Commercial Aviation And Military Headset Market Size 2024-2028

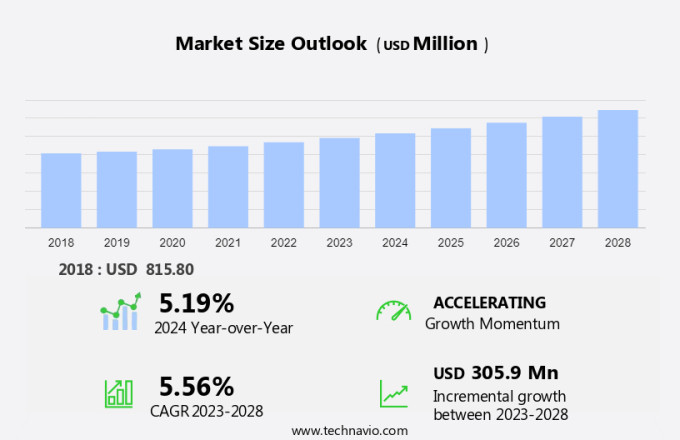

The commercial aviation and military headset market size is forecast to increase by USD 305.9 million, at a CAGR of 5.56% between 2023 and 2028. Market growth hinges on several factors, including the prioritization of improved battlefield communications, an increasing emphasis on enhancing pilot comfort, and the growing adoption of headsets for virtual training. The push for better battlefield communications underscores the critical role of real-time information exchange in modern warfare, driving demand for advanced communication technologies. Similarly, heightened attention to pilot comfort reflects a growing recognition of its impact on operational efficiency and mission success, leading to the development of more ergonomic cockpit designs and equipment. Our market growth analysis report examines historic data from 2018 - 2022, besides analyzing the current and forecasted market scenario.

Market Forecasting and Size

To learn more about this report, Request Free Sample

Market Dynamics

The market caters to the diverse needs of the aviation industry, providing essential communication tools for cockpit crews, co-pilots, and cabin staff. These headsets are crucial for maintaining clear communication between personnel and air traffic control during flights of commercial or passenger aeroplanes and in military aviation operations. Utilizing radio frequency technology, these headsets ensure efficient communication in various aviation settings, from commercial airlines to defence services. As the aviation industry continues to grow, with increasing aircraft deliveries and rising passenger traffic, the demand for high-quality headsets equipped with features like active noise cancellation and passive noise cancellation has surged. Leading manufacturers cater to the needs of both general aviation enthusiasts and professionals in the military aviation sector, providing reliable communication solutions for leisure activities like skydiving and critical missions alike. Collaboration with tier-1 suppliers ensures the development of cutting-edge headsets to meet the evolving demands of the aviation industry. Our researchers studied the market research and growth data for years, with 2023 as the base year along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver- Emphasis on better battlefield communications

A military operation/mission largely depends on efficient communication networks. Poor networking can lead to severe significance, while effective communication results in the success of the mission on the battlefield. During high-risk operations, in particular, several lives can be saved with clear instructions. The defense authorities of many countries are deploying such systems in various critical operations with the growing potential and demand for GPS-based machine-to-machine (M2M) and wireless headsets in coordinating military operations and exercises.

For instance, the armed troops of the US Army are fitted with Blue Force Trackers (BFT), which help the commander to track the movement of individual soldiers by providing real-time feed of the soldier's location. With a large number of soldier modernization programs underway, such as the Land Warrior, Future Infantry Soldier Technology (FIST), and the Improved Operational Soldier System (IOSS), will fuel the growth of the commercial aviation and military headset market during the forecast period. Additionally, advancements in technology, including virtual reality (VR) headsets, are revolutionizing training and simulation within military and aviation sectors. VR headsets offer immersive training environments, enhancing situational awareness and decision-making skills for soldiers and pilots alike. As these technologies become integral to modern warfare and aviation training programs, the demand for VR headsets is expected to contribute significantly to market growth in the coming years.

Significant Market Trends- Advent of bone conduction communication systems

The advent of bone conduction communication systems has been developed to allow two-way communication in extremely noisy environments, which necessitates the use of hearing aids for soldiers. Bone conduction allows enhanced sound quality in noisy environments/battlefields as per researchers. Also, the system is capable of dealing with a large amount of background noise on the battlefield and has good strength to operate in severe weather or geographical conditions. In addition, these devices are placed in the ears of the soldiers at an area where the jawbone meets the ear canal which results in the effective transmission of speech and voices.

However, such devices are important for soldier modernization programs such as the US Army's Land Warrior or the UK Army's FIST, where stealth operations make communication with acoustic conduction either inadvisable or impossible. Therefore, such advanced systems will result in enhanced comfort, high clarity of voice, and low leakage, thus resulting in effective military operations or missions. Such factors are expected to drive the market growth during the forecast period. Additionally, advancements in technology, such as commercial aircraft seating, are crucial in enhancing comfort and safety for passengers. Modern seating designs integrate ergonomic features, lightweight materials, and advanced configurations to optimize space and comfort, thereby improving the overall travel experience.

Major Market Challenge- Use of low-grade pilot headsets

These devices are also used by airline pilots, through which they can contact the airport ground staff or control center operators along with the widespread application of headsets on the battlefield and for the training of military recruits. Furthermore, many expensive headsets can only reduce or minimize low-frequency noises, such as the noise produced by an airplane flying over another airplane. However, these devices are not effective against high-frequency and transient noises. Consequently, the pilot of an airplane remains susceptible to noises such as the noises produced by engines and fans, which may affect his concentration while flying the airplane.

In addition, some of the headsets used in flight operations are of low quality or are counterfeit products, which is also a major concern for pilots. Such headsets are vulnerable to multiple frequencies of noise, which becomes a significant challenge for the market, as such headset devices will temporarily or permanently impact the hearing capabilities of the pilots. Such factors are expected to hinder the market growth during the forecast period.

Market Segmentation

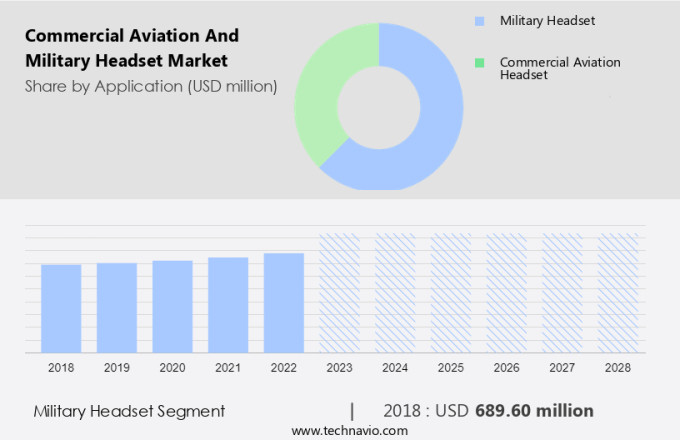

By Application

The military headset is estimated to witness significant growth during the forecast period. The varying nature of modern warfare requires a restructuring within the armed forces of countries is anticipated to be achieved through the formation of a small, efficient, highly deployable force equipped with state-of-the-art weapons and protection systems.

Customized Report as per your requirements!

The military headset segment was the largest segment and was valued at USD 689.60 million in 2018. The military headset systems are generally of two types including passive and active types for canceling background noise. The passive headset system has a closed-back design that is sealed around the ear, blocking any external noises, the active headset systems use a small microphone that detects ambient noises and creates a sound wave, which can balance the ambient noise and enable higher quality for voice transmitted through the headset systems. Therefore, such factors will accelerate the growth of the commercial aviation segment, which will drive the market during the forecast period.

By Region

For more insights on the market share of various regions Download Sample PDF now!

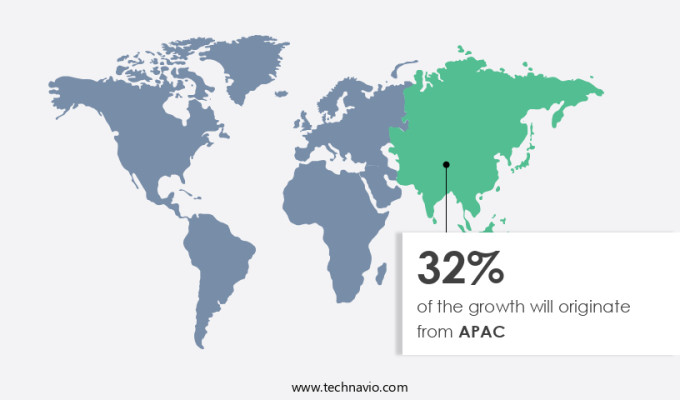

APAC is estimated to contribute 32% to the growth by 2028. Technavio's analysts have provided extensive insight into the market forecasting, detailing the regional trends and drivers influencing the market's trajectory throughout the forecast period. Another region offering significant growth opportunities to companies is North America. This region leads the world market in terms of military expenses and technological advancements and experiences a very high demand for headset systems, which airplane pilots and armed troops use. For instance, the world's largest aerospace and defense companies, including Boeing, Lockheed Martin, Northrop Grumman, and Raytheon Technologies are present in North America. The presence of these major players facilitates innovation and drives demand for high-quality headsets for both commercial and military applications. However, the US and Canadian armed forces regularly update and modernize their equipment and systems which includes the procurement of state-of-the-art military headsets to enhance communication, situational awareness, and overall effectiveness. Therefore, such factors will contribute to the growth of the market in the region during the forecast period.

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- 3M Co - The company offers commercial aviation and military headsets such as the 3M PELTOR MT series 2-way communications headset.

We also have detailed analyses of the market’s competitive landscape and offer information on 20 market companies, including:

Bose Corp., Clarity Aloft, David Clark Co., Faro Aviation, Flightcom Corp., GBH headsets, HP Inc., Imtradex Hor and sprechsysteme GmbH, INVISIO AB, Lightspeed Aviation, MicroAvionics UK Ltd, Pilot Communications USA, Radial Avcomm LLC, Safariland LLC, Samsung Electronics Co. Ltd., Savox Communications, Sonova AG, Television Equipment Associates Inc., and Titan Communication Systems

Technavio market forecast the an in-depth analysis of the market and its players through combined qualitative and quantitative data. The analysis classifies companies into categories based on their business approaches, including pure-play, category-focused, industry-focused, and diversified. Companies are specially categorized into dominant, leading, strong, tentative, and weak, based on their quantitative data analysis.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application Outlook

- Military headset

- Commercial aviation headset

- Type Outlook

- On-ea

- In-ear

- Region Outlook

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

The market caters to the communication needs of aviation professionals and military personnel across a wide range of applications. From crew and co-pilots to airline operators and army aviation, these headsets play a vital role in ensuring clear communication and safety during flights and operations. Equipped with advanced features like active noise reduction and passive noise reduction, these headsets minimize distractions in noisy environments, enhancing communication clarity. Technologies such as Bluetooth connectivity and wireless communication systems offer convenience and flexibility to users, while lightweight designs and extreme comfort ensure prolonged use without discomfort. In addition to serving the needs of technologically advanced aircraft and airline owners, the market addresses the requirements of aviation schools and recreational activities like skydiving. With a focus on fleet modernization programs and global army modernization, manufacturers collaborate with aircraft OEMs and regional aviation agencies to deliver reliable and innovative headset solutions for the evolving demands of the aviation industry.

Further, the Commercial Aviation And Military Headset market is a crucial component of aviation infrastructure, ensuring clear communication and enhanced safety for both commercial and military aircraft operators. These headsets, equipped with advanced microphone technology and digital noise reduction systems, provide unparalleled clarity even in noisy environments. Active noise cancellation aviation headsets and passive noise reduction aviation headsets mitigate ambient noise, crucial for first-time flyers and seasoned pilots alike. In the military sector, these headsets play a pivotal role in anti-terror operations and aircraft delivery, where communication precision is paramount. Automation features like auto-pilot and aircraft flight management systems further alleviate pilot workload. Lightweight designs and comfortable ear pads cater to long-haul flights and extended missions, while wired and wireless options accommodate various preferences. As air transportation infrastructure expands to handle growing international passengers and cross-border disputes, the demand for reliable, cutting-edge headsets continues to rise, shaping the future of aviation communication.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.56% |

|

Market Growth 2024-2028 |

USD 305.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.19 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 32% |

|

Key countries |

US, Germany, China, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Bose Corp., Clarity Aloft, David Clark Co., Faro Aviation, Flightcom Corp., GBH headsets, HP Inc., Imtradex Hor and sprechsysteme GmbH, INVISIO AB, Lightspeed Aviation, MicroAvionics UK Ltd, Pilot Communications USA, Radial Avcomm LLC, Safariland LLC, Samsung Electronics Co. Ltd., Savox Communications, Sonova AG, Television Equipment Associates Inc., and Titan Communication Systems |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market growth and trends and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Market growth and forecasting across North America, Europe, APAC, Middle East and Africa, and South America

- A thorough market analysis and report of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch