Industrial Automation Software Market Size 2024-2028

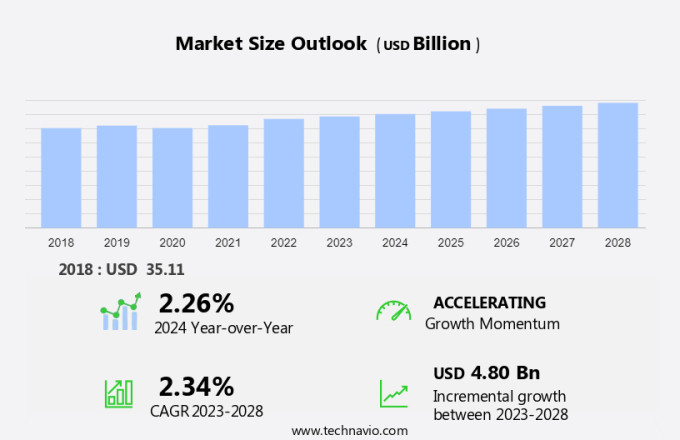

The industrial automation software market size is forecast to increase by USD 4.80 billion at a CAGR of 2.34% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing need to reduce operational expenses in various industries. One trend driving market growth is the integration of Product Lifecycle Management (PLM) and Enterprise Resource Planning (ERP) systems into industrial automation software. This integration enables seamless data flow between departments, improving efficiency and productivity. However, the market also faces challenges, including the rising threat of cybersecurity attacks. As industries increasingly rely on digital technologies, securing these systems against cyber threats becomes crucial to prevent potential disruptions and data breaches. Companies must prioritize cybersecurity measures to mitigate risks and ensure business continuity.

What will be the Size of the Industrial Automation Software Market During the Forecast Period?

- The market in the US is experiencing significant growth, driven by the increasing adoption of Industry 4.0 and digital industrial technologies in automation-driven industries. Enterprise-level solutions, including Product Lifecycle Management (PLM) systems, Human Machine Interface (HMI) software, and Manufacturing Execution Systems (MES), are gaining popularity for enhancing work efficiency and reducing human errors. The cloud-based segment is also witnessing increased demand due to its flexibility and accessibility, enabling 24/7 operations and system integration capabilities.

- Additionally, automation software processes are being adopted across various sectors, including automotive, chemicals and materials, oil and gas, and paper and pulp, to streamline automatic operations and optimize production. The trend towards on-cloud solutions and distributed control systems is expected to continue, addressing the need for skilled labor and time efficiency in the process and discrete industries.

How is this Industrial Automation Software Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- SCADA software

- MES

- DCS software

- HMI software

- PLC software

- End-user

- Process industry

- Discrete industry

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Product Insights

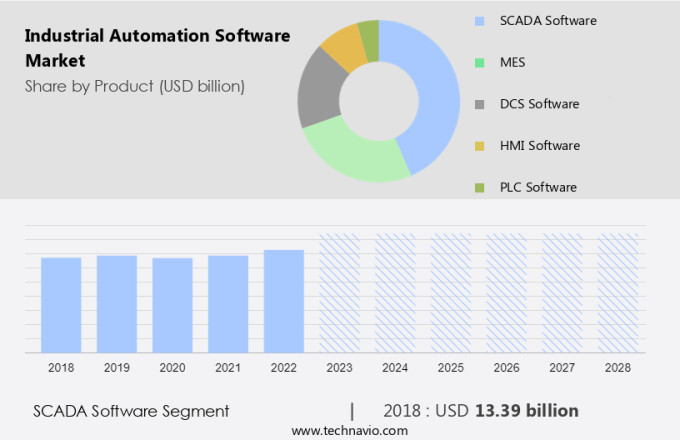

- The SCADA software segment is estimated to witness significant growth during the forecast period.

SCADA systems play a crucial role in automating industrial processes by performing functions such as data acquisition, communication, presentation, and control. These systems are essential for monitoring and gathering real-time data from various industries, including mining and metals, food and beverages, and power. By interacting with devices such as sensors, pumps, valves, and other monitoring equipment, SCADA software enables remote process monitoring and optimization. The increasing demand for operational efficiency and cost optimization has led to the growing adoption of SCADA systems. However, with the rise of cyber threats such as Legal violations and Denial-of-Service Attacks, there is a growing need for advanced security features like Multi-Factor Authentication and Remote wipe technologies to ensure data security. SCADA systems are integral to industrial automation, enabling seamless communication between Programmable Logic Controllers (PLCs) and computers, ultimately optimizing industrial processes.

Get a glance at the Industry report of share of various segments Request Free Sample

The SCADA software segment was valued at USD 13.39 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

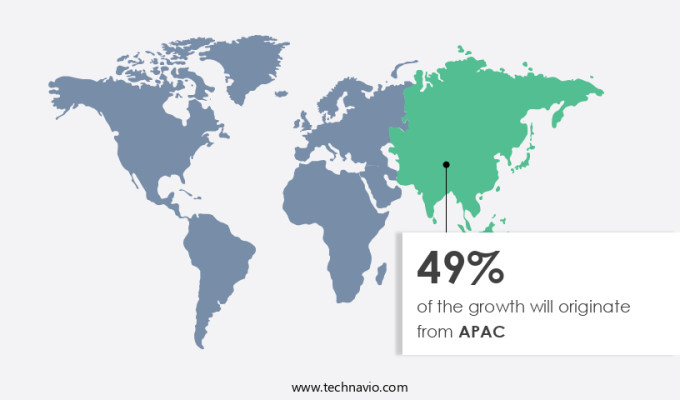

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is anticipated to experience significant growth, particularly in sectors such as power, oil and gas, automotive, and pulp and paper. In the power industry, countries like Myanmar and Australia are investing heavily in power generation and distribution, with Myanmar aiming to electrify the entire country by 2030 through coal-fired power plants, and Australia generating over 17% of its power mix from renewable energy in 2016. Furthermore, investments in smart cities in India, Japan, South Korea, and Singapore are expected to drive substantial growth in the power industry during the forecast period. Product lifecycle management, enterprise-level solutions, human machine interface, and cloud-based segments are poised for growth in the market. Companies are focusing on offering advanced features and integrating Industry 4.0 technologies to cater to the evolving demands of automation-driven industries.

Market Dynamics

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Industrial Automation Software Industry?

The need to reduce overall operational expenses is the key driver of the market.

- The market: Enhancing Manufacturing Operations in Industry 4.0 Industrial automation software plays a pivotal role in enabling automation-driven industries to streamline their manufacturing processes and improve overall productivity. This software encompasses various technologies such as DCS, SCADA, PLCs, and automation-driven Industry 4.0 solutions. Product lifecycle management, including design specifications and in-process control, is crucial for industries like chemicals and materials, mining and metals, power, machine manufacturing, semiconductor and electronics, aerospace and defense, food and beverages, and pharmaceuticals. Enterprise-level solutions offer system integration capabilities, ensuring seamless communication between various automation technologies and IIoT devices. Human machine interface (HMI) and robotic solutions are essential components of these systems, providing 24/7 operations, dynamic schedules, and human-robot collaboration.

- Additionally, Cloud-based automation offers advantages such as real-time data access, control framework leaks prevention, and denial-of-service attack protection through multi-factor authentication and remote wipe technologies. Industrial automation software processes contribute significantly to work efficiency, time efficiency, and productivity. They minimize human errors and the need for skilled labor, making them essential for various industries. The market is continually evolving, with advancements in machine vision, artificial intelligence, and the Internet of Things (IoT) shaping its future. The Manufacturing Technology Centre and other research organizations are at the forefront of these advancements, ensuring that industries remain competitive and compliant with regulatory requirements.

What are the market trends shaping the Industrial Automation Software Industry?

Integration of PLM and ERP in industrial automation software is the upcoming market trend.

- Industrial automation software plays a crucial role in optimizing manufacturing processes in various industries, including automation-driven sectors such as chemicals and materials, mining and metals, food and beverages, power, machine manufacturing, semiconductor and electronics, aerospace and defense, and medical devices. The integration of product lifecycle management (PLM) and enterprise resource planning (ERP) systems has become a standard practice to streamline the development and launch of profitable products in discrete industries. Industrial automation software manages manufacturing information, including resource allocation, manufacturing planning, supply chain information, and quality inspection, while ERP systems integrate and store business operating information about human resources, customer relationship management, accounting, and other business financials. Cloud-based industrial automation software is gaining popularity due to its benefits such as time efficiency, reduced human errors, and accessibility from anywhere. The cloud-based segment is expected to grow significantly due to the increasing adoption of digital industrial technologies like the Internet of Things (IoT), artificial intelligence (AI), machine vision, and human-robot collaboration.

- Additionally, on-premise solutions are still widely used in industries with stringent data security requirements. Automation technologies, including robotic solutions and machine vision, are essential components. These technologies enable automatic operations, in-process control, and human-robot collaboration, leading to increased productivity and work efficiency. System integration capabilities are also essential, allowing seamless integration with other systems, including MES, control frameworks, and virtual machine conditions. The adoption is driven by the need for 24/7 operations, dynamic schedules, and the ability to handle large volumes of data. However, challenges such as control framework leaks, legal violations, Denial-of-Service Attacks, and the need for multi-factor authentication and remote wipe technologies are also important considerations. The manufacturing technology center plays a vital role in implementing and optimizing the solutions.

What challenges does the Industrial Automation Software Industry face during its growth?

Cybersecurity threats are key challenges affecting the industry's growth.

- Industrial automation is a critical aspect of Industry 4.0, with automation technologies such as Machine-to-Machine (M2M) communication, Human-Machine Interface (HMI), and robotic solutions becoming increasingly prevalent in automation-driven industries. Product lifecycle management (PLM) and Enterprise-level solutions are essential components, enabling seamless integration of design specifications, in-process control, and system integration capabilities. The market is segmented into on-premise and cloud-based solutions. The cloud-based segment is gaining popularity due to its flexibility, allowing for remote access and real-time data analysis. However, data security concerns remain a challenge, necessitating robust cloud automation, multi-factor authentication, and remote wipe technologies.

- Industries such as chemicals and materials, mining and metals, food and beverages, power, machine manufacturing, semiconductor and electronics, aerospace and defense, medical devices, and others are adopting industrial automation solutions to enhance work efficiency, reduce human errors, and ensure 24/7 operations with dynamic schedules. Automation software processes include Human-Robot collaboration, Machine vision, the Internet of Things (IoT), Artificial Intelligence (AI), and others. IIoT and robotic solutions are transforming industries by enabling automatic operations, while MES and control frameworks ensure in-process control and system integration. Despite the benefits, they are vulnerable to cyber threats, including control framework leaks, virtual machine conditions, legal violations, Denial-of-Service Attacks, and others. Therefore, it is crucial to prioritize data security and implement robust cybersecurity measures to mitigate risks and ensure business continuity.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Advantech Co. Ltd.

- AMETEK Inc.

- Baosteel Group Corp.

- Beckhoff Automation

- Eaton Corp. Plc

- Emerson Electric Co.

- General Electric Co.

- Hitachi Ltd.

- Honeywell International Inc.

- Mitsubishi Electric Corp.

- OMRON Corp.

- Oracle Corp.

- Parsec Automation Corp.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Tata Consultancy Services Ltd.

- Toshiba Corp.

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Industrial automation software plays a pivotal role in the digital transformation of various industries, enabling enterprises to streamline their operations, enhance productivity, and reduce human errors. This market encompasses a broad spectrum of solutions designed to manage the product lifecycle, optimize human-machine interaction, and integrate various automation technologies. At the heart of industrial automation software are enterprise-level solutions that cater to the unique requirements of automation-driven industries. These solutions offer advanced human machine interfaces, allowing operators to interact seamlessly with machines and systems. They also provide cloud-based and on-premise deployment options, catering to the diverse needs of different organizations. It is increasingly being adopted across various sectors, including chemicals and materials, mining and metals, food and beverages, power, machine manufacturing, semiconductor and electronics, aerospace and defense, medical devices, and more. The primary drivers behind this trend include the need for time efficiency, skilled labor availability, and the integration of digital industrial technologies.

Additionally, the automation software market is characterized by the continuous evolution of automation technologies, such as machine vision, human-robot collaboration, and the Internet of Things (IoT). These technologies enable automatic operations, in-process control, and real-time data analysis, leading to increased productivity and improved design specifications. However, the adoption also presents challenges. Data security is a major concern, with potential threats such as control framework leaks, virtual machine conditions, and legal violations. To mitigate these risks, cloud automation solutions incorporate advanced security features, including multi-factor authentication, remote wipe technologies, and denial-of-service attack prevention. The market is dynamic, with constant shifts in technology trends and customer demands. Companies must adapt to these changes to remain competitive, focusing on system integration capabilities, 24/7 operations, and dynamic schedules. This requires a deep understanding of the market dynamics and the ability to provide customized solutions tailored to specific industry needs.

In summary, the market is a critical component of the digital industrial revolution, offering significant benefits in terms of productivity, efficiency, and safety. As the market continues to evolve, companies must stay abreast of the latest trends and technologies to meet the evolving needs of their customers and maintain a competitive edge.

|

Industrial Automation Software Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.34% |

|

Market growth 2024-2028 |

USD 4.80 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.26 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.