Industrial Gear Motors And Drives Market Size 2024-2028

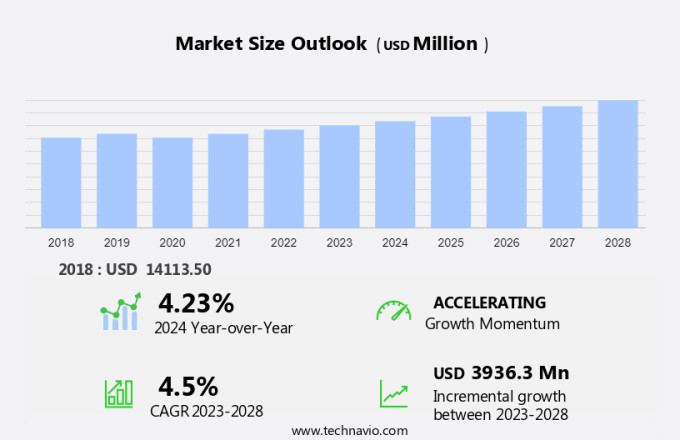

The industrial gear motors and drives market size is forecast to increase by USD 3.94 billion, at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth, driven by the increasing demand for energy-efficient solutions. This trend is being fueled by the rising awareness of energy conservation and cost savings. Another key growth factor is the increase in mergers and acquisitions (M&A) activities in the industry, as companies seek to expand their product offerings and geographical reach. Additionally, the emergence of variable speed drives (VSDs) is transforming the market, as these advanced technologies offer improved energy efficiency, enhanced system performance, and reduced maintenance requirements. Overall, the market is poised for continued growth, driven by these and other market trends.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

Industrial gear motors and drives play a crucial role in power transmission systems, particularly in heavy industries such as wind power, pulp and paper, lumber, mining, steel, aluminum, food processing, printing, textile, sanitation machinery, and manufacturing facilities. These components convert electrical energy into mechanical energy, enabling equipment to function efficiently. Gear motors are essential for reducing the rotational speed and increasing torque in various industrial applications. Different types of gears include bevel gear, helical gear, planetary gear, worm gear, and spur (in-line) gear. The choice of gear type depends on the specific application's requirements in terms of torque, speed, and efficiency. Rated power and torque are essential factors when selecting industrial gear motors and drives.

In addition, the market for these components is expected to grow significantly due to increasing automation and digitalization in industries, including the integration of IoT in manufacturing facilities. The demand for industrial gear motors and drives is particularly high in industries with heavy machinery, such as mining and steel production. In conclusion, the market is a critical segment of the industrial machinery industry, providing essential power transmission components for various industries, including wind power, pulp and paper, lumber, mining, steel, aluminum, food processing, printing, textile, sanitation machinery, and manufacturing facilities. The market is driven by the increasing demand for automation and digitalization in industries and the need for efficient power transmission solutions.

Key Market Driver

Growing demand for energy-efficient industrial gear motors and drives is notably driving market growth. The market is experiencing significant growth due to the increasing demand from various end-user industries, including material handling, food and beverage, pulp and paper, lumber, mining, steel, aluminum, wind power, printing, textile, sanitation machinery, and manufacturing facilities. These industries require high-performance and energy-efficient solutions to meet the rising production demands and reduce operational costs. Industrial gear motors and drives, with their ability to perform reduction gearing using bevel gear, helical gear, planetary gear, worm gear, and spur (in-line) gear, offer efficient power transmission and precise control.

In addition leading manufacturers such as SEW-EURODRIVE, Nord, Bosch Rexroth, Emerson, ABB, Altra Industrial Motion, Sumitomo Heavy Industries, Bonfiglioli, Rexnord, Weg, and TECO, among others, are catering to this growing demand by offering advanced and customized solutions. Additionally, the integration of IoT technology in industrial gear motors and drives is further enhancing their capabilities, enabling predictive maintenance and remote monitoring, thereby increasing their overall efficiency and reliability. The market is expected to continue its growth trajectory, driven by the increasing focus on energy efficiency and the need for high-performance solutions in various industries. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

Increase in M&A activities is the key trend in the market. Industrial gear motors and drives play a crucial role in powering various machinery and equipment in numerous industries, including material handling, wind power, pulp and paper, lumber, mining, steel, aluminum, food processing, printing, textile, sanitation machinery, and manufacturing facilities. Vendors in this market are expanding their offerings through strategic mergers and acquisitions (M&A) to broaden their product portfolios and extend their geographical reach. For instance, in May 2022, Allied Motion Technologies Inc. acquired ThinGap, a leading developer and manufacturer of high-performance, zero-cogging slotless motors, to cater to applications requiring precise motion in compact high-torque-to-volume solutions.

Similarly, in January 2022, Altra Industrial Motion Corp. acquired the power transmission business of Nexen Group to strengthen its position in the power transmission market. Key players in the market include SEW-EURODRIVE, Nord, Bosch Rexroth, Emerson, ABB, Altra Industrial Motion, Sumitomo Heavy Industries, Bonfiglioli, Rexnord, Weg, and TECO, among others. These gear motors and drives are available in various types, such as bevel gear, helical gear, planetary gear, worm gear, and spur (in-line) gear, catering to different applications based on their rated power and torque requirements. They are employed in diverse machinery, including cranes, packaging machines, rolling machines, and wind turbines, among others. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

Emerging variable speed drives (VSDs) is the major challenge that affects the growth of the market. Industrial gear motors and drives play a crucial role in various manufacturing processes, particularly in industries such as pulp and paper, lumber, mining, steel, aluminum, food processing, printing, textile, sanitation machinery, and others. Gear motors, including bevel gear, helical gear, planetary gear, worm gear, and spur (in-line) gear, are integral components of these drives. They provide a reduction in speed and torque to suit specific industrial applications. In the context of renewable energy, gear drives are employed in wind power generation to ensure efficient energy conversion. Industrial motors, powered by gear drives, are used in cranes, packaging machines, rolling machines, and other machinery. Variable Speed Drives (VSDs), also known as adjustable frequency drives, are essential components of these motors.

Additionally, they regulate the frequency and voltage supplied to the motor to control its speed, leading to energy savings of up to 50% in applications like pumps and fans. Strict regulatory norms in industries such as metals and mining, construction, and conventional power necessitate the use of energy-efficient equipment like VSDs. Conventional AC drives employ active front-end (AFE) rectifiers and multi-purpose transformers to mitigate harmonics. Leading manufacturers of industrial gear motors and drives include SEW-EURODRIVE, Nord, Bosch Rexroth, Emerson, ABB, Altra Industrial Motion, Sumitomo Heavy Industries, Bonfiglioli, Rexnord, Weg, and TECO, among others. Guomao Reducer is another significant player in this market. Hence, the above factors will impede the growth of the market during the forecast period

Customer Landscape

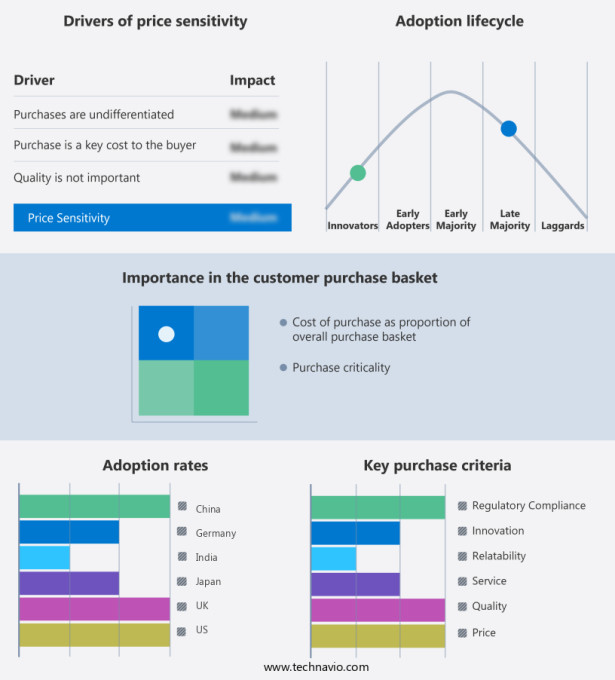

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ABB Ltd. - The company offers industrial gear motors and drives such as ACS880 industrial drives.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allied Motion Technologies Inc.

- Altra Industrial Motion Corp.

- Beacon Gear Transmissions Pvt. Ltd.

- Bonfiglioli Riduttori Spa

- Buhler Motor GmbH

- Demag Cranes and Components GmbH

- Eaton Corp. Plc

- Elecon Engineering Co. Ltd.

- ElectroCraft Inc.

- Johnson Electric Holdings Ltd.

- Mitsubishi Electric Corp.

- NER GROUP Co. Ltd.

- Nidec Corp.

- Nord Gear Ltd.

- Regal Rexnord Corp.

- SDT Drive Technology

- SEW EURODRIVE GmbH and Co KG

- Siemens AG

- Sumitomo Heavy Industries Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

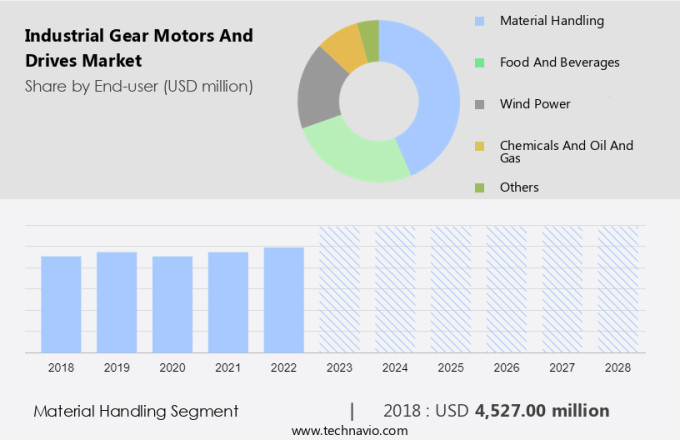

By End-user

The material handling segment is estimated to witness significant growth during the forecast period. Industrial gear motors and drives play a crucial role in material handling applications across various sectors, including wind power, pulp and paper, lumber, mining, steel and aluminum, food processing, printing, textile, sanitation machinery, and manufacturing facilities. These gear motors and drives come in various types, such as bevel gear, helical gear, planetary gear, worm gear, and spur (in-line) gear, catering to diverse power and torque requirements. Key players in the market include SEW-EURODRIVE, Nord, Bosch Rexroth, Emerson, ABB, Altra Industrial Motion, Sumitomo Heavy Industries, Bonfiglioli, Rexnord, Weg, TECO, and Guomao Reducer.

Get a glance at the market share of various regions Download the PDF Sample

The material handling segment was valued at USD 4.53 billion in 2018. In industries like mining and metal, where large-scale machinery and equipment operate continuously, gear drives are essential for efficient power transmission and high-performance operations. Applications range from cranes and packaging machines to rolling machines, ensuring smooth and reliable material handling processes. The integration of IoT technology further enhances the efficiency and productivity of these systems.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

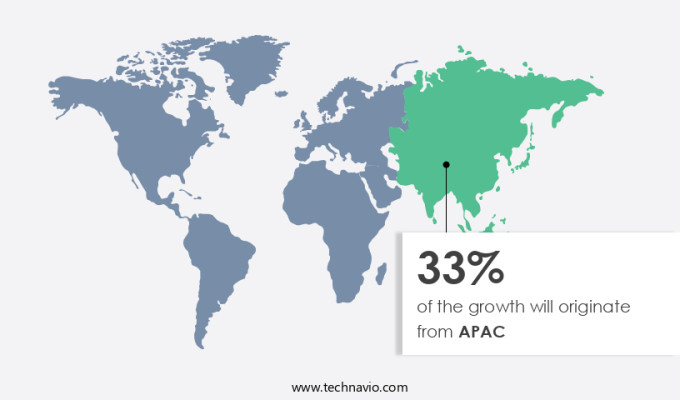

APAC is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market is experiencing a surging demand due to the infrastructure needs and regulatory encouragement in various sectors such as energy, chemical, food, transportation, and others. Key players in this market include Tailong Decelerator Machinery, Taixing Reducer, Tongli, Haoke, Hongtai, and Tianjin Speed Reducer, among others. Technological innovation is a critical factor driving market growth, with companies investing in the development of normal gear, worm gear, planetary gear, and other advanced gear systems. The 2020 market size is significant, and it is projected to grow at a steady rate until 2027. Factors such as environmental consciousness, cost efficiency, and consistency and dependability are crucial considerations for buyers. However, upfront costs and policy fluctuations can pose challenges to market growth. Market competition is intense, with supply chain vulnerabilities and public acceptance being key concerns. Knowledge gaps and energy efficiency are also areas of focus for market participants. Overall, the market is poised for growth, with companies striving to meet the demands of various industries while navigating regulatory requirements and market challenges.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- End-user Outlook

- Material handling

- Food and beverages

- Wind power

- Chemicals and oil and gas

- Others

- Type Outlook

- Standard geared products

- Precision geared products

- Region Outlook

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

- You may also interested in below market reports:

- Geared Motors and Drives Market Analysis APAC, Europe, North America, Middle East and Africa, South America - US, China, India, Germany, UK - Size and Forecast

- Motors and Drives Services Market Analysis APAC, Europe, North America, South America, Middle East and Africa - China, US, Germany, Japan, UK - Size and Forecast

- Global Air Motor Market Analysis APAC, Europe, North America, South America, Middle East and Africa - US, China, Japan, Germany, France - Size and Forecast

Market Analyst Overview

Industrial gear motors and drives play a crucial role in power transmission systems, providing torque and motion to various industries such as wind power, pulp and paper, lumber, mining, steel, aluminum, food processing, printing, textile, sanitation machinery, and manufacturing facilities. These components come in different types, including bevel gear, helical gear, planetary gear, worm gear, and spur (in-line) gear. Gear motors are electric motors that include a built-in gearbox, while gear drives refer to the power transmission system that uses gears to transmit power from a motor to a load. Rated power and torque are essential specifications for these components.

In addition, key players in the market include SEW-EURODRIVE, Nord, Bosch Rexroth, Emerson, ABB, Altra Industrial Motion, Sumitomo Heavy Industries, Bonfiglioli, Rexnord, Weg, and TECO. These companies offer various types of gear drives, such as those used in cranes, packaging machines, and rolling machines. Guomao Reducer is another notable player in the market. The integration of IoT technology in industrial gear motors and drives is a growing trend, enabling remote monitoring and predictive maintenance. Overall, the market for industrial gear motors and drives is expected to grow significantly due to the increasing demand for automation and energy efficiency in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 3.94 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 33% |

|

Key countries |

US, China, Japan, Germany, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ABB Ltd., Allied Motion Technologies Inc., Altra Industrial Motion Corp., Beacon Gear Transmissions Pvt. Ltd., Bonfiglioli Riduttori Spa, Buhler Motor GmbH, Demag Cranes and Components GmbH, Eaton Corp. Plc, Elecon Engineering Co. Ltd., ElectroCraft Inc., Johnson Electric Holdings Ltd., Mitsubishi Electric Corp., NER GROUP Co. Ltd., Nidec Corp., Nord Gear Ltd., Regal Rexnord Corp., SDT Drive Technology, SEW EURODRIVE GmbH and Co KG, Siemens AG, and Sumitomo Heavy Industries Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies