Cerebral And Tissue Oximetry Devices Market Size 2024-2028

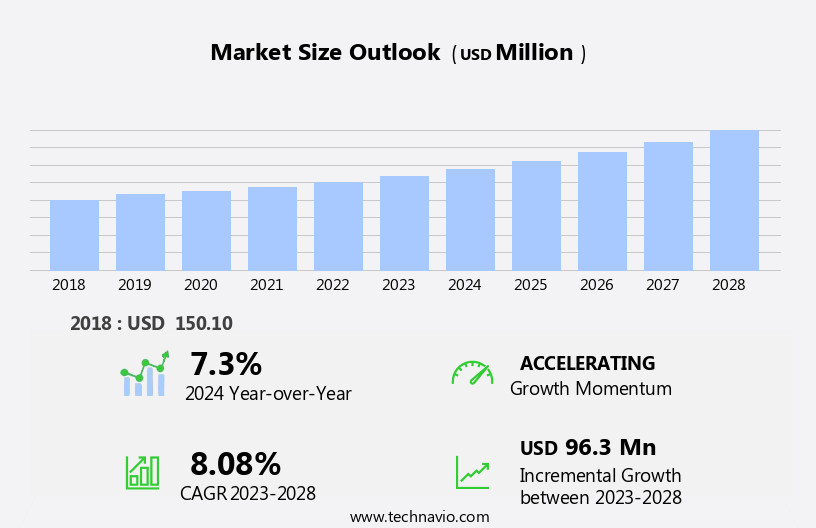

The cerebral and tissue oximetry devices market size is forecast to increase by USD 96.3 million at a CAGR of 8.08% between 2023 and 2028.

What will be the Size of the Cerebral And Tissue Oximetry Devices Market During the Forecast Period?

How is this Cerebral And Tissue Oximetry Devices Industry segmented and which is the largest segment?

The cerebral and tissue oximetry devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Modular devices

- Handheld devices

- End-user

- Hospitals

- Clinics

- Geography

- North America

- US

- Europe

- Germany

- France

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Product Insights

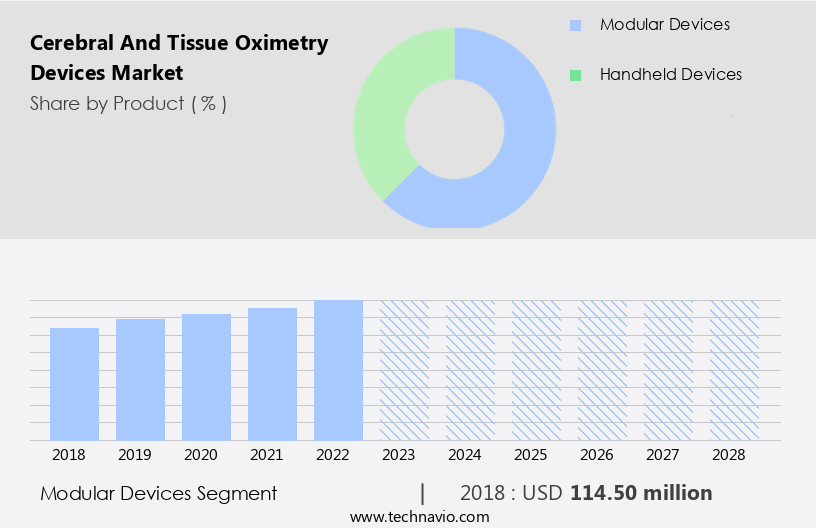

- The modular devices segment is estimated to witness significant growth during the forecast period.

Handheld cerebral and tissue oximetry devices are compact, non-invasive tools used for measuring oxygen saturation levels in various tissues, including muscles, liver, and cerebral tissues. These devices offer real-time data, making them indispensable in various medical settings, such as surgeries in ICUs, research settings, neonatal care for premature infants, and home healthcare. Sensor technologies, data analytics, and wireless connectivity enhance their functionality. These devices are user-friendly, portable, and flexible, allowing for monitoring in various medical specialties, including cardiovascular disorders, neurological conditions, and chronic diseases. Despite their benefits, high device costs and reimbursement policies remain challenges. Integration of AI and machine learning offers potential solutions.

These devices are essential for surgeons and healthcare professionals in monitoring tissue oxygen levels during surgical procedures in operating rooms, outpatient settings, and minimally invasive procedures.

Get a glance at the Cerebral And Tissue Oximetry Devices Industry report of share of various segments Request Free Sample

The Modular devices segment was valued at USD 114.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

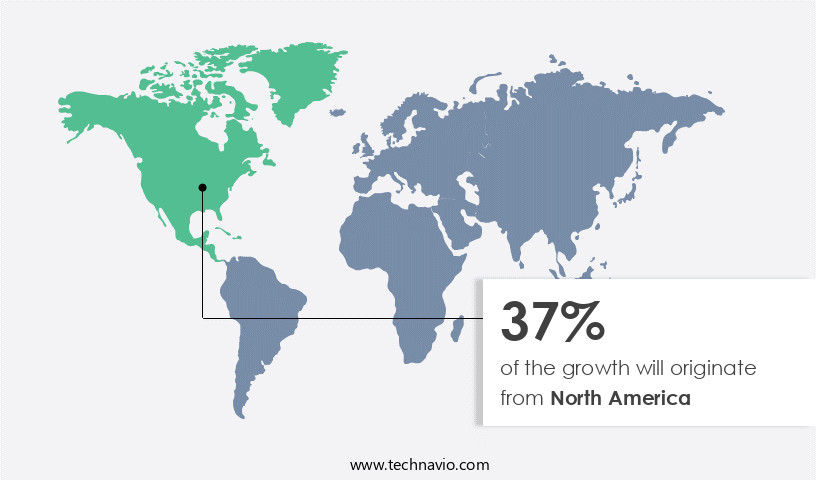

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is currently the largest, driven by the increasing prevalence of cardiovascular diseases (CVD), growing number of surgical procedures, and US FDA approvals. The US, as the key leading country, is home to several prominent companies, such as Nonin Medical, Edwards Lifesciences, ISS, Masimo, and HyperMed Imaging, offering advanced products. These devices provide non-invasive monitoring of cerebral and tissue oxygen levels in real-time, making them essential for various medical settings, including ICUs, surgery, outpatient clinics, and research. Sensor technologies, data analytics, and wireless connectivity are key features enhancing the functionality and user-friendliness of these devices. Neonatal care, premature infants, geriatric population, and patients with neurological conditions, cardiovascular disorders, and chronic diseases benefit significantly from these devices.

High device costs and reimbursement policies remain challenges, while AI integration and home healthcare solutions offer growth opportunities.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cerebral And Tissue Oximetry Devices Industry?

Growing use of cerebral and tissue oximetry devices in cardiac surgical procedures is the key driver of the market.

What are the market trends shaping the Cerebral And Tissue Oximetry Devices Industry?

Technological advances in cerebral and tissue oximetry devices is the upcoming market trend.

What challenges does the Cerebral And Tissue Oximetry Devices Industry face during its growth?

High cost of cerebral and tissue oximetry devices is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The cerebral and tissue oximetry devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cerebral and tissue oximetry devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cerebral and tissue oximetry devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Artinis Medical Systems - Cerebral and tissue oximetry devices employ functional near-infrared spectroscopy (fNIRS) technology to non-invasively monitor changes in cerebral blood oxygenation levels. This innovative approach allows for real-time assessment of brain function and tissue oxygenation status. The device measures the concentration of oxygenated and deoxygenated hemoglobin In the brain, providing valuable insights into metabolic activity and oxygen utilization. This information can be instrumental in various clinical applications, including neurosurgery, intensive care, and research settings. The device's design prioritizes user-friendliness and accuracy, making it a valuable addition to healthcare professionals' toolkit. By offering this advanced brain imaging solution, the company is committed to advancing the field of neurodiagnostics and contributing to improved patient outcomes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Artinis Medical Systems

- Boston Scientific Corp.

- Edwards Lifesciences Corp.

- GE Healthcare Technologies Inc.

- Hamamatsu Photonics KK

- HyperMed Imaging Inc.

- ISS Inc.

- Masimo Corp.

- Medtronic Plc

- Moor Instruments Ltd.

- Nonin Medical Inc.

- Sotera Health Co.

- Spectros Medical Devices Inc.

- Terumo Corp.

- ViOptix Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Cerebral and tissue oximetry devices refer to advanced medical technologies designed to monitor oxygen saturation levels in various tissues, including cerebral tissues. These devices play a crucial role in various medical settings, from intensive care units to surgical procedures and home healthcare. Sensors are the core component of these devices, responsible for detecting oxygen levels in tissues. Muscles and the liver are common targets for oxygen saturation monitoring, as they provide valuable insights into the body's overall health. In research settings, cerebral oximetry devices are used to study the effects of various conditions on cerebral oxygenation levels. Sensor technologies have evolved significantly over the years, with data analytics capabilities becoming increasingly important.

Handheld devices and tabletop systems offer portability and flexibility, making non-invasive monitoring a reality for a wide range of medical specialties. Real-time data is essential for surgeons and healthcare professionals to make informed decisions during surgical procedures and in intensive care settings. Traditional operating rooms and outpatient settings are not the only environments where cerebral oximetry devices are used. Minimally invasive procedures and home healthcare settings also benefit from these advanced monitoring systems. High device costs and complex reimbursement policies can pose challenges for widespread adoption, but the potential benefits far outweigh these obstacles. Artificial intelligence (AI) integration and wireless connectivity are two emerging trends in cerebral oximetry devices.

AI can help analyze vast amounts of data to identify patterns and trends, providing valuable insights for healthcare professionals. Wireless connectivity enables remote monitoring, making it easier for patients to receive care from the comfort of their own homes. Cerebral oximetry devices are not limited to cardiovascular disorders and heart disease. Neurological conditions, such as neurodegenerative diseases and geriatric populations, also benefit from these advanced monitoring systems. The flexibility of these devices allows for monitoring in various medical settings, from operating rooms to home healthcare. The use of cerebral oximetry devices is not limited to surgeons and physicians.

Nurses, technicians, and other healthcare professionals also play a critical role In the successful implementation and utilization of these devices. The data analysis capabilities of these devices provide valuable insights into tissue oxygen levels, helping healthcare professionals make informed decisions and improve patient outcomes. In conclusion, cerebral and tissue oximetry devices represent a significant advancement in medical technology, offering real-time monitoring of oxygen saturation levels in various tissues. These devices are essential in various medical settings, from intensive care units to surgical procedures and home healthcare. The integration of AI and wireless connectivity, along with the flexibility and portability of these devices, make them an invaluable tool for healthcare professionals in managing a wide range of medical conditions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.08% |

|

Market growth 2024-2028 |

USD 96.3 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

7.3 |

|

Key countries |

US, China, Germany, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cerebral And Tissue Oximetry Devices Market Research and Growth Report?

- CAGR of the Cerebral And Tissue Oximetry Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cerebral and tissue oximetry devices market growth of industry companies

We can help! Our analysts can customize this cerebral and tissue oximetry devices market research report to meet your requirements.