Pulp Market Size 2025-2029

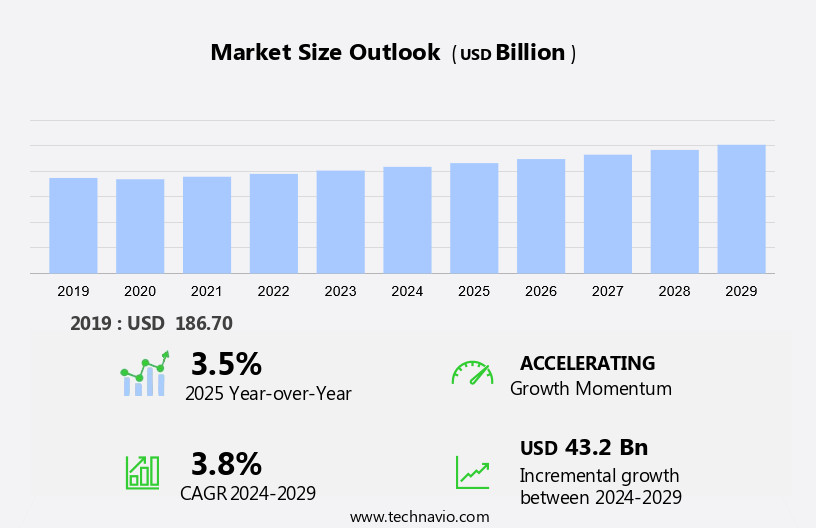

The pulp market size is forecast to increase by USD 43.2 billion, at a CAGR of 3.8% between 2024 and 2029. The market is driven by the increasing consumption of chemical wood pulp due to its widespread usage in various industries, including the paper and textiles industries.

Major Market Trends & Insights

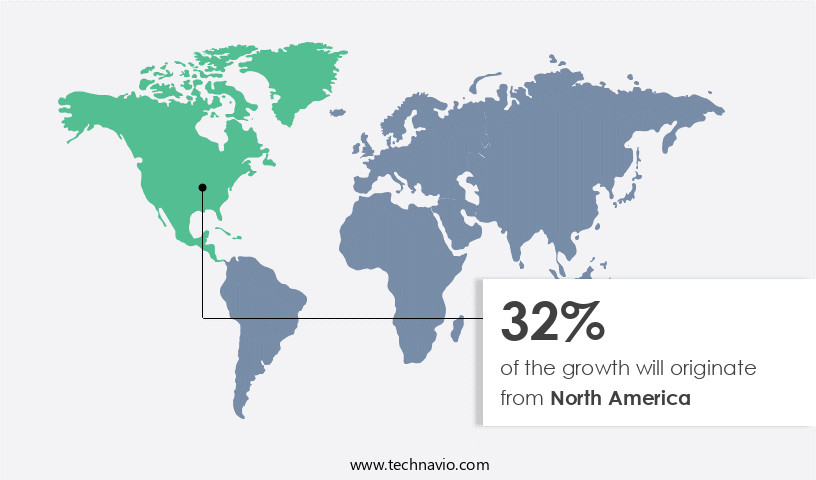

- North America dominated the market and contributed 32% to the growth during the forecast period.

- The market is expected to grow significantly in APAC region as well over the forecast period.

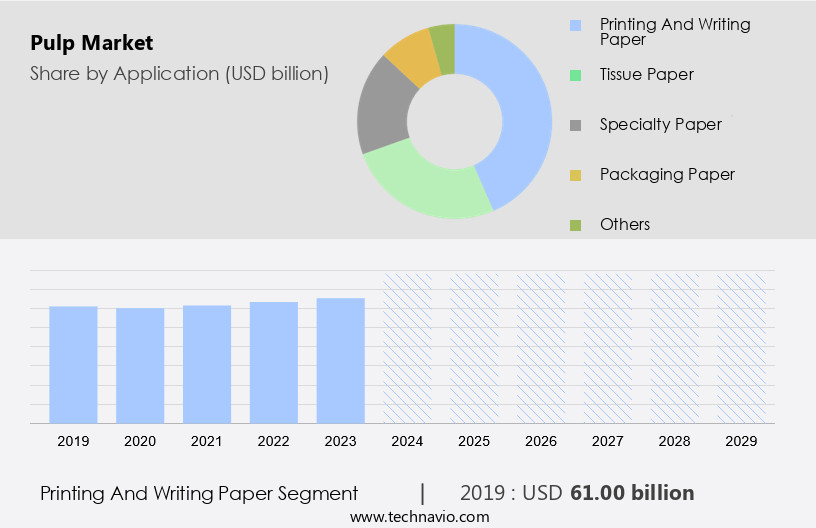

- Based on the Application, the printing and writing paper segment led the market and was valued at USD 65.30 billion of the global revenue in 2023.

