Online Dating Services Market Size 2025-2029

The online dating services market size is forecast to increase by USD 2.9 billion at a CAGR of 5.8% between 2024 and 2029.

- Online dating services have witnessed significant growth in recent years, driven by the increasing adoption of digital technologies and the rise of niche platforms catering to specific demographics. The integration of social media analytics and application development has enabled more effective matching algorithms, while artificial intelligence and machine learning are being leveraged to enhance user experience. However, concerns around security and privacy continue to pose challenges for the industry. Mobile applications dominate the market, offering convenience and accessibility to users. As online dating becomes more mainstream, there is a growing need for advanced security analytics to build trust and ensure user safety. This market analysis report explores these trends and challenges, providing insights into the future growth prospects of the market.

What will be the Size of the Online Dating Services Market During the Forecast Period?

- The market encompasses a vast array of internet platforms catering to single people In their quest for meaningful connections. With an increasing number of individuals prioritizing convenience and flexibility In their social lives, the market's sales continue to soar. Online dating services, which include dating sites and apps, have revolutionized the way people meet and interact, offering subscriptions that grant access to a vast pool of potential matches. Social media integration and artificial intelligence-driven matchmaking algorithms further enhance the user experience, allowing customers to connect with like-minded individuals more effectively. However, the industry faces challenges such as mischief and phishing attempts, requiring stringent security measures to protect personal details and online banking passwords.

- Moreover, as internet usage continues to increase, the outlook for online dating services remains positive, with continued innovation and adaptation to customer priorities shaping the future of this dynamic and evolving market.

How is this Online Dating Services Industry segmented and which is the largest segment?

The online dating services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Marriage

- Casual

- Socialize

- Pricing Scheme

- Subscription

- Advertising

- Platform

- Web-based

- App-based

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Type Insights

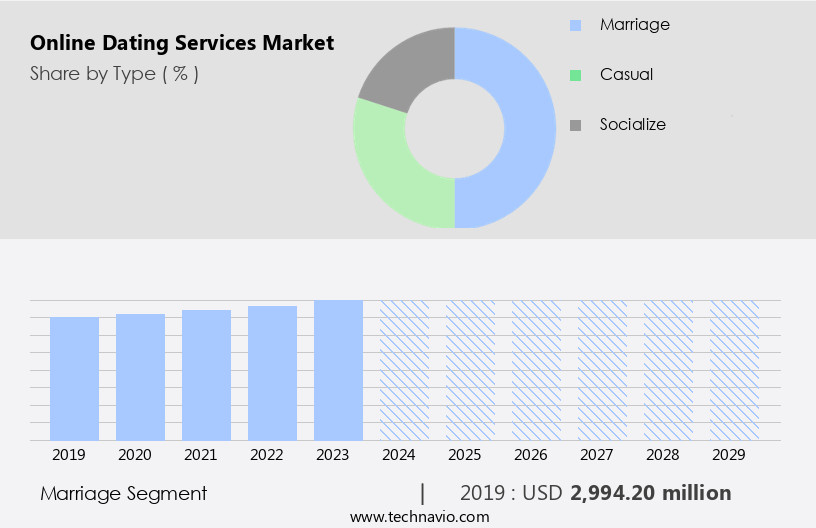

- The marriage segment is estimated to witness significant growth during the forecast period.

The marriage segment of the market caters to individuals seeking long-term, committed relationships. These users prioritize shared values, beliefs, and life goals in potential partners. They are typically older, with many In their 30s, 40s, and beyond. Online platforms serving this demographic utilize detailed profiles and advanced compatibility-matching algorithms, offering additional features like coaching and counseling to foster lasting relationships. From a business perspective, the marriage segment is valuable due to users' willingness to invest in premium services, making it a significant revenue generator for online dating providers. The use of technology, including email addresses and internet banking passwords, necessitates strong app security and protection against fraud activities, such as fake online accounts and phishing attempts.

Get a glance at the Online Dating Services Industry report of share of various segments Request Free Sample

The marriage segment was valued at USD 2.99 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

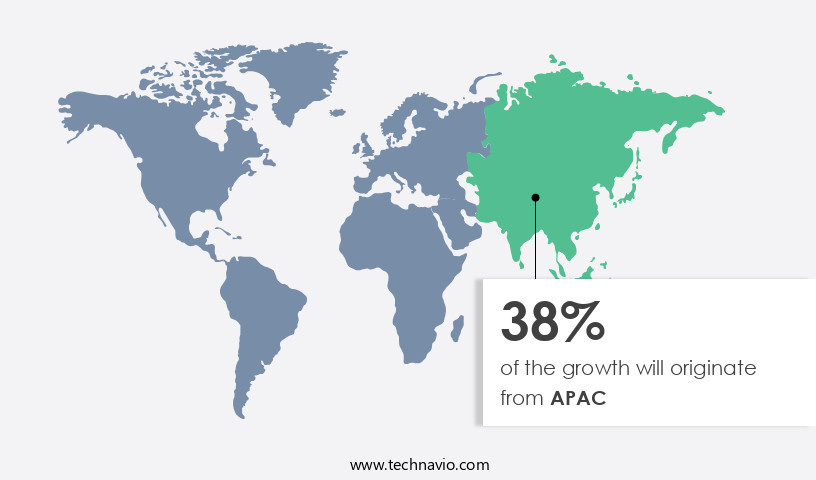

- APAC is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is experiencing growth due to the increasing acceptance and popularity of online platforms for connecting single people. Key trends in this market include the integration of artificial intelligence (AI) and machine-learning algorithms, expansion into niche demographics, and the provision of video dating options. Major players, such as Match Group, eHarmony, and Bumble, dominate the market, offering various subscription models with free and premium options. The use of online dating applications is on the rise In the region, driven by increasing smartphone and internet penetration and shifting consumer preferences. However, concerns regarding fraud, fake online accounts, and privacy breaches persist, necessitating heightened security measures and user verification processes. The market is expected to continue growing as technology advances and consumer expectations evolve.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Online Dating Services Industry?

Growing adoption of online dating is the key driver of the market.

- The dating service industry continues to expand as single people increasingly turn to online platforms for suitable partners. Driven by the widespread use of internet services and social media, online dating sites and apps have become a popular way of life for many. With enrollment rates on the rise, sales In the industry are seeing significant growth. However, challenges such as fraud and fake online accounts pose threats to both customers and service providers. Technology plays a crucial role in combating these issues, with real-time users and conversations monitored through machine-learning algorithms and AI. Personal details, including email addresses and dating profile information, are protected through advanced app security measures.

- Furthermore, internet penetration and usage continue to increase, making online dating more accessible than ever before. Innovation In the industry includes location-based matching, additional services, and consumer expectations for a good match based on sexual preference, interests, and hobbies. Despite these advancements, concerns around privacy, security, and the dehumanizing nature of online interactions remain priorities for some. Overall, the efficient and time-saving nature of online dating makes it an attractive alternative to traditional dating methods.

What are the market trends shaping the Online Dating Services Industry?

Rise of niche platforms associated with specific groups is the upcoming market trend.

- The service industry continues to expand, with sales driven by the growing number of single people seeking suitable partners through Internet services. Online platforms, including online dating sites and apps, offer customers the convenience of enrolling and connecting with potential matches from anywhere, at any time. However, with this growth comes challenges, such as fraud and the presence of fake online accounts. Technology plays a crucial role in combating these threats, with email addresses and online banking passwords among the information most frequently targeted. Internet penetration and social media usage have also contributed to the popularity of online dating, with platforms like Tinder, Bumble, Match, Plenty of Fish, Hinge, and others leading the way.

- In addition, innovation, including the use of artificial intelligence and machine-learning algorithms, is a priority for service providers to enhance user experiences and increase sign-up rates. Despite these advancements, concerns around privacy, mischief, and phishing remain, highlighting the importance of app data security and consumer expectations for additional services. The efficient and time-saving nature of online dating, which allows users to connect based on interests, hobbies, sexual preference, and location, continues to make it a popular pastime for many.

What challenges does the Online Dating Services Industry face during its growth?

Limited trust in online dating services is a key challenge affecting the industry growth.

- The dating service industry continues to grow as single people turn to online platforms for suitable partners. With the increasing use of internet services, sites and apps have become a popular way of life for many. However, concerns regarding fraud and fake online accounts persist, making customers wary of enrolling.

- Furthermore, the technology behind it including email addresses and online banking passwords, can also pose risks. As internet penetration increases and social media becomes more integrated into our lives, dating websites and apps are becoming essential tools for connecting with potential partners. Companies like Match Group and IAC are leading the innovation in this space, utilizing artificial intelligence and machine-learning algorithms to improve the user experience and increase sign-up rates. However, these advancements also present new threats and risks, including the dehumanizing state of online interactions and the potential for mischief through phishing and other fraud activities. As consumers' priorities shift towards time-saving and efficient methods of finding a good match based on sexual preference, interests, hobbies, and location, the market is poised for continued growth.

Exclusive Customer Landscape

The online dating services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, online dating services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Badoo - The company offers online dating service that allows user to match and chat with people, make friends, or find a partner.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bumble Inc.

- Coffee Meets Bagel

- Cupid Media Pty Ltd.

- eHarmony Inc.

- Elitemate.com LLC

- Feeld

- Grindr Inc.

- HAPPN

- HER

- Lex

- Love Group Global Ltd.

- Match Group

- Open

- RSVP.COM.AU Pty Ltd.

- Spark Networks SE

- Tastebuds Media Ltd.

- Truly Madly

- The Meet Group Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The industry represents a significant segment of the internet services market, catering to the needs of single people seeking suitable partners through digital platforms. This sector's sales have experienced steady growth due to the increasing popularity of Internet services and the convenience they offer. The sites and mobile apps have become a popular pastime for many individuals, providing an efficient and time-saving way to connect with potential romantic partners. These platforms have become essential tools for individuals looking to expand their social circles and form meaningful relationships. The market is characterized by a high level of competition among various players, each offering unique features and services to attract and retain customers.

Moreover, subscription-based models are common in this industry, allowing users to access additional features and services for a fee. However, the industry is not without its challenges. Fraud and the presence of fake online accounts remain significant concerns for both service providers and users. These threats can take various forms, including mischief, phishing, and identity theft. Technology plays a crucial role In the industry, with machine-learning algorithms and artificial intelligence being used to enhance the user experience and improve the chances of finding a good match. Real-time user conversations and location-based matching are also essential features that have become industry standards.

In addition, despite these advancements, consumer expectations continue to evolve, and service providers must innovate to stay competitive. Additional services, such as video chat and virtual events, have become increasingly popular during the pandemic. The use of email addresses and personal details can also pose risks, with some users reporting incidents of fraud and privacy breaches. Service providers must prioritize app security and implement strong measures to protect user data and prevent fraud activities. The dehumanizing state of online interactions can also be a concern for some users, with others preferring the more traditional methods of meeting people in person. However, the efficiency and convenience of online dating services continue to make them a popular choice for many.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 2.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.2 |

|

Key countries |

US, Canada, UK, Germany, Italy, China, France, The Netherlands, Japan, and India |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Online Dating Services Market Research and Growth Report?

- CAGR of the Online Dating Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the online dating services market growth of industry companies

We can help! Our analysts can customize this online dating services market research report to meet your requirements.