prevention strategies are essential components of modern climbing gyms, ensuring a safe and inclusive environment for climbers of all skill levels.

Climbing gym design incorporates various elements, including durable climbing holds, optimized wall angles, and effective ventilation systems, to enhance the user experience. Lighting design standards and customer management systems streamline operations and improve safety. Auto belay systems and fall protection systems offer added security, while staff training programs ensure certified instructors are on hand to guide climbers. Wall cleaning procedures and risk assessment protocols maintain gym safety, while personal training programs cater to individual needs. Climbing wall materials, harness inspection methods, and gym management software are crucial aspects of gym infrastructure. Weight training equipment and route setting techniques cater to climbers seeking a more comprehensive fitness experience.

Rope management systems, belay device types, and grip strength training equipment further enhance the gym offerings. Accessibility features ensure that climbing is accessible to a diverse range of individuals, making the market a dynamic and evolving industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Climbing Gym Market is expanding with increased focus on safety, accessibility, and customer experience. Key operational practices include climbing wall panel installation methods, optimizing bouldering wall layout for flow, and implementing an effective gym cleaning and maintenance schedule. Safety is prioritized through implementation of a gym safety audit system, effective strategies for preventing climbing injuries, and measuring the efficiency of auto belay systems in reducing injury rates. Staff development is enhanced with developing a comprehensive staff training program for climbing gyms, effective rope management training for staff, and advanced belaying techniques for multi-pitch climbing. Customer experience benefits from integrating personal training programs into a climbing gym environment, designing accessible climbing routes for adaptive athletes, creating engaging climbing routes for all skill levels, and strategies for improving customer retention in a climbing gym. Operations are further improved by best practices for climbing hold selection and placement and developing a proactive gym maintenance and repair plan.

What are the key market drivers leading to the rise in the adoption of Climbing Gym Industry?

- The surge in the popularity of outdoor sports serves as the primary catalyst for market growth. Outdoor recreation activities such as outdoor climbing are gaining popularity across the globe. These climbing gyms, including outdoor climbing, are extremely popular in North America and Europe and are gradually becoming common in developing regions, such as Southeast Asia.In the last few years, major outdoor spaces, such as parks and other green areas, have witnessed a surge in the establishment of bouldering structures for climbing, with the aim of improving public health, combating child obesity, and addressing the growing trend of sedentary lifestyles among the population.

- For instance, Scioto Audubon Metro Park, one of the major parks in the US, has a climbing wall that is 35 feet high. The construction of climbing walls, artificial climbing structures, and boulders for climbing in various public places has caught the interest of climbers, thereby further triggering the demand for outdoor climbing activities.Thus, the increased participation of people in outdoor recreation activities, coupled with the opening of new artificial climbing and bouldering structures in major outdoor locations, is expected to drive market growth further during the forecast period.

What are the market trends shaping the Climbing Gym Industry?

- The inclusion of climbing events in the Olympics represents a significant market trend. This development reflects the growing popularity and recognition of climbing as a competitive sport.

- The inclusion of climbing as a sport in the Olympics 2024 has sparked a robust surge in the global market for climbing gyms. In the US alone, there was an increase of approximately 30% in the number of climbing gyms established in 2022, with California accounting for a significant portion. Smaller states, such as Tennessee and Virginia, also experienced a climb in the number of climbing gyms.

- This trend is driven by the increasing awareness and popularity of climbing as a sport, fueled by the growing number of athletes participating in international competitions. According to industry reports, the market is expected to grow by 25% in the next five years.

What challenges does the Climbing Gym Industry face during its growth?

- In developing countries, the absence of industry awareness and limited market penetration poses a significant challenge to the industry's growth. Advanced recreational activities like climbing gyms are common in most developed countries. However, their penetration in developing countries, especially in Tier-2 and Tier-3 cities in these countries, is exceptionally low. Also, these countries face challenges, such as the lack of knowledge about the latest products and a shortage of trainers who can guide people about the latest advances in the market in focus.Furthermore, in developing countries, price consciousness among the public is a major hurdle that restricts the adoption of climbing gyms.