- Based on the Grade type, the chemical pulp segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 34.76 Billion

- Future Opportunities: USD 41.21 Billion

- CAGR (2024-2029): 3.8%

- North America: Largest market in 2023

A notable trend in the market is the rising use of fluff pulp, which offers enhanced absorbency and improved product quality in hygiene applications. However, high production costs pose a significant challenge to market participants. Producers must navigate these costs, which include raw materials, energy, and labor, to maintain profitability and competitiveness. To capitalize on opportunities, companies should focus on optimizing production processes, exploring alternative raw materials, and expanding their product offerings to cater to diverse industry demands. Effective cost management and innovation will be essential for market success in the face of production challenges.

What will be the Size of the Pulp Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the ever-changing demands of various sectors. The Kraft pulping process, a popular method for producing pulp from wood chips, has seen significant improvements in lignin content reduction, enhancing fiber strength properties and energy efficiency. Sulfite pulping process, another significant process, is undergoing automation, leading to increased paper machine speed and process control optimization. Wood chip handling and pulp stock preparation have become increasingly crucial, with a focus on wastewater treatment and black liquor recovery. The chemical pulping process, a key contributor to the industry, is experiencing a shift towards chlorine dioxide bleaching and hydrogen peroxide bleaching, reducing bleaching chemical usage and improving paper quality.

Fiber length measurement and pulp drying systems are essential components of the sheet formation process, ensuring paper strength testing, pulp density control, and pulp consistency. Pulp yield optimization and pulp consistency control are critical quality control parameters, with pulp viscosity measurement playing a vital role in the overall process. One notable example of market dynamism is the implementation of oxygen delignification in the pulp refining process, resulting in a 15% increase in pulp yield. The industry anticipates a 3% annual growth rate in the coming years, reflecting the continuous unfolding of market activities and evolving patterns.

How is this Pulp Industry segmented?

The pulp industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Printing and writing paper

- Tissue paper

- Specialty paper

- Packaging paper

- Others

- Grade Type

- Chemical pulp

- Mechanical and semi-chemical pulp

- Non-wood pulp

- End-User

- Paper & Board

- Packaging

- Textiles

- Personal Care

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The printing and writing paper segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 65.30 billion in 2023. It continued to the largest segment at a CAGR of 3.06%.

In the market, various processes such as kraft pulping and sulfite pulping are utilized to produce pulp from wood chips. Kraft pulping reduces lignin content, enhancing fiber strength properties and energy efficiency. Sulfite pulping, on the other hand, yields pulp with superior brightness and shorter fiber length. Process automation systems play a crucial role in optimizing production, with the mechanical pulping process enabling higher paper machine speeds. Chemical pulping processes, including sulfite and soda pulping, are integral to the industry. Pulp stock preparation is essential for refining the pulp, ensuring consistent quality through pulp freeness testing, density control, and consistency control.

Wastewater treatment is a critical aspect, with chlorine dioxide bleaching and hydrogen peroxide bleaching used to improve brightness. Sheet formation processes, including calendering and press felting, contribute to paper strength testing and quality control. Pulp drying systems optimize yield through pulp viscosity measurement and oxygen delignification. Fiber morphology analysis and process control optimization are essential for enhancing pulp handling equipment efficiency. The global pulp and paper industry is expected to grow by 3% annually, driven by increasing demand for printing and writing paper, especially in developing countries. For instance, China, India, and Indonesia are significant consumers due to their high population and rising literacy rates.

Pulp handling equipment manufacturers focus on innovations to meet the industry's evolving needs, such as energy-efficient systems and advanced automation.

The Printing and writing paper segment was valued at USD 61.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 32% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the North America region estimates to be around USD 43.2 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is driven by the high consumption of paper and paper-based products, with the US and Canada being the major contributors due to their mature markets. Despite the slow growth in these countries, continuous innovation by companies like Bercen, a specialty chemicals provider, is propelling industry advancements. Bercen's chemical solutions, such as BERSET, BERSIZE, BERBOND, and BERCHEM, are utilized in various pulping processes, including kraft, sulfite, mechanical, and chemical. These processes involve pulp stock preparation, wastewater treatment, bleaching, and sheet formation, among others. In the Kraft pulping process, lignin content reduction is crucial for improved energy efficiency and fiber strength properties.

Sulfite pulping, on the other hand, offers better fiber strength and shorter processing times. Mechanical pulping processes, like TMP and CTMP, yield longer fibers for higher paper machine speeds. In the chemical pulping process, bleaching chemical usage, such as chlorine dioxide and hydrogen peroxide, plays a significant role in enhancing paper quality. Process automation systems, fiber length measurement, pulp drying systems, and pulp handling equipment are essential components of the pulp industry. Pulp refining, pulp freeness testing, and pulp consistency control ensure optimal paper sheet formation. Pulp density control and pulp yield optimization are crucial for maintaining quality control parameters.

With the increasing focus on sustainability and reducing wastewater, advancements in wastewater treatment technologies are gaining importance. According to recent industry reports, the market in North America is projected to grow by approximately 2% annually. This growth is attributed to the continuous innovation in pulping technologies, the abundance of raw material resources, and the increasing demand for paper and paper-based products.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Pulp Market enhances efficiency through wood chip preparation process and chemical pulping effects on fiber morphology, while lignin removal impact fiber strength ensures quality. Oxygen delignification process optimization and chemical recovery boiler efficiency improvement reduce costs, alongside black liquor evaporation energy efficiency. Pulp refining impact paper quality and fiber length distribution effects drive pulp quality control methods. Pulp fiber properties analysis and quality control parameters pulp maintain standards, while impact of bleaching chemicals refines output. Pulp consistency control impact and process control system impact pulp yield optimize production. Pulp mill wastewater treatment strategies and pulp drying system energy consumption address sustainability, ensuring robust operations.

The market is a critical sector in the forest products industry, with a significant impact on paper production and various other applications. The production process of pulp involves several stages, each with its unique challenges and opportunities for optimization. One crucial aspect of pulp production is lignin removal, which impacts fiber strength. Effective lignin removal is essential to enhance fiber length and improve pulp refining, ultimately impacting paper quality. Pulp refining, in turn, influences the fiber morphology, which is a significant factor in determining paper quality. Another critical area of focus in the market is energy efficiency, particularly in black liquor evaporation. Optimizing this process can lead to substantial energy savings, making it an essential consideration for pulp mills. Chemical pulping processes, such as oxygen delignification, require careful optimization to achieve optimal results.

Pulp mills also face challenges in managing wastewater treatment and ensuring process control systems maintain pulp yield. Pulp drying systems consume significant energy, making energy consumption a critical factor in pulp production. Fiber length distribution and pulp freeness testing methods are essential quality control parameters that influence pulp consistency and paper machine speed optimization. Bleaching chemicals play a significant role in pulp quality control, and their impact on fiber properties analysis is a critical consideration. Wood chip preparation processes must be optimized to ensure efficient pulp production. Proper pulp storage management and pulp handling equipment maintenance are also essential to maintain pulp quality and prevent contamination. Chemical recovery boilers are a vital component of pulp production, and their efficiency is a critical factor in overall mill performance. Optimizing boiler efficiency can lead to substantial cost savings and improved environmental performance. In conclusion, the market presents numerous opportunities for innovation and optimization, from lignin removal to pulp drying and beyond.

What are the key market drivers leading to the rise in the adoption of Pulp Industry?

- The significant rise in the demand for chemical wood pulp is the primary factor fueling market growth. Chemical wood pulp, a crucial raw material in various industries such as paper, textiles, and food, experiences increasing consumption due to its versatile applications and cost-effectiveness.

- Chemical wood pulp, derived from lignocellulosic fibers of angiosperm trees, plays a pivotal role in the production of high-quality paper. Softwood fibers, obtained from trees with naked seeds and flowers, possess long fibers without pores, measuring 3 mm in length and 410 microns in breadth. In contrast, hardwood fibers, sourced from deciduous trees, feature libriform fibers that are 1 mm long and 20 micrometers wide. The semi-chemical pulping process employs neutral solutions of sodium sulfite, sodium hydroxide, and a sodium carbonate solution to cook wood chips, yielding superior paper quality. A notable example of the market's growth is the increase in demand for recycled paper, which has led to a surge in the consumption of chemical wood pulp.

- According to industry reports, the global chemical market is projected to expand at a robust rate, with an anticipated growth of around 5% per annum in the coming years. This expansion is attributed to the rising demand for paper and paper products, particularly in the packaging and printing industries.

What are the market trends shaping the Pulp Industry?

- The increasing demand for fluff pulp, owing to its enhanced absorbency, represents a notable market trend. This trend is expected to continue due to the rising preference for more absorbent materials.

- The diaper and hygiene sanitary pad market, encompassing both baby and adult products, holds substantial importance in the global arena. This significance stems from the growing awareness of safety and health practices. A key component in the manufacturing of these products is fluff pulp, which is a long fiber derived from softwood. Fluff pulp enhances absorbency, preventing leaks, making it an essential ingredient.

- The birth rates in Latin America and Asia are on the rise, leading to a projected expansion of the diaper industry by around 50% by 2023. Furthermore, the fast-paced lifestyle of consumers has made disposable diapers increasingly popular due to their ease of use and disposal.

What challenges does the Pulp Industry face during its growth?

- The escalating production costs associated with pulp manufacturing pose a significant challenge to the industry's growth trajectory.

- The market is characterized by significant investments from companies in technological advancements to enhance pulp production and maintenance. This trend primarily involves the acquisition of smaller pulp companies or assets, leading to increased pulp production but also resulting in high costs. The pulp industry's engineering is sophisticated and efficient, but its energy consumption is substantial due to the capital-intensive machinery required for forest processing and fiber integration into paper. These machines consume large amounts of energy and water to extract raw materials and remove water during production.

- For instance, the energy consumption for pulp and paper production accounts for approximately 3% of the global energy usage. Despite these challenges, the pulp industry anticipates robust growth, with expectations of a 5% annual increase in demand over the next five years.

Exclusive Customer Landscape

The pulp market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pulp market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pulp market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arctic Paper SA - The company specializes in providing pulp solutions, including Robur Flash UKP E, which is utilized in various applications, such as insulation for high-voltage marine cables.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arctic Paper SA

- Billerud AB

- Canny Tissue Paper Industry

- Gulf Paper Manufacturing Co.

- Hitachi Ltd.

- International Paper Co.

- Koch Industries Inc.

- Mercer International Inc.

- Metropolic Paper Industries

- Metsa Board Oyj

- Nath Industries Ltd.

- Nine Dragons Paper Holdings Ltd.

- Nippon Paper Industries Co. Ltd.

- Oji Holdings Corp.

- Sappi Ltd.

- Shanying International Holding Co. Ltd.

- Sinar Mas

- Stora Enso Oyj

- UPM Kymmene Corp.

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pulp Market

- In January 2024, Arauco, a leading global pulp and paper producer, announced the launch of its new line of recycled pulp, expanding its product portfolio and strengthening its commitment to sustainability (Arauco Press Release).

- In March 2024, International Paper and Tembec entered into a strategic partnership, combining their pulp and paper businesses to create a global leader in the industry, with a combined annual production capacity of over 15 million tons (International Paper Press Release).

- In April 2025, the European Union approved a € 1.3 billion funding program to support the development and production of biomass-based pulp and paper, aiming to reduce the industry's carbon footprint and increase its competitiveness in the global market (European Commission Press Release).

- In May 2025, Stora Enso completed the acquisition of Langerholmen Mill from SCA, significantly expanding its pulp and paper production capacity in Europe and increasing its market share in the region (Stora Enso Press Release).

Research Analyst Overview

- The market continues to evolve, driven by advancements in process optimization strategies and technological innovations. For instance, the implementation of a chemical recovery cycle in pulp mill operations has led to significant improvements in pulping chemical effects and delignification efficiency, resulting in a 10% increase in pulp production capacity. Moreover, the focus on fiber characterization and quality attribute mapping has enabled paper grade classification with greater precision, ensuring consistent paper manufacturing processes and meeting the evolving demands of various sectors. Environmental impact assessment and wastewater management systems are crucial aspects of modern pulp mills, with energy consumption reduction being a key priority.

- Process control technology and pulp bleaching technology have made substantial strides in reducing pulp mill emissions and improving pulp quality parameters. A recent study projects a 5% annual growth in the pulp industry, driven by the increasing demand for sustainable and eco-friendly products. Process monitoring systems and quality assurance processes have become essential components of pulp mill operations, ensuring the efficient use of resources and maintaining high-quality pulp production. The integration of process variability analysis and fiber network properties into pulp production cost models has led to significant cost savings and improved process performance. The continuous pursuit of innovation in pulp mill operations and the development of new pulping technologies will continue to shape the evolving market landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pulp Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.8% |

|

Market growth 2025-2029 |

USD 43.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.5 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pulp Market Research and Growth Report?

- CAGR of the Pulp industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pulp market growth of industry companies

We can help! Our analysts can customize this pulp market research report to meet your requirements.