Cybersecurity Services Market Size 2024-2028

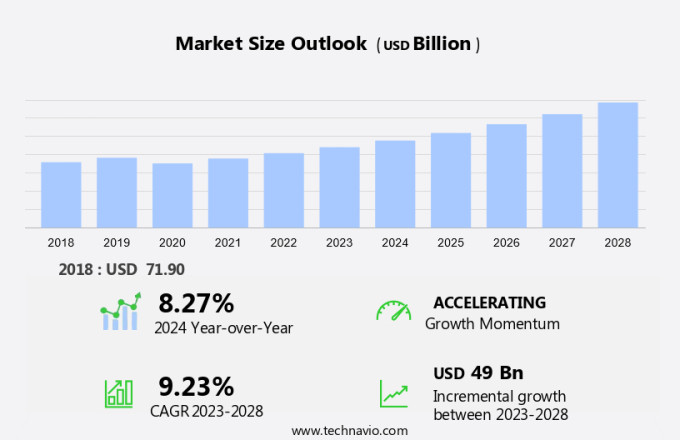

The cybersecurity services market size is forecast to increase by USD 49 billion at a CAGR of 9.23% between 2023 and 2028. The market is experiencing significant growth due to several key drivers. The increasing number of data breaches and cyber-attacks has heightened the awareness and importance of cybersecurity, leading to an increase in demand for these services. Another trend in the market is the integration of artificial intelligence (AI) and machine learning (ML) technologies to enhance threat detection and response capabilities. However, the high cost of implementing cybersecurity services remains a challenge for many organizations, particularly smaller businesses and governments with limited budgets. Despite this, the market is expected to continue growing as businesses recognize the need for cybersecurity to protect their valuable digital assets.

What will be the Size of the Market During the Forecast Period?

The market is witnessing significant growth due to the increasing reliance on digital technologies and the subsequent rise in cyber threats. With the proliferation of cloud computing, remote work, and digital transactions, enterprises across various sectors including banking, financial services, healthcare, e-commerce platforms, and critical infrastructure are increasingly vulnerable to cyberattacks. Digital technologies have revolutionized the way businesses operate, enabling them to offer new services and reach wider audiences. However, they also introduce new risks. Cybersecurity risks, such as malicious attacks, are a major concern for organizations, particularly those dealing with sensitive data.

Moreover, the energy sector and critical infrastructure are also at risk from physical threats that can have digital consequences. Advanced security solutions are essential to mitigate these risks. AI and machine learning technologies are being increasingly adopted to enhance cybersecurity capabilities. Risk-based security approaches are becoming the norm, with organizations prioritizing resources to protect their most valuable assets. The shift to remote work has further complicated cybersecurity efforts. With employees working from home, the traditional perimeter security model is no longer sufficient. Organizations must ensure their networks and data are secure, regardless of where their employees are located. The cybersecurity skills gap is another challenge.

Similarly, with the increasing complexity of cyber threats, there is a growing demand for skilled cybersecurity professionals. Organizations must invest in training and development to ensure they have the necessary expertise in-house. In conclusion, the market is crucial in helping organizations navigate the digital landscape and protect against cyber threats. The market is expected to grow as businesses continue to adopt digital technologies and as cybercriminals become more sophisticated in their attacks. Organizations must prioritize cybersecurity to safeguard their assets and maintain customer trust.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premises

- Cloud based

- End-user

- Government

- BFSI

- ICT

- Manufacturing

- Others

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- North America

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period. On-premises cybersecurity services offer organizations advanced security solutions to safeguard their infrastructure from cyberattacks. These solutions are installed and managed within an organization's own physical environment, providing a high degree of control and customization. With on-premises cybersecurity, businesses can fine-tune security configurations, set up strict access controls, and maintain direct supervision over their security operations. This level of control is essential for industries with stringent regulatory requirements, sensitive data handling policies, or unique security considerations. Machine Learning (ML) and threat detection technologies are increasingly being integrated into on-premises cybersecurity solutions to enhance their capabilities. Cloud security services are also becoming a significant component of on-premises cybersecurity offerings, allowing organizations to extend their security perimeter to the cloud. The demand for cybersecurity professionals is at an all-time high due to the increasing number of cyberattacks.

However, there is a significant cyber talent shortage, making it challenging for organizations to find and retain skilled cybersecurity personnel. To address this challenge, on-premises cybersecurity providers offer managed services, allowing businesses to leverage the expertise of cybersecurity professionals without the need to hire and train their own staff. However, there is a cyber talent shortage, making it essential for organizations to invest in cloud-based cybersecurity solutions and advanced technologies like AI and ML for network security, cloud application security, and endpoint security. The banking, financial services, healthcare, and e-commerce sectors are particularly vulnerable to digital attacks and require enterprise security solutions. Remote working vulnerabilities have also emerged as a significant concern, necessitating risk-based security measures to protect digital transactions.

Get a glance at the market share of various segments Request Free Sample

The on-premises segment was valued at USD 43.50 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

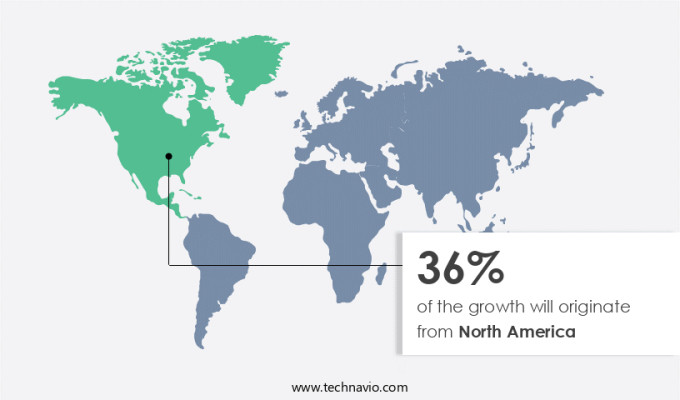

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the demand for cybersecurity services is on the rise, particularly in countries like the United States and Canada. The advancement of technology has resulted in an uptick in cyberattacks across various sectors, including retail, manufacturing, healthcare, IT and telecommunication, and BFSI. This trend is driving industries to invest in cybersecurity services to safeguard their digital assets. Additionally, the proliferation of connected devices and the expanding Internet of Things (IoT) sector have generated vast amounts of security-related data that require protection. The US is currently the largest revenue contributor to the market and is anticipated to retain this position throughout the forecast period. Organizations in North America recognize the importance of securing their networks, cloud-based solutions, and endpoints to mitigate potential threats and ensure business continuity.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

An increase in several data breaches is the key driver of the market. The market in the United States has experienced a notable rise in data breaches, posing significant risks to organizations in various sectors. Data breaches can result in substantial financial losses, reputational harm, and regulatory sanctions. This trend is anticipated to persist as cyber threats grow increasingly complex. One of the primary drivers of this trend is the expanding attack surface due to the growing number of interconnected devices and the widespread adoption of cloud applications. As businesses undergo digital transformation and adopt remote work arrangements, they inadvertently create new vulnerabilities that cybercriminals swiftly exploit. Advanced security solutions employing risk-based strategies are essential to mitigate these threats and safeguard sensitive information. Organizations must address the cybersecurity skill gap to effectively implement and manage these technologies.

Market Trends

Integration of AI and ML in cybersecurity services is the upcoming trend in the market. Cybersecurity services have been revolutionized by the integration of Artificial Intelligence (AI) and Machine Learning (ML), enhancing organizations' capabilities to swiftly and precisely identify and address emerging cyber threats. A key domain where AI and ML have made a substantial impact is threat detection and analysis. Security systems equipped with AI and ML algorithms can pinpoint anomalies, recognize patterns suggestive of malicious activities, and distinguish between regular and abnormal network traffic, user access patterns, and system activities. This technological advancement empowers proactive identification of potential security incidents, minimizing false positives and enabling security teams to concentrate on genuine threats. AI and ML in cybersecurity services ensure unparalleled efficiency, accuracy, and speed, making them indispensable in today's complex threat landscape.

Market Challenge

The high cost of cybersecurity services implementation is a key challenge affecting the market growth. The implementation of cybersecurity services comes with a significant financial burden for organizations, particularly those responsible for safeguarding critical infrastructure such as electric power and transportation of oil. This financial strain can hinder an organization's ability to invest in advanced security solutions and prioritize cybersecurity spending within their budgets. The high cost of cybersecurity services can lead to resource allocation challenges, as organizations must balance their investment in cybersecurity with other business needs. Advanced security solutions, including global threat monitoring and incident response capabilities, often require substantial financial commitments. Consequently, organizations may face limitations in their ability to adopt the latest security technologies and effectively manage cyber risks.

However, the cybersecurity companies play a crucial role in providing organizations with the necessary tools and expertise to strengthen their cybersecurity posture. However, the high cost of these services can make it difficult for some organizations to engage with multiple companies, limiting their options and potentially leaving them vulnerable to a wider range of threats. In conclusion, the high cost of cybersecurity services implementation poses a significant challenge for organizations, particularly those responsible for securing critical infrastructure. Financial constraints can limit an organization's ability to invest in comprehensive security measures and adopt advanced security solutions, potentially leaving them vulnerable to cyber threats.

Organizations must carefully consider their budgets and resource allocation to ensure they are able to effectively manage cyber risks and protect their critical assets.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AO Kaspersky Lab - The company offers cybersecurity services such as Penetration Testing, Application Security Assessment, Payment Systems Security Assessment, and ICS Security Assessment.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture Plc

- Akamai Technologies Inc

- Broadcom Inc.

- Cassava Technologies

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- CrowdStrike Inc.

- Dell Technologies Inc.

- FireEye Inc.

- Fortinet Inc.

- F Secure Corp.

- International Business Machines Corp.

- McAfee LLC

- Palo Alto Networks Inc.

- Proofpoint Inc.

- Rapid7 Inc.

- RSA Security LLC

- S.C. BITDEFENDER S.R.L.

- Sophos Ltd.

- Tenable Holdings Inc.

- Trend Micro Inc.

- Zscaler Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The cybersecurity market is experiencing significant growth due to the increasing number of digital technologies and the shift towards remote work and digital transactions. With the rise of cloud computing, organizations are investing heavily in advanced security solutions to mitigate cybersecurity risks. Cyberattacks, including malicious attacks and cyber espionage, are becoming more sophisticated, making it crucial for businesses to implement security infrastructure. Machine learning and artificial intelligence are being integrated into cybersecurity solutions to enhance threat detection and incident response. Cloud security services are gaining popularity due to the convenience and cost-effectiveness they offer. Mreover, the cybersecurity workforce faces a talent shortage, leaving many organizations vulnerable to cyber threats.

However, the Cybersecurity workforce faces a talent shortage, leading to a need for more Cybersecurity professionals. Cybersecurity investments in Cloud-based solutions, Network security, Endpoint security, and Cloud application security are on the rise to address these challenges. Security infrastructure is being strengthened with Advanced technologies like ML and AI to mitigate the Cybersecurity skill gaps. Remote working vulnerabilities are being addressed with Remote working policies and advanced security measures. In conclusion, the Cybersecurity market is evolving to provide comprehensive solutions to combat Digital attacks and ensure secure Digital transactions. The future holds immense potential for innovation and growth in this sector.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.23% |

|

Market growth 2024-2028 |

USD 49 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.27 |

|

Regional analysis |

North America, APAC, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 36% |

|

Key countries |

US, China, UK, Germany, Japan, India, France, Canada, Australia, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Accenture Plc, Akamai Technologies Inc., AO Kaspersky Lab, Broadcom Inc., Cassava Technologies, Check Point Software Technologies Ltd., Cisco Systems Inc., CrowdStrike Inc., Dell Technologies Inc., FireEye Inc., Fortinet Inc., F Secure Corp., International Business Machines Corp., McAfee LLC, Palo Alto Networks Inc., Proofpoint Inc., Rapid7 Inc., RSA Security LLC, S.C. BITDEFENDER S.R.L., Sophos Ltd., Tenable Holdings Inc., Trend Micro Inc., and Zscaler Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch