Metal Bonding Adhesives Market Size 2024-2028

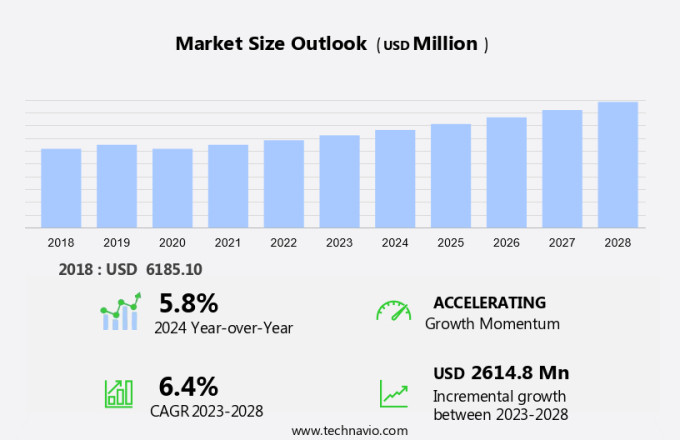

The metal bonding adhesives market size is forecast to increase by USD 2.61 billion at a CAGR of 6.4% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One trend driving market expansion is the increasing replacement of traditional mechanical fasteners with industrial adhesives in various industries, including automotive and aerospace, for applications such as chassis assembly and field services. Another growth factor is the rising demand for metal bonding adhesives in the medical industry, where their high performance and ability to ensure dimensional stability are crucial. Additionally, stringent environmental regulations are pushing manufacturers to develop adhesives with improved thermal conductivity and viscosities to meet sustainability standards. High-performance metal bonding adhesives, such as cyanoacrylates, are gaining popularity for their ability to provide strong bonds between metal surfaces while maintaining the desired physical properties. This market analysis report provides a comprehensive study of these trends and their impact on the market.

What will the size of the market be during the forecast period?

- The market encompasses a wide range of innovative adhesive solutions designed to join various metals and alloys. These advanced adhesives play a crucial role in numerous industries, including construction, transportation, and consumer durables, among others. Adhesive testing and development are ongoing processes in the market. Engineers and scientists are continually pushing the boundaries of adhesive technology to create high-performance, low volatile organic compound (VOC) adhesives and high-strength bonding solutions. Epoxy adhesives, in particular, have gained significant attention due to their excellent bonding properties and versatility. The construction industry relies heavily on structural adhesives for bonding various metal components, such as roofing, cladding, and bridges. In the transportation sector, metal bonding adhesives are essential for assembling lightweight vehicles and enhancing vehicle safety features. Aerospace applications require adhesives that can withstand extreme temperatures and pressures, making metal bonding technology a critical component in the aerospace industry. Adhesive engineering and safety are essential considerations in the market. Adhering to stringent safety regulations and ensuring the reliability and durability of adhesive bonds is crucial for industries that rely on metal bonding adhesives. Adhesive standards and patents play a significant role in maintaining quality and innovation in the market.

- Material science advancements continue to influence the market, with a focus on developing sustainable adhesives and biodegradable alternatives. The automotive industry is increasingly adopting metal bonding adhesives to improve vehicle performance and reduce weight, contributing to the overall trend toward sustainable transportation. Industrial bonding solutions and consumer durables manufacturers also rely on metal bonding adhesives for manufacturing automation and supply chain resilience. The food packaging industry uses metal bonding adhesives to ensure the safety and integrity of food products. The market is driven by the need for efficient and reliable bonding solutions. As industries continue to innovate and push the boundaries of what is possible, the demand for advanced metal bonding adhesives will only grow. The future of the market lies in continued research and development, focusing on high-performance, sustainable, and cost-effective adhesive solutions.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Automotive

- Industrial

- Machinery and equipment

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

By End-user Insights

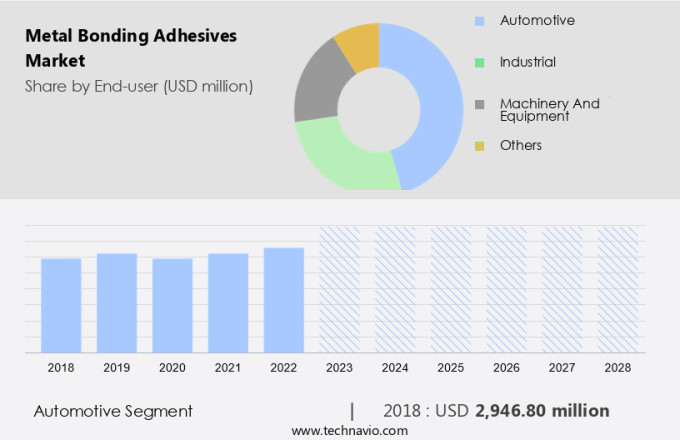

- The automotive segment is estimated to witness significant growth during the forecast period.

Metal bonding adhesives play a significant role in the automotive industry, particularly in applications such as chassis assembly, interior and exterior trim, and fiber-reinforced plastic bonding. The increasing production of automobiles globally is driving the demand for these adhesives due to their ability to ensure dimensional stability and high thermal conductivity. In field services, metal bonding adhesives are utilized to bond backing materials, thereby reducing vibrations in vehicle body panels. This contributes to improved vehicle performance and durability.

Additionally, high-performance adhesives, including cyanoacrylates, are preferred due to their specific properties, such as fast curing and strong bonding capabilities. The growing focus of automotive original equipment manufacturers (OEMs) on expanding their presence in the market is expected to further boost the demand for metal bonding adhesives during the forecast period. With the automotive industry's continuous evolution, the need for advanced adhesive solutions that offer superior bonding capabilities and viscosities tailored to specific applications remains essential.

Get a glance at the market report of share of various segments Request Free Sample

The automotive segment was valued at USD 2.95 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 53% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Metal bonding adhesives have witnessed significant demand in various industries, particularly in North America, due to their superior properties such as fatigue resistance and high bond strength. Environmental regulations have been a key driver in the production of metal bonding adhesives, as they offer a more eco-friendly alternative to traditional welding and brazing methods. In the automobile industry, metal bonding adhesives are increasingly being used to manufacture lightweight and fuel-efficient vehicles, which aligns with the current focus on reducing carbon emissions. Additionally, the consumer electronics sector has also seen an increase in the usage of metal bonding adhesives due to their ability to ensure reliable and strong bonds in the production of complex devices.

Additionally, the cost-effectiveness of metal bonding adhesives, as compared to traditional bonding methods, has further fueled their adoption. The raw material costs for metal bonding adhesives have been relatively stable, which has helped maintain the prices at an affordable level for manufacturers. The growth of industries such as construction, automobile manufacturing, and consumer electronics in North America is expected to continue driving the demand for metal bonding adhesives in the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Metal Bonding Adhesives Market?

Increasing replacement of mechanical fasteners with industrial adhesives is the key driver of the market.

- Metal bonding adhesives have gained significant traction in numerous industrial sectors, surpassing traditional methods like mechanical fastening and welding for bonding applications. The trend towards adhesive bonding, particularly metal bonding adhesives, is on the rise across industries such as construction, consumer durables, electronics, aerospace, packaging, and heavy industries. This shift is due to the superior performance and effectiveness of metal bonding adhesives compared to conventional methods. One of the primary advantages of metal bonding adhesives is their ability to eliminate the corrosion issues that arise when joining dissimilar metals with different galvanic potential, such as steel and aluminum.

- The use of these adhesives contributes to weight reduction, which is a critical factor in the transportation industry's pursuit of fuel-efficient models. However, the market for metal bonding adhesives is subject to various external factors, including geopolitical tensions and supply chain disruptions, which can impact raw material prices and availability. Innovation and technological advancements continue to drive the market, with manufacturers constantly developing new products to meet the evolving needs of industries. Despite these challenges, the future of metal bonding adhesives looks promising, with continued growth expected in the coming years.

What are the market trends shaping the Metal Bonding Adhesives Market?

Increasing demand for metal bonding adhesives in medical industry is the upcoming trend in the market.

- Metal bonding adhesives have gained significant traction in various industries due to their ability to effectively join metal surfaces. In the market, the demand for these adhesives is on the rise, particularly in sectors like transportation and costume manufacturing. For instance, in transportation, metal bonding adhesives are extensively used for bonding exterior panels of automobiles, providing a durable and aesthetically pleasing finish. In the costume industry, these adhesives are employed to create intricate designs and structures for costumes. Acrylic-based glues are a popular choice for metal bonding applications due to their high bond strength and resistance to environmental factors. However, other compositions like epoxy, silicones, and polyurethanes also find extensive use depending on the specific application requirements. Super glue, a common household name for cyanoacrylate adhesives, is also used in metal bonding applications due to its quick setting time and strong bond strength.

