Plate And Frame Heat Exchangers Market Size 2024-2028

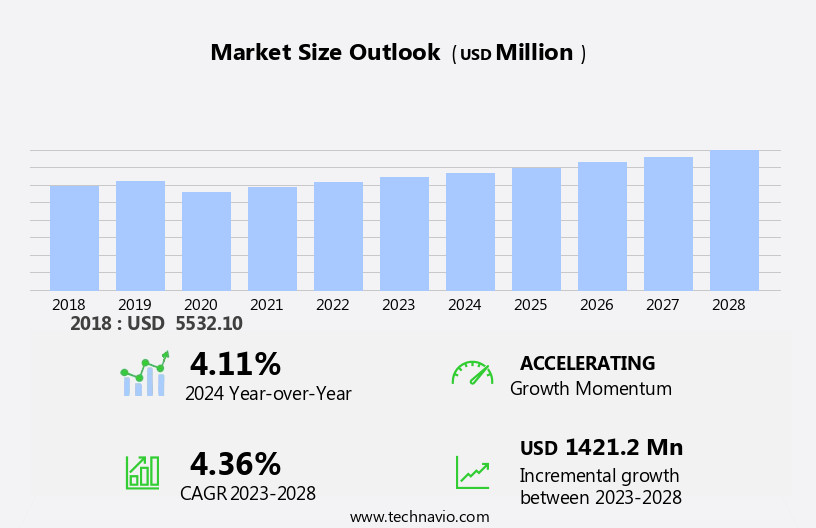

The plate and frame heat exchangers market size is forecast to increase by USD 1.42 billion at a CAGR of 4.36% between 2023 and 2028.

- Plate and frame heat exchangers have gained significant traction in various industries due to their efficiency and versatility. In the context of data center construction, the digital transformation and expansion of cloud computing have led to an increase in demand for these heat exchangers. Aluminum and steel are the primary materials used in manufacturing it, making them suitable for HVAC systems in data centers. The increasing adoption of renewable energy sources for powering data centers is another growth factor, as these are effective in heat recovery applications. However, challenges such as the fouling of heat exchangers and the rising cost of raw materials like copper and aluminum may hinder market growth. In the display industry, these are essential for cooling down the liquid used in LED displays. Overall, the market is expected to grow steadily due to these trends and challenges.

What will be the Size of the Market During the Forecast Period?

- The market encompasses a wide range of applications, including energy efficiency solutions for HVACR systems, industrial processes, and commercial refrigeration. This market is driven by the growing demand for compact and versatile heat exchangers in various sectors, such as urbanization, heating, ventilation, and air conditioning (HVAC) for commercial buildings, and the refrigeration industry. The increasing focus on heat recovery and energy efficiency in developing economies is also fueling market growth.

- Moreover, it offers advantages in terms of energy savings, ease of maintenance, and adaptability to diverse applications. They are used extensively in HVAC systems for residential AC, commercial refrigeration, and industrial activities, including engineering applications and nuclear power. Environmental regulations continue to drive the adoption of these heat exchangers as they contribute to reducing greenhouse gas emissions and improving energy infrastructure.

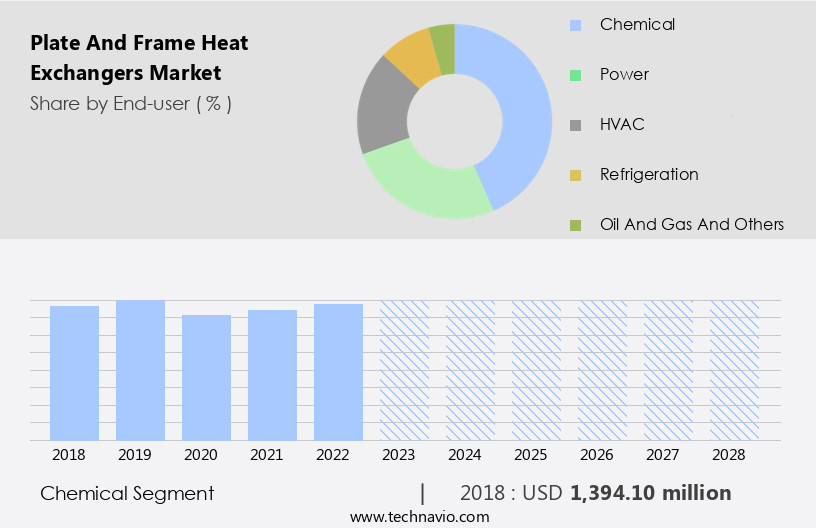

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Chemical

- Power

- HVAC

- Refrigeration

- Oil and gas and others

- Type

- Gasketed

- Welded

- Brazed

- Geography

- Europe

- Germany

- UK

- North America

- Canada

- US

- APAC

- China

- Middle East and Africa

- South America

- Europe

By End-user Insights

- The chemical segment is estimated to witness significant growth during the forecast period.

Plate and frame heat exchangers are essential components In the chemical process industry, providing efficient heat transfer solutions for various applications. These exchangers facilitate temperature regulation for base, intermediate, and final products, as well as heat recovery and container, reactor, and autoclave tempering. In the chemical sector, corrosion resistance and prevention of cross-contamination are crucial. These come in two main types: gasketed and brazed. Gasketed models offer versatility and are suitable for high-pressure and high-temperature applications. Brazed plate heat exchangers, on the other hand, have a compact design and are commonly used in HVAC systems, residential AC, commercial refrigeration, air conditioning, and domestic consumption.

Get a glance at the Plate And Frame Heat Exchangers Industry report of share of various segments Request Free Sample

The chemical segment was valued at USD 1.39 billion in 2018 and showed a gradual increase during the forecast period.

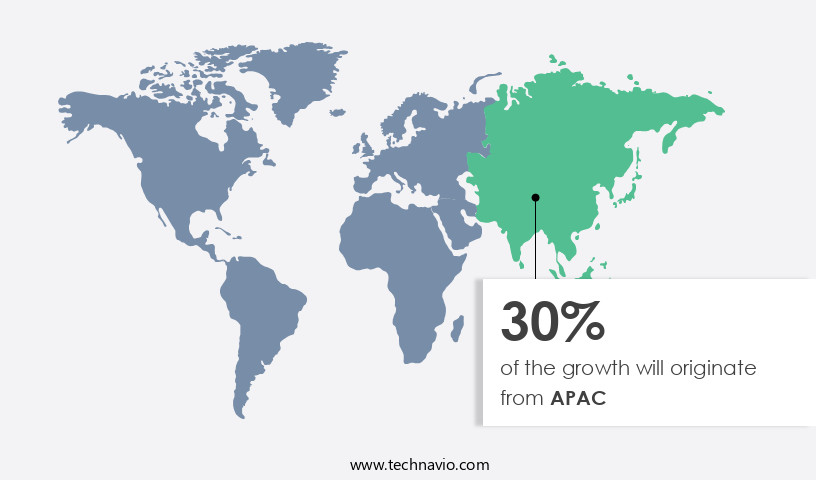

Regional Analysis

- APAC is estimated to contribute 30% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Europe's data center market is experiencing growth due to the increasing reliance on the Internet and social media, technological advancements, and favorable government regulations, such as Safe Harbor. The region's cold climate is an added advantage, making these an effective and efficient cooling solution for data centers. These systems, which include gasketed plate and frame, and brazed plate frame types, are widely used in various industries, including chemical processing, food and beverage, and oil and gas, due to their energy efficiency, versatility, and compact design. Urbanization and modernization have led to increased demand for heat recovery and sustainable practices, further driving the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Plate And Frame Heat Exchangers Industry?

Rising demand for plate and frame heat exchangers from end-users is the key driver of the market.

- Plate and frame heat exchangers are essential components in various industries, including power generation, chemical processing, oil and gas, renewable energy sources, food and beverage, and HVACR systems. Their versatility makes them suitable for heat recovery applications, enabling energy efficiency in urbanization and modernization projects. In the industrial sector, they are commonly used as cooling equipment, particularly in high-pressure and high-temperature applications. The global demand for electricity and energy is increasing, leading to an expansion In the usage of plate and frame heat exchangers. These exchangers are employed in HVAC systems, commercial refrigeration, air conditioning, and residential AC, contributing to energy conservation and reducing domestic consumption.

- In addition, the market is expected to grow significantly due to the increasing industrialization in emerging regions, the expanding middle-class population, and the need for sustainable practices. Gasketed plate and frame, as well as brazed plate frame heat exchangers, are popular choices due to their compact design, customizable and scalable nature, and operational flexibility. The materials used in manufacturing, such as copper, aluminum, and steel, influence the manufacturing cost and performance. Thermal efficiency is a critical factor In the selection of plate and frame heat exchangers, particularly in applications involving impurities, fouling, scaling, and clogging.

What are the market trends shaping the Plate And Frame Heat Exchangers Industry?

Expansion and addition of new manufacturing capacities is the upcoming market trend.

- Plate and frame heat exchangers, a critical component in energy transfer processes, witness growing demand due to their energy efficiency, versatility, and applicability across various industries. These include chemical processing, food and beverage, oil and gas, renewable energy sources, and HVAC systems. Urbanization and the increasing global electricity and energy demand fuel market growth. Sustainable practices, such as heat recovery, are driving the adoption of these exchangers in commercial projects and residential applications, including air conditioning, indoor display, and commercial refrigeration. Manufacturers focus on innovative designs, using materials like copper, aluminum, and steel, to cater to high-performance applications, high pressures, and high temperatures.

- Furthermore, organic marketing strategies, such as SEO, content marketing, social media engagement, and email campaigns, are adopted to build brand awareness and maintain customer relationships. The market is expected to grow, driven by the need for energy conservation, low maintenance, and operational flexibility. The industrialization in emerging regions, rapid industrialization, and the middle-class population expansion contribute to the market's expansion. However, factors like impurities, fouling, scaling, and clogging may impact thermal efficiency, necessitating cleaning processes and regular maintenance. Despite these challenges, the market offers significant opportunities for growth and innovation, with companies focusing on customizable, scalable, and high-performance designs.

What challenges does the Plate And Frame Heat Exchangers Industry face during its growth?

Fouling of heat exchangers is a key challenge affecting the industry growth.

- Plate and frame heat exchangers are essential components in various industries, including chemical processing, oil and gas, renewable energy sources, food and beverage, and HVACR systems. These heat exchangers offer energy efficiency, versatility, and sustainability, making them indispensable in urbanization and modernization projects. However, maintenance and cleaning are significant challenges due to the fouling of heat transfer surfaces. Fouling refers to the accumulation of unwanted deposits, such as impurities, which narrow the flow area and increase resistance to heat transfer. Consequently, this leads to increased operational issues, including reduced exchanger efficiency, excessive pressure drop, and potential damage to the equipment.

- Moreover, the extent of fouling depends on the fluid properties and operating conditions. To mitigate fouling, manufacturers offer different types, including gasketed plate and frame, and brazed plate frame designs. High-performance designs, welded plates, and customizable and scalable solutions are available to cater to various industrial applications, such as thermal efficiency, high pressures, and high temperatures. Manufacturers strive to improve longevity and maintenance costs through innovative designs and materials, such as copper, aluminum, and steel. The manufacturing cost, performance, and efficiency of these heat exchangers are essential factors for industrialization in emerging regions and commercial projects.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Industrial Components Inc.

- Alfa Laval AB

- American Plate Exchanger

- API Heat Transfer Inc.

- Avingtrans plc

- Baffles cooling systems

- Danfoss AS

- Dover Corp.

- FISCHER Maschinen u. Apparatebau GmbH

- FUNKE Warmeaustauscher Apparatebau GmbH

- Hisaka Works Ltd.

- ITT Inc.

- Kelvion Holding GmbH

- Paul Mueller Co. Inc.

- Process Engineers And Associates

- S.A. Armstrong Ltd.

- SPX FLOW Inc.

- Taco Comfort Solutions

- Thermaline Inc.

- Xylem Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Plate and frame heat exchangers have gained significant traction in various industries due to their energy efficiency and versatility. These exchangers have become increasingly important as urbanization continues to drive up energy demand and the push for sustainable practices grows. In the realm of chemical processing, plate and frame heat exchangers have proven to be an effective solution for heat recovery. The food and beverage industry also heavily relies on it for their compact design and ability to maintain consistent temperatures. HVAC systems, including residential air conditioning and commercial refrigeration, have also adopted this technology to improve energy efficiency and reduce operational costs.

In addition, plate and frame heat exchangers offer a low-maintenance and customizable alternative to traditional systems, making them an attractive option for industrial projects. The oil and gas industry, as well as renewable energy sources, have also embraced plate and frame heat exchangers due to their high-performance design and ability to handle high pressures and temperatures. The manufacturing sector, particularly in emerging regions with rapid industrialization and low-cost labor, has seen an increase In the adoption of these exchangers.

Furthermore, despite their advantages, plate and frame heat exchangers face challenges such as impurities, fouling, scaling, and clogging, which can impact thermal efficiency. However, advancements in cleaning processes and materials, such as brazed plate frame and welded plate heat exchangers, have addressed these issues, ensuring longevity and performance. Raw material prices, including copper, aluminum, and steel, have an impact on manufacturing costs. However, the benefits, such as their efficiency, performance, and low maintenance, often outweigh the initial investment. Their compact design, customizability, and scalability make them an attractive option for commercial projects and modernization efforts. Despite challenges, advancements in technology and materials continue to improve their performance and longevity.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 1.42 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, Germany, China, UK, and Canada |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Plate And Frame Heat Exchangers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.