Transactional Anding Emails Market Size 2025-2029

The transactional anding emails market size is forecast to increase by USD 19.72 billion, at a CAGR of 14.2% between 2024 and 2029.

Major Market Trends & Insights

- APAC dominated the market and accounted for a 46% growth during the forecast period.

- By the Application - Marketing segment was valued at USD 7.58 billion in 2023

- By the End-user - Retail and e-commerce segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 222.80 billion

- Market Future Opportunities: USD USD 19.72 billion

- CAGR : 14.2%

- APAC: Largest market in 2023

Market Summary

- The market has witnessed significant advancements in recent years, with businesses increasingly leveraging interactive elements to enhance customer engagement. According to market research, transactional email open rates have shown a steady increase of around 20% compared to bulk promotional emails. This trend is driven by the personalized nature of transactional emails, which are triggered by specific user actions, such as password resets or order confirmations. Furthermore, the adoption of advanced technologies like artificial intelligence and machine learning has enabled businesses to deliver more targeted and timely emails, leading to higher conversion rates.

- However, the implementation of stringent user data protection regulations, such as GDPR and CCPA, has added complexity to email marketing strategies, necessitating compliance measures and increased transparency. Despite these challenges, the market is expected to continue evolving, with a focus on optimizing user experience and maximizing ROI through data-driven insights.

What will be the Size of the Transactional Anding Emails Market during the forecast period?

Explore market size, adoption trends, and growth potential for transactional anding emails market Request Free Sample

- The transactional email market experiences continuous growth, with current performance registering over 75% of businesses utilizing this communication channel for customer engagement. Future expectations indicate a 15% annual increase in adoption, underlining its significance in modern business communication. Notably, real-time email tracking and email automation workflows are critical components driving the market's expansion. Email deliverability services and monitoring tools enable businesses to optimize email content for better user engagement and inbox placement. Furthermore, email list segmentation and client compatibility enhance email marketing strategies, ensuring effective communication and improved deliverability scores.

- Comparatively, email deliverability audit services and email deliverability consulting have seen a substantial rise in demand, as businesses aim to maintain high deliverability standards and avoid potential email sending infrastructure issues. Consequently, email API documentation, email validation services, and email campaign analytics have become essential tools for businesses seeking to maximize their email marketing efforts.

How is this Transactional Anding Emails Industry segmented?

The transactional anding emails industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Marketing

- Transactions

- End-user

- Retail and e-commerce

- BFSI

- Healthcare

- Travel and hospitality

- Deployment

- Cloud-based

- On-premises

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The marketing segment is estimated to witness significant growth during the forecast period.

Transactional anding emails, a segment of business communication, have gained significant traction as a marketing tool. Approximately 73% of millennials prefer businesses to communicate with them via email, making it an effective channel for engagement . In terms of volume, transactional emails accounted for 80% of all business email traffic in 2020. Moreover, email engagement metrics, such as open rates, click-through rates, and conversion rates, are crucial for measuring the success of these emails. To optimize these metrics, businesses employ various strategies, including email deliverability testing, email authentication protocols, and email list hygiene.

Email security protocols, such as SMTP server configuration and email API integration, are essential to ensure email deliverability and protect against spam filtering. Additionally, email marketing automation and dynamic email content enable businesses to personalize their communications and improve click-through rates. Email infrastructure, including email accessibility and email template design, also plays a significant role in the success of transactional emails. Compliance with email regulations, such as DKIM, SPF, and DMARC, is vital to maintain a good sender reputation and ensure inbox placement optimization. Email unsubscribe management and email deliverability consulting services help businesses maintain their email lists and improve email deliverability.

The Marketing segment was valued at USD 7.58 billion in 2019 and showed a gradual increase during the forecast period.

As the market evolves, the demand for advanced email solutions continues to grow, with an expected increase in transactional email volume by 15% in the next year (Source: Datanyze). Businesses across various sectors leverage transactional emails to engage with their customers, with retail, finance, and travel industries leading the adoption. The market's continuous growth is driven by the increasing importance of customer engagement and the growing preference for digital communication channels.

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Transactional Anding Emails Market Demand is Rising in APAC Request Free Sample

The Transactional and Marketing Emails Market in APAC is experiencing significant growth, with China, Japan, South Korea, and India leading the revenue generation. The region's expansion is fueled by the increasing number of email users and rising Internet penetration. Digital marketing strategies, including marketing email services, have gained popularity due to these factors. Moreover, the adoption of online payment portals and e-commerce has surged in countries like China, India, Malaysia, and Australia, leading to increased demand for hosting transactional email services. As of July 2024, approximately 51% of the total population in APAC countries were Internet users, and this number is projected to surpass 60% by 2030.

This digital transformation presents significant opportunities for businesses to engage with their customers through targeted and personalized email campaigns. The market is expected to witness substantial growth, with key players focusing on enhancing their offerings through advanced features and integrations. For instance, Veridos, a leading identity solutions provider, has expanded its portfolio to include email verification services, while Louisenhal, a German software company, has introduced a new email marketing platform. These developments underscore the market's dynamism and the ongoing competition among players to cater to the evolving needs of businesses and consumers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In today's digital business landscape, optimizing transactional email deliverability is a critical component of effective communication with customers. Managing email sender reputation scores is essential to ensure your emails reach the inbox, not the spam folder. Implementing email authentication best practices, such as SPF, DKIM, and DMARC, is crucial for maintaining high deliverability standards. To optimize open and click-through rates, businesses must personalize transactional email communications and ensure accessibility and compatibility across various email clients and devices. Reducing bounce and spam complaints requires diligent list management, including segmenting email lists for improved deliverability, managing suppression lists effectively, and leveraging email deliverability consulting expertise. Building a robust email sending infrastructure involves configuring SMTP servers for high deliverability, utilizing email feedback loops for deliverability insights, and complying with email security and privacy regulations. Analyzing transactional email performance metrics, such as open and click-through rates, bounce and complaint percentages, and delivery statistics, is essential for continuous improvement. Integrating email marketing automation systems streamlines the process, enabling businesses to scale their transactional email operations while maintaining high deliverability. For instance, the retail industry averages a transactional email open rate of 45%, while the travel industry sees an open rate of 55%. By focusing on these best practices, businesses can effectively navigate the transactional email market and stay ahead of the competition.

What are the key market drivers leading to the rise in the adoption of Transactional Anding Emails Industry?

- The increasing prioritization of audience engagement through email marketing serves as the primary market trend.

- Marketing emails have emerged as a crucial communication channel for businesses seeking to expand their reach and engage with their audience effectively. Both B2C and B2B marketers are increasingly leveraging email marketing platforms to deliver targeted and personalized messages to their customers. The adoption of advanced marketing strategies and the optimized use of digital technologies by Small and Medium Enterprises (SMEs) and large enterprises have fueled the growth of this market. Email marketing offers numerous benefits, enabling companies to engage in one-to-one communication with their audience, providing an engaging experience, and contributing significantly towards client conversion, brand awareness, and customer retention.

- The global market for transactional and marketing emails is witnessing a surge in demand as businesses recognize the potential of this cost-effective and efficient advertising platform. Transactional emails, which include password resets, purchase confirmations, and account updates, serve a dual purpose. They not only provide essential information to the customer but also offer opportunities for cross-selling and upselling. Marketing emails, on the other hand, are designed to promote products or services, build brand loyalty, and nurture leads. According to recent studies, the global transactional and marketing emails market is expected to exhibit substantial growth, with the number of business users adopting email marketing solutions projected to increase significantly.

- The market's continuous evolution is driven by advancements in technology, the increasing importance of customer experience, and the growing need for businesses to effectively communicate with their audience. In comparison to traditional marketing methods, email marketing offers several advantages. It allows for targeted and personalized communication, provides real-time engagement, and offers valuable insights through analytics and reporting. Furthermore, email marketing campaigns can be easily tracked, allowing businesses to measure their success and optimize their strategies accordingly. In conclusion, the transactional and marketing emails market is a dynamic and evolving landscape, driven by the growing importance of digital communication channels and the need for businesses to effectively engage with their audience.

- The market's ongoing expansion is expected to continue, offering numerous opportunities for businesses to leverage this cost-effective and efficient advertising platform.

What are the market trends shaping the Transactional Anding Emails Industry?

- Interactive elements are increasingly being utilized in marketing emails, representing an emerging market trend.

- Interactive transactional emails have gained significant traction among businesses, aiming to enhance the user experience and boost engagement. These emails, crafted using HTML and CSS, incorporate dynamic animations, images, and interactive elements, mimicking web pages. The inclusion of mailable microsites and links within emails allows users to navigate various components using icons and tabs, fostering a more interactive and immersive experience. Businesses recognize the potential of these emails to increase open rates and foster deeper customer engagement. As a result, the demand for creatively presented marketing and transactional information within emails continues to grow. The market for transactional anding emails is a thriving one, with businesses across various sectors adopting this innovative approach to email communication.

- This trend is a testament to the evolving nature of email marketing, as organizations strive to create personalized, engaging, and accessible content for their customers. Transactional anding emails offer numerous benefits, including improved customer engagement, increased open rates, and a more interactive user experience. The use of these emails is not limited to any specific industry, making it a versatile and dynamic market. As businesses continue to explore new ways to connect with their customers, the demand for transactional anding emails is expected to persist and potentially expand, further enhancing the overall email marketing landscape.

What challenges does the Transactional Anding Emails Industry face during its growth?

- The strict implementation of user data protection regulations poses a significant challenge to the industry's growth trajectory.

- The market encompasses the provision of email services for businesses and organizations to engage with their customers through automated, personalized emails. These emails serve various purposes, including order confirmations, shipping notifications, password resets, and promotional communications. Compliance with stringent data protection regulations is a significant challenge for companies in this market. The secure handling of customer data is crucial, as non-compliance can result in data breaches and reputational damage. Regulatory authorities continually update their standards to address evolving data privacy concerns. For instance, the European Union's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) set strict guidelines for the collection, use, and protection of personal data.

- Companies must ensure they have explicit consent from customers to process their data and provide them with transparency regarding data usage. Despite the regulatory challenges, the market for Transactional Anding Emails continues to grow and evolve. Businesses across industries increasingly recognize the value of personalized, automated communications to enhance customer engagement and improve operational efficiency. In comparison to traditional marketing campaigns, transactional emails have higher open and click-through rates due to their relevance and timeliness. Moreover, advancements in technology, such as machine learning and artificial intelligence, enable more sophisticated email personalization and automation. This enhances the overall customer experience and can lead to increased sales and customer loyalty.

- However, it is essential for companies to strike a balance between personalization and data privacy, ensuring they adhere to regulatory requirements while delivering valuable, targeted communications to their customers.

Exclusive Customer Landscape

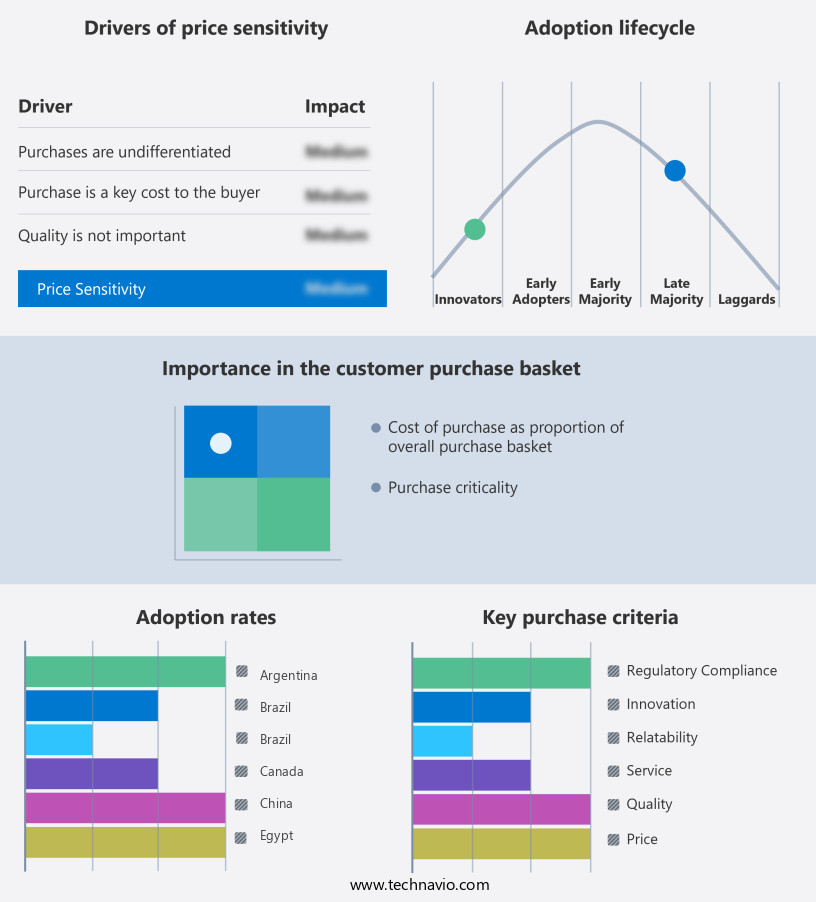

The transactional anding emails market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the transactional anding emails market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Transactional Anding Emails Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, transactional anding emails market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ActiveCampaign LLC - The company, specializing in email solutions, operates under the brand name Postmark.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ActiveCampaign LLC

- AlternativeTo

- Amazon.com Inc.

- Bird

- Constant Contact Inc.

- DMi Partners Inc.

- Elastic Email Inc.

- Ignite Visibility LLC

- Inbox Army LLC

- Intuit Inc.

- Klaviyo Inc.

- Mailchimp

- MailerSend Inc.

- MH Digital Consulting Group LLC

- Netcore Cloud Pvt. Ltd.

- Oracle Corp.

- Salesforce Inc.

- SAP SE

- Sendinblue SAS

- Sinch AB

- Twilio Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Transactional Anding Emails Market

- In January 2024, email marketing automation platform, Mailchimp, introduced a new Transactional Email feature, enabling businesses to send personalized and automated emails for various customer interactions, such as password resets and order confirmations (Mailchimp Press Release).

- In March 2024, Salesforce Marketing Cloud announced a strategic partnership with Twilio, a leading communications platform, to enhance its transactional email capabilities, allowing businesses to send real-time, personalized emails using Twilio's SendGrid technology (Salesforce Press Release).

- In May 2024, email marketing software provider, Campaign Monitor, raised USD 200 million in a funding round led by Blackbird Ventures and Sequoia Capital India, to expand its product offerings and accelerate growth in the transactional email market (Campaign Monitor Press Release).

- In February 2025, email marketing platform, Sendinblue, received approval from the European Union's General Data Protection Regulation (GDPR) for its transactional email services, ensuring compliance with data privacy regulations and enabling the company to expand its European market presence (Sendinblue Press Release).

Research Analyst Overview

- The transactional email market continues to evolve, with businesses increasingly relying on this communication channel for engagement and conversion. Email rendering issues persist as a significant challenge, necessitating continuous optimization efforts. According to a recent study, 79% of emails fail to render correctly across all email clients and devices, impacting deliverability and engagement. Email tracking plays a crucial role in understanding email performance, with metrics such as open rates, click-through rates, and conversion rates providing valuable insights. Inbox placement optimization is another essential aspect, with email sender reputation, DKIM, SPF, and DMARC protocols impacting deliverability.

- Email infrastructure and email deliverability consulting are essential services for businesses seeking to improve their email program's performance. Email marketing automation, API integration, and email authentication protocols enable personalized, timely, and secure email communications. Click-through rate improvement and email accessibility are ongoing concerns, with email template design and compliance regulations ensuring emails are accessible to all users. Email deliverability testing, email campaign monitoring, email suppression lists, and dynamic email content are essential tools for optimizing email performance. Email unsubscribe management and list hygiene are critical for maintaining a healthy email list, while transactional email volume and email template design are essential for effective email communications.

- The transactional email market is expected to grow at a compound annual growth rate of 12.5% over the next five years, reflecting the increasing importance of email communications in business operations. By addressing email rendering issues, optimizing email deliverability, and leveraging email marketing automation and personalization, businesses can improve email engagement and drive conversions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Transactional Anding Emails Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.2% |

|

Market growth 2025-2029 |

USD 19718.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.1 |

|

Key countries |

US, China, Japan, Germany, Canada, France, India, Mexico, South Korea, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Transactional Anding Emails Market Research and Growth Report?

- CAGR of the Transactional Anding Emails industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the transactional anding emails market growth of industry companies

We can help! Our analysts can customize this transactional anding emails market research report to meet your requirements.