Open Banking Market Size 2024-2028

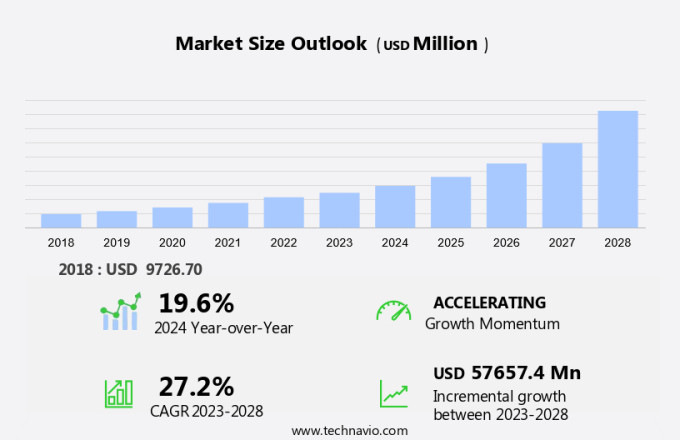

The open banking market size is forecast to increase by USD 57.66 billion at a CAGR of 27.2% between 2023 and 2028. The market is witnessing significant growth due to the increasing demand for advanced Financial Management Tools that offer real-time access to Financial Data from multiple Financial Institutions. Open Banking Solutions, which utilize Open Banking APIs, enable automated savings, real-time transactions, and enhanced security features. The integration of Artificial Intelligence (AI) into these services further streamlines financial management and enhances personalized customer experiences. However, the handling of sensitive personal financial data necessitates strict adherence to guidelines and regulations to ensure data security and privacy. Key market trends include the growing preference for faster and more seamless payment processing, increased focus on data security, and the potential for increased competition among Financial Institutions as they adapt to the Open Banking landscape.

Open banking, a financial services model that enables third-party providers to access customers' financial data through APIs, is revolutionizing the payment ecosystem. This innovative approach allows for more customer-centric services, personalized financial offerings, and informed financial decisions. Broadband connectivity plays a crucial role in the open banking landscape, ensuring seamless access to real-time data for machine learning algorithms and AI applications. These technologies are integral to the open banking model, as they enable advanced data analytics and the development of innovative financial services. Security is a top priority in the market. Financial institutions are investing heavily in advanced security measures to protect sensitive customer data from online fraud. AI and machine learning algorithms are being employed to detect and prevent fraudulent activities in real-time. E-commerce and open banking are natural partners, with the former benefiting from the real-time financial data access provided by the latter.

Further, open banking APIs are the backbone of this new financial services model, allowing for seamless integration between financial institutions and third-party service providers. These APIs enable the sharing of financial data in a secure and standardized manner, facilitating the development of innovative financial services. Personalized financial services are a key benefit of open banking. By leveraging big data analytics and AI, financial institutions can offer customized offerings tailored to individual customers' financial needs and preferences. In conclusion, open banking is transforming the payment ecosystem by enabling real-time data access, advanced data analytics, and the development of innovative financial services. With a focus on security and customer-centricity, this model is poised to disrupt traditional financial services and reshape the industry landscape.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Service

- Banking and capital markets

- Payments

- Digital currencies

- Deployment

- On premise

- Cloud

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Service Insights

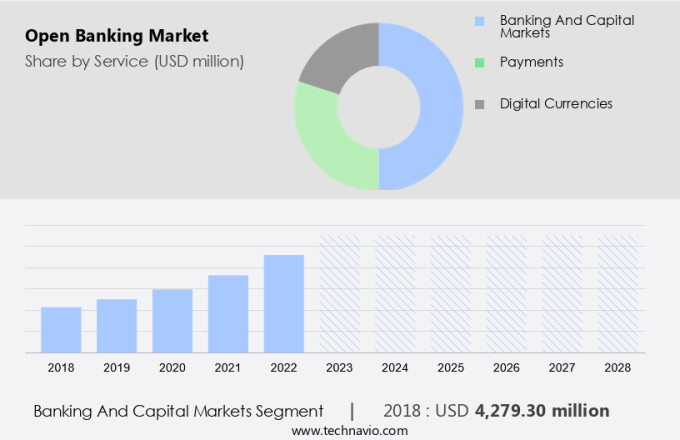

The banking and capital markets segment is estimated to witness significant growth during the forecast period. The market is revolutionizing the banking and financial services sector in the global payment ecosystem. Through strategic collaborations and innovative service offerings, Open Banking is enhancing payment processes, expanding investment accessibility, and promoting financial inclusion. In June 2024, Euronet, a leading financial technology and payments provider, partnered with Fintech Galaxy to introduce a new Banking as a Service (BaaS) offering. This collaboration aims to deliver faster, more secure, and cost-effective account-based transactions for banks, fintechs, and merchants. Key features of this service include card as a service, real-time payment processing, and advanced fraud detection. By integrating with consumer bank accounts, this solution reduces transaction costs and promotes financial inclusion, while also driving the adoption of digital transactions in the European region.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) in Open Banking is further fueling the growth of the market. Big data analytics is enabling financial institutions to gain valuable insights into customer behavior and preferences, leading to personalized services and improved customer experience. The use of Open Banking is expected to continue increasing, as more consumers seek convenience, security, and accessibility in their financial transactions.

Get a glance at the market share of various segments Request Free Sample

The banking and capital markets segment accounted for USD 4.28 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

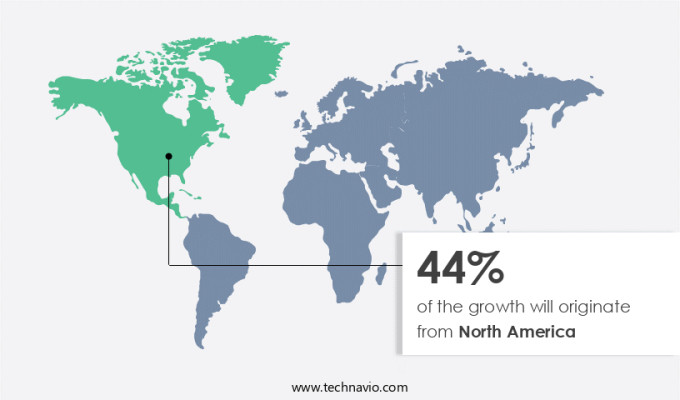

North America is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market witnessed substantial expansion in 2023, fueled by regulatory progress and customer-centric financial services. A significant milestone in this region was the introduction of the Open Banking Gateway by Koxa, a US-based enablement platform. This groundbreaking solution empowers banks to easily connect with third-party service providers through APIs, enabling informed financial decisions for consumers. Compliance with the upcoming Dodd-Frank Section 1033 regulation is ensured, as this gateway offers sophisticated access and consent management features. By facilitating seamless integration with digital financial applications and services, Koxa's Open Banking Gateway bolsters innovation in the financial sector, particularly in the realm of data analytics and insurance products.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increased demand for fast and seamless payments is the key driver of the market. The market is witnessing an increasing trend towards the adoption of Application Programming Interfaces (APIs) for enhanced payment solutions. This demand stems from the desire for swift and convenient financial transactions among retail and commercial banks' customer bases. In line with this trend, Newton Property Management, serving over 35,000 customers across 1,200 sites, recently integrated GoCardless' Instant Bank Pay feature into its existing Direct Debit functionality. This integration allows for both recurring and one-off payments through a unified platform, thereby streamlining the payment process and improving the overall customer experience. By managing various payment types within a single system, operational efficiency is boosted, addressing the growing preference for hassle-free transactions.

Additionally, open Banking Platforms prioritize security measures to ensure the protection of sensitive customer data during these transactions. Key players in the market, such as GoCardless, are at the forefront of this evolution, offering innovative solutions to meet the demands of the modern banking landscape.

Market Trends

Integration of AI into open banking services is the upcoming trend in the market. The market is undergoing a notable shift as artificial intelligence (AI) becomes an integral part of its offerings. This evolution is fueled by the demand for superior user experiences and more sophisticated financial management solutions. In a recent collaboration, bunq, the second-largest neobank in Europe with over 12.5 million users, teamed up with Mastercard. This partnership utilizes Mastercard's open banking platform, empowering bunq users to consolidate accounts from multiple banks within the bunq app. By integrating AI, bunq's advanced financial assistant, Finn, enhances these insights by analyzing transaction data from various sources. For instance, users can request a comprehensive breakdown of their travel expenses over the past year, and Finn will compile this information from both bunq and external bank accounts.

Further, API Management Solutions ensures secure and efficient data exchange between financial institutions and third-party providers. Identity Verification and Authentication Solutions are essential for maintaining security and privacy in Open Banking transactions. The integration of AI into these solutions enhances their capabilities, enabling more personalized and insightful financial services. Key players in the market include Mastercard, Visa, and Stripe, among others. They are investing in AI-driven technologies to offer innovative solutions such as Payment Initiation Solutions, Account Information Solutions, and Data Sharing. These advancements are expected to drive market growth and improve user experiences in the US Open Banking landscape.

Market Challenge

Implementation of strict guidelines in handling personal financial data is a key challenge affecting market growth. The market is experiencing significant growth due to the adoption of Open Banking Solutions and Financial Management Tools by Financial Institutions. Open Banking APIs enable the secure exchange of Financial Data in real-time, allowing for Automated Savings and improved Financial Management. However, the implementation of these solutions comes with challenges, particularly in ensuring strict compliance with data protection regulations. In response to these challenges, the Financial Data Exchange (FDX) applied for recognition from the Consumer Financial Protection Bureau (CFPB) as a standard-setting organization for open banking services. This recognition would bolster FDX's standards' credibility and authority, providing a benchmark for the industry.

Additionally, the CFPB has established qualifications for organizations seeking recognition as industry standard-setting bodies and FDX's application is currently under review. The CFPB's rule outlines the necessary qualifications for organizations to become recognized standard-setting bodies, ensuring a consistent and secure approach to handling sensitive Financial Data. This recognition would provide a significant boost to Open Banking Solutions providers, instilling confidence in consumers and financial institutions alike. The implementation of these solutions is expected to continue driving the growth of the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- American Express Co: The company offers open banking services, which allow financial institutions and financial service providers to share and access customer-driven data with each other with authorization.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airwallex

- Australia and New Zealand Banking Group Ltd

- Banco Bilbao Vizcaya Argentaria SA

- Bank of Ireland

- Caixa Geral de Depósitos SA

- Citigroup Inc.

- Credit Agricole SA

- Finastra

- HSBC Holdings Plc

- ING Groep NV

- Jack Henry and Associates Inc

- Mambu BV

- Nationwide Mutual Insurance Co.

- NCR Voyix Corp.

- Qwist GmbH

- Revolut Ltd.

- Royal Bank of Scotland plc

- Societe Generale SA

- Wise Payments Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Open banking, a revolutionary shift in the payment ecosystem, enables financial institutions to share customer data through open APIs with third-party providers. This transformation is driven by broadband connectivity, artificial intelligence (AI), machine learning, and big data analytics. Open banking platforms provide real-time data access, enabling personalized financial services and informed financial decisions. Traditional banking institutions are adopting open banking solutions to offer customer-centric services, including payment initiation solutions and account information services. APIs play a crucial role in this digital transformation, enabling seamless integration with e-commerce platforms and mobile banking apps. Security is a top priority in open banking, with strong security measures implemented to protect sensitive customer data.

Further, AI and machine learning are used to detect online fraud and ensure data security. Venture capital investment in open banking solutions continues to grow, fueling innovation in the sector. Open banking platforms offer innovative financial services, such as automated savings and insurance products, enhancing customer retention. Banks and financial institutions are embracing open banking to stay competitive and meet evolving customer demands. Open banking APIs enable secure data sharing between financial institutions and third-party service providers, providing a foundation for digital transformation in the financial sector. Cloud and on-premise solutions offer flexibility and scalability, enabling financial institutions to meet the evolving needs of their customers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 27.2% |

|

Market growth 2024-2028 |

USD 57.66 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

19.6 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 44% |

|

Key countries |

US, China, UK, Canada, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Airwallex, American Express Co., Australia and New Zealand Banking Group Ltd, Banco Bilbao Vizcaya Argentaria SA, Bank of Ireland, Caixa Geral de Depósitos SA, Citigroup Inc., Credit Agricole SA, Finastra, HSBC Holdings Plc, ING Groep NV, Jack Henry and Associates Inc, Mambu BV, Nationwide Mutual Insurance Co., NCR Voyix Corp., Qwist GmbH, Revolut Ltd., Royal Bank of Scotland plc, Societe Generale SA, and Wise Payments Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch