Data Center Market Size 2025-2029

The data center market size is valued to increase USD 535.6 billion, at a CAGR of 15.6% from 2024 to 2029. Rise in adoption of multi-cloud and network upgrades will drive the data center market.

Major Market Trends & Insights

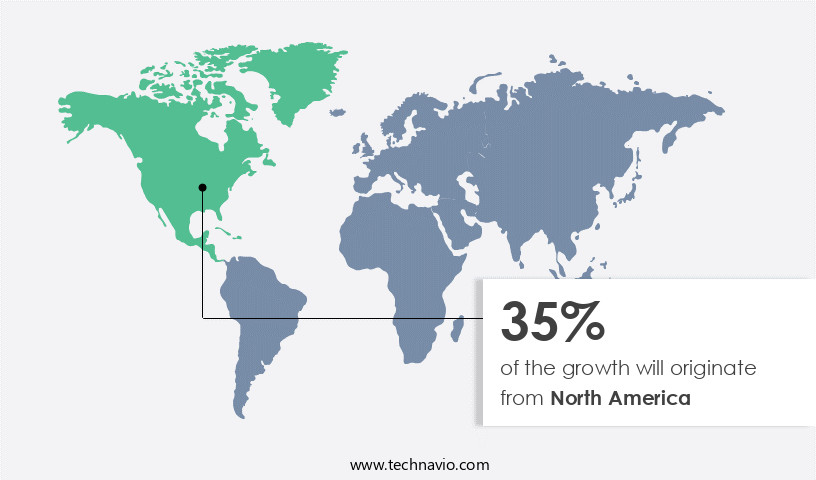

- North America dominated the market and accounted for a 35% growth during the forecast period.

- By Component - IT infrastructure segment was valued at USD 109.40 billion in 2023

- By End-user - BFSI segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 248.77 billion

- Market Future Opportunities: USD 535.60 billion

- CAGR : 15.6%

- North America: Largest market in 2023

Market Summary

- The market represents a dynamic and continually evolving landscape, driven by the increasing demand for digital transformation and the adoption of advanced technologies. Core technologies, such as artificial intelligence (AI) and multi-cloud solutions, are revolutionizing data center operations, with AI implementation projected to increase by 40% by 2025. Meanwhile, applications in sectors like finance, healthcare, and retail are fueling the growth of data centers. Service types, including colocation, managed services, and cloud services, are adapting to meet the demands of these evolving applications.

- Regulatory compliance, particularly around data security and privacy, remains a significant challenge. Despite these hurdles, opportunities abound, with the market expected to grow at a steady pace, particularly in regions like Asia Pacific and Europe, where digital transformation is accelerating.

What will be the Size of the Data Center Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Data Center Market Segmented and what are the key trends of market segmentation?

The data center industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- IT infrastructure

- Power management

- Mechanical construction

- General construction

- Security solutions

- End-user

- BFSI

- Energy

- IT

- Others

- Design

- Traditional

- Containerized

- Modular

- Data Center Size

- Small and Medium Data Centers

- Large Data Centers

- Tier Type

- Tier 1 and 2

- Tier 3

- Tier 4

- Type

- Enterprise Data Centers

- Colocation Data Centers

- Cloud Data Centers

- Managed Data Centers

- Edge Data Centers

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Component Insights

The it infrastructure segment is estimated to witness significant growth during the forecast period.

Data centers are essential IT infrastructure components that house the hardware and systems required to support the increasing demand for computing power and data storage. The market encompasses various technologies, including server hardware, storage infrastructure, software-defined data centers (SDDC), network infrastructure, converged infrastructure, backup and recovery software, automation software, and data center infrastructure management (DCIM) solutions. Enterprises worldwide are adopting cloud technologies, leading to a shift from on-premises data centers to cloud-based alternatives. This trend is fueled by the need for scalability, flexibility, and cost savings. According to recent reports, the adoption of cloud services has grown by 25%, with an estimated 30% of all workloads expected to be run in the cloud by 2022.

Moreover, the rise of edge computing and the Internet of Things (IoT) is driving the demand for bandwidth utilization and low latency, leading to the deployment of edge data centers. The uninterruptible power supply (UPS) systems market is projected to expand at a steady pace due to the increasing importance of ensuring data center uptime and minimizing downtime. Structured cabling systems and fiber optic cabling are essential for efficient data transfer and communication within data centers. The market for these systems is expected to grow by 12% due to the need for high-speed connectivity and the increasing adoption of advanced technologies like software-defined networking (SDN) and hyperconverged infrastructure (HCI).

Data center automation and virtual machine management are crucial for managing the complexity of modern data centers. These technologies are expected to experience a growth rate of 15%, driven by the need for efficient resource utilization and the increasing adoption of DevOps practices. The market for high-availability clusters and disaster recovery planning solutions is expected to expand significantly due to the growing importance of business continuity and data protection. Power distribution units (PDUs) and remote hands support are also essential for maintaining data center operations, with the market for these solutions projected to grow by 10%. Physical security systems, including access control and surveillance cameras, are essential for protecting data centers from unauthorized access and theft.

The market for these systems is expected to grow by 11% due to the increasing importance of data security and regulatory compliance. The market for cooling systems design, precision cooling solutions, and airflow management strategies is expected to grow due to the increasing importance of energy efficiency and the need to maintain optimal operating temperatures within data centers. Rack density optimization and power usage effectiveness (PUE) metrics are also critical for optimizing data center operations and reducing energy consumption. In conclusion, the market is evolving rapidly, driven by the increasing adoption of cloud technologies, the need for low latency and high bandwidth, and the importance of data security and energy efficiency.

The market for various data center technologies, including server hardware, storage infrastructure, software-defined data centers, network infrastructure, and automation software, is expected to grow significantly in the coming years.

The IT infrastructure segment was valued at USD 109.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Data Center Market Demand is Rising in North America Request Free Sample

The market in North America experiences significant growth due to the increasing preference for cloud services among US and Canadian enterprises. By choosing cloud solutions from providers like AWS, Microsoft, and Oracle, businesses aim to decrease both operating and capital expenses associated with on-premises data centers. Moreover, the region hosts numerous data centers from enterprises such as Apple, which operates 11 data centers, six of which are situated here.

The demand for data centers is further fueled by the increasing adoption of high-performance computing systems in industries like government, BFSI, healthcare, and others.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as businesses increasingly prioritize digital transformation and optimize their IT infrastructure. This evolution encompasses various strategies, including the implementation of advanced technologies and practices to enhance operational efficiency and security. One key focus is optimizing power distribution units, ensuring reliable and efficient energy management. Virtualization technologies are being implemented to maximize server utilization and reduce energy consumption. Cooling system efficiency is another critical area of improvement, with innovative solutions minimizing energy waste and lowering operational costs. Managing server hardware lifecycle is essential for maintaining optimal performance and reducing downtime. Enhanced data center security protocols, including monitoring network performance metrics and automating security measures, are increasingly prioritized to protect sensitive information.

Moreover, reducing data center energy consumption is a significant concern, with initiatives such as deploying high-availability clusters and planning for disaster recovery scenarios gaining traction. Improving airflow management strategies and automating data center operations further contribute to energy savings and increased efficiency. Implementing capacity planning models and optimizing storage area networks are essential for managing virtual machine resources effectively. Enhancing network security protocols and designing efficient server rooms are also crucial aspects of modern data center management. The adoption of edge computing solutions and migrating data to the cloud are significant trends in the data center landscape. Leveraging software-defined networking and implementing hyperconverged infrastructure are also popular strategies to streamline IT operations and improve overall performance.

According to market intelligence, more than 70% of new data center investments focus on cloud infrastructure, underscoring the growing importance of cloud services in the digital economy. This shift represents a significant departure from traditional on-premises data center deployments, highlighting the market's dynamic nature and the need for adaptive, agile solutions.

What are the key market drivers leading to the rise in the adoption of Data Center Industry?

- The increasing adoption of multi-cloud solutions and network upgrades serves as the primary catalyst for market growth.

- Multi-cloud, the practice of utilizing two or more cloud computing services to individually deploy specific application services, is gaining significant traction among enterprises. This strategy offers numerous benefits, including disaster recovery, enhanced security, and the ability to meet diverse workload requirements. According to recent studies, over 60% of enterprises worldwide have adopted multi-cloud solutions. The trend is driven by the need to prevent data loss or downtime due to localized component failures, ensure security compliances, and optimize performance. Enterprises are increasingly pushing mission-critical applications to the public cloud, while private clouds continue to serve non-critical workloads.

