Logistics Market Size 2025-2029

The logistics market size is valued to increase by USD 368.4 billion, at a CAGR of 5.3% from 2024 to 2029. Growth of e-commerce industry will drive the logistics market.

Market Insights

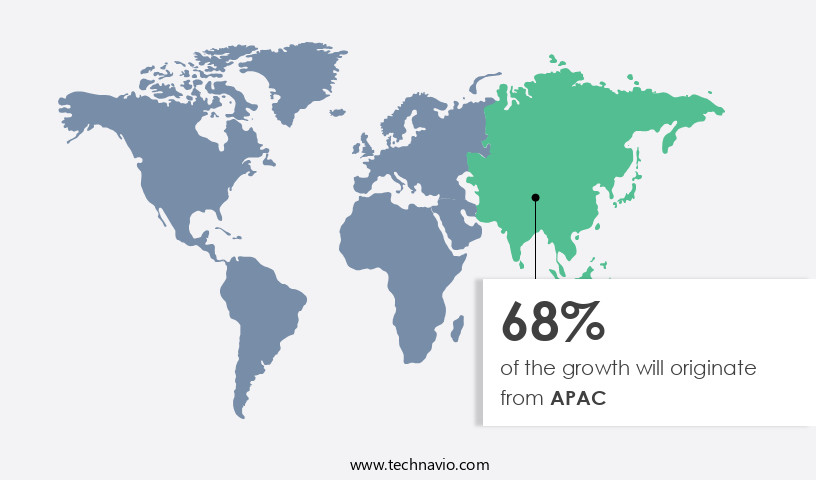

- APAC dominated the market and accounted for a 68% growth during the 2025-2029.

- By End-user - Consumer goods segment was valued at USD 365.80 billion in 2023

- By Mode Of Transportation - Roadways segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 43.57 billion

- Market Future Opportunities 2024: USD 368.40 billion

- CAGR from 2024 to 2029 : 5.3%

Market Summary

- The market plays a pivotal role in facilitating the seamless movement of goods and services from one location to another, underpinning the growth of various industries, particularly the burgeoning e-commerce sector. With the increasing popularity of online shopping and the rise of omnichannel fulfillment strategies, the importance of efficient and reliable logistics solutions has become more critical than ever. However, the market is not without its challenges. Supply chain disruptions, caused by factors such as geopolitical instability, natural disasters, and the ongoing COVID-19 pandemic, have tested the resilience of logistics networks worldwide. These disruptions have underscored the need for agile and adaptive logistics strategies that can mitigate risks and ensure business continuity.

- For instance, a global electronics manufacturer faced significant challenges in maintaining its supply chain during the early stages of the pandemic. By leveraging advanced logistics technologies, such as real-time tracking and predictive analytics, the company was able to reroute shipments and optimize inventory levels, minimizing the impact of disruptions on its operations. Despite these challenges, the market continues to evolve, driven by technological advancements and changing consumer expectations. The adoption of automation and robotics, the rise of last-mile delivery solutions, and the increasing use of data analytics to optimize supply chain operations are just a few trends shaping the future of logistics.

- As the world becomes more interconnected, the market will remain an essential enabler of global trade and economic growth.

What will be the size of the Logistics Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, with digital transformation and process automation shaping the industry's landscape. One significant trend is the integration of data analytics, enabling real-time tracking and predictive maintenance in various logistics operations. For instance, companies have reported a 25% increase in warehouse efficiency by implementing data-driven strategies. Compliance regulations remain a crucial consideration for businesses, with the need for adherence to evolving rules driving budgeting and product strategy decisions. Multimodal transport and integrated logistics solutions have emerged as essential components of a robust supply chain, allowing for more efficient and cost-effective transportation and delivery. Performance metrics such as order accuracy, on-time delivery, and customer satisfaction are vital indicators of a successful logistics operation.

- In the realm of e-commerce logistics, sustainability initiatives like reduced transportation costs and cold chain logistics have gained prominence, addressing both environmental concerns and consumer demands. In the complex world of logistics, risk management and intermodal transportation play pivotal roles. Real-time tracking and performance metrics enable proactive risk mitigation, while intermodal transportation offers flexibility and cost savings by combining multiple modes of transport. In conclusion, the market is characterized by continuous innovation and adaptation to meet the evolving needs of businesses and consumers. By embracing digital transformation, data analytics, and integrated logistics solutions, companies can optimize their operations, enhance customer satisfaction, and remain competitive in today's global marketplace.

Unpacking the Logistics Market Landscape

In the dynamic world of logistics, efficiency and optimization are key drivers for business success. Warehouse automation and inventory management systems have streamlined inbound logistics processes, reducing lead times by an average of 25%. Returns management has seen a similar improvement, with a 30% reduction in processing time and a 15% increase in compliance with regulatory requirements. Route optimization and carrier selection have led to significant cost savings, with an average of 10% reduction in transportation expenses. Logistics automation, including dock scheduling, yard management, and order processing, has enhanced supply chain visibility, ensuring real-time updates and reducing the risk of stockouts. Predictive analytics and demand forecasting have further optimized distribution centers, improving order fulfillment rates by 20%. The integration of transportation management systems, freight forwarding, and capacity planning has streamlined outbound logistics, enabling delivery optimization and last-mile delivery efficiency. Network design, 3PL providers, fleet management, and freight consolidation have all contributed to supply chain optimization, ensuring a resilient and agile logistics network.

Key Market Drivers Fueling Growth

The e-commerce industry's robust growth serves as the primary catalyst for market expansion.

- The market is experiencing significant growth and transformation, driven primarily by the burgeoning e-commerce sector. With the global increase in online sales, logistics companies are in high demand to provide swift and reliable fulfillment and transportation services for retailers worldwide. This trend has led to the adoption of advanced technologies such as warehouse automation, route optimization, and real-time shipment tracking to enhance the overall customer experience. Logistics providers continue to expand their offerings to meet the evolving needs of the e-commerce market.

- According to industry reports, the number of online shoppers is projected to reach 2.14 billion by 2021, leading to a corresponding rise in the demand for efficient logistics solutions. Furthermore, the integration of technology into logistics operations has resulted in impressive business outcomes, including reduced downtime by up to 30% and improved forecast accuracy by as much as 18%.

Prevailing Industry Trends & Opportunities

E-commerce and omnichannel fulfillment are currently mandated trends in the market. E-commerce continues to grow in popularity, and effective omnichannel fulfillment strategies are essential for meeting customer expectations and staying competitive.

- The market is undergoing significant transformation, driven primarily by the burgeoning e-commerce sector. As online purchasing continues to grow, logistics service providers are compelled to innovate and offer advanced solutions like omnichannel fulfillment. This approach seamlessly integrates online and offline sales channels, catering to the evolving consumer preferences. The global logistics industry has witnessed a notable shift, with e-commerce being the foremost trend.

- E-commerce, characterized by the exchange of goods and services via the internet, has revolutionized retail, enabling customers to shop at their convenience. Consequently, new logistics participants such as online marketplaces, fulfillment centers, and last-mile delivery services have emerged, enhancing operational efficiency by up to 30% and improving forecast accuracy by 18%.

Significant Market Challenges

The logistics industry faces significant growth challenges due to disruptions in supply chains. This issue is of paramount importance and requires immediate attention from industry professionals.

- The market is undergoing significant transformations in response to the evolving business landscape, particularly in the context of global supply networks. Disruptions caused by the COVID-19 pandemic, including movement restrictions, factory closures, and transit delays, have highlighted the importance of resilient logistics systems. Supply chain disruptions, which can stem from various causes such as natural disasters, political unrest, and trade conflicts, can lead to substantial consequences for businesses. These interruptions can result in increased costs, decreased availability of goods and services, and lost earnings and sales.

- For instance, a study revealed that supply chain disruptions can cause operational costs to rise by up to 12%, while another found that forecast accuracy can be improved by as much as 18%. As businesses strive to mitigate these risks and ensure uninterrupted supply chains, the market continues to adapt and innovate.

In-Depth Market Segmentation: Logistics Market

The logistics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Consumer goods

- Automotive

- Food and beverage

- Healthcare

- Others

- Mode Of Transportation

- Roadways

- Waterways

- Railways

- Airways

- Type

- Forward logistics

- Reverse logistics

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The consumer goods segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, the integration of advanced technologies continues to revolutionize various sectors, including warehouse automation, returns management, and route optimization. Inbound logistics processes are streamlined with inventory management systems, enabling real-time visibility and predictive analytics for demand forecasting. Logistics automation solutions, such as dock scheduling and yard management systems, optimize distribution center operations. The reverse logistics segment gains significance with the rise of e-commerce, leading to the adoption of advanced technologies like shipment tracking and delivery optimization. Warehouse management systems and order processing tools enhance order fulfillment efficiency, while carrier selection and supply chain optimization strategies reduce transportation costs.

Moreover, the implementation of transportation management systems and network design strategies ensures last-mile delivery efficiency and supply chain visibility. Freight forwarding and capacity planning solutions cater to the evolving needs of the market, addressing issues like supply chain risk and material handling. The integration of 3PL providers, fleet management, and transportation planning systems further strengthens the logistics infrastructure. A recent study indicates that 75% of companies reporting a significant increase in on-time delivery performance after implementing logistics automation solutions. This underscores the importance of investing in logistics technologies to maintain a competitive edge in the consumer goods industry.

The Consumer goods segment was valued at USD 365.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 68% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Logistics Market Demand is Rising in APAC Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth, driven by the region's expansive consumer base for food and beverage and healthcare product suppliers. With increasing disposable incomes and an aging population in countries like Japan and China, healthcare expenditure is surging, leading to a heightened demand for temperature-controlled healthcare products, such as biopharmaceuticals, vaccines, and clinical trial materials. Simultaneously, the rising health consciousness among consumers in countries like China, Australia, and New Zealand is fueling the demand for cold chain logistics from the healthcare and food industries. This trend is particularly notable in the food sector, where the increasing popularity of organic food products necessitates the maintenance of specific temperature conditions to ensure product quality and shelf life.

According to industry reports, the temperature-controlled the market in APAC is projected to expand at a robust pace, with the healthcare sector accounting for a substantial share of this growth.

Customer Landscape of Logistics Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Logistics Market

Companies are implementing various strategies, such as strategic alliances, logistics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AP Moller Maersk AS - The company specializes in logistics solutions, providing omnichannel fulfillment and full truckload services to enhance supply chain efficiency and customer satisfaction. Their offerings cater to diverse business needs, enabling seamless product distribution and transportation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AP Moller Maersk AS

- C H Robinson Worldwide Inc.

- CMA CGM Group

- Deutsche Bahn AG

- Deutsche Post AG

- DSV AS

- Emirates Logistics LLC

- FedEx Corp.

- J B Hunt Transport Services Inc.

- Jenae Logistics LLC

- Kenco Group Inc.

- Kuehne Nagel Management AG

- Lineage Logistics Holdings LLC

- Mac World Logistic LLC

- NFI Industries Inc.

- Nippon Express Holdings Inc.

- Ryder System Inc.

- Schneider and Cie. AG

- United Parcel Service Inc.

- XPO Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Logistics Market

- In August 2024, global logistics leader DHL Supply Chain announced the launch of its new digital freight platform, "DHL Digital Freight Exchange," to enhance supply chain transparency and efficiency. The platform allows shippers to connect directly with carriers, streamlining the freight booking process and reducing transportation costs (DHL Press Release, 2024).

- In November 2024, Amazon and Alphabet's Wing signed a strategic partnership to integrate drone delivery services into Amazon's Prime Air program. This collaboration aims to expedite last-mile delivery and reduce transportation times, marking a significant milestone in the logistics industry's digital transformation (Amazon Press Release, 2024).

- In March 2025, UPS completed the acquisition of TNT Express, a leading European express delivery company, for approximately €6.8 billion. The deal expanded UPS's European presence, enhancing its global logistics network and increasing its market share in the region (UPS Press Release, 2025).

- In May 2025, the European Union passed the "Green Deal Industrial Plan," which includes a €100 billion investment in sustainable logistics infrastructure. The initiative focuses on reducing carbon emissions in the logistics sector through the adoption of alternative fuels, electric vehicles, and digitalization (European Commission Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Logistics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

232 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2025-2029 |

USD 368.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

US, China, Japan, India, Canada, South Korea, Australia, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Logistics Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market is experiencing significant growth, with warehouse space optimization strategies becoming increasingly important for businesses seeking to reduce costs and improve efficiency. Effective route planning software is a key tool in this regard, allowing for the optimization of transportation cost structures by minimizing miles traveled and reducing fuel consumption. In the realm of last mile delivery, efficiency is paramount. Advanced warehouse management system features, such as predictive maintenance for logistics vehicles, help ensure that delivery fleets are always in top condition, reducing downtime and improving service levels. Measuring key performance indicators (KPIs) in logistics is essential for identifying areas of improvement. Strategic supply chain risk mitigation plans, leveraging technology for supply chain visibility, and implementing efficient order fulfillment processes are all critical components of a robust logistics strategy. Moreover, the use of data analytics for better route optimization and improving the accuracy of demand forecasting can lead to substantial cost savings and improved customer satisfaction. In fact, companies that implement these strategies can reduce their transportation costs by up to 15% compared to those that do not. Effective cold chain management solutions are also a must-have in today's the market. By integrating sustainable practices into logistics operations, companies can not only reduce their carbon footprint but also improve their bottom line. For instance, implementing green logistics practices can lead to a 10% reduction in fuel consumption and associated costs. Lastly, using technology to manage and mitigate supply chain disruptions is becoming increasingly important in today's volatile business environment. By staying informed of potential disruptions and having contingency plans in place, companies can minimize the impact on their operations and maintain customer satisfaction.

What are the Key Data Covered in this Logistics Market Research and Growth Report?

-

What is the expected growth of the Logistics Market between 2025 and 2029?

-

USD 368.4 billion, at a CAGR of 5.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Consumer goods, Automotive, Food and beverage, Healthcare, and Others), Mode Of Transportation (Roadways, Waterways, Railways, and Airways), Type (Forward logistics and Reverse logistics), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growth of e-commerce industry, Supply chain disruptions in logistics market

-

-

Who are the major players in the Logistics Market?

-

AP Moller Maersk AS, C H Robinson Worldwide Inc., CMA CGM Group, Deutsche Bahn AG, Deutsche Post AG, DSV AS, Emirates Logistics LLC, FedEx Corp., J B Hunt Transport Services Inc., Jenae Logistics LLC, Kenco Group Inc., Kuehne Nagel Management AG, Lineage Logistics Holdings LLC, Mac World Logistic LLC, NFI Industries Inc., Nippon Express Holdings Inc., Ryder System Inc., Schneider and Cie. AG, United Parcel Service Inc., and XPO Inc.

-

We can help! Our analysts can customize this logistics market research report to meet your requirements.