ePedigree Software Market Size 2024-2028

The ePedigree software market size is estimated to grow by USD 4.02 billion at a CAGR of 18.69% between 2023 and 2028. In today's dynamic business landscape, companies face escalating demands for serializability to combat counterfeiting and maintain product authenticity. The rapid adoption and proliferation of advanced technologies, such as blockchain and RFID, are essential tools in addressing these challenges. These technologies enable real-time tracking, traceability, and verification, ensuring the integrity of supply chains and reducing the risk of counterfeit products. Moreover, regulatory compliance is a critical aspect of doing business, and companies must adhere to various governmental regulations. Our solution, with its strong serialization capabilities, seamless technology integration, and regulatory compliance features, empowers businesses to mitigate counterfeiting risks, enhance operational efficiency, and maintain a strong market presence.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, Download Report Sample

Market Dynamics and Customer Landscape

The market is experiencing growth fueled by the increasing need for track and trace applications in various industries. While there are restraints such as data security and consumer safety concerns, the market offers significant opportunities for companies offering cloud-based solutions. Real-time tracking and supply chain visibility are key features driving adoption, especially in the pharma supply chain. Companies in this sector are investing heavily in R&D to meet global regulatory and compliance standards. The market landscape depends on the ePedigree software companies, vehicle sales, financials, and upcoming trends. The market is characterized by high-tech developments and a focus on data security to manage the data explosion. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The increase in the rate of technology adoption and proliferation of technologies are notably driving market growth. Innovations and technological advancements, such as RFID technology, barcodes, and advanced sensor markets, are anticipated to experience significant growth due to their simplicity, cost-effectiveness, high reusability, and durability. These advancements are expected to enhance product distribution, enable real-time tracking, ensure data security, improve supply chain visibility, and facilitate the adoption of cloud-based solutions. Additionally, these technologies address consumer safety concerns and require substantial investment in research and development (R&D). These advancements are expected to contribute to the overall market growth, especially with the emergence of new use cases.

Serialization is set to increase collaborations among all entities involved in the pharmaceutical supply chain. This trend is expected to escalate significantly as these advanced technologies become more widespread across the sector. Additionally, the proliferation of cloud-based supply chain capabilities and blockchain technology is poised to boost market growth, making the entire supply chain smarter and more efficient by offering end-to-end quality control solutions. Hence, such factors are driving the market during the forecast period.

Significant Market Trend

Data explosion due to the adoption of software across the pharma value chain is the primary trend in the market. The pharma supply chain network is a huge and disjointed array of networked entities that are inherently different from one another in terms of technological capabilities. Information administration, sharing, and validation over the different levels of the supply chain network is a crucial outcome and requirement for the appropriation of ePedigree and serializability solutions across it. The infrastructural necessities for an ePedigree system involve the sharing and verification of information alongside its secure storage.

Furthermore, the imminent execution of unit-level serialization in major pharma markets is expected to require colossal information stockpiling, calculation, and administration abilities. The scale is tremendous, considering the span of the pharma supply chain. Serialization requires information cooperation for the duration of the life cycle of a product. There will be an impending data explosion across the pharma value chain during the forecast period. Hence, such factors are driving the market during the forecast period.

Major Market Challenge

Huge time and cost requirements for infrastructural implementation is the major challenge impeding market growth. Implementing an ePedigree system starts with analyzing the immediate regulatory environment and the regulatory standards of the market wherein the buyer is expected to operate. Then, the organizational capabilities and requirements are analyzed. It is then followed by the customization of the solution offered by the companies to match the requirements so that compliance is achieved eventually.

All these processes make the total implementation cost, which consists of both hardware and software systems, a giant cost burden on the buyer. To make the packaging lines ready for serialization, massive investments and a lengthy time frame (for implementation) are required. In addition, the software must be customized to diverse regulatory requirements and organizational settings. This further adds to the total cost of implementation. Hence, such factors are hindering the market during the forecast period.

Key Market Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Market Players?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

TraceLink Inc. - The company offers ePedigree software tracking tool which provides information of drug movement in the entire supply chain segment from manufacturer to end consumer. The company offers supply chain platform products such as smart logistics, smart Rx manager, and smart inventory tracker.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market players, including:

- Altair Engineering Inc.

- ANSYS Inc.

- Antares Vision Spa

- Aptean Group of Companies

- Axway Software SA

- Bar Code Integrators Inc.

- Blue Yonder Group Inc.

- Labeling Systems LLC

- Merit Solutions Inc.

- Microsoft Corp.

- Optel Group

- rfxcel Corp.

- Siemens AG

- Oracle Corp.

- SAP SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

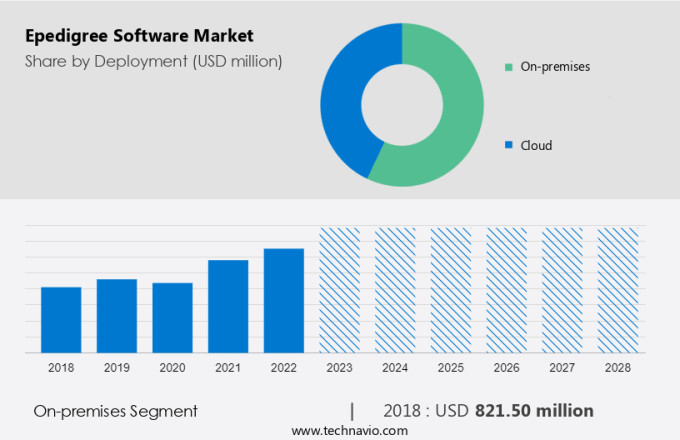

The market share growth of the on-premises segment will be significant during the forecast period. On-premises segment dominates the market as on-premises solutions are more secure compared with cloud solutions. However, since more stakeholders across the value chain come on board for serialization due to the stringent regulatory standards, the cloud model will grow in prominence due to its ease of use, cost-effectiveness, scalability, and flexibility.

Get a glance at the market contribution of various segments Request a PDF Sample

The on-premises segment was valued at USD 821.50 million in 2018 and continued to grow until 2022. The on-premises segment of the global market is expected to witness an increase in its year-over-year growth rate during the forecast period. Even though many of the entities will be switching to and adopting cloud solutions due to the overall efficiency of the cloud model, the market share of the on-premises segment will keep on increasing, owing to the stringent regulations and inherent quality control of the on-premises model. Owing to these factors, the market share of the on-premises segment is expected to be moderate during the forecast period.

By Region

For more insights on the market share of various regions Request PDF Sample now!

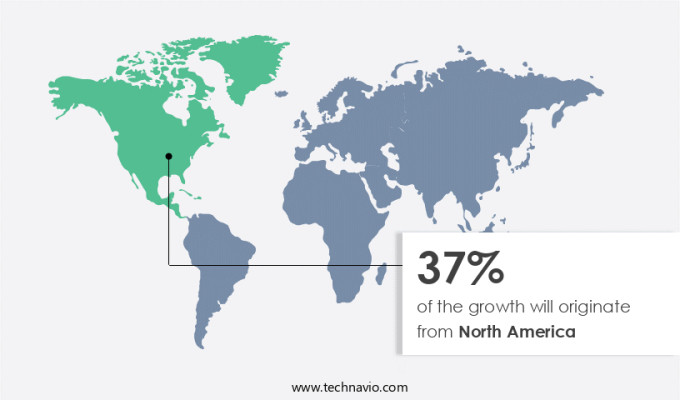

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. North America has a full-fledged and highly regulated market with stringent regulatory standards imposed on the pharma sector. The impressive growth is primarily due to the implementation deadlines of the DSCSA and other regulatory standards that will push the industry toward the faster adoption of ePedigree software during the forecast period. The key standards and regulations governing the pharma sector of the region are the GS1 EPCIS standards, the DSCSA regulations, and the 21 CFR Part 11 of the FDA. Market maturity and the overall awareness of the counterfeit drug market and its intensive growth are the main reasons for the evolving regulatory standards in the region. Furthermore, the constantly evolving regulations and standards have increased the significance of regulations and improved the adoption of ePedigree solutions for compliance requirements. Hence, such factors are driving the market in North America during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments

- Deployment Outlook

- On-premises

- Cloud

- End-user Outlook

- Large Enterprise

- Small and Medium Enterprise

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

The market stands at the forefront of pharmaceutical innovation, offering comprehensive solutions to combat challenges such as contaminated medicine and counterfeit drugs. Leveraging smart devices and cutting-edge technologies like QR codes, RFID, IoT, AR, ML, and VR, ePedigree software ensures the integrity and safety of pharmaceutical products throughout the complex supply chain. Clinical research and outsourcing are streamlined through advanced stock management and inventory maintenance systems, reducing wastage and optimizing storage conditions. The software's track-and-trace capabilities enable real-time monitoring of pharmaceutical products from manufacturing in the pharmaceutical factory to distribution and beyond.

Patient safety is prioritized with strong track-and-trace systems, addressing healthcare expenditures and enhancing drug safety. IT resources are efficiently utilized, benefiting both biotechnology firms and the medical devices sector. The market landscape depends on the Augmented reality (AR), Machine learning (ML), Virtual reality (VR), Wastage of products, Storage of drugs, Hospital Pharmacies, Retail Pharmacies, Drug pedigree, Machine learning, Internet of Things, Track and trace systems. Beyond pharmaceuticals, ePedigree software finds applications in industries like food and beverage and cosmetics, bolstering healthcare IT investments and digital healthcare platforms. Integrated with electronic health records (EHRs) and supply chain management systems, ePedigree software fosters transparency and efficiency, ensuring seamless operations across the healthcare ecosystem. As the demand for secure and reliable track-and-trace solutions grows, ePedigree software emerges as a cornerstone in safeguarding patient health and driving pharmaceutical innovation forward.

In the burgeoning pharmaceutical landscape, ePedigree software emerges as a pivotal solution, ensuring the authenticity and safety of pharmaceutical products. Leveraging advanced technologies such as drug authentication, QR codes, RFID, IoT, AR, ML, and VR, ePedigree software enables comprehensive track-and-trace systems. This facilitates efficient management of the complex pharma supply chain, minimizing wastage and optimizing storage in hospital, retail, and online pharmacies. Through big data analytics and virtual assistants, the software enhances decision-making processes, mitigating risks associated with product authentication and supply chain management. As the demand for secure pharmaceutical solutions grows, ePedigree software plays a critical role in safeguarding patient health and advancing industry standards.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.69% |

|

Market growth 2024-2028 |

USD 4.02 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.01 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 37% |

|

Key countries |

US, Germany, Japan, France, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Altair Engineering Inc., ANSYS Inc., Antares Vision S.p.A, Aptean Group of Companies, Axway Software SA, Bar Code Integrators Inc., Blue Yonder Inc., Labeling Systems LLC, Merit Solutions Inc., Microsoft Corp., Optel Group, Oracle Corp., rfxcel Corp., SAP SE, Siemens AG, and TraceLink Inc. |

|

Market dynamics |

Parent market analysis, market trends and analysis, market growth analysis, market research and growth, Market forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2023 and 2028

- Precise estimation of the size and its contribution to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the industry across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough market forecast analysis of the market's competitive landscape and detailed information about companies

- Comprehensive market analysis and report analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch