Scar Treatment Market Size 2025-2029

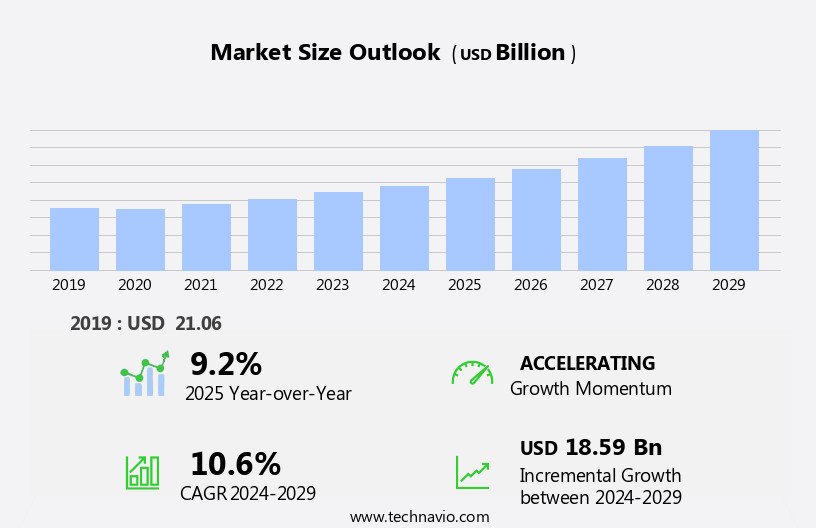

The scar treatment market size is forecast to increase by USD 18.59 billion, at a CAGR of 10.6% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for non-invasive procedures to address scars. This trend is driven by the desire for minimal downtime and fewer risks associated with surgical interventions. Additionally, the adoption of ambulatory surgery centers is on the rise, enabling more accessible and cost-effective treatment options for patients. However, the high cost of scar treatment procedures remains a notable challenge for market growth.

- Despite this, companies can capitalize on the market's potential by offering affordable, effective solutions and expanding their reach to ambulatory surgery centers. By focusing on innovation and patient-centric care, market players can differentiate themselves and meet the growing demand for non-invasive scar treatments.

What will be the Size of the Scar Treatment Market during the forecast period?

The market continues to evolve, driven by advancements in technology and the growing demand for effective solutions. Artificial intelligence and data analytics are increasingly being integrated into scar assessment and treatment, enabling more accurate diagnoses and personalized treatment plans. Virtual reality technology is used to simulate the healing process, enhancing patient satisfaction and improving communication between patients and healthcare providers. Minimally invasive treatments, such as cosmetic tattooing and injectable fillers, are gaining popularity for their cost-effectiveness and quick recovery times. Laser resurfacing and chemical peels are also commonly used for scar treatment, with clinical trials ongoing to evaluate their efficacy and safety.

Platelet-rich plasma and fibroblast growth factors are being explored for their ability to promote tissue remodeling and improve scar appearance. Professional training and patient education are crucial components of the market, ensuring that healthcare providers are equipped with the latest knowledge and techniques. Patient support groups provide valuable resources for individuals dealing with scars, offering emotional support and practical advice. Post-operative scars, burn scars, and keloid treatment are specific areas of focus within the market, with ongoing research and development efforts aimed at improving outcomes and reducing complications. Home-based treatments and over-the-counter products are also gaining traction, offering cost-effective options for individuals seeking to manage their scars at home.

Regulatory approvals and insurance coverage are important considerations for patients and healthcare providers alike, with combination therapies and prescription treatments offering potential solutions for those with complex scarring needs. Pain management and fibroscopic techniques, such as contracture release and fat grafting, are also being explored to improve functional outcomes and patient satisfaction. The use of machine learning and digital imaging in scar assessment and treatment is a promising area of research, with potential applications in skin tightening, scar camouflage, and stretch mark treatment. Scar grading and assessment tools are also being developed to help healthcare providers better understand the severity and progression of scars, enabling more effective treatment plans.

Aesthetic physicians and plastic surgeons continue to play a key role in the market, with a focus on achieving aesthetic outcomes and improving patient satisfaction. Anti-inflammatory agents and anti-scarring agents are also being explored to prevent the formation of scars and reduce their severity. The ongoing dynamism of the market reflects the evolving needs and expectations of patients, as well as the continuous advancements in technology and scientific research. With a focus on cost-effectiveness, wound healing, patient support, and functional outcomes, the market is poised for continued growth and innovation.

How is this Scar Treatment Industry segmented?

The scar treatment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Topical

- Laser

- Others

- Type

- Atrophic scar

- Hypertrophic and keloid scars

- Contracture

- Stretch marks

- End-user

- Home care

- Hospitals

- Clinics

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

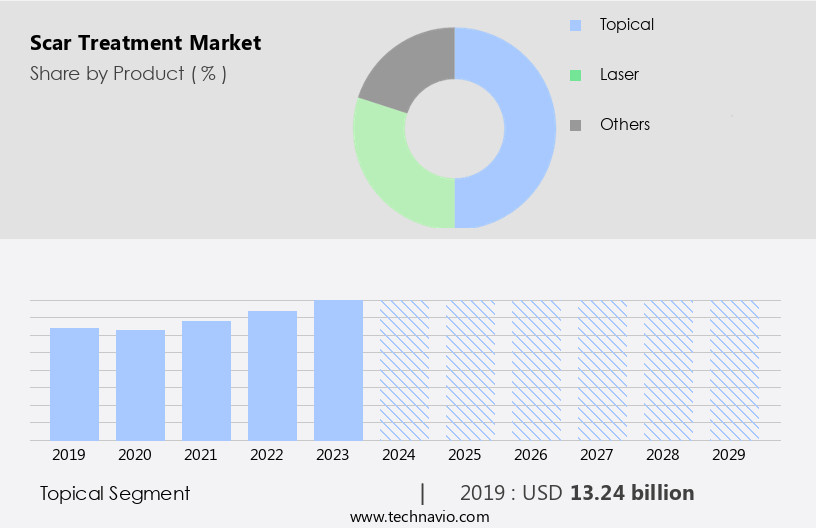

The topical segment is estimated to witness significant growth during the forecast period.

Topical scar treatments are an essential segment of the skin regeneration market, providing solutions for reducing the appearance of scars through lotions, gels, ointments, and silicone gel sheets. These products promote wound healing by hydrating the skin, filling in deformities, or gently removing the uppermost skin cells with scars. Companies like Sientra offer top-tier solutions, such as BIOCORNEUM, which is FDA-regulated as an over-the-counter drug and utilized by medical professionals for scar management. Additionally, advancements in technology have led to the integration of artificial intelligence, data analytics, and virtual reality in scar assessment and treatment. Minimally invasive treatments, like laser resurfacing and fibroblast growth factors, are also popular.

Plastic surgeons, dermatologists, and wound care specialists employ these techniques to enhance aesthetic outcomes and improve patient satisfaction. Furthermore, non-invasive treatments, such as platelet-rich plasma and injectable fillers, are increasingly gaining traction. Clinical trials and research continue to explore the potential of keloid treatment, scar revision, and combination therapies, including radiofrequency ablation, stem cell therapy, and prescription treatments. Patient education plays a crucial role in the market, with a focus on pain management, cost-effectiveness analysis, and personalized treatments for various types of scars, including surgical, acne, and hypertrophic scars. Insurance coverage is also a significant factor, with ongoing discussions regarding the reimbursement of scar treatments.

Overall, the skin regeneration market is witnessing continuous innovation, driven by the commitment to improve patient care and achieve optimal functional and aesthetic outcomes.

The Topical segment was valued at USD 13.24 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

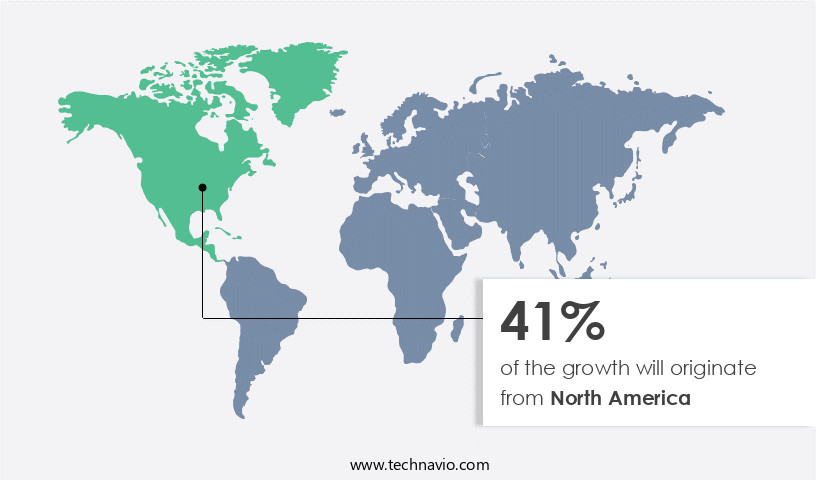

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In The market, North America leads in revenue generation, driven by the increasing preference for non-invasive treatments and advanced healthcare infrastructure. The region's experienced healthcare professionals and availability of diagnostic techniques fuel market growth. Key players like Bausch Health Companies, Candela, and Sonoma Pharmaceuticals are innovating solutions, such as Sonoma Pharmaceuticals' new office dispense products for skin care professionals, launched in January 2023. Advancements in artificial intelligence, data analytics, and virtual reality are revolutionizing scar assessment and treatment. Minimally invasive treatments, such as platelet-rich plasma and fibroblast growth factors, are gaining popularity due to their effectiveness and minimal downtime.

Non-invasive treatments, like chemical peels and laser therapy, offer quick recovery and patient satisfaction. Personalized treatments, including cosmetic tattooing and injectable fillers, cater to individual needs. Home-based treatments and over-the-counter solutions provide accessibility and affordability. Clinical trials and regulatory approvals for combination therapies, such as radiofrequency ablation and stem cell therapy, are expanding treatment options. Patient education and support groups play a crucial role in improving patient outcomes. Wound care specialists and aesthetic physicians collaborate to provide comprehensive scar care. Scar assessment and grading help in determining the best treatment protocols. Insurance coverage for scar treatments is increasing, making them more accessible.

Pain management and cost-effectiveness analysis are essential considerations for patients and healthcare providers. The market is expected to grow further with the integration of machine learning and digital imaging for skin rejuvenation and scar camouflage. Skin regeneration, tissue remodeling, and collagen induction are key aspects of scar treatment. Anti-inflammatory agents and anti-scarring agents are essential components of treatment protocols. Fat grafting, contracture release, and scar revision are surgical interventions for severe scars. Silicone gel sheets and pressure therapy are effective for hypertrophic and keloid scars. In summary, The market is evolving with advancements in technology, personalized treatments, and expanding insurance coverage.

The focus on patient satisfaction, functional outcomes, and aesthetic results will continue to drive market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Scar Treatment Industry?

- The increasing demand for non-invasive scar treatment procedures serves as the primary market driver. These minimally invasive methods cater to the growing preference among consumers for effective scar reduction techniques that minimize downtime and post-procedural recovery.

- Non-invasive scar treatment procedures have gained significant traction in the market due to their numerous advantages over traditional open surgical methods. These minimally invasive techniques involve minimal surgical incisions, thereby reducing pain and scarring. The procedures take only 30-60 minutes, and patients can resume normal activities, including strenuous ones, immediately. In contrast, open surgical procedures are lengthier and require extensive post-operative care, keeping patients away from their daily routines for a week. The non-invasive the market encompasses various techniques such as contracture release, anti-inflammatory agents, skin rejuvenation, and laser therapy. Plastic surgeons and wound care specialists employ these methods to treat different types of scars, including acne scars, using personalized treatments.

- Some of the advanced therapies include skin grafting, radiofrequency ablation, stem cell therapy, and prescription treatments for pain management. Regulatory approvals and combination therapies further enhance the efficacy of these treatments. Overall, non-invasive scar treatments offer quicker recovery times, minimal downtime, and reduced risk of complications, making them a preferred choice for patients seeking effective scar treatment solutions.

What are the market trends shaping the Scar Treatment Industry?

- The adoption of ambulatory surgery centers is gaining momentum as the latest market trend. This shift towards outpatient surgical facilities is driven by several factors, including cost savings, improved patient experience, and advanced medical technologies.

- The market has experienced notable growth in recent years, with a focus on cost-effectiveness, advanced technologies, and patient-centric approaches. ASCs (Ambulatory Surgery Centers) have gained popularity due to their affordability, efficiency, and patient-friendly environment. These centers offer various scar treatment procedures, such as laser therapies, microneedling, and minor surgical revisions, as alternatives to traditional hospital settings. The integration of portable and mobile scar treatment devices has further expanded access to high-quality care. Advancements in minimally invasive techniques and telemedicine have enhanced the appeal of ASCs. Telemedicine enables pre- and post-procedure consultations, ensuring continuity of care. Scar treatment procedures in ASCs have shown promising functional outcomes, including improved wound healing and skin tightening.

- Patient support groups and professional training programs have played a crucial role in increasing awareness and understanding of scar treatment options. Over-the-counter treatments have also gained traction, offering cost-effective solutions for patients. Digital imaging and 3D modeling have revolutionized scar assessment, enabling accurate scar grading and personalized treatment plans. Machine learning algorithms are being integrated into scar treatment systems to optimize treatment plans and improve patient outcomes. Stretch marks, a common concern for many individuals, are also being addressed through innovative scar treatment solutions. The market is expected to continue growing, driven by the increasing demand for effective and affordable scar treatment options.

What challenges does the Scar Treatment Industry face during its growth?

- The high cost of scar treatment procedures poses a significant challenge to the growth of the industry. With advanced technologies and innovative treatments emerging, the financial burden on patients and healthcare systems remains a critical concern, potentially limiting the industry's expansion.

- The market is driven by the growing demand for effective solutions to improve skin regeneration and enhance patient satisfaction. Advanced technologies, such as artificial intelligence, data analytics, and virtual reality, are transforming the scar treatment landscape. These technologies enable accurate scar assessment, personalized treatment plans, and improved patient outcomes. Minimally invasive treatments, including cosmetic tattooing and non-invasive procedures, are gaining popularity due to their efficacy and reduced recovery time. Laser resurfacing and topical scar treatments are also widely used for various types of scars, such as burn scars and keloids. Platelet-rich plasma (PRP) therapy is an emerging treatment option that utilizes the patient's own platelets to promote tissue regeneration and scar reduction.

- Clinical trials are ongoing to evaluate the safety and efficacy of PRP therapy for different types of scars. Home-based treatments are also available for patients who prefer convenient and cost-effective options. These treatments include topical creams and gels that contain active ingredients to improve scar appearance. The cost of scar treatment varies depending on the type of procedure, size of the treatment area, and the number of sessions required. Laser scar treatment, for instance, can cost between USD200 and USD34,000 for the entire course of treatment. The adoption of scar treatment procedures is relatively low in developing countries due to the high costs.

- However, advances in cosmetic dermatology and the availability of different treatment systems are expected to increase the accessibility and affordability of scar treatments for a larger population.

Exclusive Customer Landscape

The scar treatment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the scar treatment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, scar treatment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alliance Pharma PLC - The company specializes in advanced scar treatment solutions, utilizing cutting-edge technology and research-backed methods. One of our most effective offerings is our silicone scar gel, ScarAway. This innovative product is designed to minimize the appearance of scars, improving their texture and overall aesthetic. The silicone gel forms a protective barrier over the scar, allowing it to remain hydrated and promote the production of collagen. By optimizing the healing process, ScarAway helps to reduce the visibility of scars, leaving the skin smoother and more even. Our commitment to scientifically-sound treatments and continuous improvement ensures that our customers receive the best possible results.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alliance Pharma PLC

- Avita Medical Inc.

- Bayer AG

- Biodermis LLC.

- Boston Scientific Corp.

- Candela Corp.

- CCA Industries Inc.

- Cynosure LLC

- DEKA M.E.L.A. S.r.l.

- Johnson and Johnson Services Inc.

- Merz Pharma GmbH and Co KGaA

- Molnlycke Health Care AB

- Newmedical Technology Inc.

- Perrigo Co. Plc

- Quantum Health

- Scarguard Labs

- Smith and Nephew plc

- Solta Medical

- Sonoma Pharmaceuticals Inc.

- Stratpharma AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Scar Treatment Market

- In March 2023, Merck KGaA, a leading pharmaceutical and life sciences company, announced the launch of its innovative scar treatment product, ScarAway Excel Gel, which utilizes silicone gel technology to improve the appearance of scars. This new product entry signifies a significant investment in the market, aiming to cater to the increasing demand for effective scar management solutions (Merck KGaA Press Release, 2023).

- In August 2024, Allergan Aesthetics, a leading player in the aesthetics market, entered into a strategic partnership with Skinvisible Technologies, a biopharmaceutical company specializing in topical treatments. This collaboration focused on the development and commercialization of a novel scar treatment product, combining Allergan's expertise in aesthetics and Skinvisible's proprietary technology (Allergan Aesthetics Press Release, 2024).

- In December 2024, FDA granted approval to Acelity L.P. Inc., a global medical technology company, for its KCI V.A.C. Therapy System, used in the treatment of diabetic and venous ulcers. This approval also extended to the use of this system for the treatment of hypertroctic scars, marking a significant regulatory milestone in the market (FDA Press Release, 2024).

- In May 2025, Mederma, a leading brand in scar treatment, announced a major expansion of its product portfolio with the launch of Mederma Advanced Scar Gel Plus. This new product, featuring advanced silicone technology and additional active ingredients, is expected to strengthen Mederma's market position and cater to the growing demand for effective scar treatments (Mederma Press Release, 2025).

Research Analyst Overview

- The market encompasses various approaches, including tissue engineering, skin resurfacing, and reconstructive surgery, to address the physical and psychological impact of scars. Biodegradable materials and biocompatible materials are increasingly utilized in scar treatment due to their ability to promote scar adherence and improve skin texture and elasticity. Skin pigmentation, discoloration, and sensitivity are significant concerns for individuals with scars, leading to a demand for effective treatments. Dermatology research focuses on the use of growth factors and skin care products to reduce scar elevation, indentation, and pruritus.

- Scar mobility and quality of life are also key factors driving market growth. Lifestyle modifications and sun protection are essential components of scar prevention strategies. Regenerative medicine offers promising solutions for scar reduction, particularly in cases of extensive scarring. Scar management is a continuous process that requires ongoing attention and commitment to maintaining skin health.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Scar Treatment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.6% |

|

Market growth 2025-2029 |

USD 18.59 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.2 |

|

Key countries |

US, Germany, China, Canada, India, UK, Japan, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Scar Treatment Market Research and Growth Report?

- CAGR of the Scar Treatment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the scar treatment market growth of industry companies

We can help! Our analysts can customize this scar treatment market research report to meet your requirements.