Cultural Tourism Market Size 2025-2029

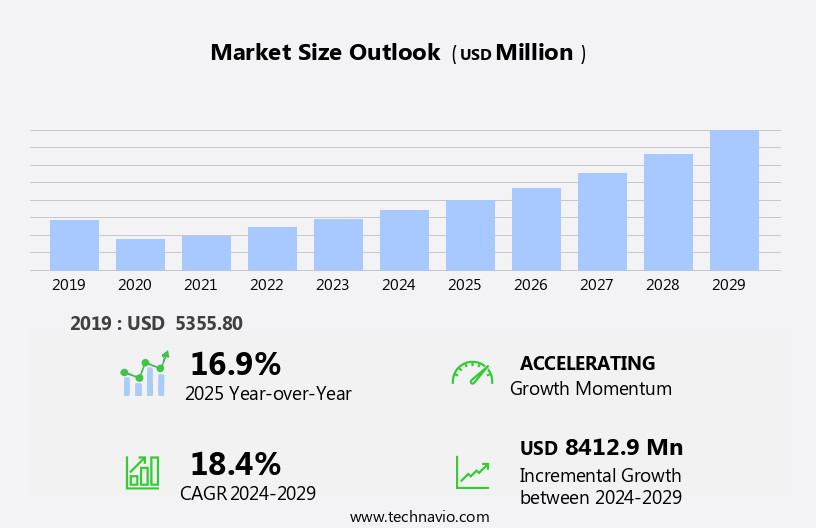

The cultural tourism market size is forecast to increase by USD 8.41 billion, at a CAGR of 18.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing number of individuals seeking unique, immersive experiences to alleviate stress and enrich their personal growth. This trend is further fueled by the burgeoning adoption of advanced technologies such as augmented reality (AR) and virtual reality (VR) in cultural tourism, enabling travelers to explore historical sites and artifacts in a more engaging and interactive manner. However, this market faces challenges as well. Overtourism, or the excessive concentration of tourists in specific locations, poses a threat to the preservation of cultural heritage sites and the local communities that rely on tourism.

- Addressing this issue through sustainable tourism practices and effective crowd management strategies is essential for companies seeking to capitalize on the opportunities presented by the market while mitigating potential risks. By focusing on innovative solutions that cater to the evolving needs and preferences of travelers, while respecting and preserving cultural heritage, businesses can differentiate themselves and thrive in this dynamic and growing market.

What will be the Size of the Cultural Tourism Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the increasing demand for authentic and immersive experiences. Crowd control and tourism infrastructure remain key concerns as cultural heritage sites attract large numbers of visitors. Digital guides and mobile applications enhance the visitor experience, offering GPS navigation, augmented reality, and interactive exhibits. Economic impact is a significant factor, with art galleries, language courses, and adventure tourism contributing to local economies. Visitor management systems and travel advisories ensure responsible tourism practices, while travel agencies and tourist information centers facilitate seamless travel experiences. Visa requirements and health precautions are essential considerations for tourists.

Sustainable tourism initiatives, such as waste management and cultural preservation, minimize environmental impact. Experiential tourism and educational tourism provide unique learning opportunities, while medical tourism caters to health-conscious travelers. Social media marketing and community-based tourism foster authentic connections with local communities. Cultural exchange programs promote cross-cultural understanding. Wellness tourism and religious tourism cater to specific niche markets, offering spiritual and rejuvenating experiences. Immersive technologies, such as virtual reality and tourist guides, bring history to life. Rural tourism and urban tourism offer diverse experiences, appealing to various travel preferences. Tourism policies and online booking platforms shape the industry, ensuring efficient and accessible travel experiences.

Ongoing trends include the integration of technology and the emphasis on sustainable and responsible tourism practices. The market continues to unfold, offering endless opportunities for exploration and discovery.

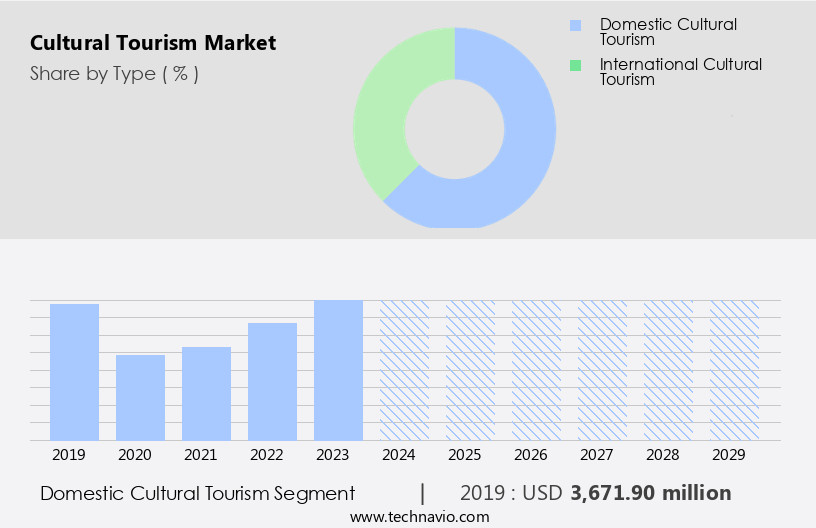

How is this Cultural Tourism Industry segmented?

The cultural tourism industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Domestic cultural tourism

- International cultural tourism

- Service

- Cultural eco-tourism

- Indigenous cultural tourism

- Socio-cultural tourism

- Application

- Leisure

- Religious pilgrimage

- Education

- Research

- Traveler Type

- Solo Travelers

- Group Travelers

- Families

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The domestic cultural tourism segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, domestic tourism is experiencing a significant surge, fueled by the quest for genuine experiences, technological innovations, and government incentives promoting local heritage. Mobile applications serve as essential tools, granting travelers instant access to detailed guides, maps, and cultural information for their destinations. This convenience and ease of use enhance the planning and navigation process for cultural tours. Virtual Reality (VR) and Augmented Reality (AR) applications have gained popularity, offering immersive experiences that enable users to virtually explore cultural sites. These technologies provide interactive tours, historical reenactments, and 3D reconstructions, significantly increasing engagement and enjoyment in domestic cultural tourism.

Art galleries and language courses cater to visitors' educational needs, while adventure tourism, GPS navigation, and visitor management systems ensure safety and organization. Travel advisories, travel agencies, visa requirements, and tourist information centers facilitate seamless travel experiences. Experiential tourism, sustainable tourism, heritage tourism, and urban tourism continue to evolve, with community-based tourism, travel blogs, and social media marketing fostering cultural exchange and awareness. Wellness tourism, religious tourism, and immersive technologies cater to diverse traveler preferences. Cultural preservation, social impact, and responsible tourism initiatives prioritize sustainability and respect for local communities. Online booking platforms, cultural exchange programs, historical monuments, and digital marketing strategies streamline the tourism industry, ensuring a memorable and enriching experience for all.

The Domestic cultural tourism segment was valued at USD 3.67 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Europe is experiencing significant growth, with numerous prominent destinations contributing to its expansion. Notable sites include Venice's lagoon, Siena's historic centers, Pisa's Piazza del Duomo, and San Gimignano in Italy. In Spain, the Alcazar in Seville and Burgos Cathedral are popular attractions. In Germany, Museumsinsel in Berlin, Cologne Cathedral, Bamberg, and the Palaces and Parks of Potsdam and Berlin are major draws. France's Bourges Cathedral, Amiens Cathedral, Chartres Cathedral, and the Pont du Gard Roman aqueduct are also significant cultural attractions. Effective crowd control, robust tourism infrastructure, digital guides, and mobile applications enhance the visitor experience.

Art galleries, language courses, adventure tourism, GPS navigation, augmented reality, and visitor management systems cater to diverse traveler needs. Travel advisories, visa requirements, and tourist information centers ensure a seamless journey. Experiential tourism, waste management, cultural preservation, social impact, responsible tourism, local crafts, and community-based tourism initiatives foster sustainable growth. Health precautions, travel insurance, and tourism marketing strategies further enhance the market. Cultural exchange programs, historical monuments, digital marketing, wellness tourism, religious tourism, immersive technologies, rural tourism, sustainable tourism, heritage tourism, urban tourism, interactive exhibits, virtual reality, and tourist guides are integral components of this dynamic market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the vibrant and ever-evolving market, travelers seek authentic experiences that connect them to new traditions and histories. This market caters to the growing demand for immersive encounters, offering visitors opportunities to explore diverse art, music, cuisine, and heritage sites. Cultural tourism attractions encompass museums, galleries, festivals, historic sites, and local communities. Sustainable practices, such as eco-tourism and community-based tourism, are increasingly important in this market. Travelers can engage in language classes, cooking workshops, and traditional crafts, fostering cross-cultural understanding. Cultural tourism also promotes economic growth and preserves local heritage, making it a win-win solution for both tourists and host communities. Tourists can embark on spiritual journeys, learn about ancient civilizations, and discover unique artistic expressions. This market continues to evolve, with technological innovations and new trends shaping the way we explore and appreciate diverse cultures.

What are the key market drivers leading to the rise in the adoption of Cultural Tourism Industry?

- The increasing prevalence of stress-related cases serves as the primary catalyst for market growth.

- Cultural tourism, a significant segment of the global travel industry, continues to gain popularity due to the experiential and educational aspects it offers. Travel advisories and visa requirements are essential considerations for tourists planning cultural trips. The market dynamics are shaped by various factors, including waste management, cultural preservation, social impact, responsible tourism, local crafts, tourist information centers, and educational tourism. Waste management is crucial to ensure sustainable tourism practices, while cultural preservation is essential to maintain authenticity and respect local traditions. Social impact and responsible tourism are increasingly important, with travelers seeking to minimize their footprint and contribute positively to the communities they visit.

- Local crafts and tourist information centers provide valuable insights into the local culture and economy. Educational tourism, including language and history lessons, adds depth to cultural experiences. Medical tourism, though not the primary focus of cultural tourism, can also be a significant draw for some travelers. Overall, cultural tourism offers a unique and immersive travel experience that resonates with travelers seeking authentic and meaningful connections with new cultures.

What are the market trends shaping the Cultural Tourism Industry?

- The rising demand for augmented reality (AR) and virtual reality (VR) technology is shaping the future of cultural tourism. This innovative trend is set to revolutionize the way we explore and experience historical sites and museums.

- The market is experiencing significant growth due to the integration of advanced technologies, such as Augmented Reality (AR) and Virtual Reality (VR), which are transforming the way travelers engage with historical sites and cultural attractions. AR and VR technologies offer immersive and interactive experiences, enabling visitors to gain a deeper understanding of the history and significance of cultural landmarks. AR-enabled devices, such as smartphones and tablets, provide virtual reconstructions, 3D models, and multimedia content, allowing tourists to explore cultural sites in a more engaging and informative way. VR headsets transport users to virtual environments, offering an opportunity to explore ancient ruins, historical sites, and cultural landscapes from the comfort of their homes or tourist centers.

- Destination marketing organizations and community-based tourism initiatives are leveraging social media marketing and travel blogs to promote cultural tourism. Health precautions and travel insurance are essential considerations for tourists, and tourism marketing strategies and policies are being developed to address these concerns. Online booking platforms are increasingly popular, providing tourists with convenient access to cultural tours and experiences. Cultural exchange programs offer unique opportunities for travelers to connect with local communities and learn about their traditions and customs. These trends reflect the evolving dynamics of the market and the growing importance of preserving cultural heritage while promoting sustainable and responsible tourism practices.

What challenges does the Cultural Tourism Industry face during its growth?

- Overtourism-related concerns pose a significant challenge to the growth of the industry. This issue, which refers to the negative impacts of mass tourism on destinations, necessitates the development and implementation of sustainable tourism practices to ensure the long-term viability and success of travel and hospitality businesses.

- The market faces a pressing issue with overtourism, as popular destinations struggle with the adverse effects of an excessive influx of visitors. Overtourism can lead to overcrowding, environmental degradation, cultural commodification, and strained local resources, particularly at historical monuments, archaeological sites, and culturally significant areas. The sheer volume of tourists can cause wear and tear, compromising the authenticity and integrity of these sites. Moreover, overcrowding negatively impacts the visitor experience, with long queues, restricted access, and limited space detracting from the enjoyment of cultural attractions.

- To mitigate these challenges, the cultural tourism industry is embracing various strategies, such as digital marketing, sustainable tourism, rural tourism, wellness tourism, religious tourism, and immersive technologies. These approaches aim to distribute tourism more evenly, preserve cultural heritage, and enhance the overall visitor experience through interactive exhibits, tourist guides, and virtual reality.

Exclusive Customer Landscape

The cultural tourism market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cultural tourism market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cultural tourism market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACE Cultural Tours Ltd. - The company specializes in curating immersive cultural experiences, featuring renowned events such as Bath Mozartfest, the Villas and Gardens of Lazio, Schubert in Schwarzenberg, and Shakespeare at Stratford.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACE Cultural Tours Ltd.

- Aracari Travel

- Envoy Tours

- Exodus Travels Ltd.

- G Adventures

- Geographic Expeditions Inc.

- Greaves Travel Ltd.

- Indigenous Tourism BC

- Intrepid Group Pty Ltd.

- JPMorgan Chase and Co.

- Kudu Travel Ltd.

- Lindblad Expeditions Holdings Inc.

- Martin Randall Travel Ltd

- Odyssey World

- Responsible Travel

- Tandem Travel OOD

- Tauck

- Travel Leaders Group Holdings LLC

- Travelogy India Pvt. Ltd.

- Wilderness Travel

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cultural Tourism Market

- In January 2024, UNESCO announced the addition of seven new sites to its World Heritage List, attracting increased attention to the cultural tourism sector (UNESCO, 2024). These sites include the historic city of Djenné in Mali, the ancient city of Ani in Armenia, and the historic bridges of Arezzo in Italy, among others.

- In March 2024, Google Arts & Culture and Airbnb collaborated to offer virtual tours of museums and historical sites, followed by immersive travel experiences (Google, 2024; Airbnb, 2024). This partnership aimed to bring cultural experiences to a wider audience, bridging the gap between virtual and real-life travel.

- In April 2025, the European Union granted â¬100 million in funding to support the development of cultural tourism infrastructure in member countries (European Union, 2025). This funding will be used to restore historical sites, improve accessibility, and promote sustainable tourism practices.

- In May 2025, GetYourGuide, a leading online marketplace for tours and activities, raised USD200 million in a Series E funding round (TechCrunch, 2025). This investment will enable the company to expand its offerings and strengthen its presence in the market, with a focus on personalized experiences and local partnerships.

Research Analyst Overview

- In the dynamic and diverse market, various sectors are experiencing significant growth and innovation. Tourism development plans are prioritizing cultural sensitivity training to enhance authentic experiences for visitors. MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism is thriving, with thematic itineraries and stakeholder collaboration driving demand. Budget tourism continues to gain traction, offering affordable options through photography tours, walking tours led by local guides, and visitor surveys. Cruise tourism is expanding, integrating sustainable practices and capacity building to minimize environmental impact. Revenue management and pricing strategies are crucial for luxury tourism, while artisan workshops and traditional performances cater to niche markets.

- Sustainable practices, such as cycling and hiking tours, are increasingly popular, aligning with the trend towards thematic itineraries and cultural routes. Historical reenactments add depth to tourist experiences, and yield management ensures optimal capacity utilization. Overall, the market is a vibrant and evolving industry, with a focus on community engagement, stakeholder collaboration, and authentic experiences.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cultural Tourism Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.4% |

|

Market growth 2025-2029 |

USD 8412.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.9 |

|

Key countries |

US, China, France, Spain, Japan, Italy, UK, India, Germany, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cultural Tourism Market Research and Growth Report?

- CAGR of the Cultural Tourism industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cultural tourism market growth of industry companies

We can help! Our analysts can customize this cultural tourism market research report to meet your requirements.