- The multi-cloud approach allows organizations to avoid company lock-in and maintain flexibility in their cloud infrastructure. This strategy is not limited to any specific industry or region. Instead, it is a dynamic response to the evolving needs of businesses, enabling them to meet their unique objectives and adapt to the ever-changing technological landscape.

What are the market trends shaping the Data Center Industry?

- The implementation of artificial intelligence in data centers is an emerging market trend. This technological advancement is set to revolutionize data center management and efficiency.

- Artificial Intelligence (AI) is revolutionizing the data center industry by optimizing energy efficiency. By analyzing server, power, and cooling system performance, AI enables faster decision-making and energy savings. Data center service providers utilize AI in automation software to minimize human intervention and promote energy-efficient operations. AI's role extends to cooling systems, enabling supervised control and efficient power usage. This is achieved through adjustments in the cooling process, reducing energy waste and enhancing overall performance. The integration of AI in data center management aims to minimize downtime and human errors, ultimately increasing productivity. AI's impact on data centers is significant, as it enables continuous improvement and adaptation to evolving market needs.

- Its application extends across various sectors, including finance, healthcare, and manufacturing, driving operational excellence and reducing environmental impact. Data centers are a crucial component of the digital economy, and the integration of AI is a strategic move towards sustainable, efficient, and competitive business operations.

What challenges does the Data Center Industry face during its growth?

- Cybersecurity challenges significantly impact the growth of industries by threatening data security and confidentiality, necessitating continuous investment in advanced security measures and technologies.

- Data has emerged as a valuable asset for businesses, enabling them to identify revenue opportunities through trend analysis and informed decision-making. However, the security of sensitive data, which encompasses user information such as names, addresses, telephone numbers, and social security numbers, remains a significant concern. The escalating threat of cyberattacks, fueled by the increasing adoption of cloud services and IoT-based solutions, poses a substantial risk to enterprise server estates. Cybercriminals can exploit IT security vulnerabilities to infiltrate enterprise servers, potentially compromising data and even causing the closure of small businesses.

- The frequency and sophistication of these attacks continue to evolve, underscoring the importance of robust data security measures. Companies must stay informed about the latest threats and adapt their strategies accordingly to protect their valuable data assets.

Exclusive Technavio Analysis on Customer Landscape

The data center market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the data center market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Data Center Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, data center market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

365 Data Centers - This company specializes in providing comprehensive data center solutions, encompassing the perimeter, infrastructure, and data layers. By optimizing these essential components, organizations can ensure secure and efficient data management.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 365 Data Centers

- Amazon.com Inc.

- Apple Inc.

- China Telecom Corp. Ltd.

- Cisco Systems Inc.

- CoreSite (an American Tower company)

- CyrusOne LLC

- Cyxtera Technologies Inc.

- Digital Realty Trust Inc.

- Equinix Inc.

- Google LLC

- Hewlett Packard Enterprise Co.

- Intel Corp.

- International Business Machines Corp.

- KDDI Corp.

- Lumen Technologies Inc.

- Microsoft Corp.

- Nippon Telegraph and Telephone Corp.

- Oracle Corp.

- Verizon Communications Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Data Center Market

- In January 2024, Amazon Web Services (AWS) announced the launch of its new Outposts service, enabling businesses to run AWS compute and storage services on-premises, extending its cloud offerings to hybrid infrastructure solutions (AWS Press Release, 2024).

- In March 2024, Microsoft and NVIDIA unveiled a strategic partnership to develop and deploy Azure AI supercomputing solutions using NVIDIA's GPUs, aiming to accelerate AI innovation and research in various industries (Microsoft News Center, 2024).

- In April 2025, Equinix, a leading data center provider, completed the acquisition of Metronode, an Australian data center company, expanding its presence in the Asia-Pacific region and increasing its market share in the competitive the market (Equinix Press Release, 2025).