- For instance, low- and middle-income countries in South America and APAC lack the proper infrastructure needed to set up high-tech climbing gyms and, therefore, prefer to promote traditional sports activities, which might impede the growth of the global climbing gym market.Vendors find it difficult to penetrate developing markets in APAC and Eastern Europe due to the lack of knowledge related to their product offerings and technology among the people. In APAC, China and Japan offer the potential to become prominent markets for climbing gyms as both countries have the most suitable demographics. However, in other developing nations in the region, the lack of well-established infrastructure and low awareness restricts the establishment of climbing gyms. Therefore, before entering developing markets, vendors need to create awareness among people about the benefits of climbing, particularly its health advantages. Hence, such factors will limit the growth of the market in focus during the forecast period.

Exclusive Customer Landscape

The climbing gym market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the climbing gym market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, climbing gym market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The North Face - This company specializes in providing climbing gym instruction, featuring techniques 1 and 2, as well as the Flinta training group, catering to both adults and children.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- The North Face

- Planet Granite

- Movement Climbing + Fitness

- Vertical Endeavors

- Earth Treks

- Climb So iLL

- Momentum Indoor Climbing

- The Spot Bouldering Gym

- Brooklyn Boulders

- Sender One Climbing

- The Climbing Wall

- Clip ‘n Climb

- The Castle Climbing Centre

- Hangar 18

- Boulderwelt

- Kletterzentrum

- Vertical World

- Touchstone Climbing

- Rockreation

- Urban Climb

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Climbing Gym Market

- In January 2024, Planet Fitness, a leading health and wellness club franchisor, announced its entry into the market with the acquisition of ClimbAway Fitness, a chain of 15 climbing gyms across the United States. This strategic move aimed to diversify Planet Fitness' offerings and cater to the growing demand for indoor climbing facilities (Planet Fitness Press Release).

- In March 2024, Entre-Prises, a leading climbing wall manufacturer, partnered with Walltopia, a global climbing wall solutions provider, to launch a new line of innovative climbing walls with augmented reality features. This collaboration aimed to enhance the user experience and attract a wider audience to climbing gyms (Entre-Prises Press Release).

- In April 2025, The Climbing Hold Company, a major climbing holds manufacturer, secured a USD 10 million Series A funding round led by Siemens-backed Next47. The investment will support the company's expansion into new markets and the development of innovative climbing hold materials (The Climbing Hold Company Press Release).

- In May 2025, the European Union passed the European Climbing Framework, a regulation aimed at standardizing safety and accessibility requirements for climbing gyms across Europe. The initiative will encourage the growth of the European market by promoting a consistent and safe environment for climbers (European Commission Press Release).

Research Analyst Overview

- The market continues to evolve, with ongoing advancements in various sectors shaping its dynamic landscape. Injury risk management remains a top priority, driving the development of top-roping safety measures and fall arrest systems. Bouldering problem design and wall construction methods are continually refined to provide more realistic climbing experiences. Rope care guidelines and safety audit processes ensure equipment reliability, while shoe fitting techniques cater to individual needs. Training program design and hold replacement cycles adapt to climbing skill development, with wall maintenance schedules and flooring safety standards ensuring a safe and enjoyable environment. Finger strength exercises, climbing skill development, and lead climbing instruction are essential components of a comprehensive training program.

- Staff certification programs and emergency procedures manuals ensure a well-prepared team. Industry growth is expected to reach 5% annually, with membership management software, insurance coverage options, and gym cleaning protocols contributing to operational efficiency. Wall surface treatments, gym layout optimization, lighting efficiency measures, and customer feedback systems enhance the overall climbing experience. Chalk usage guidelines and route setting software cater to climbers' preferences, while belaying techniques instruction and harness fitting procedures ensure proper equipment usage.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Climbing Gym Market insights. See full methodology.

Climbing Gym Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.2% |

|

Market growth 2025-2029 |

USD 7724 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.5 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Climbing Gym Market Research and Growth Report?

- CAGR of the Climbing Gym industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the climbing gym market growth of industry companies

We can help! Our analysts can customize this climbing gym market research report to meet your requirements.