Internet Of Things (IoT) Market Size 2024-2028

The internet of things (iot) market size is valued to increase USD 1554.5 billion, at a CAGR of 18.52% from 2023 to 2028. Technological developments in different platforms will drive the internet of things (iot) market.

Major Market Trends & Insights

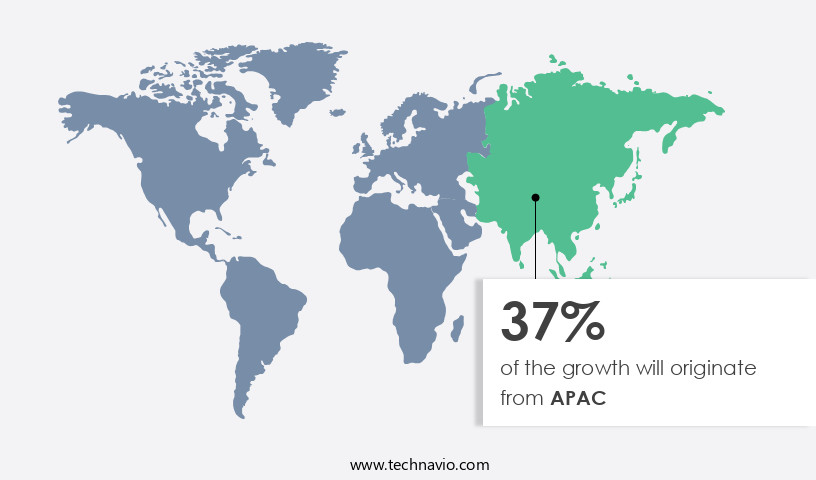

- APAC dominated the market and accounted for a 37% growth during the forecast period.

- By Application - Industrial segment was valued at USD 188.70 billion in 2022

- By Technology - RFID segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 302.53 billion

- Market Future Opportunities: USD 1554.50 billion

- CAGR : 18.52%

- APAC: Largest market in 2022

Market Summary

- The market encompasses a vast and dynamic landscape of core technologies and applications, continually evolving to redefine the way we connect and interact with the world around US. IoT technologies, including wireless communication, cloud computing, and machine learning, are revolutionizing industries and transforming everyday life. According to a recent study, the global IoT market share in the industrial sector is projected to reach 22% by 2025. Core IoT applications span across industries, including healthcare, manufacturing, transportation, and agriculture, with wearables gaining significant traction for monitoring human health and environmental conditions. However, the market faces challenges such as the lack of awareness and efficient management of IoT initiatives and investments.

- Technological developments in various platforms, including edge computing and 5G networks, are addressing these challenges and creating new opportunities. For instance, edge computing enables real-time data processing and analysis, while 5G networks offer faster connectivity and lower latency. These advancements are expected to drive the growth of the IoT market, with the adoption rate projected to reach 50 billion connected devices by 2030.

What will be the Size of the Internet Of Things (IoT) Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Internet Of Things (IoT) Market Segmented and what are the key trends of market segmentation?

The internet of things (iot) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Industrial

- Retail

- Healthcare

- ICT

- Others

- Technology

- RFID

- Sensors

- NFC

- Cloud services

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- Norway

- APAC

- China

- Rest of World (ROW)

- North America

By Application Insights

The industrial segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with an estimated 27.1% of businesses implementing IoT solutions as of 2021. This trend is expected to continue, with 30.9% of companies planning to adopt IoT technology in the near future. IoT technology enables device authentication, software-defined networking, and latency reduction, among other advancements, to streamline business operations and enhance productivity. Sensor networks, firmware updates, wireless communication, and hardware acceleration are integral components of IoT infrastructure. Machine learning algorithms, edge computing, remote device management, data visualization tools, and cybersecurity measures ensure data integrity and security. Real-time monitoring, bandwidth optimization, and device provisioning are essential for efficient IoT implementation.

Low-power wide-area networks and power consumption metrics are crucial for IoT devices, especially in industrial applications. Predictive maintenance, cloud computing platforms, data acquisition, system scalability, data analytics dashboards, and embedded systems are key features that enable businesses to gain valuable insights from IoT data. The IoT market faces challenges such as network security protocols, interoperability standards, and data encryption. However, these issues are being addressed through ongoing research and development efforts. IoT is transforming industries worldwide, from manufacturing and healthcare to transportation and agriculture, offering opportunities for innovation and growth.

The Industrial segment was valued at USD 188.70 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Internet Of Things (IoT) Market Demand is Rising in APAC Request Free Sample

The IoT market in North America is experiencing significant growth, fueled by the expanding industrial, automotive, and healthcare sectors. The US government's push for technological advancements, particularly in telehealth, mHealth, and nanomedicine, further drives market momentum. Mobile network expansion and cloud computing adoption are key factors contributing to this growth. A new trend of institutional IoT investments, consolidations, and partnerships is emerging, signifying a competitive landscape. According to recent studies, the number of IoT devices in North America is projected to reach 1.6 billion by 2025.

Additionally, the industrial IoT sector is expected to grow at a compound annual growth rate of 15%, while the healthcare IoT sector is anticipated to reach USD158.1 billion by 2022. These figures underscore the market's potential and ongoing evolution.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global IoT solutions market is evolving rapidly, driven by the adoption of cloud based data analytics platform capabilities and real-time sensor data processing frameworks that deliver immediate insights across connected networks. Businesses are increasingly implementing predictive maintenance algorithms iot to minimize downtime and extend equipment longevity, while data visualization dashboards iot support operational decision-making with clear, actionable intelligence. Alongside performance, network security best practices iot and data encryption algorithms iot remain central to safeguarding sensitive data, particularly as system scalability for iot devices expands in industrial, healthcare, and consumer domains.

Efficiency gains are also being realized through bandwidth optimization strategies iot, power consumption optimization iot, and hardware acceleration techniques iot, enabling organizations to maintain high performance while minimizing operational costs. Comparative studies reveal that companies leveraging iot edge computing infrastructure achieve up to 28% faster response times compared to cloud-only models, while low power wide area network deployment has extended device battery life by as much as 35% relative to traditional connectivity methods. These quantitative differences highlight how architecture and deployment choices significantly shape IoT outcomes.

The market's continuous progression is further supported by secure remote device management system adoption, iot firmware update processes, and remote diagnostics tools iot that enhance lifecycle stability. In parallel, innovations in machine learning model deployment, iot device lifecycle management, and api integration for iot devices ensure adaptability for diverse applications. Finally, iot device communication protocols and advanced iot device authentication methods are being refined to balance interoperability with stringent security, underscoring the sector's transition toward more resilient and intelligent connected ecosystems.

What are the key market drivers leading to the rise in the adoption of Internet Of Things (IoT) Industry?

- The advancements in technology across various platforms serve as the primary catalyst for market growth.

- The market has seen significant advancements in recent years, driven by the availability of affordable, high-reliability sensors and improved internet connectivity. This has made it possible for a wide range of manufacturers to integrate IoT technology into their products and services. Moreover, cloud computing platforms have become increasingly accessible, enabling organizations and consumers to efficiently manage and analyze the vast amounts of data generated by IoT devices. IoT technology has found applications in various sectors, including healthcare, manufacturing, transportation, and agriculture. In healthcare, wearable devices and sensors are used to monitor patients' vital signs and track their health progress.

- In manufacturing, IoT is used for predictive maintenance, optimizing production processes, and enhancing supply chain management. In transportation, IoT is employed for real-time traffic monitoring, fleet management, and predictive maintenance. In agriculture, IoT is used for precision farming, livestock monitoring, and irrigation management. The ongoing evolution of IoT technology continues to unlock new possibilities and applications across various industries. As the market matures, we can expect to see further innovations and advancements in areas such as security, privacy, and interoperability. IoT is transforming the way businesses operate and interact with their customers, offering new opportunities for growth and efficiency.

- IoT technology's impact is not limited to specific industries or regions. It is a global phenomenon, with companies and organizations worldwide adopting and implementing IoT solutions to gain a competitive edge. The IoT market is expected to continue growing, with an increasing number of businesses recognizing the benefits of connecting their devices and systems to the cloud. In conclusion, the IoT market is a dynamic and evolving space, with new technologies and applications emerging constantly. The availability of affordable sensors, improved internet connectivity, and cloud computing platforms have made IoT technology accessible to a wide range of businesses and industries, leading to significant growth and innovation. The future of IoT looks bright, with endless possibilities for new applications and use cases.

What are the market trends shaping the Internet Of Things (IoT) Industry?

- The use of wearable technology for monitoring human health and environmental conditions is an emerging market trend. This innovative approach to health and wellness is gaining significant traction.

- Mobile phones have become the primary hub for computing and communication in today's world, with integrated sensors transforming their functionality. Social networking, environmental monitoring, healthcare, and transportation are among the sectors experiencing significant advancements due to mobile phones' enhanced features. Equipped with GPS, microphones, accelerometers, cameras, ambient light sensors, gyroscopes, and digital compasses, smartphones offer unparalleled capabilities. Additionally, they come with WIFI, 3G/4G/5G, and Bluetooth radio.

- IoT wearables, an extension of these devices, empower individuals to monitor their health and enable doctors to remotely assess patients. This fusion of technology and mobility is revolutionizing various industries and improving efficiency, accessibility, and convenience.

What challenges does the Internet Of Things (IoT) Industry face during its growth?

- The absence of adequate understanding and effective management of Internet of Things (IoT) initiatives and investments is a significant challenge impeding industry growth.

- The industrial the market is experiencing significant growth, with an increasing number of enterprises implementing IoT in their facilities. However, managing, securing, and optimizing these investments poses a challenge. According to recent studies, the global industrial IoT market is projected to reach a value of USD1,102.3 billion by 2026, growing at a compound annual growth rate (CAGR) of 16.1% during the forecast period. Despite this growth, a major hurdle for industries is the lack of skilled employees to effectively handle IoT systems. Training employees on IoT platforms is crucial to enable them to adapt and maximize the potential of these technologies.

- Failure to do so may result in only partial exploitation of IoT capabilities. The industrial IoT workforce must possess the necessary knowledge and skills to maintain, secure, and optimize these systems. The ongoing evolution of IoT technologies necessitates continuous learning and adaptation, making training an essential ongoing process for industries.

Exclusive Customer Landscape

The internet of things (iot) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the internet of things (iot) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Internet Of Things (IoT) Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, internet of things (iot) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aeris Communications Inc. - The Google subsidiary provides Internet of Things innovations, including Edge TPUs, enhancing device intelligence at the edge. Edge TPUs are custom-built application-specific integrated circuits, enabling machine learning inference at the source, reducing latency and bandwidth usage.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aeris Communications Inc.

- Alphabet Inc.

- Amazon.com Inc.

- AT and T Inc.

- Cisco Systems Inc.

- Fujitsu Ltd.

- General Electric Co.

- Hewlett Packard Enterprise Co.

- Honeywell International Inc.

- Intel Corp.

- International Business Machines Corp.

- Koninklijke Philips N.V.

- Microsoft Corp.

- Oracle Corp.

- PTC Inc.

- Robert Bosch GmbH

- SAP SE

- Siemens AG

- Thales Group

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Internet Of Things (IoT) Market

- In January 2024, IBM announced the acquisition of Sigfox, a leading provider of low-power, wide-area network technology for IoT devices, for approximately USD660 million. This acquisition aimed to strengthen IBM's IoT capabilities and expand its reach in the industrial IoT sector (IBM Press Release).

- In March 2024, Amazon Web Services (AWS) launched AWS IoT Greengrass Core, a software that allows edge devices to run local compute, messaging, and data caching functions, enabling more efficient and secure IoT deployments (AWS Blog).

- In May 2024, Microsoft and Google formed a strategic partnership to interoperate their IoT platforms, Azure IoT and Google Cloud IoT Core, enabling seamless data exchange and integration between the two platforms (Microsoft Blog).

- In April 2025, the European Union passed the IoT Cybersecurity Regulation, mandating enhanced security measures for IoT devices and services sold in the EU market, effective from April 2026 (European Parliament Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Internet Of Things (IoT) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.52% |

|

Market growth 2024-2028 |

USD 1554.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.18 |

|

Key countries |

US, China, Germany, Norway, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of the market, several key trends are shaping the future of this technology-driven industry. One significant development is the increasing focus on device authentication, ensuring secure access to IoT networks and preventing unauthorized access. Another trend gaining traction is the adoption of software-defined networking (SDN) to optimize latency and improve network efficiency. SDN enables real-time monitoring, bandwidth optimization, and remote device management, enhancing the overall performance of IoT systems. Sensor networks and wireless communication are at the heart of IoT, with an increasing number of devices being integrated into these systems.

- Firmware updates and hardware acceleration play crucial roles in maintaining the functionality and security of these devices. Machine learning algorithms and edge computing are also becoming essential components, enabling predictive maintenance and data analytics. Cybersecurity measures, interoperability standards, and network security protocols are essential for securing IoT networks and ensuring data integrity. Power consumption metrics and low-power wide-area networks are also crucial considerations for optimizing the efficiency of IoT systems. Cloud computing platforms and data acquisition are integral parts of the IoT ecosystem, providing scalability and enabling data analytics dashboards. APIs and protocol stacks facilitate seamless integration of various IoT devices and systems.

- In summary, the IoT market is characterized by continuous innovation and the integration of various technologies to enhance the functionality, security, and efficiency of IoT systems. From device authentication and SDN to sensor networks, wireless communication, and data analytics, these trends are shaping the future of IoT and driving the development of new applications and use cases.

What are the Key Data Covered in this Internet Of Things (IoT) Market Research and Growth Report?

-

What is the expected growth of the Internet Of Things (IoT) Market between 2024 and 2028?

-

USD 1554.5 billion, at a CAGR of 18.52%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (Industrial, Retail, Healthcare, ICT, and Others), Technology (RFID, Sensors, NFC, Cloud services, and Others), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Technological developments in different platforms, Lack of awareness of efficient management of IoT initiatives and investments

-

-

Who are the major players in the Internet Of Things (IoT) Market?

-

Key Companies Aeris Communications Inc., Alphabet Inc., Amazon.com Inc., AT and T Inc., Cisco Systems Inc., Fujitsu Ltd., General Electric Co., Hewlett Packard Enterprise Co., Honeywell International Inc., Intel Corp., International Business Machines Corp., Koninklijke Philips N.V., Microsoft Corp., Oracle Corp., PTC Inc., Robert Bosch GmbH, SAP SE, Siemens AG, Thales Group, and Wipro Ltd.

-

Market Research Insights

- The market encompasses a vast array of hardware components and system architectures, driven by the integration of smart sensors, data processing capabilities, and device connectivity. According to recent estimates, the global IoT market is projected to reach USD1.6 trillion in value by 2025, representing a significant increase from the USD656.3 billion recorded in 2019. This growth is fueled by the demand for energy efficiency, risk management, and system reliability in various industries. Moreover, the IoT ecosystem relies heavily on system performance, data quality, and security. Performance evaluation and system testing are crucial to ensure seamless data transmission through network protocols and application programming interfaces.

- Meanwhile, data governance and compliance standards are essential to mitigate security threats and maintain data interpretation accuracy. With an increasing number of connected devices, system upgrades and fault detection become indispensable components of IoT system architecture. These aspects contribute to the ongoing evolution of the IoT market, shaping its future development and applications.

We can help! Our analysts can customize this internet of things (iot) market research report to meet your requirements.