Currency Counting Machine Market Size 2025-2029

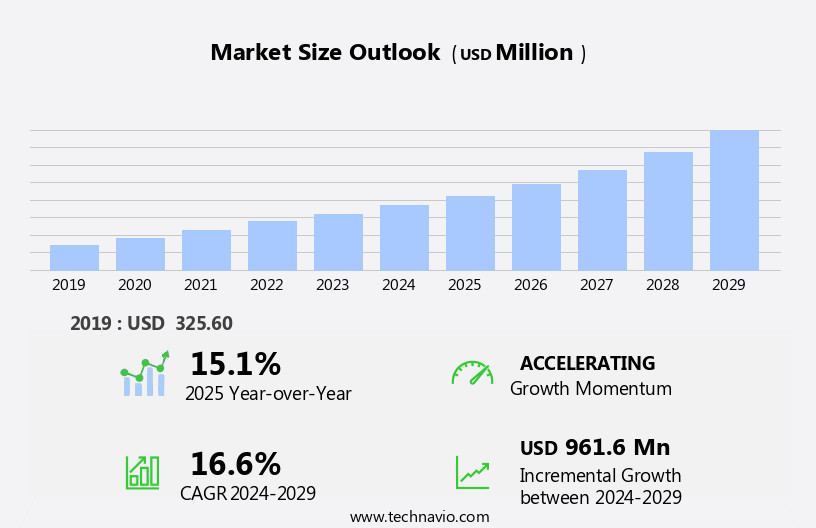

The currency counting machine market size is forecast to increase by USD 961.6 million at a CAGR of 16.6% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing prevalence of counterfeit currency and the growing need for weight-based currency counting machines. With the rise in cashless transactions, the number of card transactions has increased, leading businesses to prioritize the efficient handling of cash. This trend is particularly prominent in regions with high cash usage and a significant presence of bank notes. Key drivers for the market include the need for increased security against counterfeit currency, the growing preference for automated currency handling solutions, and the increasing demand for high-speed and high-capacity currency counting machines.

- However, challenges such as the high initial investment cost and the need for regular maintenance and calibration persist. To capitalize on market opportunities, companies in the market should focus on developing innovative solutions that address the challenges of counterfeit currency and offer advanced features such as high-speed counting, weight-based sorting, and integration with cash recycling systems. Additionally, partnerships and collaborations with financial institutions, retailers, and government organizations can provide significant growth opportunities. The market is poised for growth due to the increasing need for security against counterfeit currency and the growing preference for automated currency handling solutions.

- Companies seeking to capitalize on market opportunities should focus on developing innovative solutions that address market challenges and offer advanced features. Effective operational planning and strategic partnerships will be crucial for navigating the competitive landscape and maintaining a strong market position.

What will be the Size of the Currency Counting Machine Market during the forecast period?

- The market encompasses automated systems designed for the efficient processing of various forms of currency, including banknotes and coins. This market experiences significant growth due to the increasing prevalence of digital payments and the ongoing exchange of cash in financial transactions. Counterfeit notes pose a persistent challenge, necessitating advanced counterfeit currency detection technologies such as optical inspection and image processing. Financial inclusion and the expansion of small finance banks and commercial banks contribute to the market's expansion. These institutions rely on currency counting machines to streamline cash handling and banking operations, ensuring counting accuracy and operational efficiency.

How is this Currency Counting Machine Industry segmented?

The currency counting machine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- BFSI

- Retail

- Commercial

- Type

- Basic note counter

- Hi-speed heavy duty cash counting

- Intelligent counting cum counterfeit detection machines

- Capacity

- Low capacity

- Medium capacity

- High capacity

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- Italy

- UK

- North America

- US

- Canada

- South America

- Middle East and Africa

- APAC

By End-user Insights

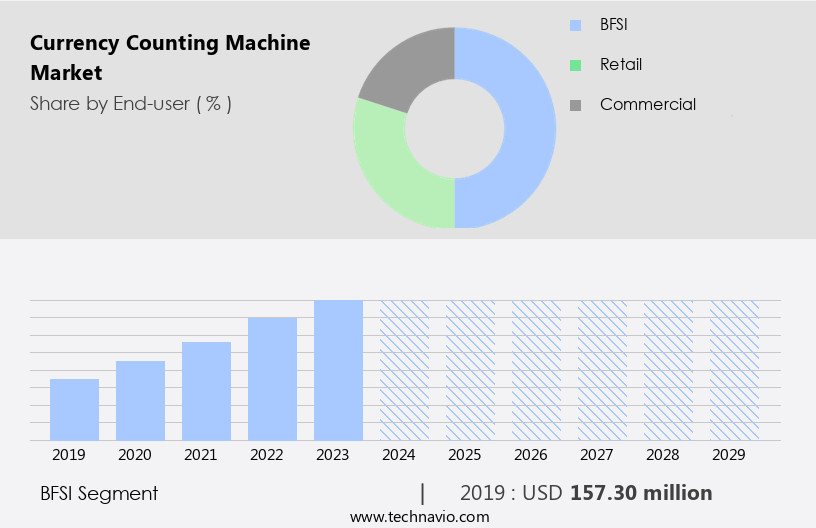

The BFSI segment is estimated to witness significant growth during the forecast period. The market plays a significant role in the banking, financial services, and insurance (BFSI) sector by automating cash handling processes, ensuring accuracy, and enhancing security. Cummins Allison Corporation is a leading provider of currency counting machines, offering advanced features such as high-speed counting, counterfeit detection, and multi-currency capability for BFSI institutions. Driving factors for the adoption of currency counting machines in this sector include the need for increased efficiency in cash handling processes, the rising volume of cash transactions, and stringent security measures to combat counterfeiting and fraud. Retail stores, commercial organizations, and financial institutions, including small finance banks and commercial banks, benefit from the automated system's accuracy and security.

Despite the benefits, security concerns, such as loose notes, bundle notes, and weight-based machines, remain a challenge for the market. Governmental regulations and the increasing production of polymer-based banknotes also impact the market's growth. Currency counting machines remain a crucial tool for the BFSI sector, offering increased efficiency, accuracy, and security in cash handling processes.

Get a glance at the market report of share of various segments Request Free Sample

The BFSI segment was valued at USD 157.30 million in 2019 and showed a gradual increase during the forecast period.

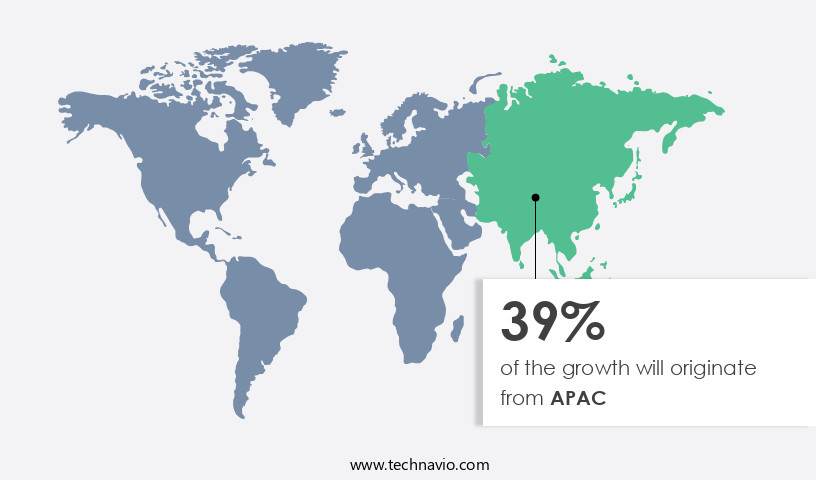

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is projected to expand significantly due to the increasing demand from the banking, financial services and insurance (BFSI), retail, and commercial sectors. The retail industry, particularly in India, is experiencing substantial investments from global players like Walmart, Tesco, Amazon.Com, and Tata, fueling the need for currency counting machines. These machines facilitate accurate counting, separating notes, and counterfeit detection, enhancing cash management efficiency for businesses and financial institutions. With the rise of digital payments, cashless transactions, and digital devices such as mobile phones, credit cards, debit cards, and prepaid cards, the market for currency counting machines is expected to remain steady.

However, security concerns, including internal theft and counterfeit currency production, necessitate the use of advanced features like optical inspection, image processing technology, and beeping noises for manual identification. Governmental regulations and the increasing prevalence of polymer-based banknotes also influence market growth. Theme amusement parks, hotels and restaurants, car transactions, internet banking, digital wallets, and weight-based machines are other end-user segments driving the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Currency Counting Machine Industry?

- Increase in counterfeit currency is the key driver of the market. The counterfeiting of currency is an age-old crime, posing significant threats to national security and economic stability. With the advent of modern technology, detecting counterfeit money has become increasingly challenging. However, currency counting machines offer a viable solution. These machines utilize advanced technology to identify counterfeit bills, preserving the integrity of legitimate currency. According to research, the global market for currency counting machines is expected to grow due to the increasing prevalence of counterfeit currency and the need for efficient currency handling in various industries.

- The machines use various features such as infrared detection, ultraviolet detection, and magnetic detection to identify counterfeit bills. By implementing these machines, governments and businesses can mitigate the risks associated with counterfeit currency and ensure the authenticity of their transactions. Counterfeit detection features, such as optical inspection and image processing technology, are essential in preventing internal theft and external counterfeit currency production. The adoption of digital payments, digital devices like mobile phones, credit cards, debit cards, and prepaid cards, and internet banking, however, has led to a decrease in cash transactions. Nevertheless, cash remains an essential aspect of financial inclusion, particularly in developing economies. The World Bank reports that over 1.7 billion adults remain unbanked, emphasizing the importance of cash management for financial inclusion. The market also caters to various industries, including theme amusement parks, hotels and restaurants, car transactions, and schools and colleges.

What are the market trends shaping the Currency Counting Machine Industry?

- Growing need for weight-based currency counting machines is the upcoming market trend. The global trend towards polymer banknotes is driving governments to adopt plastic bills due to their increased durability and security features. Polymer banknotes, made from a transparent plastic film coated with ink layers, are 2.5 times more resilient than traditional cotton-based paper notes. This switch results in fewer rejections by cash processing machines and lower destruction rates, leading to a better return on investment.

- Enhanced security features, such as transparent windows and holographic designs, make it more difficult for counterfeiters to replicate these notes. The production process involves a plastic core on which layers of ink and security features are applied. This shift towards polymer banknotes offers numerous benefits, including improved durability, security, and cost savings for financial institutions. The integration of mobile payments, such as mobile phones, credit cards, debit cards, and prepaid cards, has led to an increase in card transactions and a shift towards cashless transactions. Polymer-based banknotes and weight-based machines cater to the evolving needs of the market, offering enhanced security features and improved processing capabilities.

What challenges does the Currency Counting Machine Industry face during its growth?

- Increased number of card transactions is a key challenge affecting the industry growth. The market faces a significant challenge due to the increasing preference for digital payment methods and the subsequent decrease in cash transactions. As card-based transactions gain popularity, businesses across various sectors are shifting away from managing physical cash. This trend reduces the demand for currency counting machines in retail stores, banks, and other cash-intensive environments. The adoption of digital payment solutions not only simplifies transactions but also eliminates the need for extensive cash management infrastructure.

- Consequently, the market expansion for currency counting machine companies may be hindered. The market also serves various applications, including retail and commercial use, theme amusement parks, and governmental regulations. Machine technology continues to advance, enabling high-speed counting, authentication systems, and conveyor belts to streamline cash processing. Security concerns, such as internal theft and loose or bundled notes, are addressed through the use of intelligent counting systems. These advanced machines employ conveyor belts and weight-based measurement to ensure accurate and consistent counting, minimizing the potential for errors and fraud. Governmental regulations mandating the use of specific currency designs, such as polymer-based banknotes, have driven the demand for currency measuring devices that can accommodate these new note types. Theme amusement parks and car transactions are other industries that have adopted these machines to manage their cash flows effectively. Despite the advantages of currency measuring devices, concerns regarding security issues persist.

Exclusive Customer Landscape

The currency counting machine market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the currency counting machine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, currency counting machine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BellCon ApS - The company specializes in providing advanced currency counting solutions, featuring machines such as the BellCount S515F and Evision 5.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BellCon ApS

- Billcon Corp.

- Crane Payment Innovations Inc.

- Dolphin Automation

- Giesecke Devrient GmbH

- Glory Ltd.

- Godrej and Boyce Manufacturing Co. Ltd.

- Guangdong Baijia Baiter Co. Ltd.

- Guangzhou SmartTec Co. Ltd.

- Halma Plc

- Hilton Trading Corp.

- Julong Co. Ltd.

- Kisan Electronics Co. Ltd.

- Ktron Systems

- Laurel Bank Machines Co. Ltd.

- Magner Corporation of America

- Mycica Technologies

- NexBill Inc.

- Royalsovereign

- Volumatic

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Currency measuring devices have become an essential component of cash management systems for commercial organizations across various industries. These automated systems streamline the process of accurately counting and separating notes, enhancing operational efficiency and reducing manual errors. The proliferation of counterfeit notes poses a significant challenge to financial institutions and retail establishments alike. To mitigate this risk, currency measuring devices incorporate advanced counterfeit currency detection technologies. These systems utilize image processing technology and optical inspection to analyze the authenticity of each note, ensuring the integrity of the cash being handled. Financial inclusion initiatives, particularly in emerging economies, have led to an increased focus on small finance banks and other financial sector entities. The Currency Counting Machine market is witnessing significant growth due to the increasing demand for automated solutions in cash handling processes. With the rise of digital payments through credit cards, debit cards, and prepaid cards, the role of cash in transactions is diminishing, but it still remains a significant aspect of business operations. The cash management department in businesses and financial institutions continues to face the challenge of managing and counting large amounts of cash efficiently. Manual tasks such as counting loose notes and bundling notes can be time-consuming and prone to errors.

Currency counting machines offer an effective solution to this problem. These machines can count and sort notes of various denominations, reducing the need for manual intervention and increasing accuracy. Desktop models of currency counting machines are popular in small businesses and financial institutions due to their compact size and affordability. More advanced models of currency counting machines can even identify and reject counterfeit notes, providing an added layer of security. These machines can handle both loose notes and bundled notes, making them a versatile tool for cash handling processes. The Currency Counting Machine market is poised for growth as businesses and financial institutions seek to automate their cash handling processes and increase efficiency in their cash management operations.

These institutions often rely on currency measuring devices to manage their cash reserves efficiently and securely. The integration of digital devices and digital payments has transformed the way businesses manage their cash. Cash management teams in commercial organizations can now process transactions electronically, reducing the reliance on manual tasks and physical cash exchanges. However, the need for accurate cash counting persists, making currency measuring devices an indispensable tool. Retail stores, hotels, and restaurants are among the many commercial entities that benefit from the use of currency measuring devices. These machines enable quick and accurate counting of cash, reducing the time spent on manual tasks and improving overall productivity.

Ensuring the confidentiality and integrity of the cash being processed is crucial. Implementing security measures, such as access controls and encryption, can help mitigate these risks. Currency measuring devices play a vital role in the cash management processes of various commercial organizations. Their ability to accurately count and detect counterfeit notes, streamline manual tasks, and enhance security makes them an essential investment for businesses seeking to optimize their cash handling operations. The Currency Counting Machine Market is witnessing significant growth due to the increasing automation in cash management processes across various sectors. These advanced currency measuring devices are essential tools for financial institutions, cash management teams, and retail shops to efficiently manage and process large volumes of cash. The automated system of currency counting machines eliminates the need for manual tasks, reducing errors and saving time. Currency counting machines are not just limited to cash management departments in banks but are also becoming popular among business houses. These machines are equipped with features like beeping noise for each note detected, and the ability to identify and reject fake currency notes, loose notes, and bundle notes.

The use of currency measuring devices is not limited to cash transactions alone. With the increasing popularity of digital payments, currency counting machines are also being used to process and count notes received from customers in return for credit cards, debit cards, prepaid cards, and mobile phone top-ups. Desktop models of currency counting machines are commonly used in financial sectors, while generic machines are preferred by retail shops. The market for currency measuring devices is expected to grow further as the demand for efficient cash management solutions continues to rise. However, the challenge of preventing fake currency production remains a significant concern for manufacturers of currency measuring devices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.6% |

|

Market growth 2025-2029 |

USD 961.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.1 |

|

Key countries |

US, China, Japan, UK, India, South Korea, Germany, Italy, Canada, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Currency Counting Machine Market Research and Growth Report?

- CAGR of the Currency Counting Machine industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the currency counting machine market growth of industry companies

We can help! Our analysts can customize this currency counting machine market research report to meet your requirements.