Radiation Detection And Monitoring Equipment Market Size 2024-2028

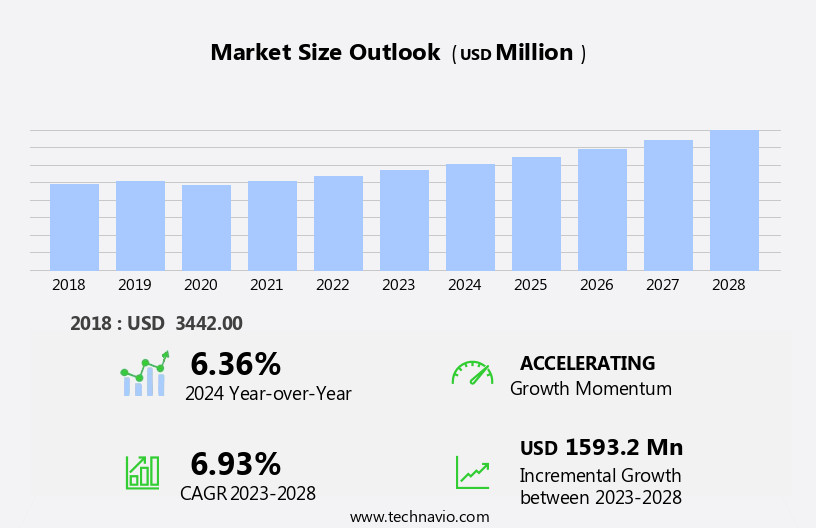

The radiation detection and monitoring equipment market size is forecast to increase by USD 1.59 billion at a CAGR of 6.93% between 2023 and 2028.

- The market is experiencing significant growth, driven by increasing demand from healthcare facilities for advanced radiation detection technologies. This need arises from the heightened focus on patient safety and regulatory compliance in the healthcare sector. Service contracts for equipment maintenance and upgrades are also fueling market expansion. However, the high cost of radiation detection and monitoring equipment remains a major challenge for market growth. This cost barrier can be addressed through government subsidies, financing options, and technological advancements leading to cost-effective solutions.

- Additionally, trends such as the integration of artificial intelligence and machine learning in radiation detection systems, and the increasing adoption of portable and handheld devices, are creating new opportunities for market participants. Companies seeking to capitalize on these opportunities must stay abreast of regulatory requirements, invest in research and development, and offer cost-effective solutions to meet the evolving needs of their customers.

What will be the Size of the Radiation Detection And Monitoring Equipment Market during the forecast period?

- The market encompasses a range of technologies, including area monitors, dosimeters, survey meters, and gas-filled detectors, used to identify and measure ionizing radiation in various industries such as nuclear power, healthcare, and renewable energy. Market growth is driven by the increasing incidence of cancer and subsequent demand for advanced diagnostic tools like PET/CT scans and radiotherapy. Nuclear power and nuclear medicine continue to be significant end-users due to the large workforce exposed to radiation and the need for stringent safety regulations. Additionally, the expansion of diagnostic imaging centers and the integration of radiation detection technologies in X-ray machines contribute to market growth.

- Skilled radiation professionals and the development of advanced scintillators and other detection technologies further bolster market momentum. Insurance companies also play a role in market growth as they increasingly require radiation monitoring for cancer patients undergoing therapy. Overall, the market is poised for continued expansion in response to growing demand for safety, accuracy, and efficiency in radiation detection and monitoring applications.

How is this Radiation Detection And Monitoring Equipment Industry segmented?

The radiation detection and monitoring equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Dosimeters

- Survey meters

- Area monitors

- Others

- Type

- Detection and monitoring

- Safety

- Geography

- North America

- US

- Europe

- France

- Germany

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Product Insights

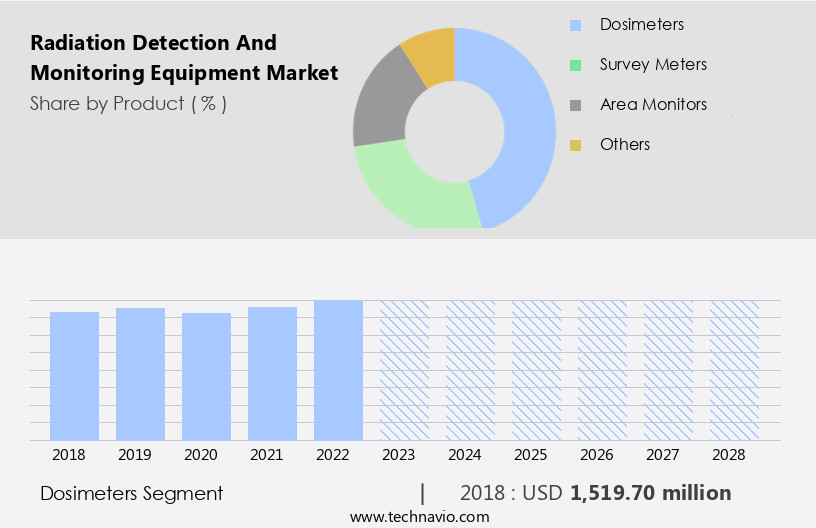

The dosimeters segment is estimated to witness significant growth during the forecast period.

Radiation detection and monitoring equipment play a crucial role in safeguarding individuals and environments from potential radiation hazards. Dosimeters, a vital component of this market, measure the ionizing radiation dose received by individuals. These devices are indispensable in occupational settings, including nuclear power plants and radiation sterilization facilities, as well as in medical facilities such as radiology centers. Dosimeters come in various types, with electronic personal dosimeters (EPDs) being the most common. EPDs are battery-operated devices, providing real-time information on the accumulated dose and dose rate to the user. Other types include self-reading and processed dosimeters. In the medical sector, dosimeters are essential for diagnostic imaging ries, cancer treatment through radiotherapy, and in non-hospital settings like clinics and diagnostic imaging centers.

Additionally, radiation detection equipment, such as scintillators (organic and inorganic), proportional chambers, gas-filled detectors, semiconductor detectors, ionization chambers, and survey meters, are used to detect and monitor radiation in various industries, including healthcare services, nuclear power, and renewable energy. Safety is paramount in handling radioactive materials, and full-body protection products, face protection products, hand safety products, and area monitors are essential for ensuring safety. The market encompasses a wide range of applications and end-users, driven by the increasing cancer incidence, growing demand for diagnostic imaging services, and the need for radiation safety in various industries.

Get a glance at the market report of share of various segments Request Free Sample

The Dosimeters segment was valued at USD 1.52 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

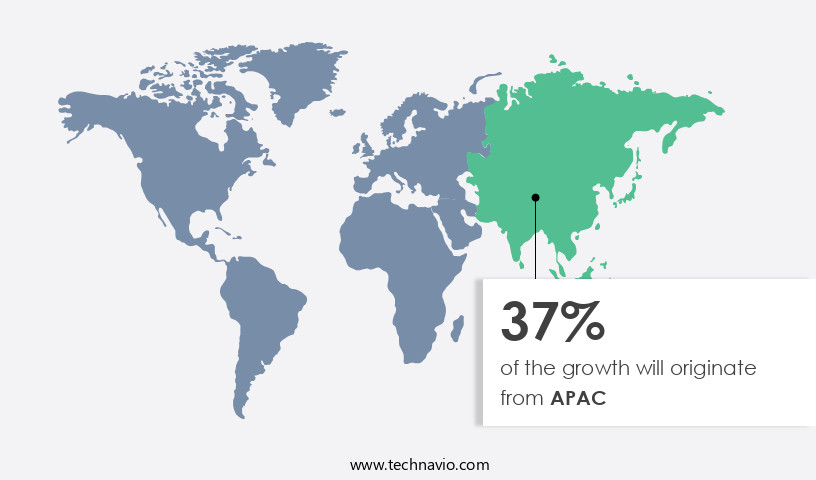

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is driven by the strong presence of key companies, increasing adoption of advanced technology, and growing demand from various industries, particularly healthcare and nuclear power. In 2022, the US was the world's largest producer of nuclear power, with over 93 reactors accounting for more than 20% of global nuclear electricity generation. The Consolidated Appropriations Act of 2016 in the US increased funding for the acquisition and deployment of radiological detection systems, including RPMs, which will positively impact market growth during the forecast period. End-users in the healthcare sector, including diagnostic imaging centers and hospitals, utilize various types of radiation detection and monitoring equipment, such as ionization chambers, semiconductor detectors, and proportional counters, for diagnostic imaging ries, cancer treatment, and patient safety.

In the nuclear industry, workers require full-body protection products, surface contamination monitors, and radiation monitors for safe operation of power plants. The market also caters to the renewable energy sector, where radiation detection and monitoring equipment are essential for ensuring the safe handling and disposal of radioactive materials. In the healthcare services sector, personal dosimeters and area monitors are crucial for ensuring the safety of healthcare professionals and patients. Additionally, safety is a top priority in healthcare facilities, ambulatory surgical centers, and diagnostic imaging centers, making the demand for radiation detection and monitoring equipment high. Inorganic and organic scintillators, diamond detectors, and gas-filled detectors are some of the key technologies used in radiation detection and monitoring equipment.

These technologies offer advantages such as high sensitivity, accuracy, and durability, making them suitable for various applications. Electronic components, such as Geiger-Muller counters and proportional counters, are also essential components in the production of radiation detection and monitoring equipment. In , the market in North America is expected to grow significantly due to the increasing demand from various industries, particularly healthcare and nuclear power, and the availability of advanced technology. The market is also driven by the need for safety and regulatory compliance in handling and disposing of radioactive materials.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Radiation Detection And Monitoring Equipment Industry?

- Demand from healthcare facilities is the key driver of the market.

- The market has experienced significant growth due to the increasing utilization of radiation-based medical devices in healthcare facilities for diagnosing and treating various health conditions, such as infectious and non-communicable diseases. According to the World Health Organization, approximately 37 million nuclear medicine procedures and 7.5 million radiotherapy treatments are performed globally. Healthcare professionals are frequently exposed to radiation from these medical devices and, as a result, are required to wear dosimeters to monitor their radiation exposure. Furthermore, healthcare facilities must maintain survey meters to ensure no leakage from radioactive sources and to maintain a safe dose rate around the equipment.

- With the rising number of medical procedures involving radiation, the demand for advanced radiation detection and monitoring equipment is expected to continue increasing.

What are the market trends shaping the Radiation Detection And Monitoring Equipment Industry?

- Service contracts for equipment is the upcoming market trend.

- In the US, various government agencies, including the Department of Energy and Department of Defense, as well as large private nuclear power plants, manage their radiation measurement services in-house. However, smaller facilities such as hospitals, medical and dental offices, universities, national laboratories, and nuclear facilities lack the necessary resources for procurement and maintenance of these services. To address this need, these facilities often enter into service contracts with radiation detection and monitoring providers like LANDAUER (Fortive Corp.). By outsourcing these services, facilities can save on capital investment and avoid the burden of recruiting, training, and managing qualified professionals for radiation surveys and data analysis.

- This partnership ensures that facilities remain compliant with regulatory requirements and maintain a safe working environment.

What challenges does the Radiation Detection And Monitoring Equipment Industry face during its growth?

- High cost of equipment is a key challenge affecting the industry growth.

- Radiation detection and monitoring equipment (RPM) is essential for various industries, including healthcare, nuclear power, and research, to ensure safety and compliance with regulations. However, the high cost of RPMs is a significant barrier to adoption. For instance, the price range for RPMs is between USD11,000 and USD18,000 per unit, depending on the features and technology level. Survey meters, a type of RPM, have a wide price range as well. A basic survey meter can cost around USD1,000 for a meter box and a single probe, while advanced survey meters can cost up to USD20,000.

- Scintillation proportional counters (SPRDs) and electrometer ionization chambers (EPDs) are other types of RPMs, with prices ranging from USD4,000 to USD10,000 per unit for SPRDs and USD300 to over USD3,000 per unit for EPDs. Despite these costs, the demand for RPMs continues to grow due to increasing safety concerns and regulatory requirements.

Exclusive Customer Landscape

The radiation detection and monitoring equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the radiation detection and monitoring equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, radiation detection and monitoring equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AMETEK Inc. - The company specializes in innovative sports products, delivering high-quality solutions to meet diverse consumer needs. Our offerings span various categories, incorporating cutting-edge technology and design to enhance athletic performance and overall wellness. By focusing on functionality, durability, and user experience, we cater to a global market, fostering active lifestyles and inspiring individuals to reach their full potential.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AMETEK Inc.

- Arktis Radiation Detectors Ltd.

- ATOMTEX SPE

- Berkeley Nucleonics Corp.

- CNIM SA

- Cobham Ltd.

- Dynasil Corp. of America

- ECOTEST

- Fortive Corp.

- Furukawa Electric Co. Ltd.

- Honeywell International Inc.

- International Medcom Inc.

- James Fisher and Sons Plc

- LAURUS Systems

- Ludlum Measurements Inc.

- Mirion Technologies Inc.

- PCE Holding GmbH

- Polimaster LLC

- Radiation Detection Co.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of technologies designed to identify and measure the presence of ionizing radiation. This market caters to various industries, including healthcare, nuclear power, and renewable energy, among others. The demand for radiation detection and monitoring equipment is driven by several factors, including the growing incidence of cancer and the need for safety in nuclear power and healthcare facilities. Organic and inorganic scintillators are key components in radiation detection systems. These materials emit light when exposed to ionizing radiation, allowing for the detection and measurement of radiation levels. Skilled radiation professionals rely on these devices to ensure safety in high-risk environments.

Proportional chambers and ionization chambers are two common types of radiation detection equipment. Proportional chambers amplify the ionization produced by radiation, making them suitable for measuring low-level radiation. Ionization chambers, on the other hand, measure the total ionization produced by radiation, making them ideal for high-level radiation measurements. Gas-filled detectors, such as Geiger-Muller counters and proportional counters, are another type of radiation detection equipment. These detectors use a gas-filled chamber to detect ionizing radiation. Solid-state detectors, including semiconductor detectors, offer higher sensitivity and resolution compared to gas-filled detectors. Full-body protection products, such as face protection products and hand safety products, are essential in environments where radiation exposure is a risk.

These products provide a barrier against ionizing radiation, protecting individuals from potential harm. Radiation therapy, a common application of radiation detection and monitoring equipment, is used to treat various types of cancer. Diagnostic imaging ries, such as PET/CT scans, also rely on radiation detection equipment to produce accurate images. In addition to healthcare applications, radiation detection and monitoring equipment is also used in the nuclear power industry to ensure safety in the handling and transportation of radioactive materials. Nuclear power plants and other nuclear facilities require radiation monitoring systems to protect their workforce and the environment.

Environment radiation monitors are used to detect and measure radiation levels in the environment, ensuring public safety. These monitors are particularly important near nuclear power plants and other high-risk areas. The market for radiation detection and monitoring equipment is expected to grow due to the increasing demand for safety in various industries and the rising incidence of cancer. The market is also driven by advancements in technology, which lead to more sensitive and accurate detection equipment. Healthcare services, diagnostic imaging centers, and hospitals are significant consumers of radiation detection and monitoring equipment. Non-hospitals, such as ambulatory surgical centers, also rely on these devices to ensure safety in their facilities.

The market for radiation detection and monitoring equipment includes various raw materials, such as electronic components, and various types of detectors, including scintillators and ionization chambers. The market also includes various types of monitoring equipment, such as survey meters and personal dosimeters, as well as area process monitors and safety equipment, such as face protection products and hand safety products. In , the market is a critical industry that caters to various applications, including healthcare, nuclear power, and renewable energy. The market is driven by several factors, including the growing incidence of cancer, the need for safety in high-risk environments, and advancements in technology.

The market includes various types of detection equipment, such as scintillators, ionization chambers, and gas-filled detectors, as well as various types of monitoring equipment and safety equipment. The market is expected to grow due to the increasing demand for safety and accuracy in radiation detection and monitoring.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.93% |

|

Market growth 2024-2028 |

USD 1593.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.36 |

|

Key countries |

US, China, Germany, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Radiation Detection And Monitoring Equipment Market Research and Growth Report?

- CAGR of the Radiation Detection And Monitoring Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the radiation detection and monitoring equipment market growth of industry companies

We can help! Our analysts can customize this radiation detection and monitoring equipment market research report to meet your requirements.