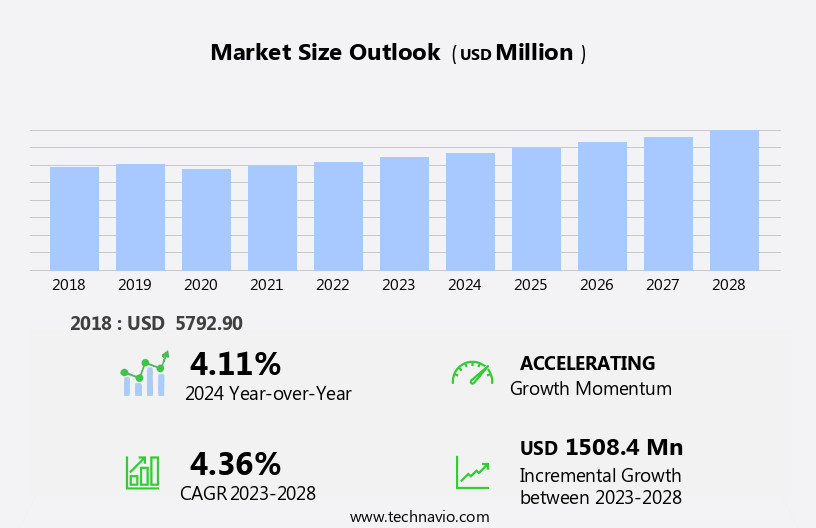

Industrial Belt Drives Market Size 2025-2029

The industrial belt drives market size is forecast to increase by USD 1.62 billion, at a CAGR of 4.5% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing demand for automated material handling equipment in various industries. This trend is attributed to the need for increased productivity and efficiency in manufacturing processes. Additionally, advancements in design and analysis technologies are enabling the development of more robust and reliable belt drives, catering to high-precision applications. However, challenges persist in the form of inefficiency in high-precision applications and the difficulty in operating belt drives in harsh environmental conditions.

- Companies operating in this market must address these challenges through technological innovation and strategic partnerships to capitalize on the growth opportunities and maintain a competitive edge. Vibration analysis, predictive analytics, and big data are transforming fault diagnosis, while machine learning and cloud computing facilitate remote monitoring.

What will be the Size of the Industrial Belt Drives Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution, with ongoing developments in vibration control, industrial automation, material handling, and industrial design. These advancements are integral to various sectors, including aerospace manufacturing, agricultural equipment, food processing, and mining, among others. Flat belts, belt tension, pulley systems, and energy efficiency are key components of belt drives, which are essential for power transmission and performance optimization. The importance of safety standards and reliability engineering in ensuring optimal belt life and minimizing belt slip is increasingly recognized. Moreover, the market's dynamics extend to the integration of motor speed control and timing belts, as well as the adoption of synchronous belts for precise speed reduction and noise reduction.

In material handling applications, belt drives play a crucial role in conveyor systems, where belt wear and maintenance optimization are essential. The use of rubber belts, polyurethane belts, and steel belts in different industries is a testament to the versatility of belt drives. From manufacturing standards and production optimization in automotive manufacturing to chemical processing and textile manufacturing, belt drives remain an indispensable part of industrial machinery. The ongoing unfolding of market activities reveals a focus on improving efficiency, reducing downtime, and enhancing safety, with a growing emphasis on energy efficiency and noise reduction. As industries continue to evolve, so too will the role and application of belt drives.

How is this Industrial Belt Drives Industry segmented?

The industrial belt drives industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Material handling

- Industrial machinery

- Agriculture industry

- Mining and mineral

- Others

- Product

- V-belt drives

- Synchronous belt drives

- Pulleys

- Distribution Channel

- Direct sales

- Industrial distributors

- Online platforms

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

.

By End-user Insights

The material handling segment is estimated to witness significant growth during the forecast period. The material handling segment dominates the market, with applications in various industries such as oil and gas, mining, medical, machine tools, and wood. These sectors rely heavily on belt drives, including V-belts and synchronous belts, for efficient material handling. The increasing demand for oil drilling equipment is boosting the material handling industry and, consequently, the market. Automation and the use of heavy-duty machinery in heavy industries are significant factors driving the demand for industrial belt drives. The material handling industry's growth is particularly pronounced in developing economies, where the adoption of automated and semi-automated systems is expanding rapidly.

Industrial belt drives are essential components in conveyor systems, power transmission, and manufacturing processes, ensuring optimal belt tension, pulley systems, energy efficiency, and safety standards. They also contribute to performance optimization, noise reduction, and belt life extension in industries such as aerospace manufacturing, agricultural equipment, food processing, textile manufacturing, paper manufacturing, chemical processing, and automotive manufacturing. Additionally, the integration of variable speed drives enhances the reliability engineering of industrial machinery, enabling precise motor speed control and torque transmission.

The Material handling segment was valued at USD 1.88 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific (APAC) region is experiencing significant growth, with China and India being the largest contributors. The industrial sector in APAC is undergoing rapid expansion, driven by markets in China, Japan, India, Vietnam, South Korea, Malaysia, and Australia. Industrial belt drives are in high demand due to their essential role in power transmission, material handling, and manufacturing processes. In conveyor systems, for instance, they ensure operating efficiency and reduce belt wear and slip. Additionally, they contribute to the reliability engineering of conveyor belts, timing belts, and pulley systems in various industries, including packaging machinery, aerospace manufacturing, agricultural equipment, food processing, and automotive manufacturing.

Safety standards and energy efficiency are crucial considerations in the design and maintenance of industrial belt drives. Manufacturing standards ensure consistent performance optimization, while belt tension and motor speed control enhance productivity. Material handling applications require belt drives to minimize noise reduction and torque transmission. The market trends also include the use of advanced materials like polyurethane belts, steel belts, and rubber belts for improved belt life, synchronous belts for precise speed reduction, and variable speed drives for production optimization.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Industrial Belt Drives Industry?

- The increasing need for automated material handling solutions is the primary market driver, given the growing demand for efficiency, productivity, and cost savings in various industries. The market is witnessing significant growth due to the increasing adoption of automated material handling equipment in various industries. This trend is driven by the need to reduce labor costs, enhance operating efficiency, and improve customer satisfaction. Automated material handling systems consist of various components, including belts, conveyors, servo motors, and machinery. These systems are utilized for transporting and storing goods and services, thereby eliminating the need for manual labor in conventional loading processes. Belt drives, a crucial component of conveyor systems, are essential for transmitting power and motion between pulleys. They are widely used in packaging machinery, construction equipment, and manufacturing processes.

- Proper belt maintenance is crucial for ensuring optimal performance and longevity. Factors such as belt wear, slip, and shaft alignment can significantly impact the efficiency of belt drives. Timing belts, another type of belt drives, are used in applications requiring precise positioning and synchronization. They are widely used in various industries, including food and beverage, automotive, and packaging. Ensuring proper belt maintenance and adherence to manufacturing standards is essential for minimizing downtime and ensuring the reliability of conveyor systems. Power transmission through belt drives plays a vital role in maintaining the productivity and efficiency of manufacturing processes.

What are the market trends shaping the Industrial Belt Drives Industry?

- The current market trend reflects a significant advancement in design and analysis technologies. Two distinct yet interconnected fields, these technologies continue to evolve and shape industry innovations. Industrial belt drives are essential components in various industries, including industrial automation, material handling, and industrial design. Manufacturers are increasingly adopting advanced technologies, such as 3D printing, to produce these drives. The use of 3D printing offers several advantages, including cost savings, shorter lead times, and the ability to easily customize end products. Belt drives manufactured through 3D printing are suitable for various applications, with the material selection based on specific requirements. For instance, those used for low torque power transmission applications are typically made of polyurethane and rubber. The manufacturing process involves selective material deposition using precise computer control, enabling adjustable product quality through varying resolution layers.

- Vibration control, energy efficiency, safety standards, reliability engineering, and motor speed control are crucial factors driving the demand for industrial belt drives. With the increasing focus on these aspects, belt drives have become indispensable in industries, making them a significant market. The customization capabilities offered by 3D printing further enhance the versatility of these drives, ensuring they meet the evolving needs of various industries.

What challenges does the Industrial Belt Drives Industry face during its growth?

- The inefficiency encountered in high-precision applications and the challenges posed by harsh environmental conditions represent significant hurdles to the industry's growth. Industrial belt drives play a crucial role in various applications, including conveyors, metal-cutting machines, textiles, steel processing, and packing, where precise rotor movement at high speeds is essential. However, belt drives face challenges in harsh industrial environments such as metals and mining, oil and gas, and chemical and petrochemicals, due to damage from oil, grease, heat, chemicals, or abrasive elements. Worn-out belts can generate unwanted noise and potentially harm the entire system. Slippage between shafts results in imperfect synchronization, although synchronized timing belts are available. End-users increasingly prefer electric motor integrated drive systems for their efficiency and reliability.

- In the context of performance optimization, belt drives are used extensively in sectors like aerospace manufacturing, agricultural equipment, and food processing. For instance, in aerospace manufacturing, belt drives are utilized for assembly lines and testing equipment. In agricultural equipment, they are employed in threshing machines and conveyor belts. In food processing, they are used in packaging lines and conveyor systems. Belt materials such as rubber and polyurethane are commonly used due to their durability and resistance to wear and tear. Mining equipment and food processing applications often require high torque transmission and speed reduction, making rubber and polyurethane belts suitable choices. Noise reduction is another essential factor in various industries, leading to the increasing popularity of belt drives with noise-absorbing properties.

Exclusive Customer Landscape

The industrial belt drives market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial belt drives market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial belt drives market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB SKF - The company specializes in providing advanced industrial belt drive solutions, including a mapping service for optimizing plant drive systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB SKF

- B and B Manufacturing Inc.

- Bando Chemical Industries Ltd.

- BEHA Innovation GmbH

- BTL UK LTD.

- Dayco IP Holdings LLC

- FLEXER

- Gates Industrial Corp. Plc

- Goodyear Rubber Products Inc.

- Ino Industrial Belting Co. Ltd.

- MEGADYNE S.P.A

- Michelin Group

- Mitsuboshi Belting Ltd.

- Navyug India Ltd.

- Optibelt GmbH

- PIX Transmissions Ltd.

- Schaeffler AG

- The Timken Co.

- WW Grainger Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Industrial Belt Drives Market

- In March 2023, Bosch Rexroth, a leading industrial technology company, introduced its new generation of Powertransmission Units (PTUs) with a modular design, enabling easier customization and installation for various industries. This innovation aims to enhance the efficiency and flexibility of industrial applications (Bosch Rexroth Press Release, 2023).

- In August 2024, Schaeffler and Nidec Corporation, two major players in the market, announced a strategic partnership to develop and manufacture electric drive systems. This collaboration combines Schaeffler's expertise in mechanical components and Nidec's strength in electric motors, aiming to create advanced, integrated drive systems for various industries (Schaeffler Press Release, 2024).

- In January 2025, SKF, a global technology leader in bearing design, signed a definitive agreement to acquire Timken's Power Transmission business. This acquisition strengthens SKF's position in the market, expanding its product portfolio and enhancing its ability to serve customers in diverse industries (SKF Press Release, 2025).

- In May 2025, the European Union introduced new regulations on the Energy Performance of Buildings Directive (EPBD), mandating the installation of energy-efficient belt drives in new and existing buildings. This policy change is expected to significantly boost the demand for energy-efficient belt drives in the European market (European Commission Press Release, 2025).

Research Analyst Overview

- The market is experiencing significant advancements, driven by the integration of technology into traditional manufacturing processes. Total productive maintenance strategies are increasingly embraced, with belt tension monitoring becoming a crucial component. The Internet of Things (IoT) and condition monitoring enable asset management through real-time data acquisition. Artificial intelligence (AI), life cycle analysis, and process optimization are key trends, with six sigma and lean manufacturing methodologies gaining traction.

- Servo drives, gear motors, and SCADA systems are essential components of industrial control systems, which are evolving to meet environmental compliance regulations. Sustainability initiatives are shaping the market, with belt tracking systems and variable frequency drives contributing to energy efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Industrial Belt Drives Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 1.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, China, Japan, Canada, India, Germany, UK, South Korea, Australia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Belt Drives Market Research and Growth Report?

- CAGR of the Industrial Belt Drives industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial belt drives market growth of industry companies

We can help! Our analysts can customize this industrial belt drives market research report to meet your requirements.