- Advancements in adhesive technology continue to drive innovation in various industries. For example, in medical applications, metal bonding adhesives are increasingly being preferred over traditional fasteners due to their ability to provide a stronger and more reliable bond. Reusable medical devices, such as disposable ECG electrodes and grounding plates, are often made from engineering resins and metals, and require adhesives that can withstand repeated use and sterilization processes. In summary, the US market for metal bonding adhesives is expected to grow significantly due to their increasing adoption across various industries, including transportation, costume manufacturing, and medical applications. The development of new adhesive technologies and their subsequent adoption in these industries will further fuel the growth of this market.

What challenges does Metal Bonding Adhesives Market face during the growth?

Stringent environmental regulations is a key challenge affecting the market growth.

- Metal bonding adhesives play a crucial role in various industries, particularly in the manufacturing of aircraft structures and exteriors. The operating environment for this market is subject to stringent regulations, such as the US Environmental Protection Agency (EPA) and the European Union's Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation. These regulations limit the VOC content in metal bonding adhesives to ensure environmental protection. The Massachusetts Department of Environmental Protection (MassDEP) also enforces regulations on adhesives and sealants (310 CMR 7). The emission of volatile organic compounds (VOCs) from these adhesives is a significant environmental concern, as it has been identified as hazardous by the US EPA.

- To address this issue, reinforcement technologies and alternative adhesive formulations are being explored. These alternatives offer increased strength and reduced VOC emissions, making them a viable solution for the market. The supply chain for metal bonding adhesives is also undergoing changes to accommodate these new regulations and technologies.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Arkema

- Astral Adhesives Ltd.

- CTec N.I Ltd.

- DELO Industrie Klebstoffe GmbH and Co. KGaA

- Dow Inc.

- Dymax Corp.

- Ford Motor Co.

- H.B. Fuller Co.

- Henkel AG and Co. KGaA

- Huntsman Corp.

- Hybond Ltd.

- Infinity Bond Adhesives

- KENT United Kingdom Ltd.

- Master Bond Inc.

- Parker Hannifin Corp.

- Parson Adhesives Inc.

- Permabond LLC

- Sika AG

- Solvay SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Metal bonding adhesives are a crucial component in various industries, including transportation and consumer electronics, where strong and durable bonds are essential. These adhesives are designed specifically for bonding metals and offer advantages such as high thermal conductivity, dimensional stability, and resistance to vibration. Cyanoacrylate-based adhesives, commonly known as super glue, are widely used due to their fast cure times and excellent bonding strength. However, high-performance metal bonding adhesives offer additional benefits, including fatigue resistance, chemical resistances, and toughness. The market for metal bonding adhesives is driven by the increasing demand for lightweight and fuel-efficient vehicles in the automobile production industry.

Additionally, the transportation industry's need for weight reduction and innovation to improve operating environment and supply chain efficiency is driving the growth of this market. Environmental regulations and geopolitical tensions can impact the supply chain and prices of raw materials, leading to volatility in the market. The market's growth is also influenced by the demand for high-performance adhesives in fields such as carpentry, design, and maintenance of automobile exteriors, chassis, and exterior panels. Factors such as outgassing, cure times, and environmental regulations are critical considerations in the selection of metal bonding adhesives. The market's future growth is expected to be influenced by the demand for adhesives with longer service life, higher strength, and improved chemical resistances.

Further, the market is experiencing significant growth due to adhesive innovation and advancements in adhesive bonding technology. With increasing demand in industries like automotive and aerospace, high-strength adhesives are essential for bonding lightweight materials and improving fuel efficiency standards in passenger vehicles and light vehicle segments. The development of low VOC adhesives and biodegradable adhesives aligns with adhesive safety and recyclable adhesives, responding to environmental concerns. Flexible food packaging adhesives and construction adhesives are gaining traction, while adhesive performance is enhanced by adhesive properties and adhesive science. Manufacturers are focusing on adhesive regulations and adhesive patents to meet safety standards. The market is further driven by adhesive distributors catering to sectors such as consumer durables adhesives, automotive adhesives, and aerospace adhesives.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2024-2028 |

USD 2.61 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.8 |

|

Key countries |

US, China, Japan, Germany, UK, India, Canada, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch