Zinc Sulfate Market Size 2024-2028

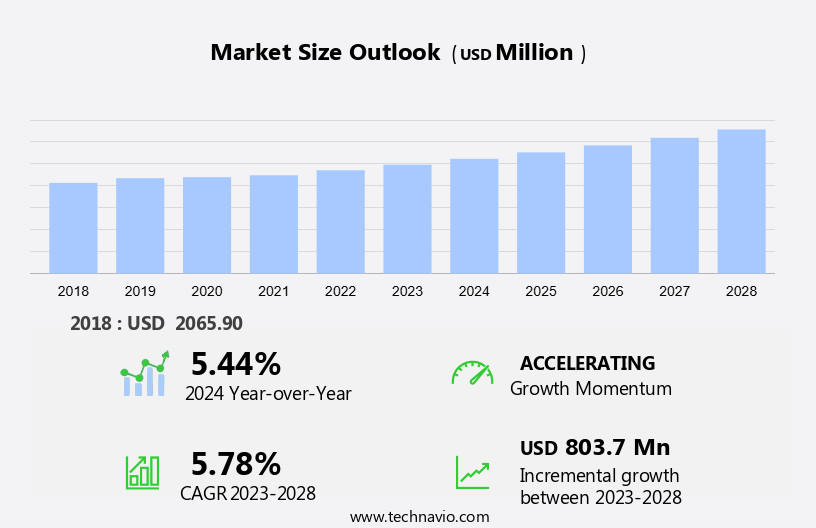

The zinc sulfate market size is forecast to increase by USD 803.7 million at a CAGR of 5.78% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for this compound in various industries. In the agricultural sector, zinc sulfate is widely used as a micronutrient to enhance crop yield and improve soil fertility. Additionally, industries like textile is another major consumer of zinc sulfate, utilizing it In the production of dyes and pigments.

- Beyond textiles and agriculture, it is utilized in various industries, including water treatment, healthcare services, mining, and the production of cosmetics, detergents, and deodorants. However, the market growth is also influenced by the volatility in zinc prices, which can impact the cost-effectiveness of using zinc sulfate. Despite this challenge, the market is expected to continue its upward trajectory due to the essential role of zinc sulfate In these key industries. The market analysis report provides a comprehensive study of these trends and growth factors, offering valuable insights for stakeholders and industry participants.

What will be the Size of the Market During the Forecast Period?

- The market has experienced significant growth in recent years, driven by a increase in usage across various industries. In the agriculture sector, it serves as an essential fertilizer additive, addressing zinc deficiency in crops and enhancing their growth. Fertilizers containing ZnSO4 are increasingly popular due to their cost-effectiveness and ease of application. The textile sector also utilizes it in fabric manufacturing, contributing to its demand.

- Additionally, it finds applications In the pharmaceutical industry for medicine production, particularly for skin-related ailments. In the water treatment industry, it is used as a flocculant and a coagulant, ensuring water clarity and safety.

- The food industry also relies on it as a food additive. With population density continuing to increase and agricultural activity expanding, the market is projected to grow steadily during the forecast period. Furthermore, zinc sulfate's use as an household insecticide and pesticide enhances its versatility and broadens its market reach.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Agriculture

- Medical

- Others

- Type

- Solid

- Liquid

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

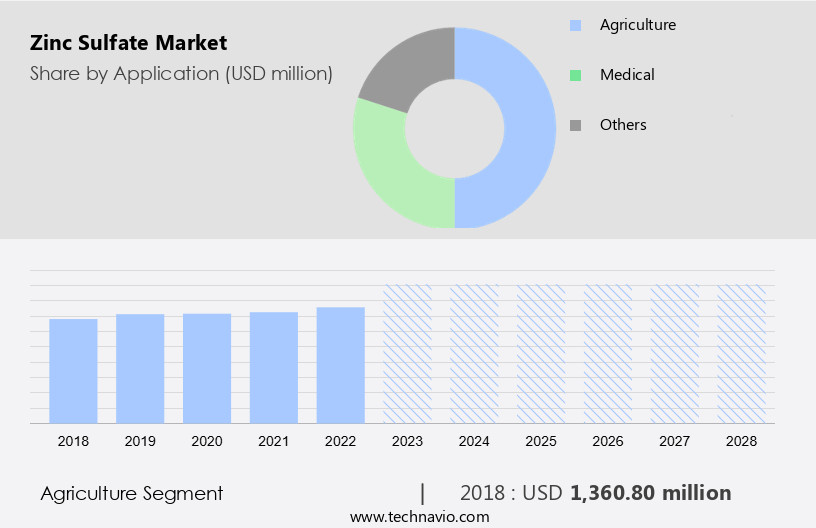

The agriculture segment is estimated to witness significant growth during the forecast period. Zinc sulfate is a crucial ingredient In the agriculture industry as a fertilizer additive, addressing zinc deficiencies in crops. Prevalent in granular fertilizers due to its high water solubility and cost-effective production, zinc sulfate significantly enhances soil nutrient value. The escalating demand for fertilizer additives will fuel zinc sulfate consumption during the projection period. With the expansion of global agriculture activities, particularly in densely populated countries like India and China, the requirement for zinc sulfate is poised to increase. Beyond agriculture, it finds applications in various industries, including textiles, pharmaceuticals, and water treatment. In the textile sector, it serves as a precursor for producing hues for textiles and a raw material for manufacturing synthetic fibers like rayon.

Get a glance at the share of various segments. Request Free Sample

The agriculture segment was valued at USD 1.36 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

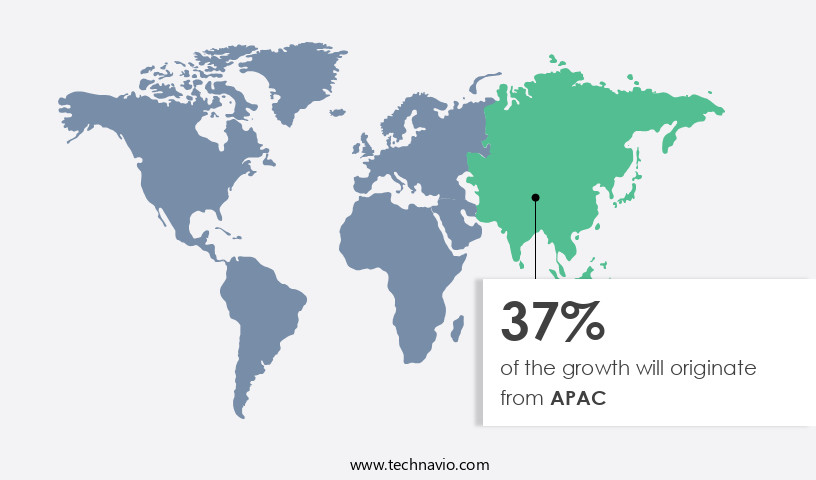

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Zinc sulfate is a crucial ingredient in various industries, including agriculture and textiles. In the agriculture sector, it functions as a fertilizer additive and agricultural spray to address zinc deficiencies in crops and enhance soil nutrients. Zinc sulfate is extensively utilized in producing agrochemicals for fertilizers, benefiting crops such as pecans, deciduous fruits, peanuts, cotton, corn, and others. The agriculture sector's expansion in developing countries in Asia Pacific (APAC), including China, India, Malaysia, and Indonesia, will fuel the demand for fertilizers, thereby increasing zinc sulfate consumption. Moreover, the emphasis on sustainability in agriculture will boost the use of zinc sulfate as a fertilizer additive during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Zinc Sulfate Industry?

Increasing demand for zinc sulfate in agricultural industry is the key driver of the market.

- Zinc sulfate plays a significant role In the agricultural sector, acting primarily as a fertilizer additive to address zinc deficiency in crops. With its high solubility in water and low production cost, zinc sulfate is the preferred choice in granular fertilizers. Zinc sulfate heptahydrate and monohydrate, known for their high solubility in soil, are suitable for various soil types. The agricultural industry's growth, given its substantial contribution to a country's GDP, is expected to fuel the demand in the forecast period. Beyond agriculture, zinc sulfate finds applications In the textile sector as a precursor for producing hues for textiles and as a mordant.

- In the chemical industry, it is used In the production of medicines, tablets, and as a coagulant in water treatment systems. It also serves as an essential raw material In the synthetic fiber industry, including rayon, and as a pigment in lithopone. In the pharmaceutical sector, zinc sulfate is used to cure zinc insufficiency and is an ingredient in various medicinal drugs. In the food industry, it is used as an additive in animal feed and livestock production. The mining industry relies on it for its use in flotation agents and as a corrosion inhibitor. The global demand is influenced by various factors, including population density, agricultural activity, and urbanization.

What are the market trends shaping the Zinc Sulfate Industry?

Rising demand for zinc sulfate in textile industry is the upcoming market trend.

- Zinc sulfate plays a significant role In the textile industry, serving as a crucial ingredient for producing various textile shades and acting as a coagulant in rayon production. In the synthetic fiber industry, it functions as a precursor for the lithopone pigment. The anticipated growth In the global textile sector is expected to boost the demand for zinc sulfate during the forecast period. This chemical is essential for fabric manufacturing, contributing to the production of textiles with diverse hues. Additionally, it is used In the agriculture industry as a fertiliser additive, addressing zinc deficiency in crops and enhancing soil nutrient value.

- It is also employed In the pharmaceutical sector for producing medicines, tablets, and curing zinc insufficiency. Its low production cost and high solubility in water make it a cost-effective and versatile raw material for numerous applications.

What challenges does the Zinc Sulfate Industry face during its growth?

Volatility in zinc prices is a key challenge affecting the industry growth.

- Zinc sulfate, a compound formed by the reaction of zinc and sulfuric acid, is a significant component in various industries. The market has faced price fluctuations due to the decreasing availability of zinc ores and geopolitical tensions, such as the Russian-Ukraine conflict, which impacted zinc production. Zinc is primarily used In the steel industry for manufacturing alloys, with major applications in automotive and construction. The increase in zinc prices will subsequently raise the cost of zinc sulfate production, negatively affecting the market. Beyond the steel industry, it is also essential In the agricultural sector as a fertiliser additive, particularly in addressing zinc deficiency in crops.

- In the textile industry, it functions as a precursor for producing hues for textiles and a coagulant in fabric manufacturing. In the pharmaceutical sector, it is used as an electrolyte, an astringent, and an oral hygiene product, among other applications. The market dynamics are influenced by various factors, including the agrochemical sector's demand for it as a raw material In the production of agrochemicals, industrial chemicals, and corrosion inhibitors for water-treatment systems. The market's growth is also driven by the mining industry's use of it as a flotation agent and In the production of medicines, tablets, and pigments, such as lithopone pigment In the synthetic fiber industry.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alpha Chemicals

- AVA Chemicals Pvt. Ltd.

- BALAJI INDUSTRIES

- Bohigh Group

- Changsha Haolin Chemicals Co. Ltd.

- Changsha Lantian Chemicals Co. Ltd.

- Clean Agro Chemicals

- Grillo Werke AG

- Illinois Tool Works Inc.

- Merck KGaA

- Oasis Fine Chem

- Ravi Chem Industries

- Rech Chemical Co. Ltd.

- Redox Ltd.

- Saba Chemical GmbH

- Sulfozyme Agro India Pvt. Ltd.

- Tianjin Xinxin Chemical Factory

- Vedanta Ltd.

- WATA Chemicals Ltd.

- Zinc Nacional S.A.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Zinc sulfate is a versatile inorganic compound with a wide range of applications in various industries. Its unique properties, such as its low production cost, high solubility in water, and ability to act as a precursor for various chemicals, make it an essential raw material in numerous sectors. In the agricultural industry, zinc sulfate is commonly used as a fertilizer additive to address zinc deficiency in crops. Granular fertilizers enriched with zinc sulfate help improve soil nutrient value and enhance crop productivity. The textile sector also utilizes it as a mordant, which helps improve the color retention of textiles during dyeing processes.

Moreover, it plays a crucial role In the production of various chemicals. For instance, it is used as a precursor In the synthesis of pigments, including lithopone pigment, which is widely used In the synthetic fiber industry. In the pharmaceutical sector, it is used In the production of medicines, particularly In the formulation of tablets to cure zinc deficiency. The cosmetics industry also relies on it as an essential ingredient. It functions as an astringent, an anti-microbial agent, and a cosmetic biocide, helping to clean the skin and deodorize personal care products. It is also used In the production of various industrial chemicals, such as corrosion inhibitors, water-treatment systems, herbicides, and flotation agents.

In addition, the mining industry utilizes zinc sulfate as a coagulant In the clarification process of mineral processing. It is also used In the plating of zinc to produce electroplated parts and as a raw material In the production of rayon fibers. Despite its wide range of applications, the market faces several challenges. Supply-side pressures, such as the high production cost of sulfuric acid, a key raw material in the production, can impact the market's cost-effectiveness. Additionally, sluggish procurement and the buildup of stockpiles can lead to fluctuations in prices. The agrochemical sector's growth is influenced by various factors, including population density, agricultural activity, and the demand for food.

Furthermore, the increasing urbanization and rapid industrialization in developing countries are expected to drive the demand for it in various applications. However, tight monetary conditions and interest rates can impact the sector's growth, as they can affect the procurement of raw materials and the production volume. The market is diverse and dynamic, with various applications in different industries. Its unique properties and wide range of applications make it an essential raw material in various sectors, including agriculture, textiles, pharmaceuticals, cosmetics, industrial chemicals, and mining. Despite the challenges, the market's growth is expected to continue, driven by the increasing demand for food, the growing population, and the expanding industrialization in developing countries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.78% |

|

Market growth 2024-2028 |

USD 803.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.44 |

|

Key countries |

China, US, India, Germany, and Japan |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Zinc Sulfate industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.