Medical Terminology Software Market Size 2025-2029

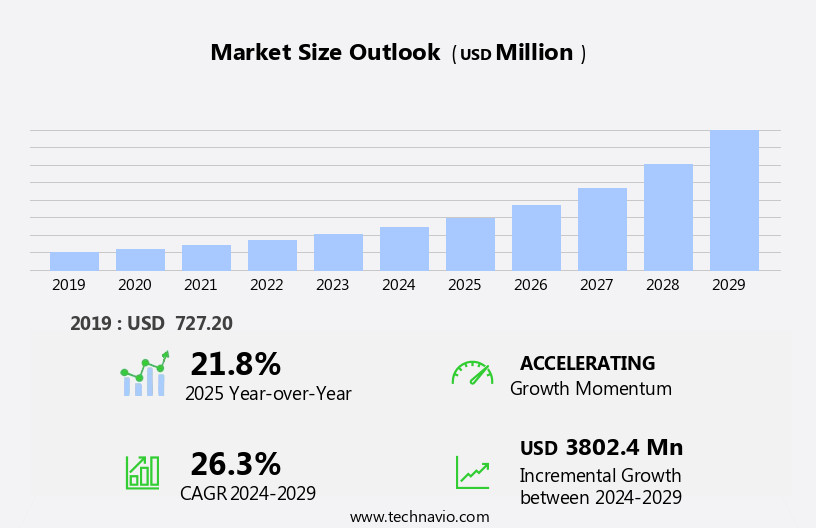

The medical terminology software market size is forecast to increase by USD 3.8 billion at a CAGR of 26.3% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing emphasis on minimizing medical errors and enhancing healthcare efficiency. With the expanding adoption of Healthcare Information and Communication Technology (HCIT), medical terminology software has become an indispensable tool for healthcare providers. However, market expansion is not without challenges. Regulatory hurdles, such as adherence to strict data privacy regulations, impact adoption and necessitate robust security measures. Additionally, supply chain inconsistencies and the need for continuous software updates to maintain accuracy pose challenges.

- Technological innovations, such as artificial intelligence and machine learning, are being integrated into medical terminology software to enhance its capabilities. Despite these obstacles, opportunities abound for companies that can effectively navigate these challenges and offer innovative solutions. By focusing on user-friendly interfaces, seamless integration with existing systems, and robust data security, medical terminology software providers can capitalize on the market's potential for growth.

What will be the Size of the Medical Terminology Software Market during the forecast period?

- In the dynamic US healthcare industry, decision support solutions have emerged as essential tools for healthcare organizations to enhance interoperability and improve patient care. Epic, a leading provider of electronic health records (EHR), is at the forefront of this trend, enabling clinical studies and data aggregation for better quality reporting. Government norms mandate compliance obligations for hospitals and hospital departments, necessitating seamless data integration and interoperability. This is crucial for effective public health surveillance, hospitalizations, and medical billing. Traditional techniques for managing patient data and clinical errors have given way to advanced technologies, including CROs and R&D operations, which prioritize decentralized clinical trials and data aggregation.

- Patient safety concerns, reimbursement, and disparity are significant factors driving the adoption of these technologies. Medical errors, a major concern for patient safety, can be mitigated through EHR and data integration, ensuring accurate claim submissions and condition tracking. Interoperability between healthcare providers plays a vital role in addressing disparities and improving patient epidemiology. The projection period for this market is marked by increasing emphasis on patient safety, government norms, and reimbursement, making it an exciting space for innovation and growth.

How is this Medical Terminology Software Industry segmented?

The medical terminology software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Healthcare providers

- Healthcare payers

- Healthcare IT vendors

- Type

- Services

- Platforms

- Application

- Data integration

- Data aggregation

- Reimbursement

- Clinical trials

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

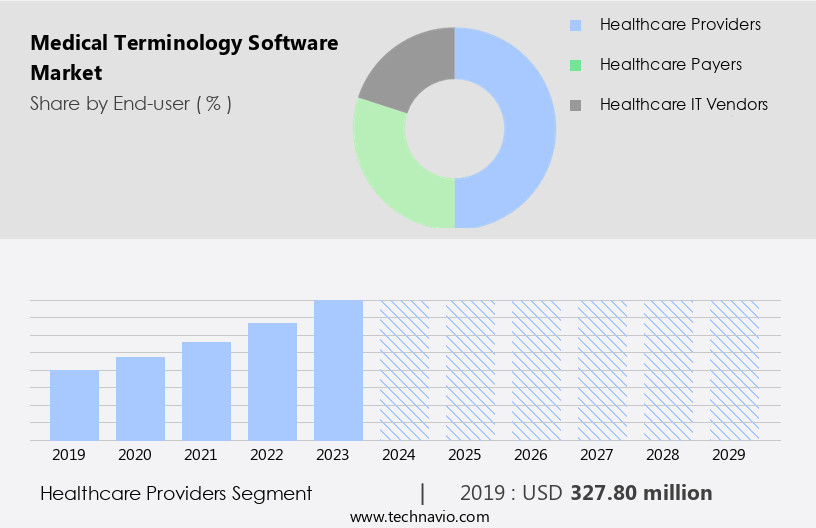

The healthcare providers segment is estimated to witness significant growth during the forecast period. Medical terminology software is a crucial tool for various healthcare organizations, including hospitals, clinics, doctor offices, long-term care facilities, and other healthcare providers. This segment relies heavily on medical terminology software for accurate and consistent clinical documentation, coding, and information sharing. The software is indispensable for healthcare providers, as it streamlines clinical workflows, enhances patient data administration, and supports billing and coding procedures. The market for medical terminology software is witnessing significant advancements, driven by technological innovations, new healthcare solutions, and regulatory compliance obligations. Compliance with government norms, such as interoperability and data integrity, is a major factor propelling the adoption of medical terminology software. Big data derived from EHR systems is transforming healthcare delivery, particularly in managing chronic diseases

New healthcare solutions, such as Electronic Health Records (EHR) and Decentralized Clinical Trials, are also fueling the demand for medical terminology software. Pricing analysis reveals that medical terminology software is available at various price points, catering to the diverse needs and budgets of healthcare providers. The software's components include terminology content, data integration, and decision support, among others. Growing markets, such as public health surveillance and patient safety concerns, are also contributing to the market's expansion. R&D operations continue to focus on improving the software's functionality, ensuring data reliability, and addressing patient data privacy concerns.

Healthcare providers must adhere to various regulatory frameworks, such as HCIT adoption and trade regulations, to ensure data security and privacy. The market is fragmented, with numerous companies offering medical terminology software. However, some dominant players, such as Epic, are leading the market with their advanced offerings and expert analysis. Medical terminology software is essential for healthcare providers to maintain accurate patient data, minimize clinical errors, and ensure efficient healthcare operations. The market is projected to grow steadily in the coming years, driven by the increasing demand for reliable data sharing, therapy management, and patient epidemiology analysis.

The Healthcare providers segment was valued at USD 327.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

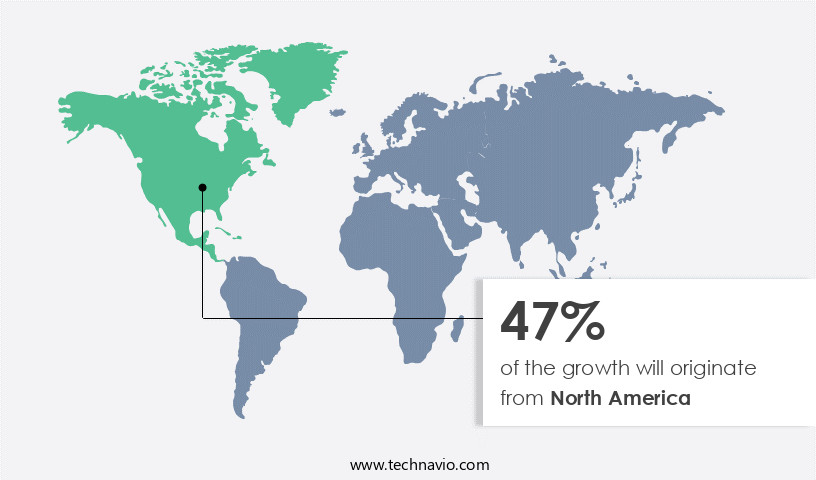

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing growth due to escalating healthcare expenditures. In 2024, US healthcare spending reached an impressive USD 4.9 trillion, equating to USD 14,570 per person and representing 17.6% of its GDP. This significant spending is largely attributed to major federal healthcare programs, such as Medicare, Medicaid, and the Children's Health Insurance Program (CHIP), as well as the creation of health insurance exchange subsidies under the Affordable Care Act (ACA). The increasing investments in healthcare systems and infrastructure are leading to an increase in the adoption of healthcare information technology (HCIT), thereby fueling the demand for medical terminology software solutions.

These software applications play a crucial role in ensuring data integrity, facilitating interoperability, and enabling reliable data sharing among healthcare professionals and providers. They help streamline clinical studies, medical billing, and clinical information management, while also supporting decision-making and patient safety initiatives. Medical terminology software is also essential for maintaining regulatory compliance, public health surveillance, and quality reporting. Moreover, the market is witnessing the emergence of new healthcare solutions and technological innovations, such as electronic health records (EHRs), telemedicine, and artificial intelligence (AI). These advancements are transforming healthcare operations, hospital departments, and healthcare organizations, making medical terminology software a vital component of these evolving systems.

However, the market is not without challenges. Compliance obligations, data integrity concerns, and the fragmentation of terminology content pose significant challenges. Additionally, the integration of medical terminology software with existing systems, such as EHRs and hospital information systems, can be complex. These factors, coupled with the need for continuous updates to maintain terminology accuracy and relevance, necessitate ongoing R&D efforts and collaboration with clinical experts and regulatory agencies. Despite these challenges, the market's growth prospects remain promising, with expanding applications in areas like patient safety, hospitalizations, and clinical trials. The adoption of HCIT is expected to continue, with governments, payers, and healthcare organizations increasingly recognizing the importance of accurate and accessible medical terminology for effective healthcare delivery and improved patient outcomes.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Medical Terminology Software market drivers leading to the rise in the adoption of Industry?

- The increasing priority placed on reducing medical errors serves as the primary market driver. Medical terminology software plays a crucial role in the healthcare industry by facilitating accurate communication and data management. This market is driven by several factors, including product approvals, pipeline analysis, and compliance obligations. Application niches span from hospital departments to public health surveillance, requiring software solutions that cater to various components and growing markets. Technological innovations and new healthcare solutions continue to emerge, necessitating pricing analysis and R&D operations to stay competitive. Quality reporting and data integrity are essential for maintaining patient safety and regulatory compliance. Medical terminology software must adapt to these evolving requirements, ensuring data accuracy and security.

- Medical errors, a significant public health concern, are a leading cause of death worldwide. These errors can be categorized as omissions and commissions. With the increasing focus on patient safety, medical terminology software plays a vital role in minimizing errors and improving healthcare outcomes. The market's growth is underpinned by the need for efficient, reliable, and user-friendly software solutions to address the complexities of healthcare data management.

What are the Medical Terminology Software market trends shaping the Industry?

- Increasing adoption of Health Information and Communication Technology (HCIT) in the healthcare industry is the new trend shaping the growth. HCIT solutions, which include medical terminology software, streamline various aspects of healthcare delivery, from workflow optimization and revenue management to care delivery and patient engagement. According to numerous studies, healthcare organizations are increasingly embracing HCIT to improve patient care efficacy and enhance the adoption of medical terminology software. This enables medical professionals to continue documenting patient care using free text, which is then automatically translated into coded data for compliance with reimbursement and quality reporting requirements.

- This, in turn, leads to improved clinical, operational, and financial outcomes. Furthermore, government norms emphasizing patient safety concerns and interoperability have accelerated the need for medical terminology software to address disparities in patient data and conditions, such as hospitalizations and patient epidemiology. As a result, the market for medical terminology software is projected to grow steadily during the forecast period.

How does Medical Terminology Software market faces challenges face during its growth?

- The growth of the healthcare industry is significantly impacted by the pressing concern for ensuring the security and protection of patient data. The market faces a critical challenge in the form of cybersecurity threats, which have intensified with the adoption of advanced technologies in the healthcare industry. The sensitive nature of medical data, including electronic health records, makes it a prime target for cyberattacks. Consequently, many healthcare organizations are cautious about implementing technologically advanced solutions due to privacy concerns. Maintaining the regulatory framework and adhering to trade regulations are essential for companies in this market. Clinical studies, medical billing, and clinical information management are key processes that require reliable data sharing among various stakeholders, including Contract Research Organizations (CROs), hospitals, and government agencies.

- Decentralized clinical trials and therapy development further complicate the need for secure and accurate medical language processing. Ensuring the security of terminology content is a significant responsibility for companies in the market. The consequences of a virus or data breach can be severe, including financial losses, reputational damage, and potential harm to patients. As such, investing in robust cybersecurity measures and adhering to regulatory guidelines is crucial for market success.

Exclusive Customer Landscape

The medical terminology software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the medical terminology software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, medical terminology software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company offers medical terminology software, such as health information systems that support the entire journey from patient visit to payment.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Apelon Inc.

- B2i Healthcare Pte Ltd.

- BITAC MAP SL

- BT Clinical Computing

- Clinical Architecture LLC

- Epic Systems Corp.

- Henry Schein Inc.

- HiveWorx

- Intelligent Medical Objects Inc.

- Medaara Healthcare Solutions

- Medocomp Systems Inc.

- Regenstrief Institute

- Rhapsody

- SNOMED International

- Spellex Corp.

- West Coast Informatics LLC

- Wolters Kluwer NV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Medical Terminology Software Market

- In February 2023, IBM Watson Health introduced a new version of its medical terminology software, IBM Watson Health Terminology, which incorporates artificial intelligence and natural language processing capabilities to improve accuracy and efficiency in coding and clinical documentation (IBM Press Release). This development signifies a significant technological advancement in medical terminology software.

- In May 2024, Cerner Corporation and Amazon Web Services (AWS) announced a strategic partnership to integrate AWS's cloud services with Cerner's health care IT solutions, including its medical terminology software. This collaboration aims to enhance interoperability and data accessibility for healthcare providers (Cerner Press Release).

- In October 2024, Meditech, a leading electronic health record (EHR) company, completed the acquisition of MedQuist, a medical transcription and coding services company. This acquisition will enable Meditech to offer integrated medical terminology services and coding solutions to its EHR clients (Meditech Press Release).

- In January 2025, the Office of the National Coordinator for Health Information Technology (ONC) launched a new initiative to standardize medical terminology and coding systems across the US healthcare industry. The initiative includes the adoption of the SNOMED-CT (Systematized Nomenclature of Medicine - Clinical Terms) standard for electronic health records, which will improve data interoperability and patient care (ONC Press Release).

Research Analyst Overview

In the dynamic and evolving market, the ongoing pursuit of new healthcare solutions and technological innovations continues to shape the landscape. Medical terminology software plays a crucial role in healthcare data management, enabling healthcare professionals and organizations to effectively communicate and document patient care. One significant trend in this market is pipeline analysis, which involves examining the development stages of various medical terminology software products. This analysis provides insights into the potential growth of the market and the emergence of new application niches. Pricing analysis is another key area of focus, as healthcare organizations seek to optimize their budgets and maximize the value of their investments.

The use of medical terminology software extends to various hospital departments and healthcare operations, from electronic health records (EHR) and medical billing to public health surveillance and clinical studies. Compliance obligations, data integrity, and interoperability are essential considerations in the development and implementation of these solutions. Governments and regulatory agencies play a significant role in the market, with an increasing focus on data sharing and reliable information exchange. This is particularly important in the context of healthcare disparities and patient safety concerns. Reimbursement and trade regulations also impact the market, with payers and healthcare providers seeking to optimize their processes and improve decision support.

Technological innovations, such as decentralized clinical trials and AI-powered linguistic solutions, are transforming the way medical terminology software is used in healthcare. These advancements offer new opportunities for data aggregation and analysis, improving the overall quality of healthcare reporting and patient care. The market for medical terminology software is fragmented, with a diverse range of players and offerings. This fragmentation presents both opportunities and challenges, as organizations seek to differentiate themselves and meet the evolving needs of healthcare providers and patients. The use of medical terminology software is not limited to traditional techniques, with growing markets in areas such as patient epidemiology, therapy, and clinical information.

These areas require specialized terminology content and advanced data integration capabilities, highlighting the importance of ongoing R&D operations and expert analysis. The market is characterized by ongoing regulatory framework changes and compliance obligations. This includes CROs, government norms, and industry standards, which impact the development and implementation of medical terminology software solutions. In the context of the human body and medical language, medical terminology software plays a critical role in ensuring data accuracy and reducing medical blunders. This is particularly important in the context of clinical errors, which can have significant consequences for patient safety and healthcare outcomes.

The projection period for the market is marked by continued growth and innovation, with a focus on improving data sharing, enhancing decision support, and optimizing healthcare operations. This will require ongoing investment in R&D, as well as a commitment to data security and privacy. In summary, the market is a dynamic and evolving landscape, shaped by ongoing technological innovations, regulatory changes, and the evolving needs of healthcare providers and patients. Medical terminology software plays a crucial role in healthcare data management, enabling more effective communication, documentation, and decision making. The market is characterized by ongoing fragmentation, with a diverse range of players and offerings, and a focus on improving data integrity, interoperability, and patient safety.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Medical Terminology Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 26.3% |

|

Market growth 2025-2029 |

USD 3.80 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

21.8 |

|

Key countries |

US, Canada, Mexico, Germany, UK, China, France, Japan, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Medical Terminology Software Market Research and Growth Report?

- CAGR of the Medical Terminology Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the medical terminology software market growth and forecasting

We can help! Our analysts can customize this medical terminology software market research report to meet your requirements.