Plastic Fillers Market Size 2022 - 2026

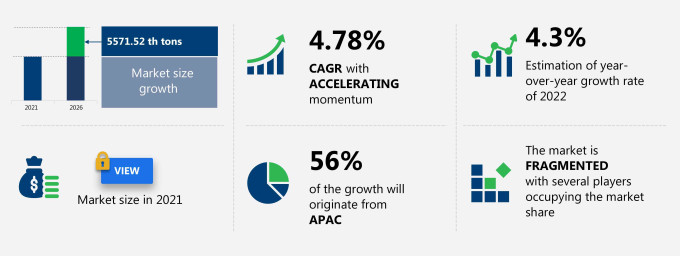

The plastic fillers market share is expected to increase by 5571.52 thousand tons from 2021 to 2026, and the market's growth momentum will accelerate at a CAGR of 4.78%. The plastic fillers market is evolving rapidly as industries seek more cost-effective solutions and sustainable alternatives to traditional materials. Plastic filler manufacturers are increasingly focusing on plastic material innovation, offering a variety of plastic fillers that enhance the properties of plastic composites used in a wide range of applications, from automotive lightweighting to sustainable construction. These plastic fillers serve to improve the mechanical properties, thermal properties, and chemical resistance of plastics, making them ideal for high-performance applications in sectors like aerospace, automotive, and green building materials.

One of the major trends in the plastic filler market is the growing demand for sustainable plastic materials. As industries push toward environmental sustainability, the use of biodegradable plastic fillers, bio-based fillers, and recycled plastic fillers has gained prominence. These fillers, derived from renewable resources, not only reduce plastic waste but also contribute to a circular economy by repurposing plastic waste into valuable materials. Plastic filler research is also focused on the development of eco-friendly composites that can be used in green construction and green technology applications. By utilizing bio-based polymers and biopolymer composites, manufacturers are able to create lightweight construction materials with improved corrosion resistance and thermal insulation properties.

What will the Plastic Fillers Market Size be During the Forecast Period?

The development of plastic filler technology has also opened new doors for the plastic material engineering field. The integration of advanced fillers improves the performance of materials in energy-efficient applications, such as in electric vehicle materials and sustainable transportation. The automotive industry, for instance, is leveraging these fillers to create lightweight vehicles that reduce fuel consumption and emissions reduction. Plastic reinforcement with fillers also enhances the structural integrity of materials, making them ideal for high-performance composites and structural composites in industries like aerospace, construction, and durable flooring.

Plastic filler suppliers are also driving the market's growth by offering a variety of plastic filler benefits, such as improved thermal properties, chemical resistance, and increased durability. The increasing demand for green building materials and eco-friendly fillers in construction, especially in sustainable building materials, has contributed to the growth of the market. Sustainable construction methods, which incorporate plastic material selection and lightweight construction techniques, are being adopted worldwide as part of broader environmental impact reduction strategies.

Plastic Fillers Market Dynamic

The stringent environmental regulations are notably driving the plastic fillers market growth, although factors such as concerns related to plastic disposal may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the plastic fillers industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

One of the biggest drivers of the market is the increasing focus on sustainability and the reduction of microplastics in the environment. Recycled microplastic fillers are becoming more popular as they offer a low-cost, readily available solution for creating durable materials without contributing to plastic waste. By using recycled microplastic fillers, manufacturers can help reduce the accumulation of plastic disposals in landfills and oceans, addressing environmental concerns about microplastics and their impact on ecosystems. Moreover, plastic filler suppliers are working to meet regulatory parameters and government requirements by offering more biodegradable and sustainable plastic fillers that comply with strict environmental guidelines.The use of polyurethane-based and epoxy-based fillers is also gaining ground in industries requiring materials with high-performance properties. These fillers enhance chemical resistance, electrical conductivity, and thermal stability, making them ideal for aerospace materials, aircraft interiors, marine industry applications, and even automotive lightweighting. Polyurethane particles and epoxy-based fillers improve the strength, durability, and resistance to chemicals, making them ideal for demanding applications where high strength and durable materials are needed. These fillers also contribute to fuel economy and carbon emissions reduction, aligning with the growing push for green technology and sustainable transportation.

Key Plastic Fillers Market Driver

The stringent environmental regulations is one of the major drivers impacting the plastic fillers market growth. Automotive manufacturers in the US and Europe use lightweight materials to adhere to stringent regulations about vehicular pollution. Automotive vehicles generally emit volatile organic compounds (VOCs) and semi-volatile organic compounds (SVOCs), which are harmful to the environment. Regulatory bodies such as the US Environmental Protection Agency (EPA) have directed automotive OEMs in the US to reduce VOC and SVOC emissions. In China and Europe, there are strict guidelines for controlling VOCs and SVOCs. Lightweight plastics are used as substitutes for metals in automotive parts as they reduce the overall weight of the vehicle and control emissions, along with increasing fuel efficiency. American and European OEMs are improvising automotive interiors to comply with emission standards. Automobile companies use polypropylene composites (both mineral and glass filled) to adhere to standard emissions. Base polypropylenes, additives, and compounding technology must adhere to standard emissions.

Key Plastic Fillers Market Trend

The growing interest in bioplastics is one of the major trends influencing the plastic fillers market growth. Bio-plastics consist of bio-based content, which is biodegradable. Polymers such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), bio poly trimethyl terephthalate (bio PTT), and bio propanediol (bio PDO) are some of the popular bioplastics. These plastics are developed from renewable materials such as biomass and save up to 40% energy during production in comparison to their petrochemical counterparts. Bioplastics play a crucial role in the development of the plastic industry. An increase in environmental awareness, government support and funding, growing vendor interest, and their R&D spending on bioplastics are leading to the increased use of organic fillers in plastics and bioplastics, which will result in the growth of the plastic fillers market during the forecast period.

Key Plastic Fillers Market Challenge

Concerns related to plastic disposal is one of the major challenges impeding the plastic fillers market growth. As most plastics are derived from oil and are non-biodegradable, disposal can be a serious challenge. Unlike organic wastes, plastics do not decompose and last for centuries. Manufacturers and end-users discard various types of plastics, which must be collected, transported, sorted, degreased, and washed. Lack of proper recycling has a severe impact on the environment. Plastics are often used to produce disposable packaging products and several other items, which are discarded in less than a year of manufacture. Globally, these polymers accumulate as waste in landfills and natural habitats because of their exceptional durability. Challenges associated with plastic disposal can reduce the demand for plastic fillers and thereby hamper the growth of the market during the forecast period.

This plastic fillers market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the global plastic fillers market as a part of the global commodity chemicals market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the plastic fillers market during the forecast period.

Who are the Major Plastic Fillers Market Vendors?

The report analyzes the market's competitive landscape and offers information on several market vendors, including:

- BASF SE

- Cabot Corp.

- Calcinor SA

- Elementis Plc

- Evonik Industries AG

- Exxon Mobil Corp.

- GCR Group

- Gustav Grolman GmbH and Co. KG

- Hoffmann Mineral GmbH

- Imerys S.A.

- J M Huber Corp.

- Lhoist Group

- MAHAVEER CERAMIC INDUSTRIES

- Minerals Technologies Inc.

- Omya International AG

- Pigmentum s.r.o.

- Quartz Works GmbH

- SCR Sibelco NV

- Standridge Color Corp

- Thiele Kaolin Co.

This statistical study of the plastic fillers market encompasses successful business strategies deployed by the key vendors. The plastic fillers market is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Basf - The company offers plastic fillers product brands such as VALERAS

To make the most of the opportunities and recover from the post-COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The plastic fillers market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Plastic Fillers Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the plastic fillers market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

Which are the Key Regions for the Plastic Fillers Market?

For more insights on the market share of various regions Request PDF Sample now!

56% of the market's growth will originate from APAC during the forecast period. China is one of the key markets for plastic fillers in APAC. Market growth in this region will be faster than the growth of the market in other regions.

The growth in end-use industries such as automotive, manufacturing, industrial, packaging, and others will facilitate the plastic fillers market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The lockdowns and other restrictions in various countries, such as India, China, Japan, Bangladesh, Australia, and Vietnam, were lifted in the second half of 2020 due to the initiation of vaccination programs. The operations in various industries, such as building and construction, automobiles, electronics, and other industries, resumed, which increased the demand for plastic fillers in the second half of 2021. Additionally, with the increasing urbanization and development in the region, industrial and construction activities have also been growing significantly. Thus all these factors will drive the growth of the regional plastic fillers market in APAC during the forecast period.

What are the Revenue-generating Application Segments in the Plastic Fillers Market?

To gain further insights on the market contribution of various segments Request a PDF Sample

The plastic fillers market share growth in the inorganic fillers segment will be significant during the forecast period. Inorganic plastic fillers have been traditionally used because of their easy availability and superior properties. However, the plastic fillers market share growth by the inorganic fillers segment will be slower than the growth of the market by the organic fillers segment.

This report provides an accurate prediction of the contribution of all the segments to the growth of the plastic fillers market size and actionable market insights on the post-COVID-19 impact on each segment.

You may be interested in:

Polymer Fillers market - The market size has the potential to grow by USD 11.70 billion during 2021-2025, and the market's growth momentum will accelerate at a CAGR of 4.13%.

Dermal Facial Fillers market - The market size is expected to grow by USD 1.45 billion, at a CAGR of 9.14%, during 2020-2025.

Reserach Analyst Overview

Plastic fillers are crucial in the development of plastic material applications in multiple industries. Whether used in plastic product design, plastic material research, or for specific uses like fire retardant materials or durable flooring, the versatility of fillers makes them essential to a wide array of sectors. The plastic industry trends are shifting toward innovation in materials that are not only high-performance but also environmentally conscious. This is evident in the growing popularity of bio-based composites, polymer modification, and plastic material science research that focus on creating more energy-efficient and environmentally friendly solutions.

The future of the plastic fillers market lies in further research and development to create advanced materials that meet the evolving demands of industries aiming for sustainable plastic materials. As plastic waste reduction becomes a key priority, plastic filler development will continue to play a critical role in creating high-performance composites for green transportation, sustainable construction, and other environmentally conscious sectors. The use of renewable resources, coupled with plastic filler technology, will help foster the shift toward a more sustainable and eco-friendly future, aligning with global goals for environmental impact reduction and emissions reduction. In conclusion, the plastic fillers market is poised for continued growth as plastic material science advances and industries focus on creating sustainable, cost-effective, and eco-friendly composites. With increasing demand for biodegradable plastics, plastic reinforcement, and lightweight construction materials, the market is positioned to drive the future of manufacturing and design in sectors like automotive, aerospace, and green construction.

|

Plastic Fillers Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.78% |

|

Market growth 2022-2026 |

5571.52 thousand tons |

|

Market structure |

Fragmented |

|

YoY growth (%) |

4.3 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 56% |

|

Key consumer countries |

US, China, Japan, India, Germany, and UK |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

BASF SE, Cabot Corp., Calcinor SA, Elementis Plc, Evonik Industries AG, Exxon Mobil Corp., GCR Group, Gustav Grolman GmbH, and Co. KG, Hoffmann Mineral GmbH, Imerys S.A., J M Huber Corp., Lhoist Group, MAHAVEER CERAMIC INDUSTRIES, Minerals Technologies Inc., Omya International AG, Pigmentum s.r.o., Quartz Works GmbH, SCR Sibelco NV, Standridge Color Corp, and Thiele Kaolin Co. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Plastic Fillers Market Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive plastic fillers market growth during the next five years

- Precise estimation of the plastic fillers market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the plastic fillers industry across APAC, Europe, North America, Middle East, Africa, and South America

- A thorough analysis of the market's competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of plastic fillers market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch