Licensed Sports Merchandise Market Size 2025-2029

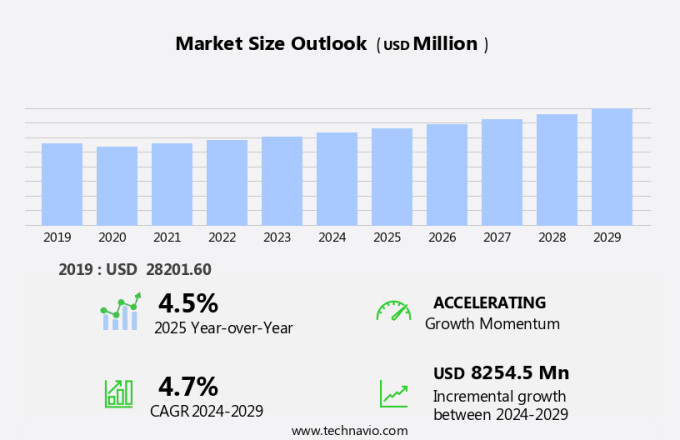

The licensed sports merchandise market size is forecast to increase by USD 8.25 billion at a CAGR of 4.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by key trends and challenges. One major trend is the innovation in design and materials, leading to the premiumization of products. This results in consumers being willing to pay more for high-quality merchandise. Another trend is the increasing popularity of athleisure, with consumers seeking comfortable and stylish clothing and accessories that can be worn both for sports apparel and everyday use.

- However, the market also faces challenges from the increasing competition from unorganized sectors, which offer lower prices and may not adhere to the same quality standards. To stay competitive, market players must focus on offering unique and innovative products, while maintaining high-quality standards and competitive pricing.

What will the Size of the Licensed Sports Merchandise Market be During the Forecast Period?

To learn more about the market report, Request Free Sample

- The market has experienced significant growth in recent years, fueled by the increasing number of sports enthusiasts worldwide. Urbanization and the rise of the online retail industry have played a pivotal role in this expansion. Traditional retailing channels have been surpassed by online platforms, providing consumers with greater convenience and access to a wider range of merchandise. T-shirts and tops, sweatshirts and hoodies, jackets, bottom wear, caps, and athletic footwear are popular categories within the market. The demand for these items is driven by sports fans who seek to express their allegiance to their favorite teams and players. Material quality and product durability are crucial factors that influence purchasing decisions.

- Professional sports leagues and brand alliances have recognized the potential of the online marketplaces and have established strategic partnerships to sell their merchandise. The convenience of shopping from the comfort of one's home, coupled with the ability to compare prices and read customer reviews, has made online shopping a preferred choice for many consumers. The sedentary lifestyles and health issues, such as muscular injuries and hip discomfort, have led to an increased focus on product quality. Consumers are looking for merchandise that not only supports their favorite teams but also provides comfort and functionality. The proliferation of smartphones and internet usage has facilitated the growth of the online marketplaces for licensed sports merchandise.

How is the Licensed Sports Merchandise Market Segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Men

- Women

- Children

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South Korea

- South America

- Middle East and Africa

- North America

By Distribution Channel

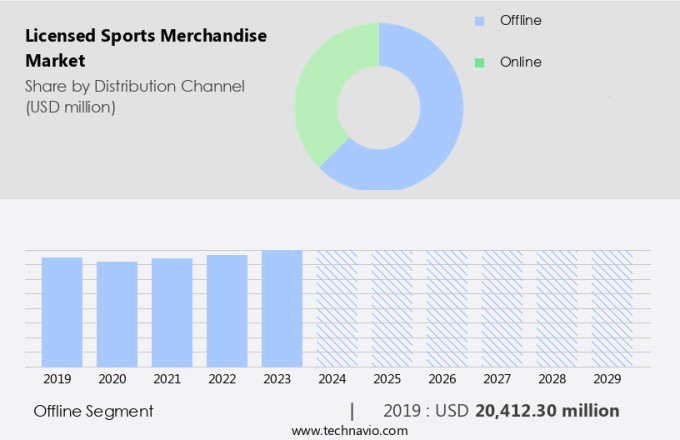

- The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses the sale of apparel, such as tops, sweatshirts, and hoodies, as well as material quality merchandise from professional sports leagues. Brands form alliances with these leagues to retail merchandise, contributing to commercial sports growth and tournament commercialization. International sports events and the latest fashion trends further drive market expansion. Denim clothing sales and running footwear are significant revenue generators. Manufacturers prioritize material quality to meet consumer demand. Retailers employ various strategies, including competitive pricing and expanded product ranges, to maintain market presence amidst increasing online shopping trends and intensifying competition. Offline distribution channels, including specialty stores, hypermarkets, and department stores, continue to contribute significantly to market revenue.

Get a glance at the market report of share of various segments. Request Free Sample

The offline segment was valued at USD 20.41 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

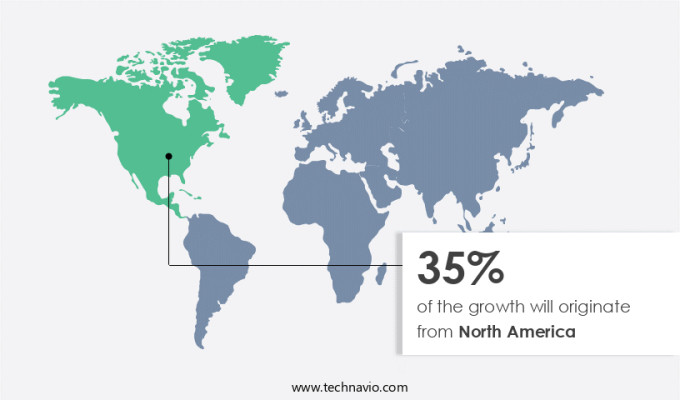

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is projected to dominate the global landscape due to the region's well-established sports industry and the increasing health consciousness among consumers. The rising participation in sports activities, fueled by the high prevalence of obesity and diabetes, is expected to drive market growth. In the US, the market is witnessing significant expansion due to the introduction of innovative products, the growing popularity of online platforms for purchasing sports apparel and accessories, and the increasing trend of using eco-friendly raw materials in manufacturing. Consumers' rising spending power, coupled with the popularity of outdoor activities, sports clubs, gyms, fitness studios, and entertainment content, are further boosting market growth. Online retailing channels, including t-shirts and tops, sweatshirts and hoodies, jackets, bottom wear, caps, and hats, are witnessing significant demand in the region.

Licensed Sports Merchandise Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Licensed Sports Merchandise Market?

Design and material innovations leading to product premiumization is the key driver of the market.

- The market caters to the demands of sports enthusiasts by offering a wide range of high-quality products, including t-shirts and tops, sweatshirts and hoodies, jackets, bottom wear, caps, hats, and various types of footwear. Urbanization and the growth of the online retail industry have significantly impacted the market, with consumers increasingly turning to online platforms for their shopping needs. Traditional retailing channels, such as mass merchants, retail stores, department stores, and specialty stores, continue to coexist with e-commerce, driven by differences in consumer preferences and internet penetration. The sports licensing industry encompasses various sectors, including outdoor activities, sports clubs, gyms, fitness studios, entertainment content, and the sports industry itself.

- Sports teams, athletes, and sporting goods companies are major contributors to this market, with royalty payments and trademarked logos and designs playing a significant role in branding and consumer engagement. Innovations in materials, such as breathable, light, and waterproof fabrics, have revolutionized sports apparel, making it increasingly popular among consumers. The market also includes accessories for sports, toys, and video games, as well as lifestyle shoes for those with sedentary lifestyles. The sports footwear category has experienced significant growth due to the availability of premium, economic, and functional offerings. Innovations in designs, materials, and technology have led to the creation of high-quality, durable footwear that caters to various sports and fitness concerns.

What are the market trends shaping the Licensed Sports Merchandise Market?

The increasing popularity of athleisure is the upcoming trend in the market.

- The market in the US is experiencing significant growth, fueled by the increasing trend of athleisure and the urbanization process. Athleisure, a fashion trend that combines comfort and style for athletic activities, has gained immense popularity among sports enthusiasts. This segment includes various product categories such as t-shirts and tops, sweatshirts and hoodies, jackets, bottom wear, caps, hats, and other sports gear and accessories. The rise in consumer spending power, urbanization, and the increasing popularity of outdoor activities, sports clubs, gyms, fitness studios, and entertainment content have contributed to the commercial sports growth. The sports industry, including sports teams, athletes, and sporting goods, has seen a wave in brand alliances and licensing deals, leading to an increase in royalty payments for trademarked logos and designs.

- The pandemic has accelerated the shift towards e-commerce, with online marketplaces becoming increasingly popular. Consumers are now more conscious of fitness concerns and are seeking athletic footwear and sports accessories to maintain an active lifestyle. However, sedentary lifestyles and health issues, such as muscle injuries, leg injuries, hip pain, and back pain, continue to be a concern. The sports industry is not limited to traditional sports but also includes e-sports, athletic events, contests, tournaments, and sports leagues. The market caters to a diverse range of consumers, from football supporters to fitness enthusiasts, and offers a wide range of products, from mugs and cups to sports footwear, including running shoes, football shoes, sneakers, and lifestyle shoes.

What challenges does Licensed Sports Merchandise Market face during the growth?

Increasing competition from unorganized sectors is a key challenge affecting the market growth.

- The market in the US is experiencing significant growth, driven by the increasing spending power of sports enthusiasts and the urbanization trend. This market caters to various product categories, including t-shirts and tops, sweatshirts and hoodies, jackets, bottom wear, caps, hats, and other sports gear and accessories. Consumers are increasingly turning to online retail platforms for their merchandise needs, with e-commerce sales surpassing traditional retailing channels. Sports licensing deals between teams, athletes, and brands have become increasingly common, leading to a proliferation of merchandise offerings. The sports industry's commercial growth, including outdoor activities, sports clubs, gyms, fitness studios, entertainment content, and athletic events, contributes to the market's expansion.

