Myoglobin Market Size 2024-2028

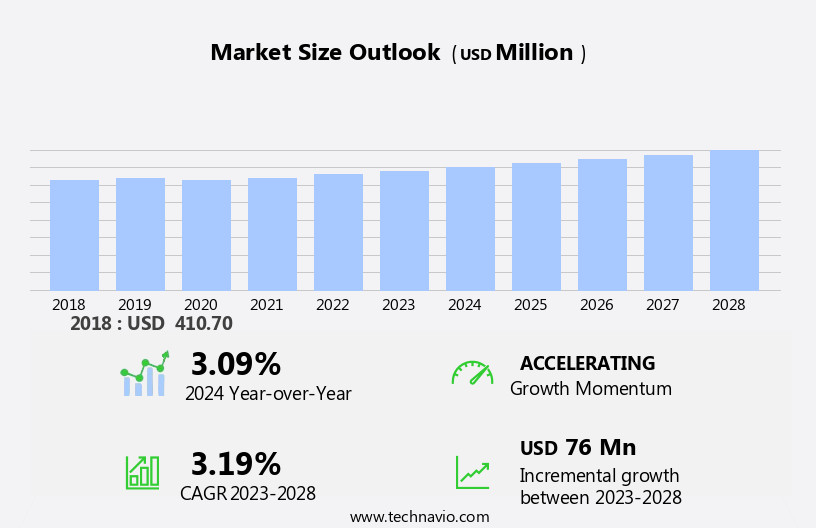

The myoglobin market size is forecast to increase by USD 76 million at a CAGR of 3.19% between 2023 and 2028.

- The market is experiencing significant growth due to various trends and drivers. One key factor driving market growth is the increasing usage of myoglobin as a biomarker for the diagnosis of Acute Coronary Syndrome (ACS) and muscle injuries. Myoglobin, a protein found in muscle tissue, is an effective indicator of muscle damage. Additionally, the demand for myoglobin instruments for emergency diagnostic patient management is increasing, as these instruments enable quick and accurate diagnosis, which is crucial for effective treatment. Proper storage and handling conditions are also essential for maintaining the accuracy and reliability of myoglobin tests, further boosting market growth. These trends are expected to continue, making the market an attractive investment opportunity for businesses and investors In the healthcare industry.

What will be the Size of the Myoglobin Market During the Forecast Period?

- The market encompasses the production and supply of myoglobin-related products and services, primarily for use in medical research, diagnostics, and therapeutic applications. Key end-users include public organizations, government research agencies, health foundations, and laboratories. Myoglobin, a protein found in muscles, plays a crucial role In the transport and storage of oxygen. Its study is relevant to various cardiovascular diseases, such as heart failure and myocardial infarctions. Technological advancements in areas like x-ray crystallography and point-of-care testing devices have facilitated the development of myoglobin testing solutions. Myoglobin's role in muscle tissues, particularly in skeletal muscle and rhabdomyolysis (muscle breakdown), is a significant area of research.

- Hemoglobin, another oxygen-carrying protein in blood cells, is often compared to myoglobin due to their similar functions. Myoglobin's unique properties, such as its presence in diving mammals like whales and seals, further expand its research potential. Elevated levels of myoglobin In the bloodstream can indicate muscle damage and are often detected through diagnostic tests.

How is this Myoglobin Industry segmented and which is the largest segment?

The myoglobin industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Animal myoglobin

- Human myoglobin

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Type Insights

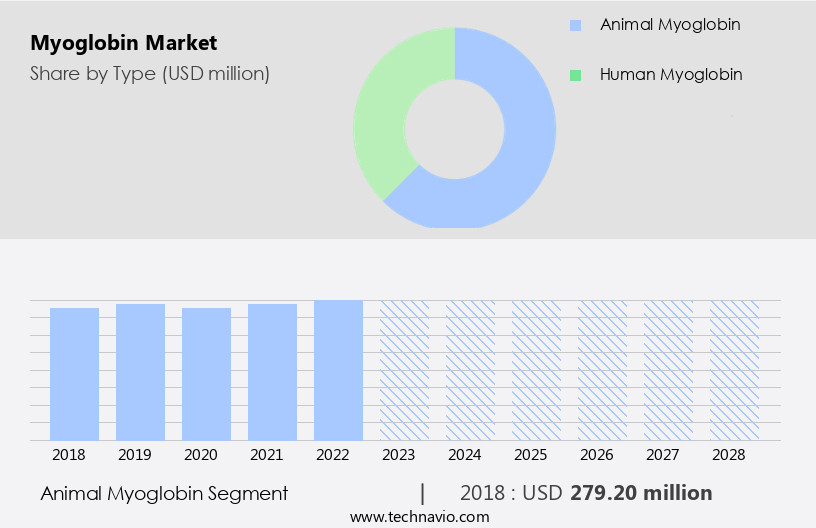

- The animal myoglobin segment is estimated to witness significant growth during the forecast period.

Myoglobin is a hemoprotein found In the muscles of vertebrates, playing a crucial role In the intracellular transport and storage of oxygen. This protein is present in various terrestrial animals, including rats, rabbits, sheep, cows, white-tailed deer, and horses. In contrast, myoglobin concentrations are significantly higher in diving mammals, such as melon-headed whales, bowhead whales, sperm whales, and bottlenose dolphins, to support their unique physiological needs during underwater activities. Myoglobin's clinical significance extends to human health, where it serves as a cardiac biomarker for various cardiovascular disorders, including heart failure, myocardial infarctions, and rhabdomyolysis. Diagnostic measures, such as myoglobin assays and high-sensitivity immunoassays, are used to detect elevated levels of this protein in blood serum and urine, contributing to improved patient outcomes and economic benefits through early diagnosis and effective healthcare solutions.

Myoglobin's role in muscle injuries and cardiac damage, as well as its applications in exercise physiology, make it an essential protein in cardiology and medical technology, including point-of-care testing devices and diagnostic tests.

Get a glance at the Myoglobin Industry report of share of various segments Request Free Sample

The Animal myoglobin segment was valued at USD 279.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

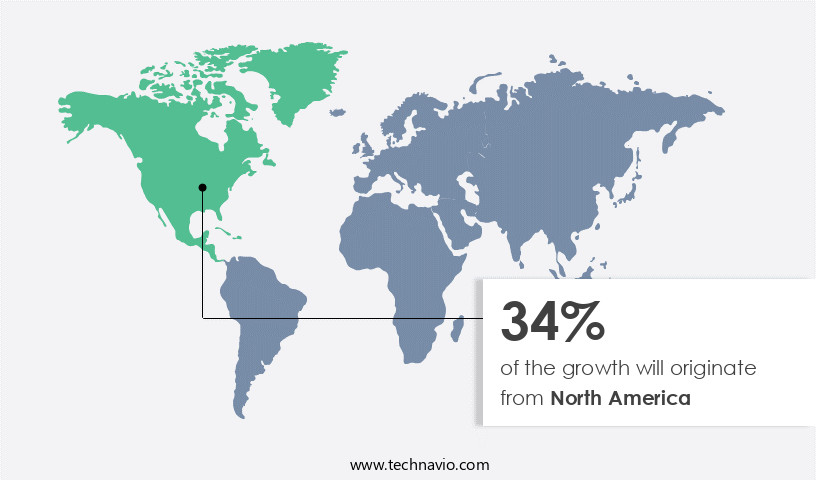

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Myoglobin, a hemoprotein found in muscle tissues, plays a crucial role in oxygen storage and transport. In the global context, North America holds the largest market share for myoglobin, driven by the well-established biotechnology industry and substantial R&D investments in cardiac biomarkers. The region's advanced healthcare infrastructure, particularly In the US, further fuels market growth. Cardiovascular diseases (CVDs), such as heart failure, myocardial infarctions, and cardiovascular disorders, are significant health concerns. According to the Centers for Disease Control and Prevention (CDC), approximately 659,000 Americans die from CVDs each year. Myoglobin testing solutions, including assays and immunoassays, are essential diagnostic measures for detecting muscle injuries, cardiac damage, and rhabdomyolysis.

The increasing focus on point-of-care testing and healthcare solutions to improve patient outcomes, accuracy, and accessibility further boosts the market. Despite economic downturns and financial uncertainties, the demand for myoglobin testing remains strong due to its importance in various clinical applications, including exercise physiology, muscle injuries, and cardiology. Myoglobin is also found in various animal species, such as diving mammals like whales and seals, highlighting its significance in understanding oxygen transport and muscle function.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Myoglobin Industry?

Usage of myoglobin as a biomarker for the diagnosis of ACS and muscle injuries is the key driver of the market.

- Myoglobin, a hemoprotein found in muscle tissues, plays a crucial role as an oxygen carrier in both humans and animals. In the human body, myoglobin is released into the bloodstream when skeletal muscles are injured due to trauma, ischemia, or myopathy. This release makes myoglobin a sensitive biomarker for muscle injuries. The rising prevalence of myositis, muscular dystrophy, and myopathy will drive the demand for myoglobin In the healthcare sector. Myoglobin is also used in combination with troponin proteins to diagnose myocardial damage following heart attacks. Myoglobin is one of the earliest biomarkers to rise above normal levels In the bloodstream following myocardial infarction.

- In addition, myoglobin is used in cardiac biomarker assays for point-of-care testing devices to improve patient outcomes. Economic downturns and financial uncertainties have led to a focus on affordable diagnostic measures, making high-sensitivity immunoassays and point-of-care testing solutions increasingly popular. Myoglobin testing solutions offer accuracy, accessibility, and convenience, making them essential tools for healthcare providers in diagnosing and managing cardiovascular disorders such as heart failure, myocardial infarctions, and rhabdomyolysis. Myoglobin's role in exercise physiology, diving mammals, and various other applications further expands its market potential In the market.

What are the market trends shaping the Myoglobin Industry?

Demand for myoglobin instruments for emergency diagnostic patient management is the upcoming market trend.

- Myoglobin, a hemoprotein found in muscles, plays a crucial role as a biomarker In the diagnosis of cardiovascular disorders, particularly In the context of myocardial infarctions and heart failure. Public organizations, government research agencies, health foundations, and hospitals have shown significant interest in this hemoprotein due to its potential in early detection and improved patient outcomes. Myoglobin levels in human and animal muscle tissues increase substantially after muscle injuries, such as those caused by cardiac damage or rhabdomyolysis. These elevated levels can be detected in blood serum and urine, making myoglobin testing an essential diagnostic measure for various medical conditions.

- The economic downturn and financial uncertainties have not deterred the growth of the market. In fact, the demand for myoglobin testing solutions has continued to rise due to the increasing prevalence of cardiovascular diseases, including myocardial infarctions and heart failure. Medical technology companies have responded by developing high-sensitivity immunoassays and point-of-care testing devices to enhance the accuracy and accessibility of myoglobin testing. These advancements have led to better patient care and improved morbidity and mortality rates. Myoglobin's role extends beyond cardiology, with applications in exercise physiology, muscle injuries, and diving mammals, such as whales and seals.

- The protein's ability to bind with oxygen makes it an essential component of muscle function and an essential diagnostic tool in various clinical settings. Myoglobin assays are used to monitor muscle tissues, including skeletal muscle, and to evaluate the effectiveness of therapeutic interventions. In summary, the market is poised for continued growth due to its importance In the diagnosis and management of various medical conditions, driven by advancements in diagnostic technologies and the increasing prevalence of cardiovascular disorders.

What challenges does the Myoglobin Industry face during its growth?

Requirement of proper storage and handling conditions is a key challenge affecting the industry growth.

- Myoglobin, a hemoprotein found in muscles, plays a crucial role In the transport and storage of oxygen. In various fields, including cardiology and exercise physiology, myoglobin is a valuable biomarker for diagnosing cardiovascular disorders such as heart failure, myocardial infarctions, and rhabdomyolysis. Public organizations, government research agencies, health foundations, hospitals, and diagnostic laboratories utilize myoglobin testing solutions for clinical use. Myoglobin assays are essential for diagnosing muscle injuries and cardiac damage. These tests require proper handling and storage of serum specimens, which must be collected using standard techniques and processed within twenty-four hours. Proper storage involves freezing at temperatures below -20 degrees Celsius for longer preservation.

- Medical technology advancements have led to the development of high-sensitivity immunoassays and point-of-care testing devices for myoglobin testing. These diagnostic measures contribute significantly to improving patient outcomes by enabling early detection and intervention of cardiovascular diseases and muscle injuries. Economic downturns and financial uncertainties have not hindered the growth of the market, which continues to expand due to the increasing demand for accurate, accessible, and cost-effective diagnostic testing solutions. Myoglobin is present in various organisms, including humans, animals, and diving mammals like whales and seals. Its presence In the bloodstream is indicative of muscle tissue damage or cardiac damage.

- Elevated levels of myoglobin in blood serum or urine can be detected through diagnostic tests, providing valuable insights for healthcare providers in managing patient care. In summary, myoglobin is a vital biomarker in various healthcare applications, including the diagnosis of cardiovascular diseases and muscle injuries. Proper handling and storage of serum specimens are essential for accurate test results. The development of advanced diagnostic technologies, such as high-sensitivity immunoassays and point-of-care testing devices, has improved the accessibility and affordability of myoglobin testing, contributing to better patient outcomes and the growth of the market.

Exclusive Customer Landscape

The myoglobin market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the myoglobin market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, myoglobin market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Abbott Laboratories - Myoglobin regulants are essential reagents supplied by the company, facilitating the storage and delivery of oxygen to muscle cells. These regulants play a crucial role in maintaining optimal muscle function. The company specializes in providing high-quality myoglobin-related solutions, ensuring the availability of essential components for various biochemical and research applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- BBI Solutions OEM Ltd.

- bioMerieux SA

- Bio Rad Laboratories Inc.

- Boditech Med Inc.

- Danaher Corp.

- DiaSys Diagnostic Systems GmbH

- F. Hoffmann La Roche Ltd.

- General Atomics

- HORIBA Ltd.

- Merck KGaA

- OriGene Technologies Inc.

- Perkin Elmer Inc.

- QuidelOrtho Corp.

- Randox Laboratories Ltd.

- Scripps Laboratories Inc.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- Tosoh Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Myoglobin, a vital hemoprotein, plays a significant role In the oxygen storage and transport within muscle tissues. This essential component of blood cells facilitates the efficient utilization of oxygen during physical activity. The extensive research on myoglobin has led to various applications In the healthcare industry, particularly In the diagnosis and management of cardiovascular disorders. The market has witnessed substantial growth due to the increasing prevalence of cardiovascular diseases and the need for accurate diagnostic measures. Myoglobin, as a cardiac biomarker, has gained considerable attention In the cardiology field due to its potential in identifying heart attacks and myocardial infarctions.

Myoglobin's role extends beyond cardiovascular applications. In exercise physiology, myoglobin's measurement can provide valuable insights into muscle injuries and the rate of muscle breakdown during strenuous activities. Moreover, its application in rhabdomyolysis, a condition characterized by muscle damage leading to the release of myoglobin into the bloodstream, is essential for accurate diagnosis and timely intervention. The advancements in diagnostic technologies have led to the development of high-sensitivity immunoassays and point-of-care testing devices for myoglobin testing. These solutions offer improved accuracy and accessibility, enabling healthcare providers to make informed decisions based on real-time data. Myoglobin's importance transcends human health applications.

Studies on various diving mammals, such as whales and seals, have revealed the critical role myoglobin plays In their ability to survive under extreme conditions. The knowledge gained from these investigations can potentially lead to new therapeutic approaches and applications for myoglobin in various industries. The market is expected to continue its growth trajectory, driven by the increasing demand for accurate diagnostic tools and the expanding research on myoglobin's applications in various fields. The potential for myoglobin to serve as a valuable biomarker in various industries, including healthcare, sports, and marine biology, presents significant opportunities for market expansion.

The market dynamics are influenced by several factors, including the increasing morbidity and mortality rates associated with cardiovascular diseases, the growing awareness of the importance of early and accurate diagnosis, and the ongoing advancements in diagnostic technologies. Additionally, the economic downturn and financial uncertainties may impact the market growth, as healthcare budgets and research funding become increasingly limited. In conclusion, myoglobin's role as a vital hemoprotein and its applications in various industries, particularly In the healthcare sector, have led to significant growth In the market. The potential for myoglobin to serve as a valuable biomarker in various applications, coupled with the ongoing advancements in diagnostic technologies, presents significant opportunities for market expansion.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.19% |

|

Market growth 2024-2028 |

USD 76 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.09 |

|

Key countries |

US, China, Germany, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Myoglobin Market Research and Growth Report?

- CAGR of the Myoglobin industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the myoglobin market growth of industry companies

We can help! Our analysts can customize this myoglobin market research report to meet your requirements.