- In May 2025, Google Cloud Platform (GCP) secured a significant contract with the European Commission to provide cloud services for its European data infrastructure, marking a significant geographic expansion and a major win for GCP in the public sector market (Google Cloud Blog, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Data Center Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

230 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.6% |

|

Market growth 2025-2029 |

USD 535.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.2 |

|

Key countries |

US, China, UK, Canada, Japan, Germany, India, France, Italy, Brazil, UAE, and Rest of World |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and ever-evolving the market, various trends and technologies continue to shape the industry's landscape. One significant focus lies in optimizing latency and throughput through advanced server hardware and network infrastructure. Server hardware lifecycle management plays a crucial role, ensuring the efficient use of resources and minimizing downtime. Bandwidth utilization is another critical aspect, with data centers increasingly adopting high-capacity connectivity solutions to accommodate growing data demands. Uninterruptible power supplies and structured cabling systems ensure business continuity, while edge computing deployment brings processing closer to the source for improved performance. HVAC system performance and data center automation are essential for maintaining optimal conditions and reducing operational costs.

- Software-defined networking, hyperconverged infrastructure, and high-availability clusters enable greater flexibility and scalability. IT infrastructure monitoring, network infrastructure, and colocation facilities provide essential services, while virtual machine management and disaster recovery planning ensure business continuity. Power distribution units, remote hands support, and physical security systems are integral components of data center operations. Cloud computing adoption continues to grow, driving innovation in cooling systems design, rack density optimization, and energy efficiency metrics. Fiber optic cabling and airflow management strategies further enhance network performance and data center efficiency. Uptime and downtime remain key performance indicators, with precision cooling solutions and network security protocols ensuring optimal conditions and protecting against threats.

- Capacity planning models and server virtualization enable organizations to effectively manage their resources and adapt to changing demands. In summary, the market is characterized by continuous innovation and evolution, with a focus on optimizing performance, reducing costs, and ensuring business continuity. From server hardware and network infrastructure to cooling systems and security protocols, data centers play a vital role in today's digital economy.

What are the Key Data Covered in this Data Center Market Research and Growth Report?

-

What is the expected growth of the Data Center Market between 2025 and 2029?

-

USD 535.6 billion, at a CAGR of 15.6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Component (IT infrastructure, Power management, Mechanical construction, General construction, and Security solutions), End-user (BFSI, Energy, IT, and Others), Geography (North America, APAC, Europe, South America, and Middle East and Africa), Design (Traditional, Containerized, and Modular), Data Center Size (Small and Medium Data Centers and Large Data Centers), Tier Type (Tier 1 and 2, Tier 3, and Tier 4), and Type (Enterprise Data Centers, Colocation Data Centers, Cloud Data Centers, Managed Data Centers, and Edge Data Centers)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rise in adoption of multi-cloud and network upgrades, Cybersecurity issues

-

-

Who are the major players in the Data Center Market?

-

365 Data Centers, Amazon.com Inc., Apple Inc., China Telecom Corp. Ltd., Cisco Systems Inc., CoreSite (an American Tower company), CyrusOne LLC, Cyxtera Technologies Inc., Digital Realty Trust Inc., Equinix Inc., Google LLC, Hewlett Packard Enterprise Co., Intel Corp., International Business Machines Corp., KDDI Corp., Lumen Technologies Inc., Microsoft Corp., Nippon Telegraph and Telephone Corp., Oracle Corp., and Verizon Communications Inc.

-

Market Research Insights

- The market is a dynamic and complex ecosystem, characterized by the constant need for capacity expansion, hardware refresh cycles, and software updates management. According to industry estimates, The market size was valued at USD153 billion in 2020, with a projected compound annual growth rate (CAGR) of 12% from 2021 to 2026. This growth is driven by the increasing demand for redundancy configurations, data center consolidation, and virtual desktop infrastructure. In contrast, maintenance procedures and thermal management techniques remain critical components of data center operations, with estimated annual costs accounting for up to 30% and 15% of total data center expenses, respectively.

- Effective capacity forecasting, network bandwidth allocation, and IT asset management are essential for optimizing data center efficiency and reducing power consumption. Additionally, system uptime guarantees, risk assessment methodologies, and cybersecurity best practices are crucial for maintaining business continuity and ensuring data security.

We can help! Our analysts can customize this data center market research report to meet your requirements.