Human Organoids Market Size 2024-2028

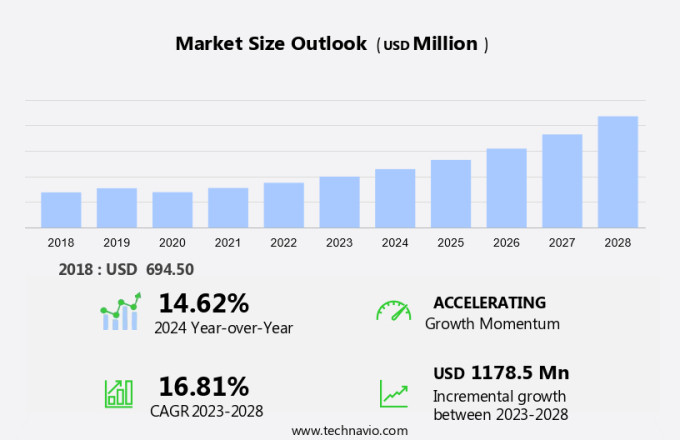

The human organoids market size is forecast to increase by USD 1.18 billion at a CAGR of 16.81% between 2023 and 2028.

- Human organoids, three-dimensional cellular structures that mimic the functionality and structure of human organs, have gained significant attention in the biopharmaceutical industry. The market for human organoids is expanding due to their advantages over traditional methods for research in areas such as oncological research, allergy studies, and infectious diseases. companies are increasingly focusing on new product launches to cater to the growing demand from academic institutions, patients, and biopharma companies. However, constraints in human organoid models, including ethical considerations and limitations in scalability, pose challenges to market growth. Despite these hurdles, the market is expected to continue expanding as researchers and pharmaceutical companies recognize the potential of human organoids for advancing medical research and drug development. Funding from both public and private sources is expected to drive the market forward, particularly in the areas of drug discovery and personalized medicine.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing demand for accurate disease modeling and drug screening. Organoids are three-dimensional structures derived from stem cells that mimic the cellular structure and function of specific organs. These structures offer a unique platform for understanding the pathogenesis of various diseases, including cancer, allergies, and infectious diseases. The use of organoids in research and development is gaining popularity in the biopharma industry and academic institutions. Organoids provide an opportunity to study the cellular mechanisms underlying diseases and test the efficacy and safety of potential therapeutics.

- For instance, oncological research has significantly benefited from organoid models, enabling the investigation of tumor growth, drug resistance, and metastasis. Disease modeling using organoids offers a more accurate representation of the in vivo environment compared to traditional two-dimensional cell cultures. This enhanced accuracy leads to more reliable test results and improved clinical trial success rates. Furthermore, organoids can be used for personalized medicines, allowing researchers to tailor treatments to individual patients based on their specific cellular makeup. The distribution channels for human organoids include biopharma companies and academic institutions. Biopharma companies are increasingly investing in organoid technology to accelerate drug discovery and development.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Pharmaceutical and biotechnology companies

- Contract research organizations

- Academic and research institutes

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By End-user Insights

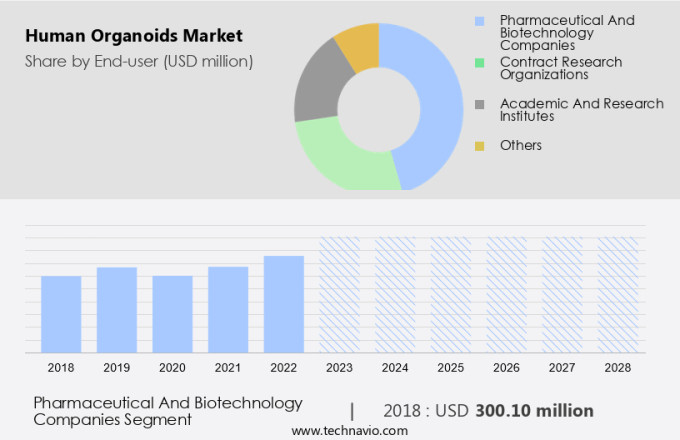

- The pharmaceutical and biotechnology companies segment is estimated to witness significant growth during the forecast period.

Pharmaceutical and biotech firms in the United States are advancing organoid technology as an alternative for preclinical drug testing. This innovation is particularly significant for personalized medicine, enabling customized disease treatment, such as oncological research, as organoids closely resemble each patient's unique genetic makeup. Several market players manufacture various human organoids, including intestinal, lung, kidney, and brain organoids. For example, DefiniGEN Ltd. (DefiniGEN) specializes in intestinal organoids, offering a unique in vitro system for modeling the human intestine. These organoids facilitate drug absorption, metabolism, transporter induction, and the study of infectious diseases. Academic institutions and biopharma companies collaborate in funding and distributing these organoids through various channels.

Get a glance at the market report of share of various segments Request Free Sample

The pharmaceutical and biotechnology companies segment was valued at USD 300.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

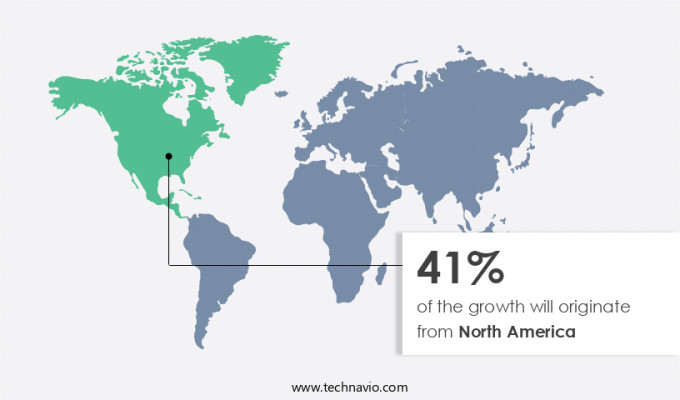

- North America is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the market, the largest market share was held by a specific region in 2023. Several factors contribute to this region's dominance, including the presence of numerous multinational healthcare companies and pharmaceutical firms, a high volume of industrial research and development activities, and substantial investments in medical research. The region's economy, both at the state and local levels, benefits significantly from these industries. Neurological disorders have become a major focus for researchers in the field of human organoids due to their increasing prevalence. According to the National Library of Medicine, approximately 30 million Americans are diagnosed with neurological and psychiatric disorders each year. These disorders include neurodegenerative diseases, such as Alzheimer's disease and Parkinson's disease, and psychiatric disorders, including autism spectrum disorder, depression, and schizophrenia. The development of cerebral organoids is a significant step forward in understanding and treating these conditions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Human Organoids Market?

The advantages of human organoids over traditional methods is the key driver of the market.

- Organoids have emerged as a promising area of research in the biomedical field over the past decade. Unlike traditional 2D cell cultures, organoids offer several advantages, making them increasingly popular in various research applications. These three-dimensional structures closely mimic the original tissues, providing a more accurate representation of genetic and phenotypic heterogeneity. Organoids have been successfully used in cancer research, particularly in the study of liver and gastrointestinal diseases. They offer a cost-effective and efficient solution for drug screening, enabling the identification of potential therapeutics with high sensitivity and precision. Furthermore, organoids can be used to guide clinical precision treatment and personalized medicine.

- In the near future, organoids are expected to expand their reach across various medical research domains. Biobanking and toxicology are just a few areas where organoids can contribute significantly. Research institutes and academic organizations are increasingly investing in this field to unlock new therapeutic applications. Organoids' ability to retain the 3D structure of the original tissues and offer a high success rate in clinical trials makes them an attractive alternative to conventional research methods.

What are the market trends shaping the Human Organoids Market?

The increasing focus of vendors on new product launches is the upcoming trend in the market.

- The market is experiencing substantial growth due to the heightened interest of market participants in innovative product offerings. Merck KGaA's introduction of 3dGRO Patient-Derived Organoids (PDOs) in 2023 is a prime example, with the launch of 20 pancreatic and 20 colorectal organoids, along with the 3dGRO Wnt3a conditioned media supplement. These advanced, three-dimensional in-vitro cell models closely mimic the intricacy of in-vivo organs, making them indispensable in biomedical research.

- Organoids are revolutionizing the investigation of drug responses and disease progression, offering a more precise representation of human organs compared to conventional 2D cell cultures. In disease modeling, organoids are increasingly utilized for cancer research, enabling a better understanding of pathogenesis and aiding in the development of personalized medicines. In drug screening, organoids serve as effective tools for predicting therapeutic efficacy and potential side effects, thereby expediting clinical trials. The application of organoids in regenerative medicine also holds immense promise, offering the potential for the generation of functional tissue replacements.

What challenges does the Human Organoids Market face during its growth?

Constraints in human organoid models is a key challenge affecting market growth.

- Human organoids, three-dimensional cultures of human cells, have gained increasing attention in scientific research over the past decade. These models, derived from pluripotent stem cells (PSCs), offer a more physiologically relevant alternative to traditional two-dimensional cell cultures and animal models. However, they come with certain limitations. For instance, 3D liver organoids generated from PSCs exhibit immature hepatocytes, expressing fetal markers and lacking the full functionality of mature hepatocytes. To overcome this challenge, researchers have proposed various strategies, such as the manipulation of transcription factors or miRNAs and the addition of growth factors or small molecules to promote differentiation and maturation.

- Similarly, 3D cardiac organoids, while providing a more complex microenvironment, do not recapitulate all the cell types present in the adult heart, such as immune cells. To advance the field of human organoid technology, strategic collaborations between academia and industry, as well as the utilization of technologically advanced development frameworks, are essential. DNA modifications, such as CRISPR/Cas9, can also be employed to enhance the functionality of human organoids in tumor biology studies, particularly in the context of breast cancer organoids. The use of these advanced techniques can lead to a better understanding of tumor biology and the development of novel therapeutic approaches.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BICO Group AB

- Biopredic International

- Cellesce Ltd.

- CN Bio Innovations Ltd.

- Corning Inc.

- DefiniGEN Ltd.

- Emulate Inc.

- Hubrecht Organoid Technology

- InSphero AG

- Kirkstall Ltd.

- Merck KGaA

- MIMETAS BV

- Organoid Therapeutics

- Organovo Holdings Inc.

- Pandorum Technologies Pvt. Ltd.

- STEMCELL Technologies Inc.

- Thermo Fisher Scientific Inc.

- United Therapeutics Corp.

- ZenBio Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for advanced disease modeling and drug screening tools. These three-dimensional cell cultures, which mimic the structure and function of human organs, are revolutionizing research in various fields such as oncology, neurology, and allergy. Cancer models derived from organoids are providing valuable insights into tumor biology, enabling the development of personalized medicines and clinical trials. Pathogenesis of diseases like cerebral organoids for neurological disorders and intestinal organoids for gastrointestinal diseases can be studied in detail using these advanced tissue models. Biopharma companies and academic institutions are investing heavily in this area to expand their product scope and stay competitive.

Furthermore, research advancements in organoid technology are leading to the creation of organ-specific cells, cell toxicity monitoring, and cell-based assays. These tools are essential for understanding cellular mechanisms and testing the efficacy of drugs, especially in cases of complex diseases like cancer and infectious diseases. Funding from organizations like the National Institutes of Health (NIH) and the Department of Health and Human Services (DHHS) is driving research grants and collaborations between industrial, state, and local economies. Strategic collaborations between multinational healthcare firms and research institutes are further accelerating the growth of the market. Technologically advanced tools like NGD, CSIs, and DNA modifications are being integrated into organoid development frameworks to improve the accuracy and efficiency of organoid production. The therapeutic applications of organoids in drug discovery and toxicology are expected to fuel the market's growth in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.81% |

|

Market Growth 2024-2028 |

USD 1.18 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

14.62 |

|

Key countries |

US, Germany, UK, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch