Road Haulage Market Size 2024-2028

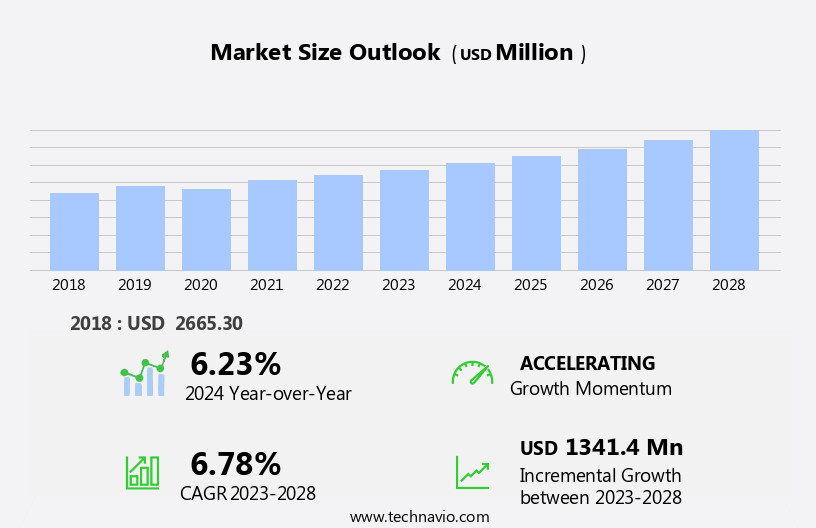

The road haulage market size is forecast to increase by USD 1.34 billion at a CAGR of 6.78% between 2023 and 2028.

- The rising freight demand from the retail and manufacturing industries is the key driver of the road haulage market. As these sectors grow, the need for efficient logistics and transportation increases. An upcoming trend in the market is the rapid adoption of smartphones and growing internet penetration. These technological advancements enable real-time tracking, improved route optimization, and better communication between carriers and customers, enhancing the overall efficiency and transparency of road haulage operations.

- However, the market faces challenges including a shortage of heavy vehicle drivers, which is leading to increased competition for skilled labor and higher wages. To mitigate this issue, companies are exploring alternative solutions such as automation and outsourcing to third-party logistics providers. Overall, these trends and challenges are shaping the future of the market, presenting both opportunities and challenges for market participants.

What will be the Size of the Road Haulage Market During the Forecast Period?

- The market encompasses the transportation of various goods, including agricultural products, automotive, coal, construction materials, and bulk distribution, via heavy trucks and heavy vehicles. Key trends shaping this market include the integration of innovative vehicles, such as those utilizing autonomous driving technology, into supply chains to enhance efficiency and reduce delivery fees.

- Additionally, the transition towards sustainable practices, including the adoption of alternative fuels like diesel fuel and the reduction of carbon emissions from diesel engines, is a significant market development. Globalization has also expanded the market's reach, enabling the transportation of goods across borders and increasing competition among domestic and international players.

- Other trends include the implementation of hoisting and lifting equipment for heavy haulage and the optimization of infrastructure to accommodate the growing demand for efficient and reliable logistics solutions.

How is this Road Haulage Industry segmented and which is the largest segment?

The road haulage industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Heavy commercial vehicles

- Light commercial vehicles

- Type

- Domestic road haulage

- International road haulage

- Application

- Mining & Construction

- Oil & Gas

- Food & Beverage

- Retail

- Manufacturing

- Healthcare

- Automotive

- Others

- Geography

- APAC

- China

- India

- North America

- Canada

- US

- Europe

- UK

- South America

- Middle East and Africa

- APAC

By Vehicle Type Insights

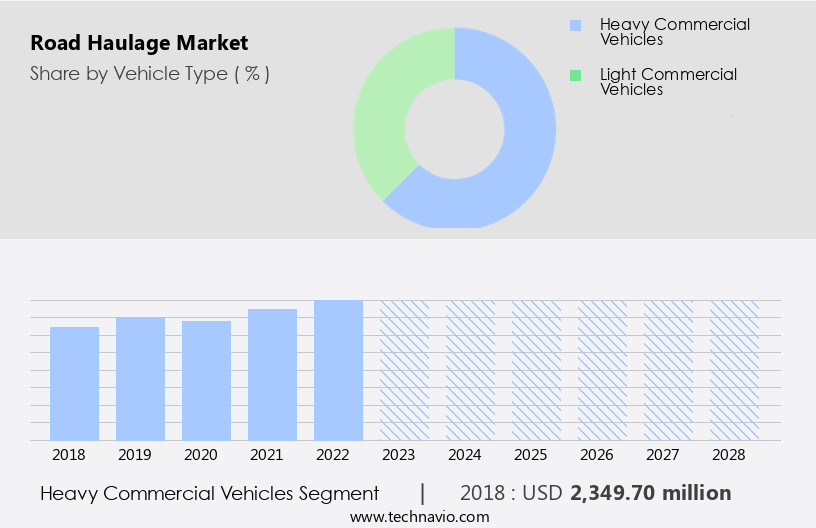

The heavy commercial vehicles segment is estimated to witness significant growth during the forecast period. The market encompasses the transportation of goods via heavy commercial vehicles (HCVs), including trucks and trailers, for domestic and international shipments. HCVs are utilized for larger consignments, occupying more than half of a 48-foot or 53-foot trailer's capacity. This mode of transport is preferred when shippers require time-sensitive deliveries, have sufficient cargo to fill a vehicle, or find it more cost-effective compared to other options. Refrigerated trucks, a subset of HCV, are essential for transporting temperature-sensitive goods. Advanced technologies, such as autonomous driving, vehicle-to-vehicle communication, and remote diagnostics, are increasingly integrated into HCVs to enhance efficiency, safety, and customer experience.

Additionally, the transportation of agricultural products, automotive, coal, construction materials, and other bulk items is facilitated through HCVs. Logistical networks and strategies are optimized to streamline the transportation process, ensuring quick road transportation and cutting-edge delivery options. Stringent emission norms and regulations are driving investments in innovative vehicles, such as those with diesel engines that meet emission standards, to minimize the environmental impact. The e-commerce sector and retail industries rely heavily on road haulage to meet rising demand for quick and efficient delivery services.

Get a glance at the share of various segments. Request Free Sample

The Heavy commercial vehicles segment was valued at USD 2.35 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

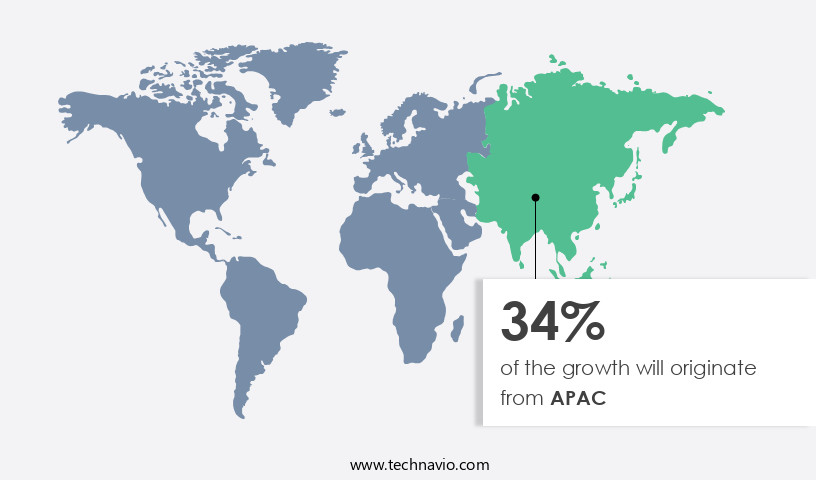

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The e-commerce sector's expansion in Asia-Pacific (APAC) markets, driven by rising per capita income and increased purchasing power, is fueling the demand for efficient road haulage services. This trend is particularly significant in developing economies like China, India, and Indonesia, where infrastructure development initiatives aim to enhance connectivity, improve trade, and upgrade logistics, transportation, and communication networks. Advanced technologies, such as autonomous driving, vehicle-to-vehicle communication, and remote diagnostics, are transforming the market by streamlining operations and reducing carbon emissions. Technological advances in vehicles, including cutting-edge delivery options and innovative designs, are also improving customer experience. The market encompasses various sectors, including agricultural products, automotive, construction, coal, container haulage, container transport, cranes, defense, and waste.

Stringent regulations and emission norms are shaping the market landscape, with companies investing in diesel engine upgrades and alternative fuel solutions to meet environmental impact concerns. The market caters to diverse requirements, from light commercial vehicles and medium trucks to heavy trucks and heavy haulage, serving industries such as retail, petroleum, and ore. Despite rising fuel prices, the market remains competitive, with logistics operators employing strategic techniques to optimize costs and maintain efficient logistical networks.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Road Haulage Industry?

Rising freight demand from retail and manufacturing industries is the key driver of the market.

- The market encompasses the transportation of various goods, including agricultural products, automotive, coal, construction materials, and more, via roadways. Advanced technologies, such as Autonomous driving and Vehicle-to-vehicle communication, are revolutionizing this sector, offering cutting-edge delivery options and improving safety. However, challenges persist, including the environmental impact of Diesel engine emissions and the rising fuel prices. To mitigate these issues, investments in innovative vehicles, like electric and hybrid trucks, and the adoption of efficient logistical strategies are crucial. In the context of globalization, the e-commerce sector's growth has significantly increased the demand for domestic and international road haulage. Logistical networks and techniques are being streamlined to meet the quick turnaround times required by e-commerce retail businesses.

- Integrated supply chains and the use of advanced technologies, like Remote diagnostics, are essential for maintaining a positive customer experience. Despite these advancements, challenges remain. Strict Emission norms and regulations continue to evolve, requiring the industry to adapt and comply. The shortage of Heavy vehicle drivers and the need for skilled labor is another concern. Additionally, the infrastructure required for heavy haulage, such as cranes and hoisting equipment, can be costly. In conclusion, the market is a dynamic and evolving industry, influenced by technological advancements, changing customer preferences, and regulatory requirements. Companies must stay informed and adapt to these changes to remain competitive and efficient In the face of increasing demand and operational challenges.

What are the market trends shaping the Road Haulage Industry?

Rapid adoption of smartphones and growing internet penetration is the upcoming market trend.

- The market is experiencing significant growth due to advanced technological innovations and increasing demand from various industries. The integration of cutting-edge technologies, such as autonomous driving and vehicle-to-vehicle communication, is revolutionizing the transportation sector. These technologies are particularly beneficial for bulk distribution, heavy haulage, and container transport, enabling efficient and quick road transportation for agricultural products, automotive, coal, construction materials, and other goods. Moreover, the e-commerce sector's rising demand for delivery services is fueling the market's growth. E-commerce retail businesses require efficient logistical networks and strategies to ensure cutting-edge delivery options and excellent customer experience. Light commercial vehicles and medium trucks are increasingly being used for parcel transportation procedures and pallet haulage.

- However, the market faces challenges such as stringent emission norms and regulations, rising fuel prices, and traffic accidents. To address these challenges, investments in innovative vehicles and technological advances are essential. For instance, Volvo Trucks has partnered with Aurora to develop autonomous transport solutions, focusing on hub-to-hub applications for North America. This partnership is an example of how companies are adapting to the changing market dynamics and meeting the demands of various industries. In conclusion, the market is expected to grow significantly during the forecast period due to technological advancements, increasing demand from various industries, and the need for efficient and quick transportation services.

- However, challenges such as emission norms and regulations, rising fuel prices, and traffic accidents require continuous innovation and investment to ensure safe and environmentally friendly transportation solutions.

What challenges does the Road Haulage Industry face during its growth?

Shortage of heavy vehicle drivers is a key challenge affecting the industry growth.

- The market is experiencing significant challenges due to the global shortage of Heavy Commercial Vehicle (HCV) drivers. This issue is prevalent in various regions, with Europe reporting a 20%-22% deficit from October 2018 to January 2019, and the US estimating a shortage of 80,000 drivers in October 2021, up from 61,000 in 2018. The decline in potential drivers is also evident in Spain, where numbers dropped in 2019. Several factors contribute to this trend, including waning interest among the populace and a lack of women and young people entering the profession. Additionally, the aging driver population is anticipated to exacerbate market growth during the forecast period.

- Advanced technologies, such as Autonomous driving and Remote diagnostics, are being adopted to mitigate the driver shortage and enhance efficiency In the haulage sector. These technological advancements are revolutionizing industries like automotive, construction, agricultural products, coal, and container transport, among others. The integration of cutting-edge vehicles and logistical networks is streamlining delivery options, reducing carbon emissions, and improving customer experience for various sectors, including e-commerce retail businesses and the defense industry. Despite these advancements, the haulage market continues to face stringent regulations and emission norms, which necessitate investments in innovative vehicles and logistical strategies. The rising fuel prices further complicate matters, necessitating continuous optimization of logistical techniques and transportation services.

Exclusive Customer Landscape

The road haulage market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the road haulage market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, road haulage market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AM Cargo Ltd. - The company specializes in transporting shipping containers and less-than-container-load (LCL) goods via road haulage services. With a robust network and extensive experience, it effectively moves freight between various origins and destinations, ensuring timely and secure deliveries. The company's commitment to operational efficiency and customer satisfaction positions it as a reliable partner In the global logistics industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AM Cargo Ltd.

- Leicester Heavy Haulage

- Caterpillar Inc.

- CEVA Logistics

- Container Corp. of India Ltd.

- DB Schenker

- DSV AS

- Fercam Spa

- FM Logistic

- Gosselin Group

- Ital Logistics Ltd.

- KLG Europe

- WALTER LEASING GmbH

- Manitoulin Transport Inc.

- Maxi Group Ltd.

- Mesaroli Spa

- Monarch Transport Ltd.

- Siemens AG

- SLH Transport Inc.

- Woodside Haulage Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the transportation of various goods, including agricultural products and raw materials, via heavy trucks and trailers. This essential sector plays a significant role In the global economy, facilitating the movement of goods from production sites to markets and consumers. The road haulage industry is subject to stringent regulations aimed at ensuring safety, reducing carbon emissions, and minimizing the environmental impact of transportation. These regulations, coupled with the increasing focus on efficient logistical networks and strategies, have driven technological advancements In the sector. One of the most notable trends In the market is the adoption of advanced technologies.

Innovative vehicles equipped with cutting-edge features, such as self-driving capabilities and remote diagnostics, are increasingly common. These technological advances aim to improve efficiency, reduce costs, and enhance the overall customer experience. Moreover, the integration of logistical networks and the optimization of transportation services have become crucial for businesses, particularly those In the e-commerce sector. Quick road transportation and cutting-edge delivery options are essential for retailers seeking to meet consumer demands for timely and convenient delivery. Despite these advancements, the market faces several challenges. Rising fuel prices and stringent emission norms continue to pose significant costs for logistics operators.

Additionally, traffic accidents and road traffic injuries remain a concern, necessitating ongoing efforts to improve safety standards. Furthermore, the globalization of markets and the increasing demand for staple foods and other essential goods have led to an increase in international road haulage. This trend has put pressure on logistics operators to adapt to new markets and regulations while maintaining efficiency and cost-effectiveness. Investments in infrastructure, such as highways and transportation hubs, are also crucial for the growth of the market. These investments facilitate the movement of goods and reduce transportation costs, making it easier for businesses to reach new markets and customers.

In conclusion, the market is a dynamic and evolving sector that plays a vital role In the global economy. Its continued growth depends on the adoption of advanced technologies, the optimization of logistical networks, and the ability to navigate regulatory challenges. By focusing on these areas, logistics operators can ensure the efficient and cost-effective movement of goods while minimizing environmental impact and enhancing the customer experience.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 1341.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Key countries |

China, US, UK, India, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Road Haulage Market Research and Growth Report?

- CAGR of the Road Haulage industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the road haulage market growth of industry companies

We can help! Our analysts can customize this road haulage market research report to meet your requirements.