BFSI Contact Center Analytics Market Size 2024-2028

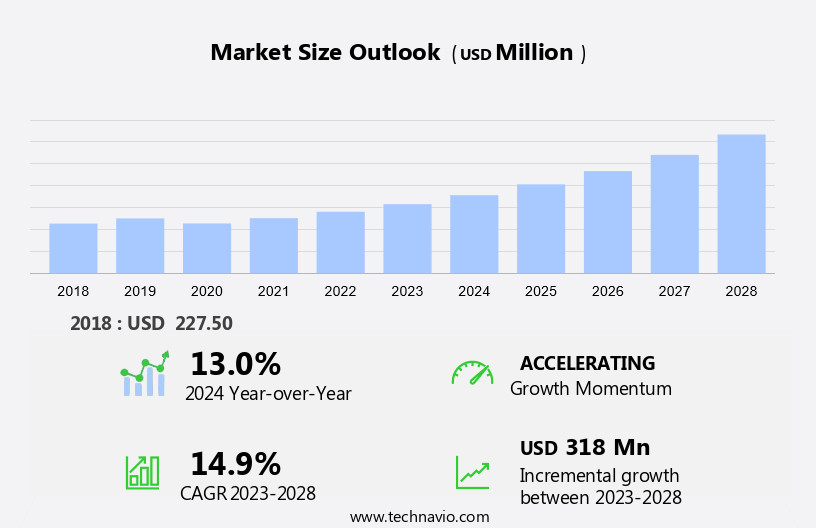

The BFSI contact center analytics market size is forecast to increase by USD 318 million at a CAGR of 14.9% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. One major trend is the increasing need for financial institutions to enhance their customer relationship management (CRM) systems for effective revenue generation. Another trend is the integration of chatbots to improve turnaround times and enhance customer experience. The integration of advanced technology, such as artificial intelligence and machine learning, enables BFSI contact centers to analyze customer conversations and transactions in real time. However, rising data privacy and security concerns are also posing challenges to market growth. Financial organizations must ensure the security and confidentiality of customer data while implementing analytics solutions. These trends and challenges are shaping the future of the market. By leveraging advanced analytics tools, financial institutions can gain valuable insights from customer interactions, improve operational efficiency, and deliver personalized services to their clients. This will not only help in enhancing customer satisfaction but also in driving revenue growth and competitiveness In the market.

What will be the BFSI Contact Center Analytics Market Size During the Forecast Period?

- The market In the US is witnessing significant growth due to the increasing demand for efficient systems to manage customer interactions and financial risks In the highly regulated financial services industry. With the rise of technology, call centers have evolved from traditional inbound and outbound call handling to customer-centric platforms that leverage digital tools to analyze customer conversations and transactions across various communication channels. Financial institutions, ranging from conglomerates to mid-sized and smaller institutions, are adopting cloud-based phone systems and call center software to improve customer experience, accessibility, and productivity. Remote and distributed teams are increasingly common In the virtual call center landscape, making it crucial for financial institutions to invest in advanced analytics solutions to manage their contact centers effectively and mitigate risks.

How is this BFSI Contact Center Analytics Industry segmented and which is the largest segment?

The BFSI contact center analytics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- Cloud-based

- On-premises

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Deployment Insights

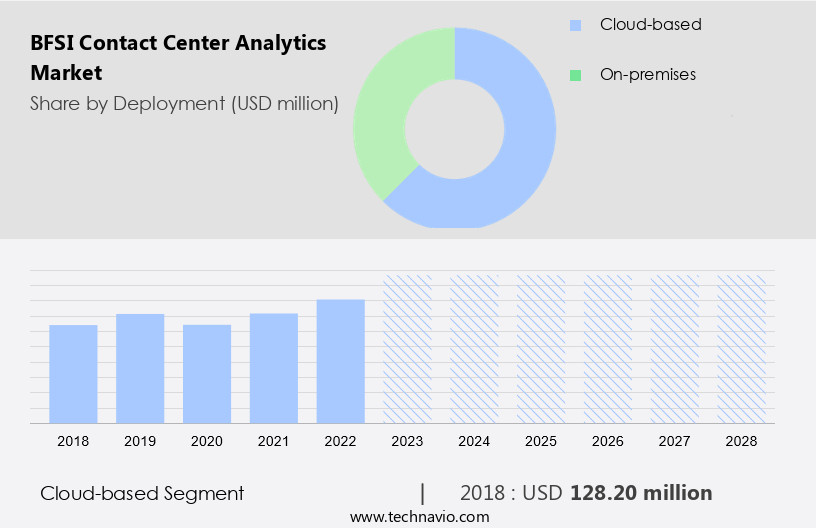

- The cloud-based segment is estimated to witness significant growth during the forecast period.

The BFSI sector has witnessed significant growth In the adoption of cloud-based contact center solutions over the past five years. This trend is driven by the need for scalability, flexibility, and cost-effectiveness in managing contact centers. BFSI companies are investing in contact center analytics to optimize operations, enhance customer experience, and ensure regulatory compliance. Digital transformation initiatives and the offering of financial advisory services have further increased the demand for advanced contact center analytics. Additionally, by leveraging these solutions, BFSI institutions can gain valuable insights into customer behavior, preferences, and needs, enabling them to provide personalized services and improve overall customer satisfaction. Cloud-based call center software offers a secure and automated environment, allowing for efficient handling of both inbound and outbound calls. This technology is essential for mid-sized and smaller institutions, as well as conglomerates and regulated entities, to stay competitive In the market.

Get a glance at the BFSI Contact Center Analytics Industry report of share of various segments Request Free Sample

The cloud-based segment was valued at USD 128.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is expected to dominate the global market due to the increasing adoption of cloud services and the presence of key market players. The use of analytics in BFSI contact centers is becoming increasingly important as enterprises shift towards omnichannel customer care. In North America, the adoption of multichannel customer interaction analytics, speech analytics, and contact center performance analytics is on the rise. These analytics applications enable enterprises to offer improved customer experiences and gain valuable insights from customer interactions. Additionally, cost reduction and the need for secure payments are driving the market growth in this region. Software integrations facilitate seamless data access from various sources, enabling real-time metrics analysis and top-performing representative identification.

Market Dynamics

Our BFSI contact center analytics market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of BFSI Contact Center Analytics Industry?

The need to improve CRM for effective revenue generation is the key driver of the market.

- In the highly regulated BFSI sector, where serving customers efficiently and managing financial risks are paramount, contact center analytics have emerged as essential tools for financial institutions of all sizes. Call centers are the primary point of customer contact, handling both inbound and outbound communications via various channels such as call, email, chat, and social media. To ensure a better customer experience, financial institutions are adopting technology-driven solutions, including cloud-based phone systems, call center software, and digital tools, to manage customer data, communication, and transactions securely. Moreover, the increasing use of remote and distributed teams necessitates the need for a virtual call center that offers accessibility and convenience. Software integrations enable seamless communication between different departments and systems, allowing for a multichannel approach to customer contact.

- Additionally, customer data analysis helps identify trends, vulnerabilities, and opportunities for improvement, ensuring financial well-being and enhancing clientele satisfaction. Effective call center analytics also facilitate cost reduction by providing metrics on top-performing representatives, identifying areas for improvement, and optimizing support services. By implementing user-friendly interfaces and secure payment platforms, financial institutions can build trust with their clientele and safeguard against potential risks. The digital transformation of customer support services has led to the integration of AI-driven chatbots, blockchain, and transaction platforms, enabling faster response times and improved customer satisfaction.

What are the market trends shaping the BFSI Contact Center Analytics Industry?

Integration of chatbots for better turnaround times is the upcoming market trend.

- In the BFSI (Banking, Financial Services, and Insurance) sector, contact centers play a pivotal role in serving customers and managing financial risks. With the increasing use of technology in customer service, contact centers are transitioning from traditional support to a more customer-centric approach. This shift includes implementing efficient systems such as cloud-based phone systems, call center software, and digital tools to handle inbound and outbound calls. BFSI institutions, ranging from conglomerates to smaller institutions, are leveraging these solutions to improve communication channels, accessibility, and convenience for their clientele. By integrating software with customer data, financial institutions can provide secure payments, better customer experience, and cost reduction.

- However, the regulated nature of the industry necessitates safeguarding against vulnerabilities, ensuring trust, and maintaining efficiency. Metrics like top-performing representatives and customer satisfaction are essential indicators of financial well-being. The future of contact centers lies in a multichannel approach, incorporating traditional support with digital channels such as social media, chatbots, and transaction platforms. AI-driven chatbots and blockchain technology are becoming increasingly popular for handling simple queries and securing transactions. User-friendly interfaces and digital transformation are essential for providing a seamless customer contact experience. By focusing on these elements, financial institutions can provide better customer service, enhance clientele loyalty, and maintain a competitive edge.

What challenges does the BFSI Contact Center Analytics Industry face during its growth?

Rising data privacy and security concerns are a key challenge affecting the industry growth.

- The market is a critical component of the financial services industry, enabling efficient system management and serving customers through various communication channels. This market caters to the needs of conglomerates, mid-sized institutions, and smaller financial institutions, handling both inbound and outbound calls. The implementation of cloud-based phone systems and call center software, coupled with digital tools, enhances accessibility and convenience for remote and distributed teams. Customer data and communication channels are integral to this market, which includes banks, credit unions, and other financial institutions. The focus on better customer experience, account data security, and secure payments is essential in this regulated industry.

- Additionally, data security and privacy are paramount concerns, as the predictive models used in contact center analytics access vast amounts of sensitive data. Any potential vulnerabilities may result in serious financial risks and damage to trust with the clientele. To ensure efficiency and safeguard against threats, this market employs various metrics, software integrations, and top-performing representatives. The financial well-being of the organization depends on the effective management of these risks and the delivery of high-quality support services. A user-friendly interface and multichannel approach are essential for a successful digital transformation, incorporating traditional support and digital channels like social media, chatbots, and AI-driven chatbots. The integration of blockchain technology and transaction platforms further strengthens security and enhances customer satisfaction.

Exclusive Customer Landscape

The BFSI contact center analytics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the BFSI contact center analytics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, BFSI contact center analytics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 247.ai Inc.

- 8x8 Inc.

- Accenture PLC

- Alvaria Inc.

- Ameyo Pvt Ltd.

- Calabrio Inc.

- CallFinder

- CallMiner Inc.

- Cisco Systems Inc.

- Enghouse Systems Ltd.

- Five9 Inc.

- Genesys Telecommunications Laboratories Inc.

- Genpact Ltd.

- International Business Machines Corp.

- Mitel Networks Corp.

- NICE Ltd.

- Oracle Corp.

- SAP SE

- Servion Global Solutions

- Stratifyd Inc.

- Verint Systems Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

In the dynamic world of business, contact centers play a pivotal role in managing customer interactions and financial risks for financial institutions. These centers serve as the primary point of communication between financial conglomerates, mid-sized institutions, and smaller entities, and their clientele. The efficient system of managing inbound and outbound calls, transactions, and conversations is crucial in delivering a better customer experience. Technology has revolutionized the contact center landscape, enabling financial institutions to leverage digital tools and cloud-based phone systems. Call center software, with its user-friendly interfaces, has streamlined the process of managing customer contact, account data, and secure payments.

Additionally, this digital transformation has made customer service more accessible and convenient for both parties. The contact center analytics market In the regulated financial industry is witnessing significant growth, driven by the need for improved efficiency, cost reduction, and enhanced customer satisfaction. The market dynamics are shaped by various factors, including the increasing demand for a multichannel approach to customer support and the integration of software solutions with various communication channels. The financial sector, comprised of banks and credit unions, recognizes the importance of a customer-centric approach in managing customer interactions. The use of AI-driven chatbots and blockchain technology has enabled institutions to provide quicker responses and secure transactions, thereby enhancing the overall customer experience.

Moreover, the shift towards remote and distributed teams has necessitated the need for virtual call centers. This trend has gained momentum due to the convenience and accessibility it offers, allowing financial institutions to serve their clientele from anywhere In the world. However, with the increasing use of digital channels, financial institutions face vulnerabilities related to data security and safeguarding customer trust. The market for contact center analytics is responding to these challenges by providing advanced metrics and top-performing representative tools to help institutions manage these risks effectively. The adoption of technology in contact centers has also led to cost reduction and increased efficiency.

In addition, institutions can now monitor and analyze customer interactions in real-time, identify trends, and make data-driven decisions to improve their financial well-being. The use of digital channels for customer support has also led to a shift in communication preferences. Traditional support methods, such as phone calls, are being supplemented by digital channels like social media and chatbots. This multichannel approach enables financial institutions to cater to the diverse needs and preferences of their clientele. In summary, the contact center analytics market In the financial services industry is a dynamic and evolving space. The use of technology, digital tools, and a customer-centric approach are driving the market's growth and shaping its future. Financial institutions must stay abreast of these trends to provide their clientele with the best possible service and maintain their trust.

|

BFSI Contact Center Analytics Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.9% |

|

Market growth 2024-2028 |

USD 318 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

13.0 |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this BFSI Contact Center Analytics Market Research and Growth Report?

- CAGR of the BFSI Contact Center Analytics industry during the forecast period

- Detailed information on factors that will drive the BFSI Contact Center Analytics growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the BFSI contact center analytics market growth of industry companies

We can help! Our analysts can customize this BFSI contact center analytics market research report to meet your requirements.