Wind Turbine Shaft Market Size 2024-2028

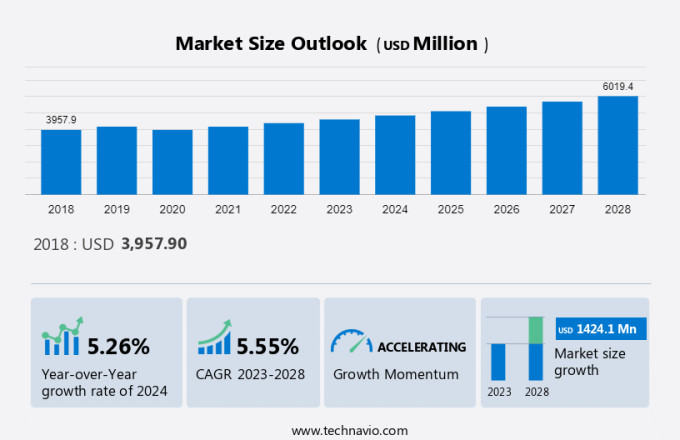

The wind turbine shaft market size is forecast to increase by USD 1.42 million, at a CAGR of 5.55% between 2023 and 2028. Market growth depends on several crucial factors. The rapid growth of the global wind power industry is a primary driver, fueled by the increasing demand for renewable energy sources. Rising investments in clean sources of energy further support this expansion, as both public and private sectors allocate funds towards developing and scaling wind energy technologies. Additionally, regulatory support for wind energy projects plays a significant role, with governments implementing policies and incentives that facilitate the deployment and integration of wind power systems. These elements collectively drive the market forward, promoting advancements in technology, increasing project feasibility, and accelerating the transition towards a sustainable energy future.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The market is driven by the increasing demand for renewable energy sources, particularly wind energy, to reduce CO2 emissions and minimize the carbon footprint. The market is primarily focused on the production of wind turbine shafts, a crucial component of wind turbines that connects the rotor to the generator. Wind turbines are a significant contributor to the electricity generation sector, especially in wind power countries. The transportation sector and petrochemicals industry also rely on wind energy as an alternate fuel. However, government regulations, lockdowns, and disruptions in the supply chain due to raw material supply issues and production rate constraints have affected the market. OEM companies such as Nordex SE dominate the market, with net sales reaching billions. International bodies and energy organizations emphasize the importance of wind power in reducing CO2 emissions and promoting sustainable energy. Design advancements in wind turbines, such as larger rotors and more efficient blades, have increased the demand for stronger and more durable wind turbine shafts. The market is also witnessing growth in the solar energy and hydropower energy sectors, as these industries also require robust shafts for their turbines.

Key Market Driver

Rapid growth of the global wind power industry is notably driving the market growth. The market is experiencing significant expansion due to the increasing demand for eco-friendly electricity sources and government regulations promoting renewable energy. With the global economy growing at a rate of 3.4% annually and a projected population increase from 7.4 billion in 2017 to 9 billion by 2040, the need for sustainable energy solutions is more crucial than ever. Europe and China are leading the way in this market, with Europe's advanced wind technology and China's vast resources and investment in the sector. Onshore wind development has gained significant traction due to technological advancements, including sophisticated electronics and efficient planning and management. These improvements have enhanced the reliability of wind turbine systems and reduced costs, making them a competitive alternative to traditional energy sources. Offshore wind development is also gaining momentum, with new product launches and increasing production rates from OEM companies like Nordex SE. The market is a critical component of wind power generation, with accuracy and functionality playing essential roles in the efficiency and reliability of wind turbines. The market is also influenced by government regulations, supply chain disruptions due to lockdowns, and raw material supply issues. However, the market's long-term growth prospects remain strong, with potential for secondary power generation through combined cycle systems, steam turbines, and exhaust heat recovery.

Further, the shift towards renewable energy sources is reducing CO2 emission and minimizing the carbon footprint of the power sector. Wind power countries are exploring alternate fuels and energy sources like solar and hydropower to diversify their energy mix. Thermal efficiency and noise pollution are also key considerations in wind power development, with peak motor speeds and energy usage optimized to minimize these issues. Water pumping activities and peak power demands are other areas where wind power can make a significant contribution. International bodies like the International Energy Agency (IEA) are promoting wind power as a key component of the global energy mix, with a goal of increasing wind power capacity to 1,200 GW by 2050. This will require continued innovation and investment in wind power technology, including reciprocating engines, wind turbine designs, and energy storage solutions. The wind power industry is expected to continue its growth trajectory, providing opportunities for new product launches and technological advancements. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

Increasing government initiatives for the use of renewable energy resources is the key trend in the market. The market is witnessing significant growth due to increasing government regulations and initiatives to promote the use of eco-friendly electricity sources. With the global shift towards a service-based economy and the rising demand for clean sources of energy, the need for renewable energy resources, particularly wind power, is on the rise. For instance, the Indian government has set ambitious targets for wind energy development, aiming for 5 GW of installed capacity by 2022 and 30 GW by 2030. Similarly, Taiwan's government is actively supporting the development of wind turbine power systems. The production rate of wind turbines has been increasing due to new product launches and technological advancements, leading to higher net sales for OEM companies such as Nordex SE. The efficiency of wind turbines has also been improving, with some models achieving thermal efficiency rates of up to 60%. However, challenges such as supply chain disruptions due to lockdowns and raw material supply issues have affected the industry's production rate. Reliability is a crucial factor in the wind turbine market, with manufacturers focusing on designing wind turbines that can operate at peak motor speeds with minimal energy usage.

Additionally, wind turbines are being used for secondary power generation applications, such as water pumping activities and combined cycle power generation, which utilizes the exhaust heat from the turbine to generate additional power. Despite the benefits of wind power, there are challenges such as noise pollution and CO2 emissions, which international bodies are addressing through regulations and research into alternate fuels and design improvements. Wind power countries such as Denmark, Germany, and China are leading the way in wind energy production, with solar energy and hydropower energy also playing a significant role in the global energy mix. Overall, the wind turbine market is expected to continue growing, driven by government regulations, technological advancements, and the need for sustainable energy sources. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

Increasing adoption of alternative energy sources is the major challenge that affects the growth of the market. The global energy landscape is undergoing a significant shift towards renewable energy sources, particularly wind power, as countries strive to reduce their carbon footprint and meet increasing energy demands. Wind energy, derived from the rotation of wind turbines, is a key contributor to the renewable energy sector. Wind turbines convert wind energy into electricity through a complex mechanical and electrical process. The rotor, a large, wing-like structure, captures the wind and spins the shaft, which drives a generator to produce electricity. Despite the growing popularity of wind energy, traditional energy sources, such as transportation fuels, petrochemicals, and thermal power generation from coal, natural gas, and oil, continue to dominate the global energy mix. According to the International Energy Agency, in 2018, these sources accounted for 64% of total global electricity generation. Government regulations and lockdowns due to the COVID-19 pandemic have disrupted the supply chain and raw material supply, affecting the production rate of OEM companies such as Nordex SE. However, the wind energy market is expected to grow significantly, with new product launches and advancements in design and technology aimed at improving efficiency, reliability, and functionality.

Moreover, the integration of wind energy with combined cycle power plants, secondary power generation, and steam turbines can increase the overall efficiency of the power generation process. Additionally, the use of exhaust heat for secondary power generation, such as water pumping activities, can further enhance the economic viability of wind energy. Despite the benefits of wind energy, concerns regarding accuracy, noise pollution, peak motor speeds, energy usage, and CO2 emissions continue to be raised. International bodies are working to address these issues through research and development of alternate fuels and technologies. The wind power sector is expected to continue its growth trajectory, with key countries such as China, the United States, Germany, and India leading the way. The integration of wind energy with solar energy and hydropower energy is also expected to play a significant role in the future of renewable energy. Hence, the above factors will impede the growth of the market during the forecast period

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

B and D Industrial - The company offers wind turbine main shaft repair that provides repair and engineered upgrades of wind turbine main shaft assemblies.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Acciona SA

- Altra Industrial Motion Corp.

- Bergey Wind Power Co.

- Broadwind Energy Inc

- General Electric Co.

- Jiangsu Huixuan New Energy Equipment Co. Ltd.

- Jiangyin Zenkung Forging Co. Ltd

- Luoyang Yujie Industry and Trade Co. Ltd

- Ming Yang Smart Energy Group Ltd.

- Nordex SE

- Sany Group

- Schaeffler AG

- Senvion Wind Technology Pvt. Ltd.

- Siemens AG

- Sinovel Wind Group Co. Ltd.

- Suzlon Energy Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Application

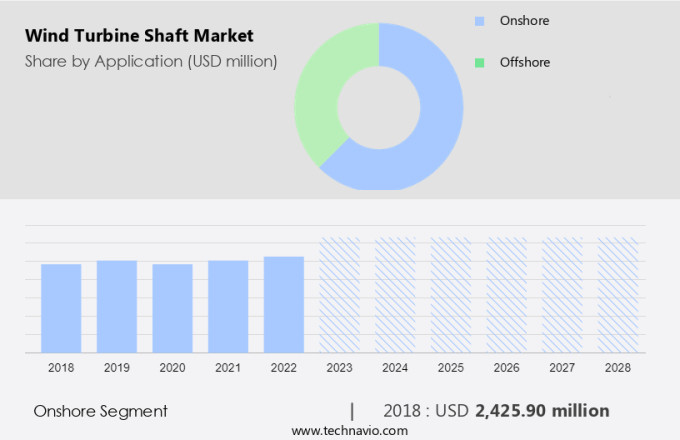

The onshore segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth due to the increasing demand for eco-friendly electricity sources, particularly wind energy. The rotor blades, harnessed by the wind, generate electricity, which is transported and utilized in various sectors such as petrochemicals, transportation, and government regulations. The lockdown and disruptions in the supply chain have impacted the raw material supply and production rate, affecting OEM companies like Nordex SE. New product launches focusing on efficiency and accuracy are essential to meet the growing demand for GW of energy. The design of wind turbines is becoming more complex, integrating functionality with combined cycle systems, secondary power generation, and steam turbines.

Get a glance at the market share of various regions Download the PDF Sample

The onshore segment was the largest and was valued at USD 2.43 billion in 2018. Exhaust heat can be utilized for water pumping activities, reducing energy usage and CO2 emissions. International bodies are emphasizing the importance of alternate fuels, such as wind power, in reducing the carbon footprint. Thermal efficiency and reliability are crucial factors for OEMs, with peak motor speeds and noise pollution being critical considerations. Renewable energy sources like wind, solar, and hydropower are becoming increasingly important in the global energy mix. The market is expected to grow, driven by technological advancements, government incentives, and the need for sustainable energy solutions.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

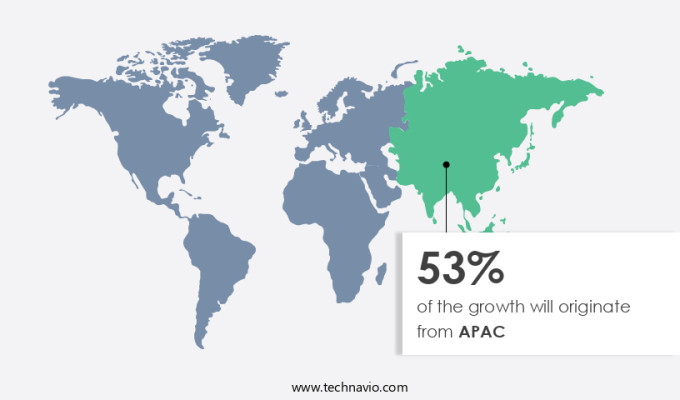

APAC is estimated to contribute 53% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market is witnessing significant growth due to the increasing demand for eco-friendly electricity generation from renewable sources such as wind. The rotor blades of wind turbines harness wind energy and convert it into mechanical power, which is then transferred to the shaft for generating electricity. The transportation sector and petrochemicals industry are major consumers of electricity, driving the market growth. However, government regulations, lockdowns, and disruptions in the supply chain due to raw material supply issues and production rate fluctuations have impacted the market. OEM companies like Nordex SE are focusing on new product launches to improve efficiency and functionality. The combined cycle power plants, secondary power generation from exhaust heat, and steam turbines are emerging trends in the wind energy sector.

In addition, the design of wind turbines is becoming more sophisticated to minimize noise pollution, peak motor speeds, and energy usage. International bodies are promoting the use of alternate fuels and reducing CO2 emissions, further boosting the market. Water pumping activities are also a significant application area for wind turbines, reducing the carbon footprint. The wind power countries like China, Germany, and the US are leading in the adoption of wind energy. Solar energy and hydropower energy are complementary renewable energy sources, and their integration with wind energy is gaining popularity. The thermal efficiency of reciprocating engines and the reliability of wind turbines are critical factors influencing market growth. The market is expected to reach GW of energy generation capacity in the coming years. Accuracy and precision in manufacturing are essential to ensure the optimal functioning of wind turbines.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Application Outlook

- Onshore

- Offshore

- Region Outlook

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

- Wind Turbine Bearing Market Analysis APAC, Europe, North America, South America, Middle East and Africa - China, US, Germany, India, Spain - Size and Forecast

- Wind Turbine Gearbox Market Analysis APAC, Europe, North America, South America, Middle East and Africa - China, US, Germany, India, Spain - Size and Forecast

- Wind Turbine Gear Oil Market Analysis APAC, Europe, North America, South America, Middle East and Africa - China, US, India, Germany, Spain - Size and Forecast

Market Analyst Overview

Wind turbine shafts play a crucial role in the conversion of wind energy into electricity. The wind rotor blades capture the wind's kinetic energy, which is then transferred to the shaft, causing it to spin. This rotation drives the generator, producing electrical power. The market is significantly influenced by the wind energy sector's growth. Factors such as government regulations promoting renewable energy, increasing demand for eco-friendly electricity, and the depletion of traditional energy sources like petroleum are driving the market. However, the market is not without challenges. Supply chain disruptions due to lockdowns and raw material supply issues have affected production rates. OEM companies like Nordex SE have faced net sales declines due to these challenges. Efficiency and reliability are essential factors in wind turbine shaft design. Further, new product launches focusing on accuracy and functionality have gained popularity. Combined cycle power plants and secondary power generation through steam turbines and exhaust heat recovery are also being explored. Noise pollution and peak motor speeds are concerns in wind turbine operations.

In addition, energy usage in water pumping activities and CO2 emissions contribute to the wind turbine's carbon footprint. International bodies are pushing for alternate fuels and energy sources like solar and hydropower to reduce the carbon footprint. The wind power sector's growth is not limited to traditional wind power countries. The market is expanding to include emerging economies, making it an exciting space for innovation and growth. The market is expected to reach new heights, generating over GW of energy in the coming years. In addition, the market is driven by advancements like Combined Cycle Wind Turbines and Integrated Wind Combined Cycle systems. Increasing installation of wind turbines in the industrial and commercial sector emphasizes the need for high-performance shafts. These shafts support eco friendly electricity generation, enhancing the power to weight ratio and efficiency of reciprocating engine and steam turbine. As the demand for clean sources of energy grows, the focus on reducing CO2 emissions and expanding wind energy installation capacity further propels market growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.55% |

|

Market growth 2024-2028 |

USD 1.42 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.26 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 53% |

|

Key countries |

China, US, UK, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ABB Ltd., Acciona SA, Altra Industrial Motion Corp., B and D Industrial, Bergey Wind Power Co., Broadwind Energy Inc, General Electric Co., Jiangsu Huixuan New Energy Equipment Co. Ltd., Jiangyin Zenkung Forging Co. Ltd, Luoyang Yujie Industry and Trade Co. Ltd, Ming Yang Smart Energy Group Ltd., Nordex SE, Sany Group, Schaeffler AG, Senvion Wind Technology Pvt. Ltd., Siemens AG, Sinovel Wind Group Co. Ltd., and Suzlon Energy Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies