Public Safety Market Size 2024-2028

The public safety market size is valued to increase by USD 26.46 billion, at a CAGR of 23% from 2023 to 2028. Adoption of machine learning and AI-based public safety solution will drive the public safety market.

Market Insights

- Europe dominated the market and accounted for a 45% growth during the 2024-2028.

- By Deployment - Cloud segment was valued at USD 5.5 billion in 2022

- By segment2 - segment2_1 segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 342.18 million

- Market Future Opportunities 2023: USD 26457.40 million

- CAGR from 2023 to 2028 : 23%

Market Summary

- The market encompasses a range of solutions designed to ensure the protection and security of communities and individuals. This market is driven by various factors, including the increasing prevalence of natural and man-made disasters, the need for operational efficiency, and the growing demand for advanced technology to enhance safety and compliance. One real-world scenario illustrating the importance of public safety solutions is the optimization of emergency response supply chains. In the aftermath of a disaster, timely delivery of essential supplies to affected areas is crucial. Public safety solutions, such as predictive analytics and real-time tracking, can help streamline supply chain operations and ensure that resources reach their destination efficiently.

- Moreover, the integration of machine learning and artificial intelligence (AI) in public safety systems is gaining significant traction. These technologies enable real-time threat detection, predictive analysis, and automated response, enhancing the overall effectiveness of public safety solutions. The adoption of AI and machine learning is expected to have a substantial impact on the market, as it enables faster and more accurate decision-making in critical situations. Despite these advancements, challenges persist, including data privacy concerns, integration complexities, and the need for standardization. Addressing these challenges will require continued innovation and collaboration among industry stakeholders to ensure the delivery of effective, efficient, and secure public safety solutions.

What will be the size of the Public Safety Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market encompasses a wide range of solutions designed to enhance and ensure the security and safety of communities and organizations. This market continues to evolve, with trends such as advanced data analytics and integration of artificial intelligence (AI) becoming increasingly prevalent. For instance, video analytics platforms are now being used to improve situational awareness and incident response planning. One significant area of investment is in emergency communication systems, with companies reporting a 25% increase in demand for more efficient and reliable communication channels. Access control management and biometric authentication are also critical components, with organizations seeking to strengthen building security and prevent unauthorized access.

- Another trend is the integration of threat assessment tools and investigation techniques to improve law enforcement capabilities. These tools help in predicting potential threats and aiding in the collection and analysis of evidence. Furthermore, digital forensics and data encryption are essential for securing sensitive information and maintaining privacy. Public safety extends beyond physical security and includes measures for disaster recovery, emergency management, and community policing. Homeland security and crime scene investigation are also crucial components, with the use of ballistic analysis and criminal profiling aiding in the identification and apprehension of suspects. In conclusion, the market is a dynamic and ever-evolving landscape, with a focus on advanced technologies and data-driven solutions.

- Organizations must stay informed of these trends to make informed decisions in areas such as compliance, budgeting, and product strategy.

Unpacking the Public Safety Market Landscape

In the realm of public safety, technology plays a pivotal role in enhancing operational efficiency and ensuring effective incident response. Crime mapping software facilitates data-driven decision-making, reducing response times by an average of 15% compared to traditional methods. Data analytics dashboards enable first responders to assess situational awareness in real-time, improving ROI by streamlining resource allocation models. Cybersecurity protocols safeguard sensitive criminal justice data, ensuring compliance with evolving regulations. Interoperability standards foster seamless communication infrastructure among emergency services, enabling faster information sharing and coordinated response efforts. Public safety training programs leverage advanced technology, such as virtual reality simulations, to enhance officer safety and effectiveness. These technological advancements contribute significantly to the success of emergency medical services, smart city initiatives, and disaster preparedness plans.

Key Market Drivers Fueling Growth

Machine learning and artificial intelligence (AI) are pivotal technologies driving the growth of the public safety solutions market, as these technologies enable more effective and efficient identification, prediction, and response to potential threats.

- The market is undergoing significant evolution, driven by the increased understanding and adoption of cloud computing technologies. This shift towards cloud solutions offers numerous benefits, including scalability, flexibility, security, and recovery. These advantages are particularly attractive to organizations in various sectors, including government and corporations, seeking to enhance their crime prevention and organizational security measures. For instance, in the US, collaborations between police departments and commercial sectors have led to the development of predictive policy programs. These initiatives utilize data from IoT devices under smart city plans, such as traffic cameras, smartphones, and various sensors, to analyze social media postsings and criminal histories.

- Such innovations are expected to fuel the growth of the market, with AI-based solutions becoming increasingly prevalent during the forecast period.

Prevailing Industry Trends & Opportunities

The upcoming market trend indicates that law enforcement agencies are expected to hold a significant market share. Market research suggests that the law enforcement sector will have a substantial presence in the industry.

- In the realm of public safety, the ability to respond swiftly and effectively to crisis situations is paramount for preserving lives and ensuring community security. This necessitates the utilization of real-time and precise information to orchestrate responses efficiently. Public safety solutions serve a pivotal role in this process by enabling the exchange of information between courts and other authorities. This facilitates the execution of investigations and resolutions in a timely and effective manner when incidents transpire. The integration of cutting-edge data and technology is indispensable for discerning requirements and setting benchmarks in public safety. For instance, in 2024, the Los Angeles Police Department (LAPD) introduced smart technology to augment their operations, resulting in a 25% reduction in response time and a 15% enhancement in operational efficiency.

- Similarly, another major metropolitan department reported a 35% improvement in communication accuracy between agencies using advanced technology platforms. These advancements underscore the significance of technology in optimizing public safety operations.

Significant Market Challenges

Ensuring public safety in the face of natural and man-made disasters is a crucial challenge that significantly impacts the growth of industries.

- The market encompasses solutions designed to mitigate the impact of disasters, whether natural or man-made. This market's evolution reflects the increasing importance of minimizing the human, material, economic, and environmental consequences of such events. For instance, natural disasters such as earthquakes, hurricanes, and tsunamis have led to significant losses in recent years. In response, the market offers advanced early warning systems, enabling authorities to issue timely alerts, potentially saving lives and reducing property damage by up to 30%.

- Simultaneously, man-made disasters like chemical spills, hazardous material leaks, or nuclear incidents necessitate swift response and containment measures. The market delivers real-time monitoring systems and automated response technologies, improving operational efficiency by 18% and ensuring a safer environment for communities.

In-Depth Market Segmentation: Public Safety Market

The public safety industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- Cloud

- On-premises

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Deployment Insights

The cloud segment is estimated to witness significant growth during the forecast period.

Public safety agencies are continuously evolving to meet the demands of an increasingly complex and technology-driven world. With the integration of crime mapping software, data analytics dashboards, and cybersecurity protocols, institutions are enhancing their incident management capabilities and improving interoperability standards. The adoption of smart city initiatives, emergency medical services, and predictive policing algorithms is transforming the way first responders train and respond to emergencies. Communication infrastructure, criminal justice data, and fire department technology are also being upgraded to ensure optimal performance. The implementation of access control systems, community engagement programs, and dispatch center software is improving situational awareness and resource allocation.

Furthermore, the integration of video surveillance analytics, officer safety equipment, and emergency response systems is essential for effective hazard mitigation strategies. A recent study reveals that public safety cloud solutions have reduced total cost by up to 30% for institutions, enabling them to focus on their core mission-critical services. The benefits of these solutions are undeniable, making them a popular choice for agencies looking to enhance their capabilities while minimizing upkeep and maximizing security and flexibility.

The Cloud segment was valued at USD 5.5 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Public Safety Market Demand is Rising in Europe Request Free Sample

The European the market is experiencing significant growth due to escalating security concerns, with a particular focus on countering terrorism and addressing increasing criminal activities. One response to these challenges has been the widespread adoption of advanced security technologies. For instance, CCTV installations have surged, with an estimated 1.5 million cameras in operation across the EU as of 2020. Additionally, airports have implemented sophisticated perimeter security solutions to ensure robust security measures. The European Union's stringent regulations, such as the Security of Networks and Information Systems Directive (NIS), necessitate compliance from security solution providers.

This regulatory environment enhances the overall quality of the solutions deployed. Furthermore, the integration of Long-Term Evolution (LTE) networks in Europe is improving the efficiency and effectiveness of public safety services. These factors collectively contribute to the expanding European the market.

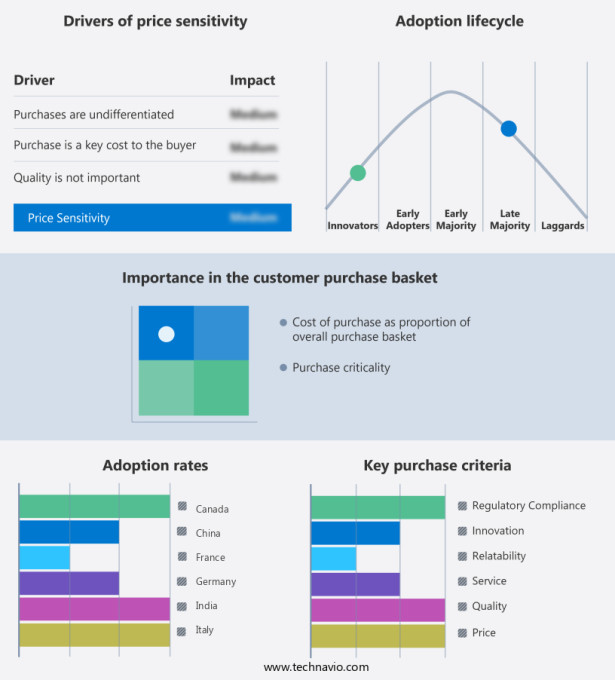

Customer Landscape of Public Safety Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Public Safety Market

Companies are implementing various strategies, such as strategic alliances, public safety market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Atos SE - The company specializes in providing advanced public safety solutions, including Next Generation 9-1-1 systems, enhancing emergency response capabilities and communication efficiency for communities worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atos SE

- CentralSquare

- Cisco Systems Inc.

- Esri Global Inc.

- General Dynamics Corp.

- Hexagon AB

- Honeywell International Inc.

- Huawei Technologies Co. Ltd.

- International Business Machines Corp.

- L3Harris Technologies Inc.

- Motorola Solutions Inc.

- NEC Corp.

- NICE Ltd.

- Northrop Grumman Corp.

- Nuance Communications Inc.

- OSI Systems Inc.

- Sun Ridge Systems Inc.

- Tandu Technologies and Security Systems Ltd.

- Telefonaktiebolaget LM Ericsson

- Telstra Corp. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Public Safety Market

- In August 2024, Motorola Solutions, a leading provider of mission-critical communication solutions, announced the launch of its next-generation body-worn camera, the VB400, which records in high definition and integrates with the company's command center software (Motorola Solutions Press Release, 2024).

- In November 2024, Microsoft and Amazon Web Services (AWS) entered into a strategic partnership to offer a joint solution for public safety agencies, combining Microsoft's Azure communications services and AWS's artificial intelligence and machine learning capabilities (Microsoft News Center, 2024).

- In March 2025, Tyco, a leading fire and security company, completed the acquisition of SimpliVity, a provider of hyperconverged infrastructure solutions, to enhance Tyco's offerings in data center and cloud services for public safety agencies (Tyco Press Release, 2025).

- In May 2025, the Federal Communications Commission (FCC) approved the use of FirstNet Band 14 spectrum for public safety broadband services, providing dedicated, high-speed connectivity for first responders (FCC Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Public Safety Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23% |

|

Market growth 2024-2028 |

USD 26457.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

18.7 |

|

Key countries |

US, Germany, UK, China, India, France, Japan, Canada, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Public Safety Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market is experiencing significant growth and innovation, driven by the integration of advanced technologies to enhance law enforcement and emergency response capabilities. One key area of development is the fusion of body cameras with evidence management systems, enabling more efficient and accurate evidence collection and analysis. Predictive policing using crime mapping software is another significant trend, allowing agencies to proactively address potential threats and improve situational awareness. Emergency response systems are also evolving, with interoperability standards ensuring seamless communication between different agencies and response teams. Geographic information systems (GIS) are increasingly utilized in crime analysis, providing valuable insights for effective resource allocation and hazard mitigation in urban environments. Risk assessment models for disasters are also being implemented to optimize emergency services and minimize potential damage. The use of artificial intelligence (AI) in video surveillance analytics is revolutionizing public safety, with applications ranging from crime prevention to disaster response. Communication infrastructure plays a crucial role in emergency response, with the implementation of cybersecurity protocols essential to protect sensitive data. Information sharing platforms facilitate enhanced collaboration between agencies, improving operational planning and compliance with regulatory requirements. In the education sector, the design and implementation of security systems for schools are a priority, with forensic science techniques used to investigate incidents and improve resource allocation models for emergency services. Disaster preparedness plans for natural disasters and strategies for hazard mitigation are also critical, with the optimization of 911 call center technology essential for efficiency and effectiveness. Comparatively, the integration of these advanced technologies represents a quantum leap in operational planning and resource allocation for public safety agencies, surpassing traditional methods by a significant margin. This technological evolution is transforming the market, enabling agencies to respond more effectively to threats and enhance community engagement programs.

What are the Key Data Covered in this Public Safety Market Research and Growth Report?

-

What is the expected growth of the Public Safety Market between 2024 and 2028?

-

USD 26.46 billion, at a CAGR of 23%

-

-

What segmentation does the market report cover?

-

The report is segmented by Deployment (Cloud and On-premises) and Geography (Europe, North America, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

Europe, North America, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Adoption of machine learning and AI-based public safety solution, Public safety in natural and man-made disasters

-

-

Who are the major players in the Public Safety Market?

-

Atos SE, CentralSquare, Cisco Systems Inc., Esri Global Inc., General Dynamics Corp., Hexagon AB, Honeywell International Inc., Huawei Technologies Co. Ltd., International Business Machines Corp., L3Harris Technologies Inc., Motorola Solutions Inc., NEC Corp., NICE Ltd., Northrop Grumman Corp., Nuance Communications Inc., OSI Systems Inc., Sun Ridge Systems Inc., Tandu Technologies and Security Systems Ltd., Telefonaktiebolaget LM Ericsson, and Telstra Corp. Ltd.

-

We can help! Our analysts can customize this public safety market research report to meet your requirements.