Teeth Whitening Gels Market Size 2025-2029

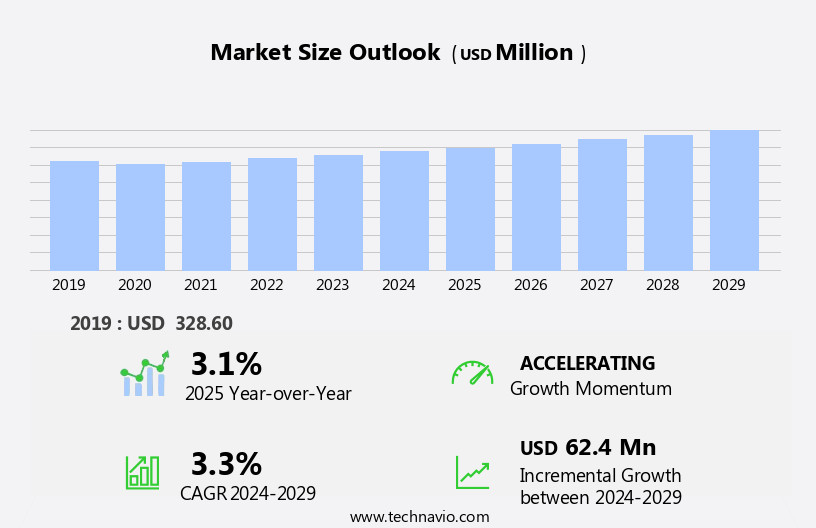

The teeth whitening gels market size is forecast to increase by USD 62.4 million at a CAGR of 3.3% between 2024 and 2029.

- The market experiences significant growth, driven by the increasing online availability of these products and the influence of social media. Consumers are increasingly turning to e-commerce platforms to purchase teeth whitening gels, making the market more accessible and convenient. Furthermore, social media influencers and celebrities endorsing these products have led to high demand, particularly among younger demographics. However, market expansion faces challenges. Regulatory hurdles impact adoption due to stringent regulations regarding the safety and efficacy of teeth whitening agents. Retail giants like Walmart, Costco Wholesale Corporation, Target Brands, Inc., and Tesco.com, as well as Colgate Palmolive and other oral care product manufacturers, sell their teeth whitening gels through these channels.

- Additionally, supply chain inconsistencies temper growth potential as manufacturers struggle to maintain a steady supply of raw materials and ensure product quality. Companies seeking to capitalize on market opportunities must navigate these challenges effectively by adhering to regulatory guidelines, establishing robust supply chains, and leveraging digital marketing strategies to reach consumers.

What will be the Size of the Teeth Whitening Gels Market during the forecast period?

- The teeth whitening gels market encompasses a diverse range of products, catering to various dental needs and consumer preferences. Natural whitening agents, such as activated charcoal, have gained popularity among those seeking alternative solutions for whitening. Premium whitening gels offer intensive results for crowns, dentures, bonding, fillings, braces, bridges, veneers, and implants. Fast-acting gels provide instant gratification, while long-lasting formulas ensure sustained brightness.

- Sensitive teeth formula and cruelty-free, vegan whitening options are available for those with specific concerns. Blue light technology enhances the whitening process for some users. Whitening for smokers and deep whitening gels address the challenges of stubborn stains. Professional-grade whitening gels offer superior results, and plant-based ingredients add an eco-conscious touch to the market.

How is this Teeth Whitening Gels Industry segmented?

The teeth whitening gels industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Hydrogen peroxide

- Carbamide peroxide

- Product Type

- Chemical based

- Natural or Organic based

- Charcoal infused

- Enzyme based

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

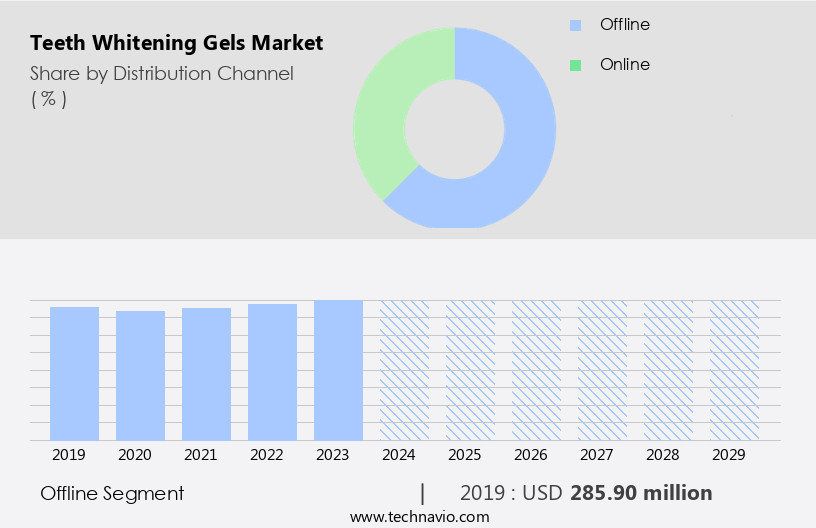

The offline segment is estimated to witness significant growth during the forecast period.

Teeth whitening gels have gained significant popularity in the US market due to the growing trend of smile makeovers and the importance placed on dental health and aesthetics. The integration of LED light activation technology in teeth whitening treatments has led to innovative product offerings, catering to diverse consumer preferences. Dental professionals continue to use carbamide peroxide and hydrogen peroxide-based gels in their practices for dental bleaching and whitening procedures. Product safety standards and regulatory approvals are crucial factors influencing the market's growth. Manufacturers focus on product efficacy testing, quality control, and enamel safety to ensure customer satisfaction and long-term use.

Whitening treatments' results and duration vary, with some gels providing instant results while others require prolonged use. The distribution of teeth whitening gels extends beyond professional settings, with offline channels including hypermarkets, supermarkets, department stores, and drugstores and pharmacies. Price sensitivity and competitive advantage are essential factors in the market, with manufacturers differentiating their products through various means, such as ingredient sourcing, packaging design, and desensitizing agents for sensitive teeth.

Whitening maintenance and the availability of at-home whitening kits further expand the market's reach. Clinical trials and ingredient safety are crucial aspects of product development, with manufacturers focusing on tooth discoloration removal and enamel safety. The US market is driven by the increasing demand for dental aesthetics, consumer preferences, and advancements in teeth whitening technology. The integration of LED light activation, product innovation, and distribution channels catering to various consumer segments contributes to the market's growth. Manufacturers focus on product safety, regulatory approvals, and competitive advantage to maintain their market position and cater to the evolving needs of dental care consumers.

The Offline segment was valued at USD 285.90 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

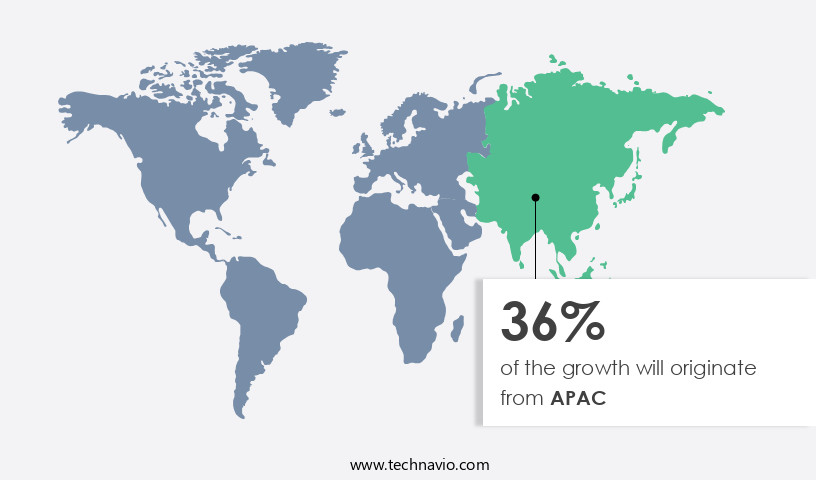

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth and is anticipated to continue this trend throughout the forecast period. Factors such as increasing urbanization, rising consumer spending power, evolving preferences towards dental health and aesthetics, and the adoption of innovative teeth whitening technologies are driving market expansion. The market's growth is further fueled by the large population base in APAC, creating a vast consumer pool. In response, manufacturers are developing multifunctional teeth whitening gels with natural and organic ingredients to cater to consumer demands. LED light activation technology is increasingly being integrated into teeth whitening gels to enhance their efficacy.

Product innovation, such as the development of desensitizing agents for sensitive teeth and longer shelf life, is also a key focus area. Regulatory approvals and stringent product safety standards ensure the delivery of high-quality, effective teeth whitening gels to consumers. The market's competitive landscape is characterized by product differentiation, value proposition, and product efficacy testing, with dental professionals playing a crucial role in promoting and administering teeth whitening procedures. At-home whitening solutions, such as whitening kits and trays, are gaining popularity due to their convenience and affordability. Oral hygiene and dental care are integral to teeth whitening, and the market is expected to continue growing as consumers prioritize these aspects of their overall health and well-being.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Teeth Whitening Gels market drivers leading to the rise in the adoption of Industry?

- The significant expansion of online product accessibility serves as the primary market catalyst. The market has experienced significant growth due to advancements in teeth whitening technology and increasing consumer preferences for a smile makeover. Professional whitening treatments using dental bleaching and LED light activation have gained popularity in cosmetic dentistry. Product innovation, such as over-the-counter gels with reduced tooth sensitivity, has expanded the market reach. The distribution channels for teeth whitening gels have broadened, with online sales becoming increasingly common. As Internet penetration increases, awareness about dental health and teeth whitening treatments has grown, leading to high demand.

- Consumers prioritize product safety standards when selecting teeth whitening gels, ensuring companies focus on delivering effective and safe solutions. Overall, the market is expected to continue growing as consumers seek to enhance their smiles and improve their dental health.

What are the Teeth Whitening Gels market trends shaping the Industry?

- The rising influence of social media is a significant market trend that cannot be ignored. This trend reflects the increasing importance of digital platforms in shaping consumer behavior and business strategies. Teeth whitening gels have gained significant popularity in the personal care industry due to the desire for smile enhancement. Regulatory approvals ensure the safety and efficacy of these products. The duration of whitening results varies, with some gels offering immediate results while others require prolonged use. Carbamide peroxide is a common active ingredient in teeth whitening gels, effectively penetrating tooth enamel to remove stains. Quality control is crucial in teeth whitening gels, ensuring consistent results and maintaining product efficacy. Dental professionals often recommend teeth whitening gels as a safe and effective option for at-home use. Shelf life is an essential factor, with manufacturers ensuring their products maintain their potency throughout the specified period.

- Social media plays a pivotal role in increasing awareness and promoting teeth whitening gels. Consumers turn to social networking sites and blogs for information, making these platforms valuable for product promotion. Companies leverage these channels to engage with consumers and showcase the benefits of their teeth whitening gels. Product differentiation is key in the teeth whitening market, with companies focusing on unique selling propositions to attract customers. Product efficacy testing and clinical trials further validate the safety and effectiveness of these gels, instilling consumer confidence. Overall, teeth whitening gels offer a valuable addition to dental care routines, enhancing personal appearance and boosting self-confidence.

How does Teeth Whitening Gels market faces challenges during its growth?

- The teeth whitening industry faces significant challenges due to the potential side effects associated with the use of whitening gels, which can limit its growth. Teeth whitening gels are widely used for improving dental aesthetics by removing stains and enhancing the brightness of teeth. The manufacturing processes involve the use of hydrogen peroxide as a primary whitening agent. However, the use of these products may lead to side effects, particularly on the oral mucosa. Improper application of the gel or prolonged contact with the gum tissue can result in inflammation, redness, and in severe cases, bleeding and pain. To mitigate these issues, desensitizing agents are often included in whitening products to minimize sensitivity in teeth.

- Ensuring proper sourcing of ingredients and following recommended application procedures are essential to maintain whitening efficacy while minimizing potential side effects. Whitening maintenance, such as regular use of whitening kits or strips, should be carried out under the guidance of dental professionals to ensure optimal results and oral health.

Exclusive Customer Landscape

The teeth whitening gels market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the teeth whitening gels market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, teeth whitening gels market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AuraGlow - This company provides high-quality teeth whitening gel solutions, including AuraGlow Teeth Whitening Gel Syringe Refill Pack.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AuraGlow

- Beaming White LLC

- BMS Dental srl

- CCA Industries Inc.

- Church and Dwight Co. Inc.

- Colgate Palmolive Co.

- CosmoLab Manufacturing

- DaVinci LLC

- FGM Dental Group

- GLO Science

- GoSmile LLC

- NovaWhite

- Only Kosmetik GmbH

- Oralgen

- Pearly Whites

- ProWhiteSmile

- Ultradent Products Inc.

- WSD Labs USA Inc

- Zhengzhou Huaer Electro Optics Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Teeth Whitening Gels Market

- In February 2023, Colgate-Palmolive introduced a new teeth whitening gel product, "Colgate Optic White Renewal Plus," featuring a unique formula with potassium nitrate and fluoride to strengthen enamel and prevent sensitivity while whitening (Colgate-Palmolive Press Release).

- In May 2024, Shiseido Company Limited and GlaxoSmithKline plc announced a strategic partnership to co-develop and commercialize a new line of teeth whitening gels, combining Shiseido's expertise in oral care and cosmetics with GlaxoSmithKline's marketing capabilities (Reuters).

- In October 2024, Dentsply Sirona, a leading dental solutions provider, acquired NuSmile, a California-based company specializing in teeth whitening gels and other cosmetic dental products, for an undisclosed sum, expanding its portfolio and market presence (Dentsply Sirona Press Release).

Research Analyst Overview

The market continues to evolve, driven by consumer preferences for brighter, more radiant smiles. Professional whitening solutions, incorporating LED light activation and cosmetic dentistry procedures, remain popular for their dramatic results. Product innovation in the form of new whitening treatments, technologies, and whitening maintenance solutions caters to the diverse needs of consumers. Dental health is a primary concern, with tooth sensitivity a significant factor influencing market dynamics. Regulatory approvals and product safety standards ensure the efficacy and durability of teeth whitening gels, while dental professionals continue to play a crucial role in providing quality control and dental care. Shelf life, smile enhancement, and value proposition are essential considerations for manufacturers as they strive to differentiate their products and meet evolving consumer demands.

Product efficacy testing, manufacturing processes, and ingredient sourcing are critical components of the development and production of high-quality whitening gels. Oral hygiene and dental aesthetics are integral to the overall dental care experience, with teeth whitening gels offering a solution for tooth discoloration and stain removal. Hydrogen peroxide and carbamide peroxide remain popular whitening agents, while desensitizing agents address tooth sensitivity concerns. Price sensitivity and competitive advantage are key factors shaping distribution channels, with retail sales and e-commerce platforms offering accessible and convenient options for consumers. Whitening kits, trays, and strips cater to various preferences and budgets, ensuring a diverse range of solutions for teeth brightening and teeth whitening solutions.

Ingredient safety and enamel safety are paramount, with clinical trials and ongoing research ensuring the continued improvement and innovation of whitening gels. The market's dynamism reflects the ongoing commitment to providing effective, safe, and high-quality teeth whitening solutions for consumers. The Teeth Whitening Gels Market is flourishing as consumers seek effective solutions for a brighter smile. Innovations in whitening trays enhance convenience, while demand for cruelty-free whitening options grows among ethically conscious buyers. Products promising fast whitening and long-lasting whitening appeal to those looking for quick, durable results. Specialized formulas target whitening for stains, ensuring comprehensive care for various discolorations. Unique solutions like whitening for braces, whitening for veneers, whitening for crowns, whitening for dentures, whitening for implants, and whitening for bridges cater to diverse dental needs.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Teeth Whitening Gels Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 62.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

US, China, India, UK, Germany, Japan, South Korea, Canada, Brazil, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Teeth Whitening Gels Market Research and Growth Report?

- CAGR of the Teeth Whitening Gels industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the teeth whitening gels market growth of industry companies

We can help! Our analysts can customize this teeth whitening gels market research report to meet your requirements.