- The market's growth is also influenced by the increasing penetration of the internet and the availability of online marketplaces. Brands are leveraging digital content, such as OTT sports viewership, to engage with consumers and promote their merchandise. Women in sports and the growing trend of cross-cultural fashion have further expanded the market's reach. Despite the challenges, the market is expected to continue its growth trajectory, driven by the increasing popularity of sports and the demand for high-quality, functional merchandise.

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market growth analysis report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Licensed Sports Merchandise Market Companies

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- ANTA Sports Products Ltd.: The company offers Always Original t-shirts, laced tank tops, leggings, tights, joggers, and hoodies.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 47 Brand LLC

- Adidas AG

- Boardriders

- Columbia Sportswear Co.

- DICKS Sporting Goods Inc.

- Fanatics Inc.

- Frasers Group plc

- G III Apparel Group Ltd.

- Hanesbrands Inc.

- Li Ning Co. Ltd.

- New Era Cap LLC

- Nike Inc.

- Prada Spa

- PUMA SE

- Ralph Lauren Corp.

- Rawlings Sporting Goods Co. Inc.

- Thornico AS

- Under Armour Inc.

- VF Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Developments and News

-

In December 2024, Nike launched a new line of officially licensed sports merchandise, including jerseys and footwear, for the 2024 Summer Olympics. The collection features exclusive designs and incorporates sustainable materials, catering to sports fans looking for both premium and eco-friendly products.

-

In November 2024, Adidas introduced a new collaboration with major football clubs to release limited-edition merchandise for fans. The collection includes jerseys, scarves, and accessories, with a focus on high-quality materials and exclusive designs, aiming to boost brand loyalty and fan engagement.

-

In October 2024, Fanatics expanded its licensed sports merchandise offerings by partnering with the NBA to release a new range of fan gear, including custom jerseys and apparel. The collection is available through both online platforms and physical retail locations, enhancing accessibility for sports enthusiasts.

-

In September 2024, Under Armour entered a partnership with several NFL teams to produce exclusive team-branded athletic wear and accessories. The merchandise line targets fans of all ages and includes performance-focused clothing designed for both everyday wear and active lifestyles.

Research Analyst Overview

The sports merchandise market continues to thrive, fueled by the growing urbanization and the increasing popularity of sports and fitness activities. This market encompasses a wide range of products, from clothes and footwear to accessories and collectibles, all bearing the trademarked logos and designs of sports teams, athletes, and leagues. Urbanization and the rise of the online retail industry have significantly impacted the sports merchandise market. Traditional retailing channels, such as mass merchants, retail stores, department stores, and specialty stores, still hold a considerable market share. However, the shift towards online platforms has gained momentum, with e-commerce platforms becoming increasingly popular among consumers. The sports merchandise market caters to various product categories, including t-shirts and tops, sweatshirts and hoodies, jackets, bottom wear, caps, hats, mugs, cups, and sports footwear. Consumer spending power plays a crucial role in determining the demand for these products.

Additionally, sports licensing has emerged as a significant revenue generator in the sports industry. Outdoor activities, sports clubs, gyms, fitness studios, entertainment content, and sports industry events all contribute to the growth of the sports merchandise market. The market also extends to e-sports, athletic events, contests, and tournaments, further broadening its scope. Branding and consumer preferences are essential factors influencing the sports merchandise market. Consumers seek high-quality, breathable, light, and waterproof materials for their sports gear and accessories. The latest fashion trends, such as denim clothing sales and the running footwear category, also impact market dynamics. The sports merchandise market is not limited to traditional sports. It also caters to the growing demand for e-sports and lifestyle brands. The market is further segmented into premium and economic product offerings, catering to various consumer segments. The sports merchandise market faces challenges, including health concerns arising from sedentary lifestyles and the resulting health problems, such as muscle injuries, leg injuries, hip pain, and back pain.

Moreover, physical display and product features are essential considerations for consumers when purchasing sports merchandise. The sports merchandise market is a dynamic and ever-evolving industry, influenced by various factors, including consumer preferences, market trends, and economic conditions. The market is expected to continue growing, driven by the increasing popularity of sports and fitness activities and the rising demand for high-quality, functional, and fashionable sports merchandise. In conclusion, the sports merchandise market is a significant contributor to the retail industry, with a wide range of products catering to various consumer segments and preferences. The market's growth is driven by urbanization, the rise of the online retail industry, and the increasing popularity of sports and fitness activities. Consumer spending power, branding, and product quality are essential factors influencing market dynamics. The market faces challenges, including health concerns and the need for functional and fashionable products. The sports merchandise market is expected to continue growing, driven by these factors and the evolving consumer landscape.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 8.25 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.5 |

|

Key countries |

US, India, China, Germany, UK, Canada, Japan, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch