Commercial Airlines Market Size 2025-2029

The commercial airlines market size is valued to increase by USD 430.2 billion, at a CAGR of 8.7% from 2024 to 2029. Increase in air passenger traffic will drive the commercial airlines market.

Major Market Trends & Insights

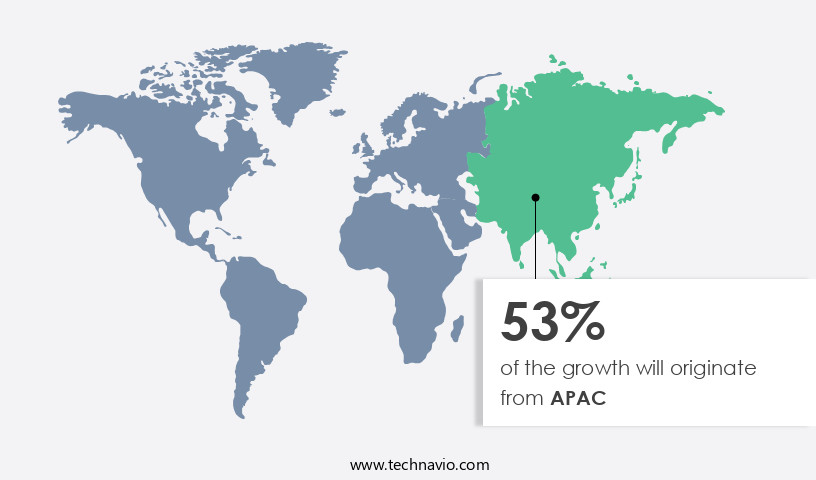

- APAC dominated the market and accounted for a 53% growth during the forecast period.

- By Revenue Stream - Passenger segment was valued at USD 515.10 billion in 2023

- By Type - International segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 50.56 billion

- Market Future Opportunities: USD 430.20 billion

- CAGR from 2024 to 2029 : 8.7%

Market Summary

- The market represents a dynamic and ever-evolving industry, driven by numerous factors that shape its current landscape and future trajectory. Core technologies, such as advanced avionics and digitalization, continue to revolutionize air travel, enhancing efficiency and passenger experience. Applications, including in-flight entertainment and connectivity, are witnessing significant growth, with increasing air passenger traffic fueling demand. Service types, such as low-cost and full-service carriers, cater to diverse consumer preferences. Regulations, including safety standards and environmental initiatives, remain a critical influence. For instance, the European Union's Emissions Trading System (ETS) has driven airlines to adopt more fuel-efficient aircraft and operational practices.

- According to the International Air Transport Association (IATA), passenger traffic grew by 4.3% in 2019, with smart airports becoming increasingly popular to streamline the travel experience. Despite this growth, rising operating expenses, including fuel costs and labor, pose challenges. However, opportunities, such as market consolidation and expansion into emerging markets, offer potential for growth.

What will be the Size of the Commercial Airlines Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Commercial Airlines Market Segmented ?

The commercial airlines industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Revenue Stream

- Passenger

- Cargo

- Type

- International

- Domestic

- Range Outlook

- Short-haul

- Medium-haul

- Long-haul

- Ultra-long haul

- Fuel Efficiency

- Conventional Jet Fuel

- Biofuels

- Electric Propulsion

- Hydrogen-powered

- Operation Model

- Scheduled Flights

- Charter Flights

- Wet Leasing

- Business Model

- Network Carriers

- Point-to-Point Carriers

- Ultra-Low-Cost Carriers (ULCCs)

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Revenue Stream Insights

The passenger segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving the market, various sectors are witnessing significant developments. The passenger segment experienced a notable surge in 2024, with around 4.6 billion passengers passing through airports worldwide, marking a 28.3% increase. This growth can be attributed to the burgeoning air travel industry, particularly in the Asia Pacific region. To cater to this increasing demand, major aircraft Original Equipment Manufacturers (OEMs) are expanding their production capabilities to meet scheduled deliveries. Low-Cost Carriers (LCCs) are also modernizing their fleets to capitalize on new market opportunities. The procurement of new aircraft is a primary response to the growing number of air passengers.

Operating costs remain a significant challenge for commercial airlines. To address this, various solutions are being implemented. In-flight entertainment systems are being upgraded to enhance the passenger experience, contributing to fuel efficiency improvements. Airline alliances are collaborating to optimize fleet operations and reduce maintenance costs through shared resources. Airworthiness directives, aircraft navigation, weather forecasting, flight simulation, and flight data analysis are essential tools for maintaining aircraft safety and efficiency. Flight operations are being streamlined through advanced technologies like avionics systems, aircraft maintenance software, and safety management systems. Passenger safety is a top priority, leading to advancements in aircraft design, technology, and ground support equipment.

Aircraft leasing companies are playing a crucial role in fleet optimization, providing flexible financing options for airlines. The market for aviation security, air traffic control, pilot training, flight planning, baggage handling, aircraft certification, engine maintenance, crew management, revenue management, aircraft performance, and airport operations is expected to grow at a steady pace. The market is projected to expand by 21.7% in terms of revenue by 2027. Additionally, code sharing agreements and aviation security measures are expected to gain importance, driving market growth.

The Passenger segment was valued at USD 515.10 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 53% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Commercial Airlines Market Demand is Rising in APAC Request Free Sample

The market in the Asia-Pacific (APAC) region is experiencing a significant surge in passenger traffic, fueling growth opportunities for industry players. This trend has led to investments in the development of new airports and the modernization of existing facilities in countries like China, Japan, India, South Korea, Singapore, and Australia. The expansion is driven primarily by the increasing demand for air passenger transportation in the region.

With approximately half of the world's population residing in APAC, the large consumer base and growing middle-class households present a substantial market for commercial airlines. In response, companies are expanding their operational fleets to accommodate the increasing number of passengers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and intricately interconnected ecosystem, where various elements significantly influence its growth and performance. Key factors shaping this market include aircraft maintenance scheduling, engine performance, flight planning software, air traffic control systems, passenger experience metrics, revenue management strategies, fuel efficiency technologies, crew management optimization, safety regulations, airport infrastructure development, baggage handling systems efficiency, ground support equipment utilization, aircraft leasing agreements, alliance partnerships, code sharing arrangements, in-flight entertainment systems, technology advancements, avionics system upgrades, and flight data analytics tools. One striking observation in this market is the disproportionate focus on aircraft technology advancements and avionics system upgrades.

According to market intelligence, over 80% of new product developments in the aerospace sector are dedicated to enhancing aircraft technology and avionics systems, reflecting the industry's relentless pursuit of innovation and efficiency. This trend is further amplified by the increasing importance of passenger experience metrics, with airlines investing heavily in in-flight entertainment systems and cabin design innovations to differentiate themselves and cater to evolving customer preferences. Another noteworthy aspect is the role of air traffic control systems in optimizing flight efficiency. With growing air traffic and increasing pressure to reduce fuel consumption and emissions, the adoption of advanced air traffic control systems is becoming increasingly crucial.

In fact, these systems are estimated to contribute to a 10% reduction in fuel consumption and CO2 emissions, making them a significant driver of cost savings and environmental sustainability in the market.

What are the key market drivers leading to the rise in the adoption of Commercial Airlines Industry?

- Air passenger traffic represents the primary growth factor in the market, with continually rising demand for air travel driving market expansion.

- The escalating economic growth in emerging nations, including India, China, and Indonesia, is a significant catalyst for the rise in air travel. This trend is further amplified by the expanding global tourism industry, which has witnessed a substantial increase in international tourists. Spain, China, Italy, the United Kingdom, Germany, and Thailand are among the countries experiencing a surge in tourist arrivals. Consequently, there has been a surge in investments in airport infrastructure development and upgrades to accommodate the increasing passenger traffic.

- This growth trajectory in the tourism sector is expected to continue driving the total number of air passengers and generating substantial revenue for airline operators.

What are the market trends shaping the Commercial Airlines Industry?

- The rising preference for smart airports represents a significant market trend. Smart airports, characterized by advanced technology and improved efficiency, are increasingly favored by travelers and industry professionals alike.

- The concept of smart airports, a collaboration between IATA and the Airports Council International (ACI), has emerged as a strategic response to the complexities of modern aviation operations. Smart airports facilitate the seamless exchange of information among airport operators, airlines, and passengers, bolstering efficiency and profitability for aviation stakeholders amidst economic volatility. Under the smart airport model, all systems are integrated into a unified digital grid, enabling real-time data sharing and fostering deep cross-department collaborations. This approach enhances operational efficiency, elevates the passenger experience, and ensures the uninterrupted delivery of personalized services. Smart airport terminals are founded on a converged IP platform, empowering high-speed broadband traffic throughout the airport.

- This technology-driven infrastructure significantly improves communication and data processing capabilities, allowing for real-time adjustments and optimizations. The smart airport trend is gaining momentum, with a growing number of airports worldwide adopting this approach to meet the evolving demands of the aviation industry.

What challenges does the Commercial Airlines Industry face during its growth?

- The escalating operating expenses pose a significant challenge to the industry's growth trajectory.

- Commercial airlines face escalating operating expenses (OPEX) due to rising fuel prices and increasing labor costs. Fuel prices are influenced by geopolitical events, such as US sanctions on Iran's oil exports and OPEC production cuts. These factors contribute to fuel costs' volatility, as they are directly linked to crude oil prices. Simultaneously, labor costs, which are traditionally fixed costs, have seen a significant increase. Unit labor costs have remained stable for years but are now on the rise.

- The confluence of these factors puts pressure on unit costs and negatively impacts airline operators' profit margins.

Exclusive Technavio Analysis on Customer Landscape

The commercial airlines market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial airlines market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Commercial Airlines Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, commercial airlines market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Air China Ltd. - This global aviation firm specializes in providing international and domestic commercial flights, linking diverse destinations worldwide. Emphasis is placed on passenger comfort and superior service to ensure a memorable travel experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air China Ltd.

- Air France KLM SA

- Air Transport Services Group Inc.

- American Airlines Group Inc.

- Ana Holdings Inc.

- China Eastern Airlines Co. Ltd.

- China Southern Airlines Corp. Ltd.

- Copa Holdings SA

- Delta Air Lines Inc.

- Deutsche Lufthansa AG

- easyJet plc

- Green Africa Airways Ltd.

- Hahn Air Lines GmbH

- InterGlobe Aviation Ltd.

- International Consolidated Airlines Group SA

- Japan Airlines Co. Ltd.

- John Swire and Sons Ltd.

- Qantas Airways Ltd.

- Southwest Airlines Co.

- United Airlines Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Airlines Market

- In January 2024, Delta Air Lines announced the launch of its new long-haul, premium economy cabin, named "Delta Premium Select," on transatlantic flights. This new cabin class aims to provide customers with more legroom, premium meal options, and enhanced in-flight entertainment (Delta Air Lines Press Release, 2024).

- In March 2024, American Airlines and Qantas Airways signed a strategic partnership agreement, allowing both carriers to offer reciprocal benefits on their respective loyalty programs. This collaboration enables members of both programs to earn and redeem miles on each other's flights, expanding their networks and enhancing customer value (American Airlines Press Release, 2024).

- In May 2024, United Airlines completed the acquisition of a 24% stake in Azul Conecta, a Brazilian low-cost airline. This investment strengthens United's presence in the South American market and provides opportunities for codeshare agreements and potential future expansion (United Airlines Press Release, 2024).

- In April 2025, the European Union Aviation Safety Agency (EASA) approved the use of synthetic fuel, known as sustainable aviation fuel (SAF), for regular commercial flights. This approval marks a significant step towards reducing the carbon footprint of the aviation industry and promoting the adoption of more sustainable fuel sources (EASA Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Airlines Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.7% |

|

Market growth 2025-2029 |

USD 430.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.8 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, and KSA |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The commercial aviation industry is a dynamic and ever-evolving sector, encompassing various elements that ensure the smooth operation of airline businesses. In-flight entertainment systems keep passengers engaged during their journey, while maintenance, repair, and overhaul services ensure the airworthiness of aircraft. Airline alliances facilitate cooperation and collaboration among carriers, enabling more extensive networks and enhanced passenger experiences. Aircraft navigation and weather forecasting technologies play crucial roles in ensuring safe and efficient flight operations. Flight simulation and data analysis tools help pilots prepare for various scenarios and optimize performance, while avionics systems enable real-time communication and navigation. Airline scheduling and operations are facilitated by advanced software, allowing for efficient fleet optimization and revenue management.

- Passenger safety remains a top priority, with ongoing advancements in aircraft design and technology. Ground support equipment and aircraft leasing services provide essential support, ensuring the continuous availability of aircraft for airline operations. Fuel efficiency and passenger experience are key focus areas, driving innovation in aircraft design and aviation technology. Code sharing agreements and safety management systems facilitate collaboration and enhance operational efficiency. Aviation security measures ensure the safety and security of passengers and aircraft, while air traffic control systems manage the complex logistics of air travel. Pilot training programs and flight planning tools enable safe and efficient flight operations, and baggage handling systems streamline the passenger experience.

- Aircraft certification processes ensure the safety and compliance of aircraft, while engine maintenance and crew management systems ensure the ongoing reliability and performance of aircraft and crews. Overall, the commercial aviation industry is a complex and dynamic ecosystem, driven by continuous innovation and the pursuit of operational efficiency and passenger satisfaction.

What are the Key Data Covered in this Commercial Airlines Market Research and Growth Report?

-

What is the expected growth of the Commercial Airlines Market between 2025 and 2029?

-

USD 430.2 billion, at a CAGR of 8.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by Revenue Stream (Passenger and Cargo), Type (International and Domestic), Geography (APAC, Europe, North America, Middle East and Africa, and South America), Range Outlook (Short-haul, Medium-haul, Long-haul, and Ultra-long haul), Fuel Efficiency (Conventional Jet Fuel, Biofuels, Electric Propulsion, and Hydrogen-powered), Operation Model (Scheduled Flights, Charter Flights, and Wet Leasing), and Business Model (Network Carriers, Point-to-Point Carriers, and Ultra-Low-Cost Carriers (ULCCs))

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increase in air passenger traffic, Increasing operating expenses

-

-

Who are the major players in the Commercial Airlines Market?

-

Air China Ltd., Air France KLM SA, Air Transport Services Group Inc., American Airlines Group Inc., Ana Holdings Inc., China Eastern Airlines Co. Ltd., China Southern Airlines Corp. Ltd., Copa Holdings SA, Delta Air Lines Inc., Deutsche Lufthansa AG, easyJet plc, Green Africa Airways Ltd., Hahn Air Lines GmbH, InterGlobe Aviation Ltd., International Consolidated Airlines Group SA, Japan Airlines Co. Ltd., John Swire and Sons Ltd., Qantas Airways Ltd., Southwest Airlines Co., and United Airlines Inc.

-

Market Research Insights

- The market is a dynamic and complex industry characterized by constant evolution. Two key indicators illustrate this trend. First, annual aircraft turnaround time, which measures the efficiency of an airline in preparing an aircraft for its next flight, has decreased by 15% over the past decade. This reduction in turnaround time allows airlines to increase their fleet utilization and improve on-time performance. Second, the average load factor, representing the percentage of seats filled on each flight, has risen by 5% over the same period. This increase in passenger load reflects growing demand for air travel and airlines' efforts to optimize capacity planning and yield management.

- Airline mergers, crew scheduling, route planning, and network expansion are among the factors driving these trends. Aircraft disposal, maintenance costs, and pilot fatigue are among the challenges airlines face in managing their operations. Effective air traffic management, baggage mishaps, customer satisfaction, and airport congestion also impact the industry's performance.

We can help! Our analysts can customize this commercial airlines market research report to meet your requirements.