What is the Size of Gas Generator Market?

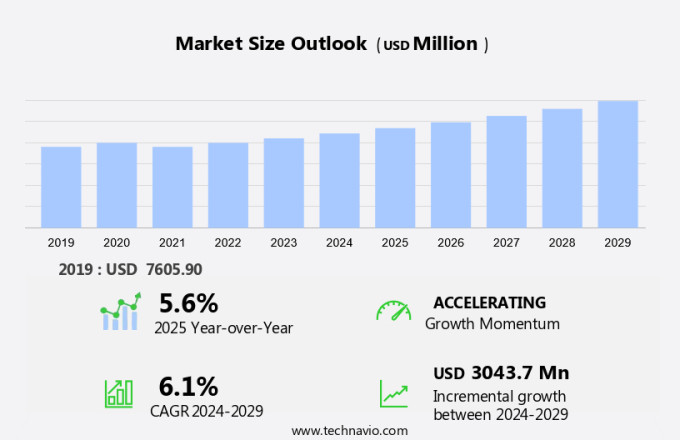

The gas generator market size is forecast to increase by USD 3.04 billion, at a CAGR of 6.1% between 2024 and 2029. The gas generator market is experiencing significant growth due to several key factors. Firstly, the increasing number of power grid failures has led to a greater demand for backup power solutions, driving market expansion. Secondly, the rising demand for repair and remanufacturing of energy equipment is creating opportunities for gas generator manufacturers. Lastly, the availability of diesel generators in the market is providing strong competition, but gas generators offer advantages such as lower emissions and longer runtime, making them a preferred choice for many applications. Further, energy policies promoting clean energy and the adoption of clean energy technologies have driven the demand for gas generators, as natural gas is considered a cleaner alternative to fossil fuels. Overall, these trends are expected to continue shaping the growth of the gas generator market.

Request Free Gas Generator Market Sample

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019 - 2023 for the following segments.

- End-user

- Industrial

- Commercial

- Residential

- Geography

- Europe

- Germany

- France

- Italy

- North America

- APAC

- China

- Japan

- Middle East and Africa

- South America

- Europe

Which is the largest segment driving market growth?

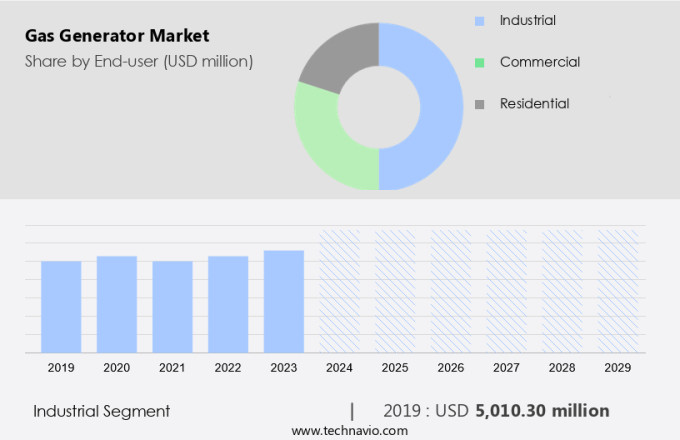

The industrial segment is estimated to witness significant growth during the forecast period. In the industrial sector, gas generators have gained significant traction as a backup power solution for various applications. These generators, fueled by natural gas and greenhouse gas, are increasingly preferred due to the growing regulations against the use of diesel engines and generators in several industries.

Get a glance at the market share of various regions. Download the PDF Sample

The industrial segment was valued at USD 5.01 billion in 2019. The global industrial sector's expansion, particularly in developing countries like China, Brazil, and India, is driving the demand for uninterrupted power supply. Construction sites, mining operations, chemical manufacturing, and semiconductor fabrication are some sectors that heavily rely on gas generators. In many cases, construction sites do not have access to a reliable electricity grid, making gas generators an essential power source for operating necessary equipment at these locations. The construction industry's growth and increased spending worldwide are significant factors contributing to the market's expansion.

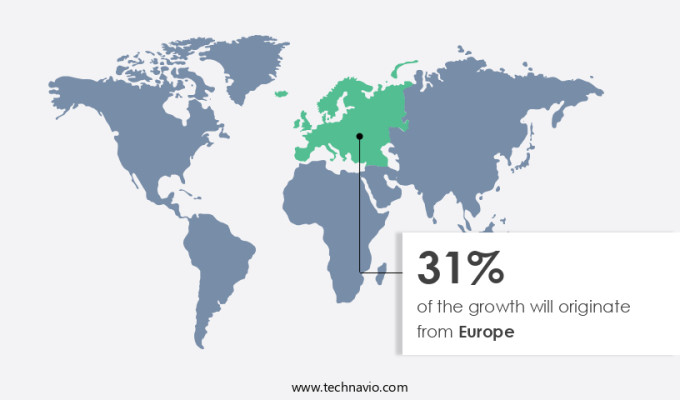

Which region is leading the market?

For more insights on the market share of various regions, Request Free Sample

Europe is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. In Europe, countries such as Russia, the UK, Germany, France, and Italy hold a significant share of the gas generator market. The power grids in these regions are highly dependable, reducing the need for backup power solutions in most cases. However, the demand for reliable fuel sources remains high, particularly in the automotive and energy industries. Europe's abundant natural gas reserves, found in countries like Russia and Norway, contribute to the market's expansion. The region's upstream oil and gas sector has seen substantial investment, further boosting the gas generator market's growth.

How do company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Aggreko Plc: The company offers gas generators that are more versatile and flexible on gas fuel type.

Technavio provides the ranking index for the top 20 companies along with insights on the market positioning of:

- Atlas Copco AB

- Briggs and Stratton LLC

- Caterpillar Inc.

- Champion Power Equipment Inc.

- Chroma Power Systems India Pvt. Ltd.

- Cooper Corp.

- Cummins Inc.

- DIMAX International GmbH

- Endress Elektrogeratebau GmbH

- Generac Holdings Inc.

- Himalayan Power Machines Co.

- Kohler Co.

- Mahindra and Mahindra Ltd.

- R Schmitt Enertec GmbH

- Rolls Royce Holdings Plc

- Teksan Generator Power Industries and Trade Co. Inc.

- Yanmar Holdings Co. Ltd.

Explore our company rankings and market positioning. Request Free Sample

How can Technavio assist you in making critical decisions?

What is the market structure and year-over-year growth of the Market?

|

Market structure |

Fragmented |

|

YoY growth 2024-2025 |

5.6 |

Market Dynamics

The market is expanding rapidly due to innovations in generator market technology and the growing adoption of cleaner fuel solutions. Gas generators for renewable energy sources like solar power and wind power are gaining traction, offering gas generator efficiency and reliable power. With increased demand for gas generators for backup power, the market has seen advancements in generator market adoption and generator market innovation. Gas generator suppliers are focusing on providing high-quality gas generator parts, accessories, and installation services. Gas generators for medical use and emergency power are critical in ensuring reliable energy during crises. Additionally, gas generators for off-grid living, camping, and construction are highly sought after for their portability and versatility. Diesel refueling options continue to support various applications, enhancing gas generator capacity for both commercial and residential use. Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the primary factors driving the market growth?

Increasing instances of power grid failure is the key factor driving the market growth. The generator industry is experiencing significant growth due to the increasing demand for reliable fuel sources to address power outages and grid failures. With the global population explosion and the resulting wave in energy consumption, particularly in developing countries, the pressure on existing power grids has become immense. This pressure often leads to power overload, resulting in power outages and blackouts, which can have detrimental effects on human activities and the environment. Natural gas generators offer several advantages, including lower carbon emissions, higher power capacity, and easier maintenance compared to diesel generators. These factors have made gas generators a popular choice for utilities, residential applications, and small-scale industries.

Further, natural gas is a finite resource, and its extraction and transportation can have negative environmental impacts, including deforestation and carbon emissions. However, with advancements in technology and the ongoing focus on reducing carbon emissions, the future of the gas generator market looks promising. In conclusion, the demand for gas generators is on the rise due to the need for reliable fuel sources to address power outages and grid failures. The shift towards cleaner fuel sources, such as natural gas, is driving the growth of the generator industry. Despite the challenges, the future of the gas generator market looks promising, with advancements in technology and a focus on reducing carbon emissions. Thus, such factors are driving the growth of the market during the forecast period.

What are the significant trends being witnessed in the market?

Rising demand for repair and remanufacturing of energy equipment is the primary trend shaping the market growth. The generator industry is witnessing significant growth due to increasing energy policies promoting clean energy and reducing power outage rates. Gas generators, specifically natural gas generators, are gaining popularity as a reliable fuel source for power supply in various sectors, including utilities, industrial, residential, and small-scale industries. The demand for gas generators is driven by human activities, population explosion, and natural calamities, which often lead to power outages and the need for backup power sources. Natural gas generators offer several advantages, such as lower carbon emissions compared to fossil fuels, and are more environmentally friendly. However, the high initial investment cost and maintenance requirements, particularly for diesel maintenance, can be a deterrent for some end-users.

Moreover, natural gas generators are also used in critical applications, such as water treatment and wastewater treatment, where the cost of investment is high. In such cases, the repair or remanufacturing of worn-out components using advanced technologies, such as plasma arc welding and laser cladding, can be a cost-effective solution. In conclusion, the gas generator market is expected to grow significantly due to increasing power capacity demand, the need for reliable power sources, and the shift towards cleaner energy sources. Gas generators offer several advantages, including lower carbon emissions and the ability to provide backup power during power outages. The use of advanced repair and renovation technologies can also make gas generators a cost-effective solution for critical applications. Thus, such trends will shape the growth of the market during the forecast period.

What are the major market challenges?

The availability of diesel generators in market is the major challenge that impedes market growth. The generator industry, driven by the increasing demand for reliable fuel sources, has seen a shift towards gas-fired generators. According to recent market research, the generator market revenue is projected to grow significantly due to the rising power demand in various sectors, including utilities, residential, and small-scale industries. Energy policies promoting clean energy and the adoption of clean energy technologies have also contributed to the growth of the gas generator market. Natural gas, as a fuel source, is becoming increasingly popular due to its lower carbon emissions compared to fossil fuels. Gas generators offer several advantages, including lower maintenance costs compared to diesel generators, and their ability to provide power during power outages caused by natural calamities or human activities. Despite the advantages of gas generators, there are challenges, such as the need for natural gas infrastructure and the potential for higher upfront costs compared to diesel generators.

However, the benefits of lower emissions and improved fuel economy make gas generators an attractive option for many industries. The generator industry is continuously innovating to improve the efficiency and reliability of gas generators. For instance, advances in power capacity and technology have led to the development of natural gas generators that can provide power to entire communities during power outages caused by natural disasters or other power supply disruptions. In conclusion, the generator market is expected to grow significantly due to the increasing demand for reliable power sources and the adoption of clean energy policies. Gas generators offer several advantages, including lower carbon emissions, lower maintenance costs, and improved fuel economy, making them an attractive option for various industries. The industry is continuously innovating to address the challenges of natural gas infrastructure and higher upfront costs, and the future looks promising for the gas generator market. Hence, the above factors will impede the growth of the market during the forecast period.

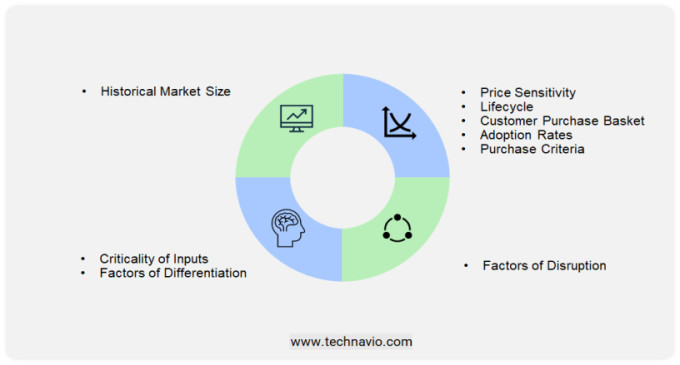

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. The market forecast report focuses on adoption rates in different regions based on penetration and market trends. Furthermore, the market research and growth report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

The market is witnessing significant growth, driven by the increasing demand for reliable power solutions across various sectors. Gas generator for medical use, server rooms, and emergency power are crucial for maintaining continuous operations in critical environments. With the rising focus on clean fuel, gas generator for renewable energy applications, including wind power and solar power, are gaining popularity for their sustainability. The market also sees demand for portable gas generator for camping and off-grid living, offering flexibility and convenience. Gas generator for hybrid power solutions and construction applications provide strong performance. Key market players offer gas generator maintenance, repair, installation, and essential accessories, ensuring long-term reliability. The gas generator advantages include cost-effectiveness, ease of use, and gas generator power capacity, making them ideal for both backup power and off-grid energy solutions.

Further, the market is evolving with diverse applications across sectors. Gas generator for medical use ensure continuous power in healthcare settings, while gas generator for server room provide critical backup power for data centers. The growing demand for portable gas generator is fueled by their versatility for camping and off-grid living. Additionally, gas generator for renewable energy applications, including wind power and solar power, support sustainable energy solutions.In construction, gas generator for construction sites offer reliable power, while gas generator for backup power ensures homes and businesses stay operational during outages. With efficient gas generator installation, repair, and essential accessories, these solutions provide long-term reliability. The generator market supply chain plays a vital role in ensuring timely delivery of gas generator for emergency power and supporting the transition to cleaner energy.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2024 |

|

Historic period |

2019 - 2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market growth 2025-2029 |

USD 3.04 billion |

|

Regional analysis |

Europe, North America, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

Europe at 31% |

|

Key countries |

Germany, China, Japan, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aggreko Plc, Atlas Copco AB, Briggs and Stratton LLC, Caterpillar Inc., Champion Power Equipment Inc., Chroma Power Systems India Pvt. Ltd., Cooper Corp., Cummins Inc., DIMAX International GmbH, Endress Elektrogeratebau GmbH, Generac Holdings Inc., Himalayan Power Machines Co., Kohler Co., Mahindra and Mahindra Ltd., R Schmitt Enertec GmbH, Rolls Royce Holdings Plc, Teksan Generator Power Industries and Trade Co. Inc., and Yanmar Holdings Co. Ltd. |

|

Market Segmentation |

End-user (Industrial, Commercial, and Residential) and Geography (Europe, North America, APAC, Middle East and Africa, and South America) |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies