Coin Sorter Market Size 2024-2028

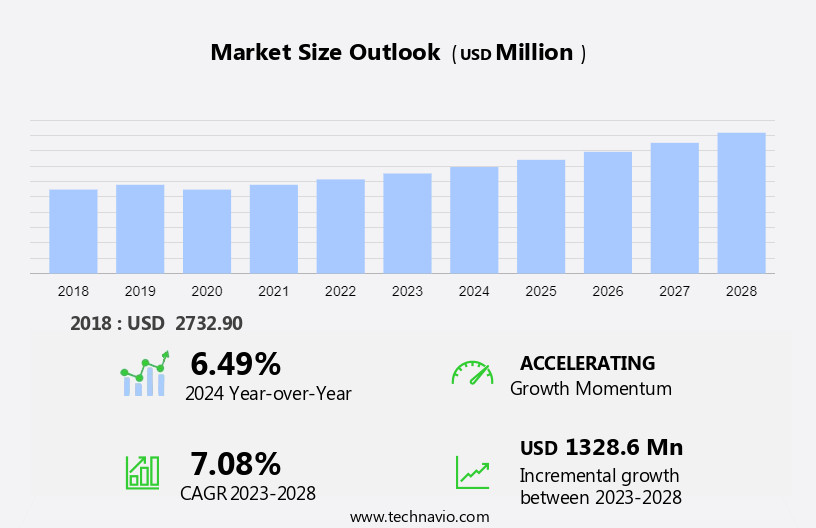

The coin sorter market size is forecast to increase by USD 1.33 billion, at a CAGR of 7.08% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing adoption of automation and digital technologies in various industries, including e-commerce and IT, is driving the demand for coin sorters. The semiconductor industry's advancements in sensor technology have led to more accurate coin counting, making coin sorters an essential tool for businesses.

- In developing countries, the rising number of bank branches is increasing the need for coin sorting machines to manage the high volume of cash transactions. Furthermore, the increasing popularity of card transactions does not diminish the importance of coin sorters, especially in sectors such as casinos and support services. Overall, the market is expected to grow steadily, fueled by these trends and the continuous advancements in electronics and digital technologies.

What will be the Size of the Coin Sorter Market During the Forecast Period?

- The market encompasses devices designed to automate the sorting and counting of coins in various denominations for revenue-generating processes. These devices, which include containers and tubes, cater to end users in commercial banking and retail industries, particularly in cash-intensive environments. The market's growth is driven by the increasing need for efficiency and performance in handling currency, as well as the global digitization trend.

- Human error reduction is a significant factor In the market's appeal, as organizations seek to streamline their cash handling operations. End-use industries, such as retail outlets and commercial establishments, benefit from the increased accuracy and speed offered by coin sorters. The market's size is substantial, with sectors like electronics production, semiconductor manufacturing, and IT gear also utilizing coin sorters in their operations. Studies suggest that the market will continue to grow, with a contact form available for those interested in learning more about automated cash handling solutions.

How is this Coin Sorter Industry segmented and which is the largest segment?

The coin sorter industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Small size coin sorter

- Medium size coin sorter

- Large size coin sorter

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Type Insights

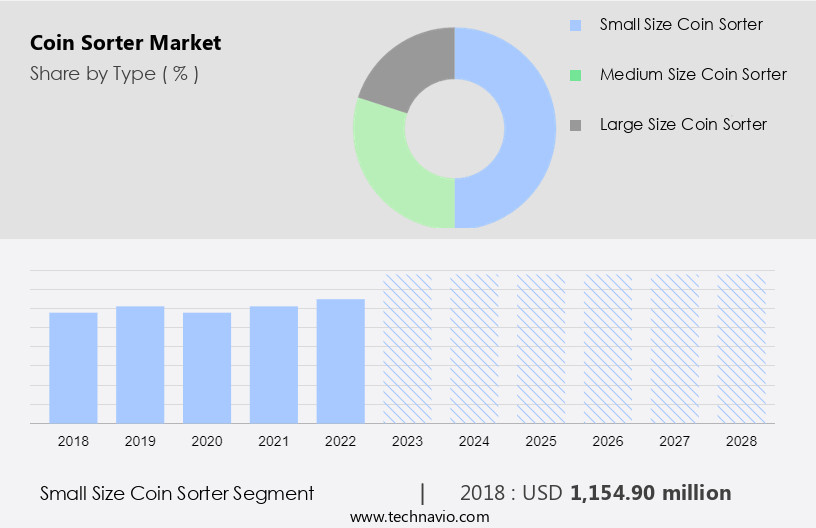

- The small size coin sorter segment is estimated to witness significant growth during the forecast period.

The small-size coin sorter segment is projected to experience substantial growth In the market due to the rising preference for these devices in cash-intensive environments, particularly in retail industries. Small-size coin sorters are increasingly popular due to their ability to handle a large number of coins of various denominations and sizes. The efficiency and performance gains from automating cash handling in retail outlets are significant, contributing to the market's expansion. Commercial banking and lodging establishments also rely on coin sorters for revenue generation and organizational efficiency.

The market's growth is driven by the increasing trend toward cashless transactions, including card transactions and online payment methods, which has not diminished the need for coin handling solutions. Key players In the ecosystem include manufacturers of coin machines, IT gear, electronics production, and semiconductor companies. The coin sorter industry continues to evolve with advanced automation technologies, improving the accuracy and speed of coin sorting processes while reducing human error.

Get a glance at the Coin Sorter Industry report of share of various segments Request Free Sample

The small size coin sorter segment was valued at USD 1.15 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

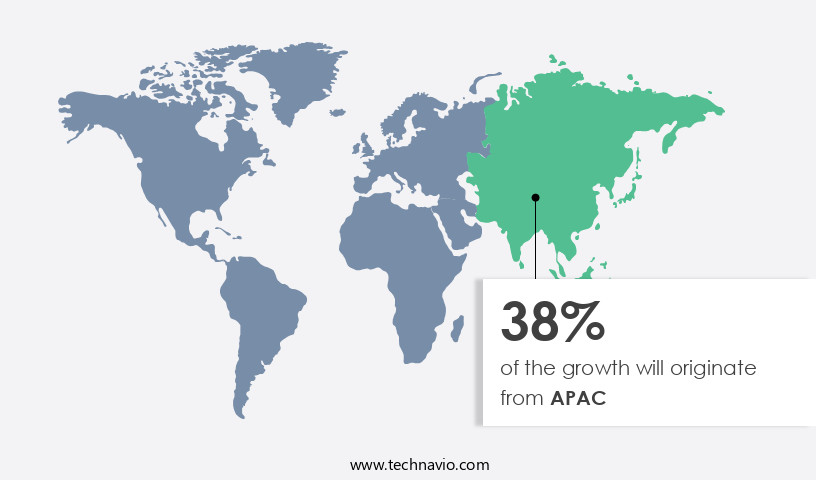

- APAC is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC experienced significant growth in 2023, with China, South Korea, and Japan being the primary contributors to revenue. The expansion of banks, retail industries, commercial establishments, and monetary organizations In these countries fueled this growth. The increasing savings and disposable income In the region have encouraged banks to extend their reach into rural sectors of developing countries, such as India, Afghanistan, Bangladesh, Bhutan, and Cambodia. Coin sorters are essential for cash-intensive environments, including retail outlets, lodging establishments, and merchants, to efficiently process high-value coin transactions.

Further, the coin sorter industry is experiencing growth due to the integration of technologically advanced automated cash handling systems and the shift towards cashless transactions through card payments, retail e-commerce, and online payment platforms. The ecosystem of coin machines, IT gear, electronics production, and semiconductors supports the industry's growth. The market is expected to continue its expansion, driven by the increasing demand for cashless technologies and payment transactions, as well as the global digitization trend.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of the Coin Sorter Industry?

Accurate counting of coins is the key driver of the market.

- Coin sorting devices play a crucial role in revenue-generating processes for various organizations, particularly in cash-intensive environments such as commercial banking and retail industries. Manual counting of coins can lead to human error, resulting in financial losses and complications in financial record-keeping. Coin sorters, on the other hand, offer high levels of accuracy and efficiency, enabling the sorting, counting, and authentication of currency. These machines are essential in institutions like banks, retail outlets, schools and colleges, hospitals, railway stations, airports, and shopping malls.

- With their technologically advanced ecosystem, coin sorters can process large amounts of money at a significantly faster rate than human staff, ensuring precision and convenience. The coin sorter industry continues to evolve, integrating with cashless technologies like card transactions, consumer cashless, retail e-commerce, and online payment. As the global digitization trend continues, the demand for automated cash handling solutions is expected to grow, making coin sorters an investment pocket for businesses seeking competitive strength In their operations.

What are the market trends shaping the Coin Sorter Industry?

The rising number of bank branches in developing countries is the upcoming market trend.

- In developed economies, the retail banking sector is experiencing significant digitization, leading to a decline In the use of cash and coin transactions. Conversely, in emerging economies, the expansion of commercial banking networks is driving the demand for coin sorting devices. According to recent studies, the number of commercial bank branches in countries like India and Armenia has increased significantly, from 9.28 per 100,000 adults in 2008 to 14.7 per 100,000 adults in 2020 and from 17 in 2008 to 56 in 2020, respectively. These branches cater to the unbanked population, necessitating the use of coin sorters to manage the high volume of cash transactions.

- The market is expected to witness substantial growth due to the increasing number of bank branches and cash-intensive environments in emerging economies. The market is also influenced by the need for efficiency and performance in revenue-generating processes, as well as the integration of technologically advanced ecosystems in commercial banking and retail industries. End users, such as lodging establishments, banks, merchants, and retail outlets, are investing in coin machines and cash handling automation to streamline their operations and reduce human error. The market for coin sorters is poised for growth, with current estimates indicating a steady increase in demand during the forecast period.

What challenges does the Coin Sorter Industry face during its growth?

The increased number of card transactions is a key challenge affecting the industry growth.

- The market faces challenges due to the increasing trend towards cashless transactions and the growing popularity of card payments. According to recent estimates, over half of all payment transactions worldwide were made using cards in 2023. This shift towards card transactions is driven by the convenience and efficiency offered by debit and credit cards in the retail and hospitality industries. The retail e-commerce sector, in particular, has seen significant growth due to the rise in online payments. These trends are encouraging banks and merchants to invest in digital payments, cashless technologies, potentially hindering the growth of the market.

- Despite this, the coin sorter industry continues to offer competitive strength in cash-intensive environments, such as lodging establishments and commercial banking institutions. The ecosystem of coin machines and automated cash handling systems remains an essential part of the revenue-generating processes for these organizations, ensuring the accuracy and efficiency of cash handling. However, human error and the need for ongoing maintenance and staffing can impact performance. As the global economy continues to digitize, investments in IT gear, electronics production, and semiconductors will be crucial for the future of the coin sorter industry.

Exclusive Customer Landscape

The coin sorter market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the coin sorter market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, coin sorter market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arihant Maxsell Technologies Pvt. Ltd.

- BCASH ELECTRONICS CO. LTD.

- Crane Holdings Co.

- CTcoin AS

- De La Rue PLC

- Giesecke Devrient GmbH

- Glory Ltd.

- GRGBanking

- Hilton Trading Corp.

- International Business Machines Corp.

- Julong Co. Ltd.

- KLOPP Coin Inc.

- Nadex Coins

- Royalsovereign

- Safescan BV

- Semacon Business Machines Inc.

- Suzhou Ribao Technology Co. Ltd.

- SUZOHAPP

- TaskFile

- Teachers Choice

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of devices designed to automate the process of sorting and counting coins in various industries. These devices, often referred to as coin machines or coin sorters, are integral to revenue-generating processes in cash-intensive environments. Containers and tubes are essential components of coin sorters, facilitating the segregation of coins by denomination. The currency used in these machines can vary, with some designed for specific denominations and others capable of handling multiple currencies. Staff in commercial banking and retail industries rely on these technologically advanced devices to maintain efficiency and performance in their operations.

Further, human error is minimized through the use of coin sorters, ensuring accurate counting and reducing the need for manual labor. Organizations in cash-intensive environments, such as lodging establishments and banks, benefit significantly from the implementation of coin sorters. These machines streamline cash handling processes, improving overall organizational productivity. End users of coin sorters include merchants, banks, and retail outlets. In an increasingly cashless world, the importance of coin sorters In the ecosystem remains undiminished. With the rise of card transactions, consumer cashless behavior, retail e-commerce, and global digitization, the need for automated cash handling solutions persists. Coin machines are essential in industries where high cash value transactions occur frequently.

In addition, a study on the current and future estimates of the coin sorter industry reveals a growing trend towards investment In these devices, driven by their competitive strength in enhancing operational efficiency and reducing human error. The semiconductor industry plays a crucial role in the production of electronics required for coin sorters. IT gear and other related electronics are integral to the functioning of these machines, ensuring their accuracy and reliability. Contact forms and automated cash handling systems are increasingly being integrated into coin sorters, allowing for seamless integration with other payment transactions and cashless technologies. This integration enables organizations to provide a more comprehensive and convenient service to their customers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market Growth 2024-2028 |

USD 1.33 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Key countries |

US, China, Japan, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Coin Sorter Market Research and Growth Report?

- CAGR of the Coin Sorter industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the coin sorter market growth of industry companies

We can help! Our analysts can customize this coin sorter market research report to meet your requirements.